Mobility-related health issues such as musculoskeletal disorders, stroke, and neurological conditions are becoming more prevalent as life expectancy rises. These impairments lead to limited independence and a higher risk of falls, prompting healthcare providers and caregivers to recommend mobility aids. Enhanced features like ergonomic construction, fall detection, and integrated GPS systems are transforming the design and efficiency of modern devices. Users now benefit from greater freedom of movement and safer navigation, which directly improves their quality of life and confidence in managing daily tasks.

The wheelchair segment is expected to generate USD 9.2 billion by 2034 at a CAGR of 7.3%. As seniors live longer, many experience mobility limitations due to chronic diseases such as arthritis and post-stroke conditions. Mobility devices, particularly wheelchairs, support recovery and day-to-day movement both in clinical and home-based care. The increasing emphasis on post-surgical rehabilitation at home and the growing popularity of outpatient therapy have fueled demand for personalized mobility solutions tailored for residential use.

The hospitals and nursing homes segment is projected to generate USD 7.4 billion by 2034, growing at a CAGR of 6.9%. These facilities regularly care for aging patients recovering from surgery, chronic illness, or long-term disability, making reliable mobility aids essential. Walkers, transfer devices, and ergonomic wheelchairs are commonly used to enhance mobility and prevent falls. Healthcare regulations in multiple regions require institutions to implement fall-prevention measures and ensure safe movement, which drives continued investment in up-to-date, well-maintained mobility devices.

United States Senior Mobility Aid Devices Market was valued at USD 3.4 billion in 2024. The country’s well-established healthcare infrastructure and insurance systems, including Medicare and Medicaid, make assistive devices more accessible to older adults. These reimbursement programs have eased financial burdens for seniors and have supported growth in both institutional and home-based segments. Access to medical equipment through hospitals, rehab centers, and home health providers continues to fuel demand, especially as seniors seek options that allow them to maintain independence.

Key players actively shaping this market include LEVO, CAREX, Drive DeVilbiss Healthcare, PERMOBIL, GF Health Products, MEDLINE, MEYRA, nova, PRIDE MOBILITY, Ottobock, INVACARE, SUNRISE MEDICAL, BESCO, Hoveround Mobility, and 21st Century SCIENTIFIC. To maintain a strong position in the senior mobility aid devices market, leading firms are prioritizing R&D to deliver more ergonomic, tech-enabled, and user-friendly products. Many are introducing smart features like GPS tracking, voice commands, and fall alerts to appeal to tech-savvy caregivers and end-users.

Strategic partnerships with healthcare institutions and aging care facilities allow for larger product adoption at scale. Companies are also expanding into emerging markets by localizing product design and streamlining distribution channels. Additionally, firms are focusing on compliance with global safety and quality standards while increasing investments in digital platforms to improve product accessibility and customer support.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

- BESCO

- 21st Century SCIENTIFIC

- CAREX

- Drive DeVilbiss Healthcare

- GF Health Products

- Hoveround Mobility

- INVACARE

- LEVO

- MEDLINE

- MEYRA

- nova

- ottobock

- peromobil

- PRIDE MOBILITY

- SUNRISE MEDICAL

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 150 |

| Published | July 2025 |

| Forecast Period | 2024 - 2034 |

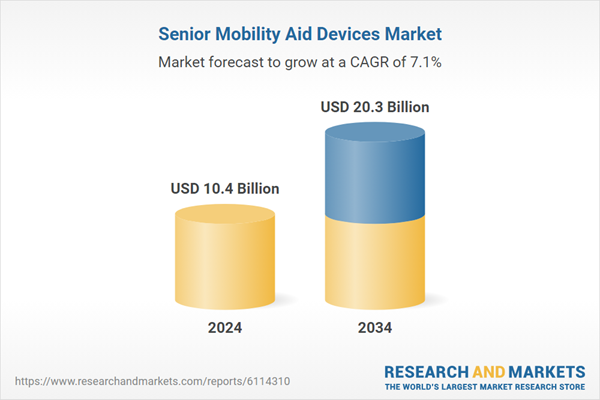

| Estimated Market Value ( USD | $ 10.4 Billion |

| Forecasted Market Value ( USD | $ 20.3 Billion |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |