Speak directly to the analyst to clarify any post sales queries you may have.

US BODY CARE MARKET NEWS

- In September 2024, Beiersdorf announced a partnership with Macro Biologics, Inc. to co-develop biodegradable antimicrobial peptides for skincare and healthcare use. This move reflects the growing demand in the US body care market for sustainable, science-driven ingredients and aligns with the shift toward biotechnology-based personal care solutions, particularly in products aimed at skin health and barrier protection.

- In April 2025, Unilever acquired the personal care brand Wild, signaling its strategic intent to penetrate premium, eco-conscious body care segments in the U.S. market. As American consumers increasingly seek natural, refillable, and plastic-free products, this acquisition supports Unilever’s presence in sustainability-focused and direct-to-consumer body care spaces.

KEY TAKEAWAY

- By Product Type: The deodorants & antiperspirants segment accounted for the largest market share of over 37%.

- By Age Group: The Gen Z segment shows the highest growth, with a CAGR of 4.18% during the forecast period.

- By Category: The mass segment dominates and holds the largest market share in 2024.

- By Distribution Channel: The offline segment holds the largest U.S. body care market share.

- By Gender: The male segment shows significant growth, with the highest CAGR during the forecast period.

- Growth Factor: The U.S. body care market is set to grow due to the shift towards self-care and wellness and a rise in social media influencers.

US BODY CARE MARKET TRENDS

- Personalization & Customization: Consumers increasingly seek personalized body care products tailored to their individual body needs, preferences, and environmental factors.

- Rising Adoption of Functional Body Care: Body care products offering targeted benefits like firming, brightening, and skin repair are gaining traction among solution-seeking consumers.

- Growing Premiumization: Consumers are willing to pay more for high-performance, sensorial body care products that blend luxury with skincare efficacy.

- Rising Focus Towards Clean & Natural Formulations: Demand is growing for body care products that are clean, sustainable, and ethically formulated without harmful ingredients.

U.S. BODY CARE MARKET DRIVERS

- Increase in Shift Towards Self-Body Care & Wellness: Body care is evolving into a holistic self-care practice, with consumers integrating emotional wellness into their daily body care routines.

- Rise in Social Media Influencers: Influencers on platforms like TikTok and Instagram are reshaping consumer habits by popularizing body care rituals and driving product discovery.

- Rise in Innovation in Formats: New product formats like stick lotions, spray oils, and gel-based moisturizers are boosting convenience, engagement, and trial among modern consumers.

- Growth in E-commerce: E-commerce and social commerce are transforming how consumers explore, customize, and purchase body care products with ease and personalization.

INDUSTRY RESTRAINTS

- High Competition: The US body care market is highly saturated, making it difficult for brands to stand out amid similar claims, ingredients, and packaging.

- Short Product Loyalty Cycles: Frequent brand switching driven by trends and seasonal scents limits long-term consumer loyalty in the body care segment.

U.S. BODY CARE MARKET SEGMENTATION INSIGHTS

INSIGHTS BY PRODUCT TYPE

The U.S. body care market by product type is segmented into moisturizers, cleansers, deodorants & antiperspirants, hand & foot care, and others. The deodorants & antiperspirants segment accounted for the largest market share of over 37%. Deodorants & antiperspirants are hygiene products aimed at reducing body odor and controlling perspiration, especially in the underarms. Deodorants & antiperspirants are staple hygiene products for consumers in the U.S., making them the most consistently purchased products in the body care segment. Additionally, there is a growing demand for deodorants among people who are involved in health and fitness activities such as jogging, yoga, and bicycle riding. This will further propel the market growth. According to a publication of the National Library of Medicine in 2023, Consumers are demanding antiperspirants and deodorants that have active ingredients that are alcohol‐free, paraben‐free, and naturally derived.Roll-on deodorants are also gaining traction in the market due to their faster application, portability, and less residue, which is particularly among active and on-the-go users. For example, NIVEA offers roll-on deodorants such as the NIVEA Fresh Natural Anti-Perspirant Deo Roll On. Overall, in the market, deodorants and antiperspirants remain essential daily use products with growing consumer preference for clean, convenient, and skin-friendly products.

INSIGHTS BY AGE GROUP

The U.S. body care market by age group is categorized into millennials, Gen X, Gen Z, and baby boomers. The Gen Z segment shows prominent growth, with the fastest-growing CAGR of 4.18% during the forecast period. Gen Z is redefining the body care market in the U.S. by embracing bold experimentation, aesthetic value, and digital influence. As digital natives in their teens to mid-twenties, Gen Z consumers view body care as an extension of personal expression, wellness, and routine-based self-care. They are early adopters of sensory, trend-aligned products such as odor-control body sprays, anti-itch lotions, and barrier-repair body moisturizers.Influencer-led content on platforms like TikTok and Instagram heavily shapes their choices - viral routines like “shower resets” or “get unready with me” often drive mass appeal for certain body care brands. Gen Z also places high importance on ethical values such as sustainability, vegan certifications, and cruelty-free labeling. Ultimately, Gen Z is steering the body care market toward innovation, bold branding, and rapid trend cycles that reward creativity and authenticity. Gen Z consumers are having a great impact on the U.S. body care market.

INSIGHTS BY CATEGORY

The mass segment dominates and holds the largest U.S. body care market share in 2024. The segment forms the foundation of the U.S. body care market, offering affordable, widely accessible products across major retail and drugstore channels. This category caters to a broad consumer base by emphasizing functionality, convenience, and cost-effectiveness. Brands in this segment, such as Suave, Dove, Vaseline, and Aveeno, typically provide standard body care products like lotions, soaps, body washes, and creams in large volume sizes and family packs. Consumers in this category prioritize basic benefits such as hydration, skin-soothing, or gentle cleansing, and tend to repurchase based on familiarity, price, or immediate need rather than strong brand loyalty. However, even in the mass space, there has been a gradual shift toward clean formulations, cruelty-free claims, and dermatologically tested ingredients to match evolving consumer preferences. A rising trend in the mass segment is the introduction of semi-premium features at affordable prices, such as plant-based ingredients, refillable packaging, or sensitive-skin formulations, enabling value-conscious consumers to access better-quality options without premium pricing.INSIGHT BY DISTRIBUTION CHANNEL

In 2024, the offline segment holds the largest share and remains a vital pillar in the U.S. body care market, serving as the primary point of sale for a large portion of consumers seeking immediate product access and sensory evaluation. Brick-and-mortar stores, including drugstores (CVS, Walgreens), supermarkets (Walmart, Target), beauty retailers (Ulta, Sephora), and department stores, continue to account for a significant share of body care product sales. Many consumers still prefer offline channels to test scents, textures, and formulations before purchasing. Moreover, in-store promotions, displays, and product bundling play a crucial role in driving impulse purchases, especially in the mass market. Retailers also allocate prominent shelf space to best-selling or fast-moving brands, often creating dedicated sections for seasonal or trending products.One key trend revitalizing offline retail is experiential shopping, where retailers incorporate wellness zones, mini facial stations, or scent-testing kiosks to boost engagement and allow consumers to "experience" body care before committing to a purchase.

INSIGHT BY GENDER

The U.S. body care market by gender is segmented into male and female. The male segment shows significant growth, with the highest CAGR during the forecast period. Male consumers are an increasingly active and evolving segment within the US body care market, gradually moving beyond basic hygiene products.Historically less engaged than women in the category, today’s male buyers are expanding their routines to include a wider range of body care products, such as exfoliating washes, post-shave balms, anti-chafing creams, and moisturizing lotions tailored to men’s skin needs. Functional products such as odor-removing deodorants and dirt-removing body washes are gaining traction among men, particularly in fitness-focused or professional lifestyles. This shift is driven in part by changing cultural norms, increased awareness of grooming, and the rise of male-focused brands and unisex body care offerings. Packaging that emphasizes simplicity, performance, and masculine scents such as woodsy, fresh, or citrus notes tends to appeal to this segment.

U.S. BODY CARE MARKET COMPETITIVE LANDSCAPE

The U.S. body care market report consists of exclusive data on 25 vendors. Beiersdorf and Cetaphil (by Galderma) are leading players in the dermatological segment of the US body care market. Beiersdorf’s partnership with Macro Biologics to develop biodegradable antimicrobial peptides highlights its move toward biotech-driven solutions, while Cetaphil’s launch of a gentle exfoliating line reflects its continued focus on sensitive skin and clinically tested care.With its acquisition of Wild, a refillable natural body care brand, Unilever is expanding its presence in the eco-conscious space. This aligns with growing consumer demand for sustainable and minimal-waste products, particularly among Gen Z and millennial shoppers who prioritize ethical and environmental values.

L’Oréal is pushing the boundaries of personalization through technology, with innovations like the Cell BioPrint device offering rapid skin diagnostics. This tech-forward approach positions L’Oréal as a leader in delivering customized body care experiences in a data-driven age.

Colgate-Palmolive and Bath & Body Works focus on fragrance-led body care that delivers emotional and sensory experiences. Palmolive’s Aroma campaign and Bath & Body Works’ seasonal launches appeal to consumers seeking indulgence and self-care through scent-rich, moisturizing products.

Many brands are targeting younger consumers with modern, relatable strategies. Cetaphil’s influencer-driven campaigns and L’Oréal’s tech integration resonate with Gen Z, who expect authenticity, results, and innovation from their body care routines.

Key Vendors

- Beiersdorf

- Unilever

- L’Oréal

- Bath & Body Works

- Procter & Gamble

- Johnson & Johnson

Other Prominent Vendors

- Dr. Bronner’s

- Eos (Evolution Of Smooth)

- E.T. Browne Drug Co.

- Avalon Organics

- Mario Badescu

- Herbivore Botanicals

- Kopari Beauty

- OSEA International

- Pacifica Beauty

- The Seaweed Bath Co.

- Sky Organics

- Nécessaire

- MALIN+GOETZ

- True Botanicals

- Better Planet Brands

- Alikay Naturals

- Colgate-Palmolive

- Cetaphil

- L’OCCITANE Groupe

SEGMENTATION & FORECASTS

- By Product Type

- Moisturizers

- Cleansers

- Deodorants & Antiperspirants

- Hand & Foot Care

- Others

- By Age Group

- Millennials

- Gen X

- Gen Z

- Baby Boomers

- By Category

- Mass

- Premium

- By Distribution Channel

- Offline

- Online

- By Gender

- Female

- Male

KEY QUESTIONS ANSWERED

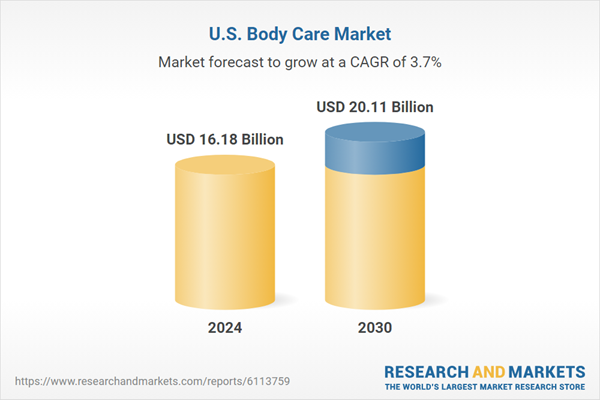

1. How big is the U.S. body care market?2. What is the growth rate of the U.S. body care market?

3. What are the trends in the U.S. body care market?

4. Which product type has the largest share in the U.S. body care market?

5. Who are the major players in the U.S. body care market?

Table of Contents

Companies Mentioned

- Beiersdorf

- Unilever

- L’Oréal

- Bath & Body Works

- Procter & Gamble

- Johnson & Johnson

- Dr. Bronner’s

- Eos (Evolution Of Smooth)

- E.T. Browne Drug Co.

- Avalon Organics

- Mario Badescu

- Herbivore Botanicals

- Kopari Beauty

- OSEA International

- Pacifica Beauty

- The Seaweed Bath Co.

- Sky Organics

- Nécessaire

- MALIN+GOETZ

- True Botanicals

- Better Planet Brands

- Alikay Naturals

- Colgate-Palmolive

- Cetaphil

- L’OCCITANE Groupe

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 97 |

| Published | July 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 16.18 Billion |

| Forecasted Market Value ( USD | $ 20.11 Billion |

| Compound Annual Growth Rate | 3.6% |

| Regions Covered | United States |

| No. of Companies Mentioned | 25 |