A major driver behind the market’s expansion is the global effort to strengthen early screening initiatives. Government-backed healthcare programs are rolling out structured strategies to support high-risk populations with better diagnostic access. These initiatives are accelerating early identification through community-based testing and outreach. Tuberculosis diagnostic tests are used to detect the presence of the mycobacterium tuberculosis bacteria and to determine if an individual has active TB or a latent TB infection, which is essential for guiding treatment decisions. With more emphasis on accurate identification, the market continues to witness greater investment in innovation and infrastructure across diagnostic platforms.

In 2024, molecular diagnostics emerged as the leading segment, contributing 36.6% share and projected to grow at a CAGR of 5.9% through 2034. These diagnostics have changed the game by offering fast, sensitive, and accurate detection of Mycobacterium tuberculosis and its drug resistance traits. The use of polymerase chain reaction (PCR) as a central technique in this space enables healthcare providers to detect TB bacteria from clinical samples with precision, making early treatment decisions more effective.

The laboratory-based testing category held the largest share 65% in 2024. Its dominance is primarily attributed to the use of accurate, centralized testing methods critical for diagnosing complex and drug-resistant TB cases. These tests are typically performed in hospitals, public health institutions, and private certified laboratories. Common testing techniques include smear microscopy, culture-based diagnostics, and interferon-gamma release assays (IGRAs), all of which offer in-depth insight into disease severity and potential resistance, guiding clinicians in creating tailored treatment plans.

Asia Pacific Tuberculosis Diagnostics Test Market is expected to grow at a CAGR of 5.6% from 2025 to 2034. Factors contributing to this growth include the increasing number of TB cases, expanding public health education, greater access to diagnostic labs, and supportive governmental policies aimed at strengthening diagnostic infrastructure. As the region continues to invest in healthcare, the demand for advanced TB testing solutions is forecasted to rise.

Prominent players leading this space include Danaher Corporation, Abbott Laboratories, bioMérieux, Qiagen N.V., Becton, Dickinson and Company, and F. Hoffmann-La Roche. To strengthen their market presence, top firms are heavily investing in R&D to advance molecular and rapid diagnostic technologies. Strategic mergers and collaborations with healthcare providers and research institutions are helping companies expand their diagnostic portfolios and global footprint. Several players are focusing on creating low-cost, portable TB testing solutions tailored for low-resource settings, particularly in high-burden regions. Additionally, manufacturers are optimizing test sensitivity, reducing turnaround time, and ensuring their platforms meet international regulatory standards. These strategies collectively enhance accessibility, accuracy, and efficiency, positioning companies for long-term market leadership.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

- Abbott Laboratories

- Anhui Zhifei Longcom Biopharmaceutical Co.

- Becton, Dickinson and Company

- bioMérieux

- Danaher Corporation (Cepheid)

- F. Hoffmann-La Roche

- Generium Pharmaceuticals

- Hain Lifescience

- Hologic

- Japan BCG Laboratory

- NIPRO

- Oxford Immunotec

- Qiagen N.V.

- Sanofi

- Siemens Healthineers

- Thermo Fisher Scientific

Table Information

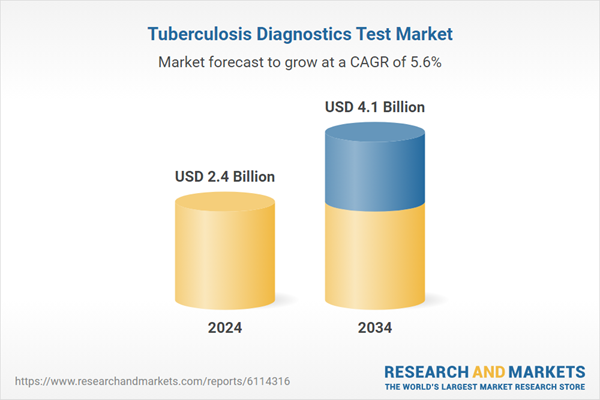

| Report Attribute | Details |

|---|---|

| No. of Pages | 145 |

| Published | July 2025 |

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 2.4 Billion |

| Forecasted Market Value ( USD | $ 4.1 Billion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |