U.S. DNA Manufacturing Market Growth & Trends

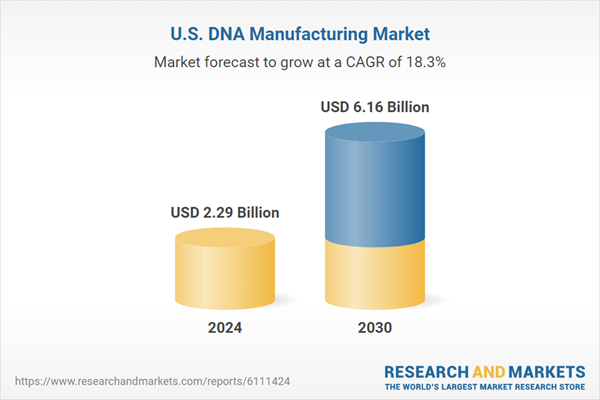

The U.S. DNA manufacturing market size is projected to reach USD 6.16 billion by 2030, growing at a CAGR of 18.27% during the forecast period. The U.S. DNA manufacturing industry is experiencing robust growth, driven by the expanding landscape of personalized medicine, synthetic biology, and the biopharmaceutical sector. As the largest hub for biotechnology innovation, the U.S. leads in adopting advanced technologies for DNA synthesis, gene editing, and therapeutic development.Technological innovations such as enzymatic DNA synthesis, automated oligonucleotide production, and continuous manufacturing systems are transforming production processes, making them more efficient and scalable. U.S.-based companies also invest heavily in cell-free DNA synthesis platforms, which reduce dependency on traditional microbial systems and shorten development timelines.

Strategic partnerships among biotech firms, academic institutions, and Contract Development and Manufacturing Organizations (CDMOs) accelerate innovation and enable faster market entry in the U.S. DNA manufacturing industry. With critical applications spanning gene and cell therapies, oncology diagnostics, infectious disease research, and vaccine development, the demand for scalable, high-quality DNA solutions continues to grow. Consequently, the U.S. market is positioned to play a foundational role in advancing precision medicine, next-generation biotherapeutics, and cutting-edge diagnostics.

U.S. DNA Manufacturing Market Report Highlights

- By type, synthetic DNA dominated the U.S. DNA manufacturing industry in 2024, accounting for 61.89% of the revenue share. This segment's growth is driven by the rising use of synthetic DNA in modular biologics, customized diagnostics, and next-gen vaccine platforms. Its adaptability for producing complex sequences without relying on live organisms positions it as a preferred choice for rapid prototyping and advanced screening. The increasing role of synthetic DNA in CRISPR workflows, biosensor development, and engineered cell lines further supports its market dominance.

- By grade, the GMP grade segment is expanding rapidly with the progression of DNA-based therapies into clinical development and commercial use. The requirement for strict compliance with regulatory standards is pushing manufacturers to invest in quality assurance systems, validated processes, and cleanroom infrastructure. As more therapies approach FDA approval, GMP-grade DNA is becoming essential for clinical trial supply chains, production, and biomanufacturing scale-up.

- By application, cell and gene therapy led the market in 2024, capturing a 43.81% revenue share. This leadership stems from the surge in demand for DNA inputs in viral vector production, genetic payload design, and cell reprogramming protocols. As therapies targeting oncology, hematological disorders, and neurological diseases expand, the requirement for precise, high-quality DNA continues to drive segment growth. Investment in clinical-stage programs also contributes to the scaling of DNA production infrastructure.

- By end use, pharmaceutical and biotechnology companies represented 49.08% of the market share in 2024. These companies increasingly rely on DNA manufacturing for pipeline development, vaccine innovation, and therapeutic engineering. With a focus on accelerating timelines from discovery to commercialization, the industry is turning to specialized DNA providers for customized, scalable, and regulatory-grade solutions.

- In May 2025, VGXI, Inc., a contract development and manufacturing organization (CDMO) specializing in nucleic acid-based therapeutics, announced the successful completion of a U.S. Food and Drug Administration (FDA) inspection at its Conroe, Texas facility. This milestone enables VGXI's client to submit a Biologics License Application (BLA) for clinical trials involving plasmid DNA, a critical component in gene therapies and mRNA vaccines. VGXI's achievement underscores its leadership in plasmid DNA manufacturing, offering scalable and high-purity production capabilities. The company has been a trusted partner in advancing life-changing medical research and innovation worldwide.

Why should you buy this report?

- Comprehensive Market Analysis: Gain detailed insights into the global market across major regions and segments.

- Competitive Landscape: Explore the market presence of key players worldwide.

- Future Trends: Discover the pivotal trends and drivers shaping the future of the global market.

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions.

This report addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segment and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listing for you to stay ahead of the curve

- COVID-19's impact and how to sustain in these fast-evolving markets

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned

- Charles River Laboratories

- VGXI, Inc.

- Danaher (Aldevron)

- Thermo Fisher Scientific

- Lonza

- GenScript

- Twist Bioscience

- AGC Biologics

- Catalent

- Eurofins Genomics

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 90 |

| Published | June 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.29 Billion |

| Forecasted Market Value ( USD | $ 6.16 Billion |

| Compound Annual Growth Rate | 18.2% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |