Based on end-use, IT and telecommunication led the Australia flexible office space market by enabling remote connectivity, virtual collaboration, and efficient workspace management

The Australia flexible office space market growth is being driven by the IT and telecommunications industry which drives digital transformation initiatives in flexible office spaces, enabling innovative services such as digital signage, smart access control, and personalized tenant experiences through mobile apps and IoT-enabled amenities. Flexible office spaces necessitate scalable IT infrastructure capable of adjusting to evolving tenant requirements and technological advancements. This encompasses robust networking solutions, cloud storage solutions, and adaptable software applications.According to ABS, in January 2024, the number of individuals employed has been 948,600 in South Australia.

The development of flexible office spaces in Australia is propelled by several factors. With the rise of remote work, there is an increased demand for flexible solutions that can accommodate varying work arrangements. Additionally, large corporations are embracing flexible office solutions to adapt to evolving business needs. Moreover, the integration of technology, such as smart building systems, enhances user experience and streamlines operations. There is also a growing emphasis on wellness and sustainability in office design, incorporating biophilic elements and eco-friendly features. Hybrid work models, which combine remote work with office time, are further driving demand for on-demand access to workspace amenities.

This report offers a detailed analysis of the market based on the following segments:

Market Breakup by Type

- Private Offices

- Co-working Offices

- Virtua Offices

Market Breakup by End Use

- IT and Telecommunications

- Media and Entertainment

- Retail and Consumer Goods

- Others

Market Breakup by Region

- New South Wales

- Victoria

- Queensland

- Australian Capital Territory

- Western Australia

- Others

Australia Flexible Office Space Market Share

Co-working spaces led the Australia flexible office space market because of their adaptability, cost-effectiveness, community-oriented environment, and capacity to cater to a wide range of requirements from contemporary businesses and professionals.Leading Companies in the Australia Flexible Office Space Market

The growth of flexible office spaces is fuelled by remote work adoption, corporate flexibility, technology integration, hybrid work models, agile lease terms, and customisation and personalisation.- Servcorp Limited

- Hub Australia Pty Ltd.

- Desk Space

- Interoffice Holdings Pty Ltd.

- WeWork Companies Inc.

- Workspace365 Pty Ltd.

- BlackWall Funds Pty Ltd.

- Others

Table of Contents

Companies Mentioned

- Servcorp Limited

- Hub Australia Pty Ltd.

- Desk Space

- Interoffice Holdings Pty Ltd.

- WeWork Companies Inc.

- Workspace365 Pty Ltd.

- BlackWall Funds Pty Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 109 |

| Published | October 2025 |

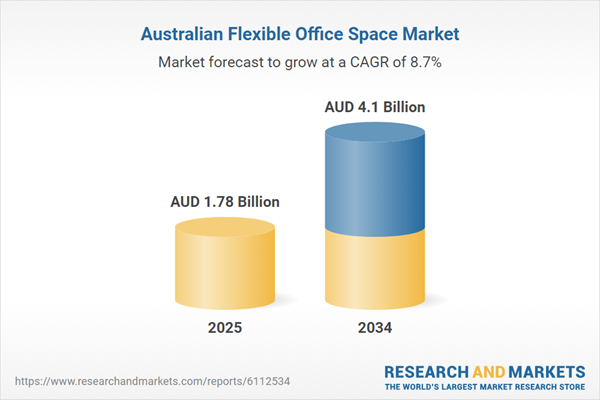

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( AUD | $ 1.78 Billion |

| Forecasted Market Value ( AUD | $ 4.1 Billion |

| Compound Annual Growth Rate | 8.7% |

| Regions Covered | Australia |

| No. of Companies Mentioned | 7 |