As more patients present with complex lesions, particularly those resistant to traditional treatment, coronary cutting balloons are being increasingly utilized for their accuracy and safety in plaque modification. The growing use of advanced diagnostic tools like intravascular imaging and coronary angiography has allowed for earlier detection of complex arterial blockages, enhancing timely treatment using cutting balloons. These specialized devices combine a conventional balloon catheter with microblades that create precise incisions during inflation, facilitating safer and more effective lesion dilation. With coronary artery disease (CAD) rising across both emerging and developed healthcare markets, clinical reliance on these tools continues to gain traction worldwide.

The calcified lesion treatment segment is projected to generate USD 229.3 million in 2034. The increasing prevalence of heavily calcified coronary artery disease, especially among elderly populations and diabetic individuals, has made this treatment area a key focus. Cutting balloons provide interventional cardiologists with greater control by enabling refined plaque scoring, which enhances stent delivery and expansion during procedures. With procedural volumes rising for complex percutaneous coronary interventions (PCIs), the clinical need for reliable lesion preparation devices like cutting balloons continues to increase. Their role in improving procedural success rates and outcomes has accelerated their adoption across cardiovascular care settings globally.

In 2024, the hospitals segment, captured the largest share and projected to continue expanding during 2025-20234 Hospitals are equipped with advanced catheterization labs and multidisciplinary cardiac teams, making them the primary centers for performing complex PCIs. The ability to handle high-risk CAD cases, including severe blockages and in-stent restenosis, gives hospitals a leading edge in utilizing coronary cutting balloons effectively. Growing healthcare investments and infrastructure development in tertiary and urban hospitals, along with 24/7 availability of cardiac services, further support the strong demand from this segment.

United States Coronary Cutting Balloon Market generated USD 64.4 million in 2024. The U.S. remains at the forefront of cutting balloon adoption due to its large CAD patient pool, widespread availability of advanced cardiac facilities, and high volume of PCI procedures. Early adoption of innovative medical devices and favorable reimbursement policies continue to support the market’s growth. In addition, the rising use of technologies for imaging inside blood vessels further supports the clinical use of cutting balloons in identifying and treating complex lesions. Ongoing innovation from key players ensures consistent supply and performance enhancements that contribute to market expansion.

Leading companies in this market include LEPU MEDICAL, SHENQI MEDICAL, and Boston Scientific. To strengthen their market position, companies in the coronary cutting balloon space are deploying several targeted strategies. They are investing heavily in R&D to innovate next-generation devices that offer greater precision and safety. Geographic expansion through regional partnerships and regulatory approvals in high-growth countries is helping firms enter untapped markets. Companies are also focusing on physician training programs to boost awareness and encourage broader adoption of cutting balloons in complex procedures. Strengthening supply chains, optimizing pricing models, and expanding indications for use are other approaches being adopted to maintain competitive advantage and increase global footprint.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

- Boston Scientific

- LEPU MEDICAL

- SHENQI MEDICAL

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 135 |

| Published | July 2025 |

| Forecast Period | 2024 - 2034 |

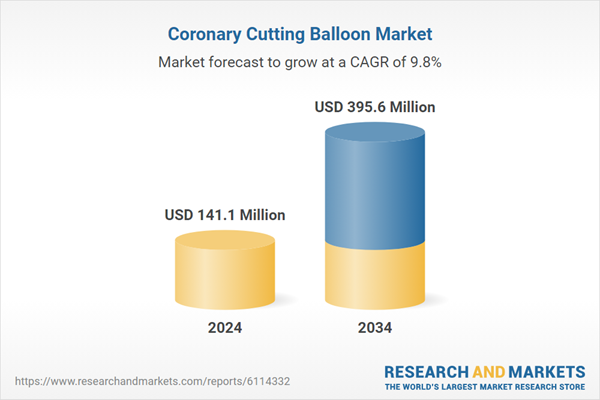

| Estimated Market Value ( USD | $ 141.1 Million |

| Forecasted Market Value ( USD | $ 395.6 Million |

| Compound Annual Growth Rate | 9.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 3 |