Additionally, the rise in demand for capsule endoscopy, ingestible sensors, and drug delivery systems has spurred the need for accurate testing of enteric devices. This includes evaluating factors like dissolution, transit time, and localized release within gastrointestinal structures, further driving market expansion. Enteric disease testing refers to diagnostic methods used to identify infections caused by bacteria, viruses, or parasites that affect the digestive tract. Tests are used to detect conditions like diarrhea, cholera, typhoid, and dysentery.

The immunoassay segment dominated the market, generating USD 790.6 million in 2024, and is projected to grow at a CAGR of 4.3% through 2034. Immunoassays are widely used for detecting enteric pathogens and are particularly prevalent in low-resource settings, including point-of-care environments. They are the primary method for surveillance and outbreak response, especially for bacterial toxins and viral infections like rotavirus and norovirus.

The hospitals segment led the market in 2024 with a revenue of USD 998.3 million and is expected to grow at a CAGR of 4.4% during 2025-2034. As major centers for acute care and emergency interventions, hospitals handle many severe gastrointestinal cases, especially those related to foodborne diseases. Most urgent cases are processed in hospital-based labs, reflecting the crucial role of these institutions in enteric disease testing.

U.S. Enteric Disease Testing Market was valued at USD 822.4 million in 2024. The country sees millions of foodborne illness cases annually, driven by pathogens like Salmonella, E. coli, and Norovirus. Addressing this public health challenge requires regular, accurate enteric disease testing. Programs from organizations like the CDC and FDA, such as FoodNet and PulseNet, play a vital role in outbreak detection and the development of advanced diagnostic tests. These agencies drive the innovation necessary to improve diagnostic speed and accuracy.

Key players in the Enteric Disease Testing Market include Abbott Laboratories, Becton, Dickinson and Company, Biomerica, bioMérieux, Bio-Rad Laboratories, Coris BioConcept, Danaher, DiaSorin, Merck KGaA, Meridian Bioscience, Techlab, and Thermo Fisher Scientific. To strengthen their position in the enteric disease testing market, companies are focusing on continuous innovation and the development of advanced diagnostic technologies. This includes investing heavily in research and development (R&D) to improve the accuracy, speed, and ease of use of testing kits, particularly for point-of-care settings. Strategic collaborations with government agencies, research institutions, and healthcare providers are also key to expanding their market footprint. Companies are also increasing their presence in emerging markets where the incidence of enteric diseases is high by providing affordable, easy-to-use diagnostic solutions.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

- Abbott Laboratories

- Becton, Dickinson and Company

- Biomerica

- bioMérieux

- Bio-Rad Laboratories

- Coris BioConcept

- Danaher

- DiaSorin

- Merck KGaA

- Meridian Bioscience

- Techlab

- Thermo Fisher Scientific

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 130 |

| Published | July 2025 |

| Forecast Period | 2024 - 2034 |

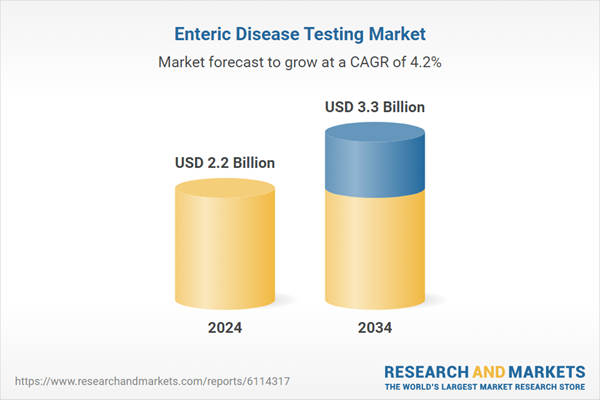

| Estimated Market Value ( USD | $ 2.2 Billion |

| Forecasted Market Value ( USD | $ 3.3 Billion |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |