Market Introduction

Flow cytometry is a powerful analytical technology enabling multiparametric analysis of individual cells in suspension, widely used in research, clinical diagnostics, and biopharmaceutical development. Its applications span immunophenotyping, cell cycle analysis, and biomarker detection, driving demand across oncology, immunology, and infectious disease research. With advancements in spectral flow cytometry and high-throughput systems, the market is poised for significant growth, supported by increasing adoption in personalized medicine and cell therapy, and the expanding use of sophisticated reagents and software for precise cell analysis.Regional Segmentation:

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Italy

- Spain

- Rest-of-Europe

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Thailand

- Singapore

- Rest-of-Asia-Pacific

- Latin America

- Brazil

- Mexico

- Argentina

- Rest-of-Latin America

- Middle East & Africa

Recent Developments in the Flow Cytometry Market

- In May 2025, Cytek Biosciences launched the Cytek Aurora Evo, an advanced full-spectrum flow cytometer that builds upon the capabilities of its flagship Aurora system.

- In May 2025, Becton, Dickinson and Company launched the world’s first cell analyzer combining advanced spectral and real-time cell imaging technologies. This innovation enables researchers to gain deeper cellular insights across more applications, with enhanced ease and higher throughput in flow cytometry.

- In March 2025, Beckman Coulter Life Sciences, a Danaher company, introduced the CytoFLEX mosaic Spectral Detection Module - the industry’s first modular solution transforming spectral flow cytometry.

- In February 2025, Becton, Dickinson and Company announced plans to spin off its Biosciences and Diagnostic Solutions business to sharpen strategic focus and enhance shareholder value. Post-separation, “New BD” will be a pure-play MedTech company focused on innovation, growth, and targeted investments, while the spun-off unit will operate as a standalone life sciences leader.

- In January 2025, Bio-Rad Laboratories launched its TrailBlazer Tag and StarBright Dye Label Kits, providing an easy way to label antibodies for flow cytometry and fluorescent western blot applications.

How can this report add value to an organization?

Product/Innovation Strategy:The flow cytometry market analysis provides insights into evolving research and clinical needs, enabling organizations to develop customized flow cytometry instruments, reagents, and software solutions that address specific requirements such as high-parameter analysis, spectral capabilities, or streamlined workflows for clinical diagnostics.Growth/Marketing Strategy:The report helps organizations implement targeted marketing strategies tailored to key segments such as academic research, immuno-oncology, or infectious disease diagnostics and specific regional opportunities, improving customer engagement and accelerating adoption.

Competitive Strategy: Organizations can differentiate their flow cytometry offerings by emphasizing features particularly valued by end-users in target regions, such as instrument scalability, ease of use, reagent compatibility, after-sales support, or specialized applications like cell therapy or immunophenotyping.

Methodology

Key Considerations and Assumptions in Market Engineering and Validation

- The base year considered for the calculation of the market size is 2024. A historical year analysis has been done for the period FY2021-FY2023. The market size has been estimated for FY2024 and projected for the period FY2025-FY2035.

- The scope of this report has been carefully derived based on interactions with experts in different companies worldwide.

- The market contribution of flow cytometry anticipated to be launched in the future has been calculated based on the historical analysis of the solutions.

- Revenues of the companies have been referenced from their annual reports for FY2023 and FY2024. For private companies, revenues have been estimated based on factors such as inputs obtained from primary research, funding history, market collaborations, and operational history.

- The market has been mapped based on the available flow cytometry products. This report has considered and profiled all the key companies with significant offerings in this field.

- The report excludes repair and maintenance services, other flow cytometry-related services, and refurbished instruments from the market sizing and forecast analysis, focusing purely on new product sales and innovations.

Primary Research:

The primary sources involve industry experts in flow cytometry, including the market players offering products and services. Resources such as CEOs, vice presidents, marketing directors, and salespersons have been interviewed to obtain and verify both qualitative and quantitative aspects of this research study.The key data points taken from the primary sources include:

- Validation and triangulation of all the numbers and graphs

- Validation of the report’s segmentation and key qualitative findings

- Understanding the competitive landscape and business model

- Current and proposed production values of a product by market players

- Percentage split of individual markets for regional analysis

Secondary Research

Open Sources

- Certified publications, articles from recognized authors, white papers, directories, and major databases, among others

- Annual reports, SEC filings, and investor presentations of the leading market players

- Company websites and detailed study of their product portfolio

- Gold standard magazines, journals, white papers, press releases, and news articles

- Paid databases

The key data points taken from the secondary sources include:

- Segmentations and percentage shares

- Data for market value

- Key industry trends of the top players of the market

- Qualitative insights into various aspects of the market, key trends, and emerging areas of innovation

- Quantitative data for mathematical and statistical calculations

Key Market Players and Competition Synopsis

The global flow cytometry market is dominated by Becton, Dickinson and Company, Danaher Corporation (Beckman Coulter, Inc.), and Thermo Fisher Scientific Inc., each offering comprehensive portfolios of instruments, reagents, and consumables that set industry benchmarks for clinical diagnostics and advanced biomedical research. Bio-Rad Laboratories, Inc. specializes in high-resolution flow cytometry solutions and innovative reagents, solidifying its position as a key player in immune research and oncology diagnostics. Cytek Biosciences, Inc., with its cost-effective, high-parameter systems like the Cytek Aurora, is rapidly capturing market share, particularly in advanced spectral applications, and emerging as a formidable competitor. Regional players such as Agilent Technologies, Inc. and Sony Biotechnology, Inc. continue to innovate in specialized niches, including spectral flow cytometry and customized cell analysis tools. To sustain growth, market leaders must focus on continuous product innovation, expanding reagent portfolios, and forging strategic collaborations to address the evolving needs of precision medicine and personalized diagnostics.Some prominent names established in flow cytometry market are:

- Becton, Dickinson and Company (BD)

- Danaher Corporation (Beckman Coulter, Inc.)

- Thermo Fisher Scientific Inc.

- Bio-Rad Laboratories, Inc.

- Cytek Biosciences

- Agilent Technologies, Inc.

- Sony Biotechnology, Inc.

Table of Contents

Companies Mentioned

- Agilent Technologies, Inc.

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- Cytek Biosciences, Inc.

- Danaher Corporation (Beckman Coulter)

- Sony Biotechnology Inc.

- Thermo Fisher Scientific Inc.

- Sysmex Corporation

- Merck KGaA

- Miltenyi Biotec

- Stratedigm, Inc.

- Cell Signaling Technology Inc.

- STEMCELL Technologies

- Bio-Techne

- Revvity (BioLegend, Inc)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 184 |

| Published | July 2025 |

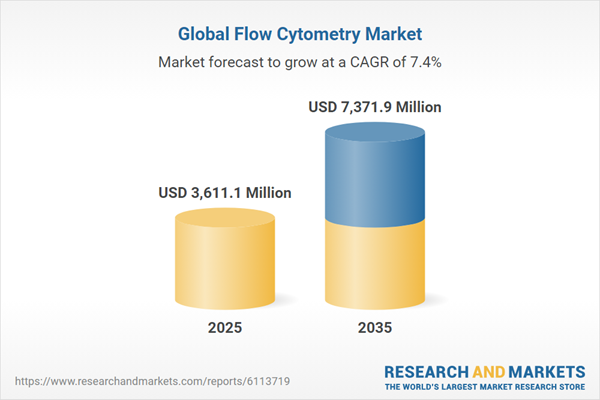

| Forecast Period | 2025 - 2035 |

| Estimated Market Value ( USD | $ 3611.1 Million |

| Forecasted Market Value ( USD | $ 7371.9 Million |

| Compound Annual Growth Rate | 7.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |