The Pet Food Ingredients Market Study provides a comprehensive analysis of the global pet food ingredients market, tailored for industry experts seeking actionable insights into market dynamics, competitive intelligence, and emerging trends. This study delves into the key developments, market segmentation, and strategic moves by leading players, offering a detailed perspective on the forces shaping the industry. With a focus on ingredient types, sources, forms, pet types, and geographic regions, the Pet Food Ingredients Market Study equips stakeholders with the knowledge needed to navigate this rapidly evolving market.

Market Overview and Scope

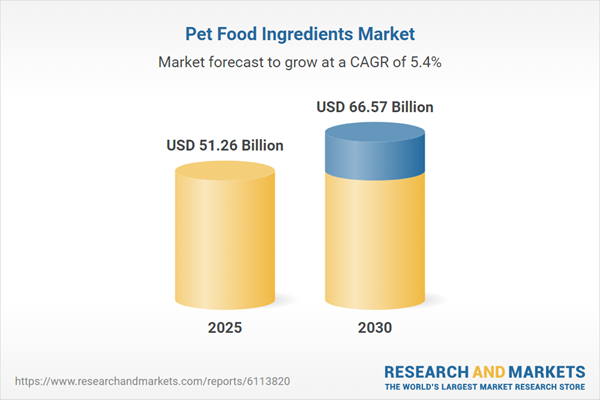

The Pet Food Ingredients Market Study examines the global pet food ingredients landscape, driven by rising pet ownership, increasing demand for premium and health-focused pet foods, and innovations in ingredient formulations. The study segments the market by ingredient type (animal-based, plant-derived, additives, functional, and novel ingredients), source (animal-based, plant-based, marine-based, insect-based, and synthetic/bioengineered), form (liquid, dry, wet), pet type (dog, cat, fish, birds, and others), and geography (North America, South America, Europe, Middle East and Africa, and Asia Pacific). It addresses key market drivers, such as consumer trends toward pet humanization and sustainability, alongside restraints like stringent regulations and ingredient sourcing challenges.Competitive Environment and Analysis

In the Pet Food Ingredients Market Study, the competitive environment is thoroughly analyzed, highlighting the strategic maneuvers of key market players to maintain and expand their market share. The study emphasizes the highly competitive nature of the pet food ingredients sector, characterized by innovation, mergers, acquisitions, and product differentiation. Below are two notable developments from major players in the competitive intelligence section:Cargill, Incorporated’s Investment in Sustainable Sourcing and Innovation: Cargill has intensified its focus on sustainability by partnering with agricultural firms to secure high-quality, traceable raw materials for pet food ingredients. In 2023, the company expanded its production facilities in North America to enhance its supply chain efficiency and meet the growing demand for plant-based and novel ingredients, such as insect-based proteins. This move aligns with consumer demand for eco-friendly and health-focused pet food products, positioning Cargill as a leader in sustainable ingredient solutions.

DSM Nutritional Products, LLC’s Functional Ingredient Advancements: DSM has prioritized research and development to introduce functional ingredients, such as omega-3 fatty acids and probiotics, tailored to address specific pet health needs like digestive health and immunity. In 2024, DSM launched a new line of bioengineered additives designed to enhance palatability and nutritional value, catering to the premiumization trend in the pet food market. This strategic innovation strengthens DSM’s competitive edge in the functional ingredients segment.

The Pet Food Ingredients Market Study also includes a market share analysis, detailing the dominance of key players like Cargill, DSM, and Archer Daniels Midland Company, alongside emerging players like Biorigin and Kemin Industries. The study explores recent mergers, acquisitions, and collaborations, such as Cargill’s strategic partnerships and DSM’s product portfolio expansion, which underscore the industry’s focus on innovation and market consolidation.

Strategic Insights and Conclusion

The Pet Food Ingredients Market Study offers industry experts a robust framework to understand the competitive dynamics and capitalize on emerging opportunities. By analyzing key developments, such as Cargill’s sustainable sourcing initiatives and DSM’s advancements in functional ingredients, the study highlights how market leaders are responding to consumer demands for premium, health-focused, and sustainable pet food ingredients. The pet food ingredients market presents significant growth potential. Industry experts can leverage the Pet Food Ingredients Market Study to inform strategic decisions, optimize supply chains, and develop innovative products that align with evolving consumer preferences and regulatory landscapes.Key Benefits of this Report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, and other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decisions to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive IntelligenceReport Coverage:

- Historical data from 2022 to 2024 & forecast data from 2025 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others).

Pet Food Ingredients Market Segmentation:

By Ingredient Type

- Animal-Based Ingredients

- Plant-Derived Ingredients

- Additives

- Functional Ingredients

- Novel Ingredients

By Source

- Animal-Based

- Plant-Based

- Marine-Based

- Insect-Based

- Synthetic or Bioengineered

By Form

- Liquid

- Dry

- Wet

By Pet Type

- Dog

- Cat

- Fish

- Birds

- Others

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- UK

- Germany

- France

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Israel

- Others

- Asia Pacific

- Japan

- China

- India

- South Korea

- Thailand

- Indonesia

- Taiwan

- Others

Table of Contents

Companies Mentioned

- 3D Corporate Solutions, LLC

- AFB International

- Alltech, Inc.

- Balchem Corporation

- Biorigin

- BTSA Biotecnologías Aplicadas, S.L.

- Cargill, Incorporated

- DSM Nutritional Products, LLC

- DuPont de Nemours, Inc.

- Kemin Industries, Inc.

- Archer Daniels Midland Company

- Darling Ingredients Inc.

- Ingredion Incorporated

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 140 |

| Published | June 2025 |

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 51.26 Billion |

| Forecasted Market Value ( USD | $ 66.57 Billion |

| Compound Annual Growth Rate | 5.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |