Market Size & Trends

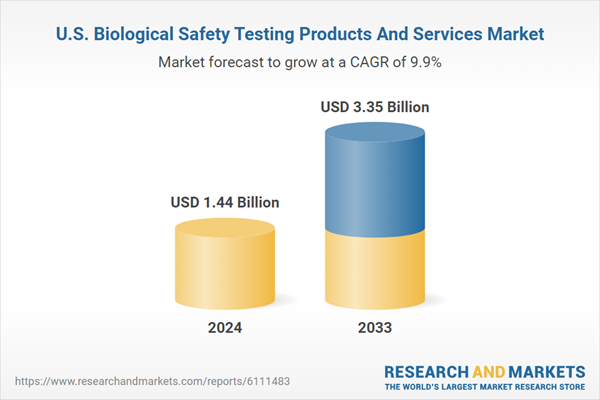

The U.S. biological safety testing products and services market size was estimated at USD 1.44 billion in 2024 and is expected to grow at a CAGR of 9.88% from 2025 to 2033. The rapid growth of the biopharmaceutical and biotechnology industries in the U.S. is one of the foremost drivers of the biological safety testing market. With increasing R&D investment in biologics, biosimilars, gene therapies, and regenerative medicines, there is heightened demand for validated, precise biosafety testing. These therapies, being complex and sensitive, require robust safety protocols to meet regulatory and clinical expectations.The surge in novel therapeutic candidates has led to an expansion in testing volumes and a need for new assay types, accelerating the development of cutting-edge biosafety platforms. The strategic push toward personalized medicine, combined with an aging population and increasing prevalence of chronic diseases, further amplifies this need. Merck's October 2024 launch of a USD 305 million biosafety testing and cell bank facility in Maryland illustrates how major players are responding to this demand. The site integrates testing with analytical development and manufacturing, streamlining workflows. Its proprietary Blazar CHO AOF panel, which reduces testing timelines by more than half, exemplifies the emphasis on speed and reliability in biosafety services. Such investments signify the foundational role of biological safety in securing the therapeutic pipeline and enabling rapid market entry for high-value biologics.

Regulatory oversight in the U.S. is a key force shaping the biological safety testing market. agencies like the U.S. Food and Drug Administration (FDA) and the U.S. Pharmacopeia (USP) enforce rigorous safety testing mandates for biologics throughout their development and manufacturing lifecycle. These include sterility, endotoxin, bioburden, and mycoplasma tests, among others. Regulatory expectations are especially strict for products such as monoclonal antibodies, vaccines, and gene therapies, where contamination risks can compromise safety and efficacy. As a result, pharmaceutical companies and contract research organizations (CROs) are compelled to implement high-quality, validated biosafety procedures to secure approvals and minimize risks.

Non-compliance can result in clinical holds, product recalls, or market withdrawal, increasing the strategic importance of robust safety frameworks. Thermo Fisher Scientific’s February 2024 enhancement of its GMP lab in Middleton, Wisconsin-adding rapid qPCR-based mycoplasma testing-demonstrates industry alignment with these expectations. The new method delivers results in just five days, enabling manufacturers to meet FDA timelines without compromising quality. As biologic modalities become more complex and distributed, regulatory harmonization efforts will continue to drive innovations and investments in safety infrastructure, ensuring that U.S.-based firms remain compliant while accelerating therapeutic delivery.

Innovations such as qPCR, next-generation sequencing (NGS), biosensors, and automation are transforming traditional testing models. These technologies enable earlier detection of microbial or viral contaminants, significantly reducing the time and cost associated with batch release and product development. Automated and integrated platforms are also enhancing throughput, a crucial capability as testing demand increases with larger therapeutic pipelines. Companies are not only modernizing existing facilities but also building new centers equipped with digital and robotic systems to support high-volume testing with minimal human error. SGS North America’s July 2024 expansion of its Center of Excellence in Lincolnshire, Illinois, exemplifies this trend. The 60,000 sq. ft. upgrade added new instrumentation to support biosimilar and novel biologic testing across all drug development stage. These integrated systems offer end-to-end analytical support, enhancing traceability and data integrity-two core requirements in regulated environments. Looking ahead, technology convergence with AI and machine learning may enable predictive biosafety analytics, ushering in a new era of proactive contamination risk management. The increasing availability of such sophisticated tools cements the U.S.'s position as a global leader in biosafety innovation.

U.S. Biological Safety Testing Products And Services Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, the analyst has segmented the U.S. biological safety testing products and services market report on the basis of product, application, and test type:Product and Service Outlook (Revenue, USD Million, 2021 - 2033)

- Reagents & Kits

- Instruments

- Services

Application Outlook (Revenue, USD Million, 2021 - 2033)

- Vaccines & Therapeutics

- Vaccines

- Monoclonal Antibodies

- Recombinant Protein

- Blood & Blood-based Products

- Gene Therapy

- Tissue & Tissue-based Products

- Stem Cell

Test Type Outlook (Revenue, USD Million, 2021 - 2033)

- Endotoxin Tests

- Sterility Tests

- Cell Line Authentication & Characterization Tests

- Bioburden Tests

- Adventitious Agent Detection Tests

- Residual Host Contamination Detection Tests

- Others

Why should you buy this report?

- Comprehensive Market Analysis: Gain detailed insights into the global market across major regions and segments.

- Competitive Landscape: Explore the market presence of key players worldwide.

- Future Trends: Discover the pivotal trends and drivers shaping the future of the global market.

- Actionable Recommendations: Utilize insights to uncover new revenue streams and guide strategic business decisions.

This report addresses:

- Market intelligence to enable effective decision-making

- Market estimates and forecasts from 2018 to 2030

- Growth opportunities and trend analyses

- Segment and regional revenue forecasts for market assessment

- Competition strategy and market share analysis

- Product innovation listing for you to stay ahead of the curve

- COVID-19's impact and how to sustain in these fast-evolving markets

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Charles River Laboratories

- BSL Bioservice

- Merck KGaA

- Samsung Biologics

- Sartorius AG

- Eurofins Scientific

- SGS Société Générale de Surveillance SA

- Thermo Fisher Scientific Inc.

- BIOMÉRIEUX

- Lonza

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 100 |

| Published | June 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 1.44 Billion |

| Forecasted Market Value ( USD | $ 3.35 Billion |

| Compound Annual Growth Rate | 9.8% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |