Market Size & Trends

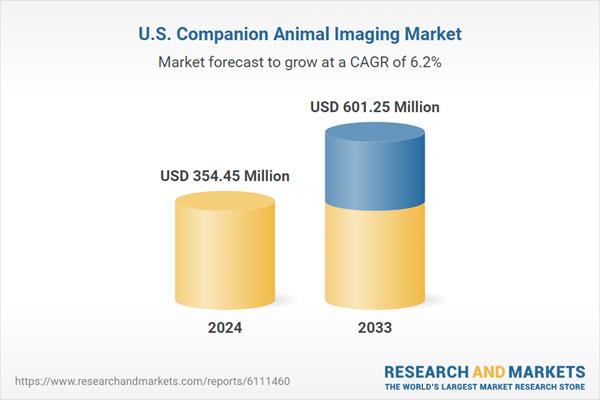

The U.S. companion animal imaging market size was estimated at USD 354.45 million in 2024 and is projected to grow at a CAGR of 6.19% from 2025 to 2033. The U.S. companion animal imaging market is continuously growing, driven by demographic shifts and urbanization, increasing adoption of pet insurance, and growing specialty and emergency veterinary services. According to the U.S. Census Bureau report of 2025, in 2023 and 2024, the population of the U.S. 387 metropolitan areas increased by nearly 3.2 million people. This growth slightly exceeded the overall U.S. population increase of 1.0% during the same time frame.By July 2024, about 294 million individuals approximately 86% of the U.S. population had gravitated towards urban living. Urbanization in the U.S. has led to higher concentrations of veterinary clinics and animal hospitals in metropolitan areas, where pet ownership among younger professionals and families continues to rise. Smaller companion animals are common in urban environments are living longer due to better care, requiring regular imaging for age-related conditions. This convergence of urban lifestyles and shifting demographics continues to propel market demand. The chart below illustrates population shift towards urban areas in the U.S. for the period of 2021-2024.

In addition, higher disposable incomes in urban areas support spending on advanced veterinary services. As cities continue to grow, so does the need for compact, efficient imaging technologies that fit into urban clinic layouts, further driving innovation and adoption of imaging solutions in the U.S. market.

Growing adoption of pet insurance is significantly impacting the market growth. In the U.S. every six seconds, a pet owner encounters a veterinary expense of USD 1,000 or more. Hence, large number of pet owners are turning to insurance to help manage rising veterinary costs, including advanced diagnostics. Accident and illness insurance plans typically provide coverage for a wide range of issues, including fractures, torn ligaments, cancer, and various common illnesses. In contrast, accident-only plans are limited to injuries resulting from accidents, such as bite wounds and ligament damage.

Many providers also offer optional wellness plans that can be added to cover routine care costs, like yearly veterinary exams and vaccinations. The major insurers offer coverage for imaging procedures like X-rays, MRIs, and ultrasounds, and financial barriers to care are decreasing. This shift empowers owners to choose more comprehensive diagnostic paths when pets present with symptoms. As a result, veterinary clinics are experiencing increased demand for imaging services. The financial support provided by insurance plans thus acts as a catalyst for market growth, enabling broader access to high-end imaging technologies.

Specialty and emergency veterinary services are growing rapidly across the U.S., driven by increased pet owner expectations and demand for 24/7 care. These centres often require high-end imaging systems such as CT scans and MRIs to support specialists in cardiology, neurology, and oncology. As more referral and specialty clinics open, particularly in urban and affluent suburban areas, the need for advanced diagnostic imaging becomes more acute. The availability of these services is contributing to a cultural shift in how pets are treated in the U.S., creating a market that increasingly mirrors human healthcare in both capability and complexity.

U.S. Companion Animal Imaging Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, the analyst has segmented the U.S. companion animal imaging market report based on product, type, animal type, application, modality, end use, and country.Product Outlook (Revenue, USD Million, 2021 - 2033)

- Equipment

- Accessories/ Consumables

- Software

Type Outlook (Revenue, USD Million, 2021 - 2033)

- X-ray

- Ultrasound

- MRI

- CT Respiratory

- Video Endoscopy

Animal Type Outlook (Revenue, USD Million, 2021 - 2033)

- Dogs

- Cats

- Horses

- Others

Application Outlook (Revenue, USD Million, 2021 - 2033)

- Orthopedics and Traumatology

- Oncology

- Cardiology

- Neurology

- Respiratory

- Dental Applications

- Others

Modality Outlook (Revenue, USD Million, 2021 - 2033)

- Fixed

- Portable

End Use Outlook (Revenue, USD Million, 2021 - 2033)

- Veterinary Hospitals and Clinics

- Specialty Imaging Centers

- Others

Country Outlook (Revenue, USD Million, 2021- 2033)

- U.S.

Why should you buy this report?

- Comprehensive Market Analysis: Gain detailed insights into the global market across major regions and segments.

- Competitive Landscape: Explore the market presence of key players worldwide.

- Future Trends: Discover the pivotal trends and drivers shaping the future of the global market.

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions.

This report addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segment and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listing for you to stay ahead of the curve

- COVID-19's impact and how to sustain in these fast-evolving markets

This product will be delivered within 2 business days.

Table of Contents

Companies Mentioned

- IDEXX Laboratories, Inc.

- Esaote SPA

- Antech Diagnostics, Inc.

- General Electric Company

- Midmark Corporation

- FUJIFILM Holdings America Corporation

- Hallmarq Veterinary Imaging

- CANON MEDICAL SYSTEMS EUROPE B.V.

- Shenzhen Mindray Animal Medical Technology Co., LTD

- Siemens Healthcare Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 150 |

| Published | June 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 354.45 Million |

| Forecasted Market Value ( USD | $ 601.25 Million |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |