The Automotive Sensors Market Study provides a comprehensive analysis of the global automotive sensors industry, offering industry experts a detailed examination of market trends, technological advancements, and competitive dynamics. This study explores the critical role of sensors in enhancing vehicle performance, safety, and efficiency across various vehicle types and regions. By analyzing market drivers, restraints, opportunities, and competitive strategies, the Automotive Sensors Market Study equips stakeholders with actionable insights to navigate this rapidly evolving sector.

Market Overview and Scope

The Automotive Sensors Market Study defines automotive sensors as electronic devices that monitor and manage various vehicle parameters, such as speed, temperature, pressure, and position, to optimize performance and ensure safety. The study covers a broad scope, including sensor types (speed, temperature, pressure, position, and others), vehicle types (passenger and commercial vehicles), and distribution channels (OEMs and aftermarket). Geographically, it spans North America, South America, Europe, Middle East & Africa, and Asia Pacific, providing a granular analysis of regional market dynamics. The study also evaluates market segmentation to offer a clear understanding of demand patterns and growth opportunities.Business and Technological Landscape

The Automotive Sensors Market Study identifies key market drivers, such as the rising adoption of advanced driver-assistance systems (ADAS) and the increasing demand for electric vehicles (EVs), which necessitate sophisticated sensor technologies. Market restraints, including high development costs and supply chain disruptions, are also analyzed, alongside opportunities like the integration of IoT and AI in sensor systems. The study includes a Porter’s Five Forces analysis to assess competitive intensity and an industry value chain analysis to highlight critical supply chain components. Additionally, it examines policies and regulations shaping the market, such as emission standards and safety mandates, and provides strategic recommendations for stakeholders.The technological outlook section delves into innovations driving the automotive sensors market, including advancements in MEMS (Micro-Electro-Mechanical Systems) technology and the development of multi-sensor fusion systems for autonomous driving. These technological trends are critical for industry experts seeking to understand the future direction of sensor applications in the automotive sector.

Competitive Environment and Analysis

In the Automotive Sensors Market Study, the competitive environment is thoroughly evaluated, focusing on major players and their strategic initiatives. The study highlights recent developments from key market players, showcasing their efforts to strengthen their market positions. For instance, Robert Bosch GmbH has advanced its portfolio with the launch of next-generation LiDAR sensors, designed to enhance the precision of autonomous driving systems. This development underscores Bosch’s commitment to supporting Level 3 and Level 4 autonomy, addressing the growing demand for reliable sensor solutions in ADAS and self-driving vehicles. Similarly, NXP Semiconductors N.V. recently introduced a new radar sensor platform that integrates AI capabilities, enabling faster data processing and improved object detection for real-time decision-making in vehicles. This innovation positions NXP as a leader in radar-based sensor technologies, catering to the increasing complexity of automotive applications.The competitive analysis also includes market share evaluations, mergers, acquisitions, and collaborations. Notable examples include strategic partnerships between DENSO CORPORATION and software firms to develop integrated sensor-software solutions, enhancing vehicle connectivity and performance. The Automotive Sensors Market Study further provides a competitive dashboard, offering a visual representation of key players’ market positioning and strategic focus, enabling industry experts to benchmark performance and identify collaboration opportunities.

Regional and Segmental Insights

The Automotive Sensors Market Study offers detailed insights into market dynamics across key regions. Asia Pacific, led by China, Japan, and South Korea, dominates due to high vehicle production and rapid adoption of EVs and ADAS. North America and Europe follow, driven by stringent safety regulations and technological advancements. The study also examines sensor applications across passenger and commercial vehicles, highlighting the growing aftermarket demand for replacement sensors. By analyzing these segments, the study provides a holistic view of market opportunities and challenges.Key Benefits of this Report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, and other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decisions to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive IntelligenceReport Coverage:

- Historical data from 2022 to 2024 & forecast data from 2025 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others).

Market Segmentation

By Sensor Type

- Speed Sensor

- Temperature Sensor

- Pressure Sensor

- Position Sensor

- Others

By Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

By Distribution Channel

- OEMs

- Aftermarket

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- France

- United Kingdom

- Spain

- Others

- Middle East and Africa

- Saudi Arabia

- Israel

- UAE

- Others

- Asia Pacific

- China

- Japan

- South Korea

- India

- Thailand

- Taiwan

- Indonesia

- Others

Table of Contents

Companies Mentioned

- Robert Bosch GmbH

- STMicroelectronics

- PHINIA Inc.

- Texas Instruments Incorporated

- DENSO CORPORATION

- NXP Semiconductors N.V.

- TE Connectivity

- Sensata Technologies, Inc

- Continental AG

- TGS GROUP

- Murata Manufacturing Co., Ltd.

- CTS Corporation

- Infineon Technologies AG

- Hitachi, Ltd.

- Analog Devices, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 145 |

| Published | June 2025 |

| Forecast Period | 2025 - 2030 |

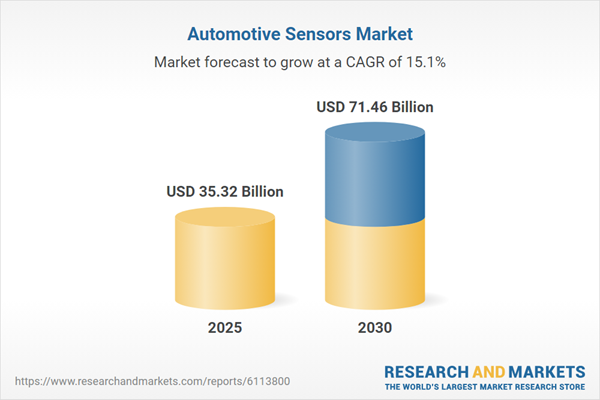

| Estimated Market Value ( USD | $ 35.32 Billion |

| Forecasted Market Value ( USD | $ 71.46 Billion |

| Compound Annual Growth Rate | 15.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |