Milk replacers serve as substitutes for animal milk, providing essential nutrition to young animals such as calves, piglets, foals, and lambs when natural milk is unavailable or impractical. Comprising key components like protein (18%-30%), fat (10%-28%), lactose, ash, and vitamins (A, D, E), milk replacers are critical during the early developmental stages, often referred to as the second feeding phase. They are categorized into medicated (containing antibiotics) and non-medicated types, with formulations designed to mimic the nutritional profile of animal milk to support growth and health.

Market Trends

In 2024 and beyond, milk replacers are formulated to deliver high-quality proteins for muscle development, fats for energy and essential fatty acids, and vitamins for overall health. Medicated milk replacers, incorporating antibiotics like neomycin sulfate (Neomycin) and oxytetracycline (Terramycin), have shifted to a mandatory 1:1 dosage ratio, moving away from the previously used 2:1 ratio to comply with updated health standards. Non-medicated replacers remain a cost-effective option for healthy animals. The market sees a preference for powder-based replacers due to their ease of mixing, longer shelf life, and consistent composition compared to liquid forms.Market Drivers

The milk replacers market is driven by increasing demand for proper animal nutrition and the rising global animal population. As countries prioritize animal health and high-quality produce, milk replacers address nutritional deficiencies that can compromise animal health and product quality. Key players like MannaPro offer products such as UniMilk, which supports optimal growth and digestion in species like calves, goat kids, foals, and piglets, and Colostrum Supplement, enriched with vitamins and minerals for gut health across various animals. Strategic industry moves, such as Trouw Nutrition International’s acquisition of a 51% stake in Turkey’s Interekim, aim to expand supply chains for milk replacers. The growing demand for meat and quality animal products further fuels market growth. However, the unorganized nature of cattle breeding and dairy sectors in some regions limits market penetration, posing a challenge to growth.Market Segmentation

By Type: Medicated milk replacers dominate due to their antibiotic content, which prevents disease and ensures optimal nutrition, holding a larger market share than cost-effective non-medicated replacers used for healthy animals.By Form: Powder-based replacers lead the market due to their practicality and shelf stability, making them more widely adopted than liquid replacers.

By Livestock: Calves account for the largest market share, as they are the primary recipients of milk replacers, followed by piglets, foals, lambs, kittens, and puppies.

Geographical Outlook

The Asia-Pacific region holds a significant share of the global milk replacers market, driven by high production in China and growing demand in Japan and India. The region’s focus on pork and poultry consumption, coupled with population growth, is expected to increase demand for milk replacers in poultry and other livestock sectors. Other regions, including North America, Europe, the Middle East & Africa, and South America, contribute to the market, but Asia-Pacific remains a key growth hub due to its large livestock population and rising nutritional standards.Conclusion

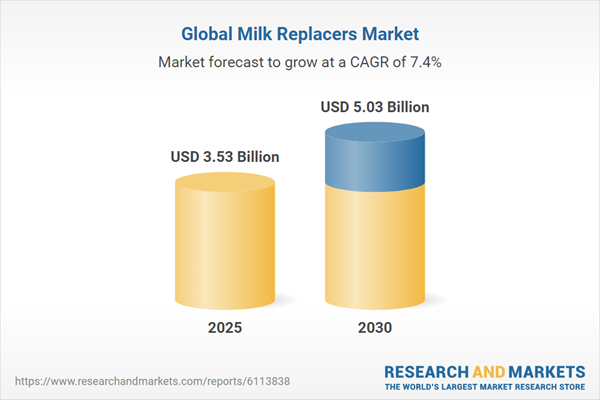

The milk replacers market is poised for modest growth, driven by the need for proper animal nutrition, rising meat demand, and strategic industry expansions. While challenges like unorganized dairy sectors persist, the focus on health standards and quality products will continue to propel the market forward, particularly in Asia-Pacific.Key Benefits of this Report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, and other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decisions to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive IntelligenceReport Coverage:

- Historical data from 2022 to 2024 & forecast data from 2025 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others).

Segmentation

By Type

- Medicated

- Non-Medicated

By Form

- Liquid

- Powder

By Livestock

- Calves

- Piglets

- Kittens

- Puppies

- Foals

- Lambs

By Geography

- North America

- USA

- Canada

- Mexico

- South America

- Brazil

- Argentina

- Others

- Europe

- Germany

- Spain

- United Kingdom

- Italy

- France

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Indonesia

- Thailand

- Taiwan

- Others

Table of Contents

Companies Mentioned

- Nukamel

- Manna Pro Products LLC

- Archer Daniels Midland Company

- CHS Inc.

- Calva Products, LLC

- Cargill, Incorporated

- Purina Animal Nutrition LLC

- Liprovit BV

- Pet-Ag, Inc.

- Milk Specialties Global

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 149 |

| Published | June 2025 |

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 3.53 Billion |

| Forecasted Market Value ( USD | $ 5.03 Billion |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |