A key factor supporting market expansion is the rapid growth of global aircraft fleets, which necessitates more advanced and scalable MRO management systems. As the volume of air traffic rises, the complexity of maintaining aircraft fleets has increased, making traditional maintenance models insufficient. Digital MRO solutions have become essential tools in optimizing turnaround times, reducing unexpected downtime, and lowering maintenance costs. Furthermore, regulatory frameworks imposed by international aviation bodies continue to enforce stringent compliance protocols. These mandates require accurate, real-time documentation and traceability of parts, technician credentials, and maintenance histories. Aviation MRO software simplifies compliance by offering automated workflows and comprehensive audit trails, enabling operators to minimize errors and maintain regulatory alignment across all processes.

The market also benefits from the growing demand for operational transparency and risk mitigation. Software-driven platforms empower operators to centralize data and monitor every component’s life cycle, supporting better forecasting, parts inventory control, and performance analysis. The drive to eliminate paper-based documentation and enable remote access to data is accelerating the transition to digital solutions, especially among operators looking to enhance safety standards and maintenance reliability.

Based on the solution type, the market is categorized into enterprise resource planning (ERP) solutions, point solutions, and software suites. Among these, ERP solutions dominate with a market share of 42.9% in 2024, equivalent to USD 3.1 billion. The ERP segment is also expected to grow at the fastest pace, recording a CAGR of 5.7% throughout the forecast timeline. This growth is supported by the ability of ERP systems to integrate core functions such as inventory, maintenance, procurement, and compliance under one unified dashboard. Organizations adopting ERP tools are seeing gains in productivity and decision-making, driven by better data visibility and more efficient resource planning.

In terms of deployment models, the market is segmented into cloud-based and on-premises platforms. On-premises solutions captured the largest share at 64% in 2024, translating to a market value of USD 4.7 billion. Despite the shift toward cloud computing, many aviation companies continue to favor on-premises software due to higher levels of data control, greater system customization, and alignment with regulatory and security policies. These solutions remain especially relevant among operators with complex legacy systems or stringent data protection standards.

The end-user landscape includes airlines, MRO service providers, and OEMs. OEMs held the largest market share of 47.6% in 2024, driven by their extensive involvement in managing aircraft components and supporting lifecycle services. However, the airline segment, valued at USD 2.3 billion in 2024, is emerging as a significant growth driver, with a projected CAGR of 4.6% through 2034. Airlines are increasingly leveraging digital MRO platforms to enhance operational uptime, support predictive maintenance strategies, and reduce the overall cost of ownership. These platforms help streamline decision-making and resource allocation, ultimately improving fleet efficiency.

Regionally, North America led the aviation MRO software market in 2024 with a 38.7% share, underpinned by its mature aviation ecosystem, high aircraft concentration, and early adoption of digital technologies. Within the region, the United States emerged as the largest contributor with a market value of USD 2.5 billion in 2024. The country's leadership position is supported by its vast commercial and defense fleet, ongoing investment in digital transformation, and presence of major MRO software providers. Increasing integration of AI-powered analytics, real-time monitoring systems, and compliance management tools continues to support the country’s dominance in the global market.

Key companies active in the aviation MRO software space include Boeing, Ramco Systems Ltd., IBM Corporation, SAP SE, Swiss AviationSoftware Ltd. (Swiss-AS), GE Aerospace, Ultramain Systems, and Veryon. These companies are at the forefront of delivering robust, scalable software platforms designed to address the evolving needs of the aviation industry through automation, data integration, and predictive maintenance capabilities.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

- ASA Software ApS

- Aviation Intertec Services Inc.

- Boeing

- Communications Software (Airline Systems) Limited

- Flatirons Solution

- Flatirons Solutions, Inc.

- GE Aerospace

- HCL Technologies Limited

- IBM Corporation

- IBS Software Private Limited

- IFS Aktiebolag

- Jet Support Services Inc.

- Lufthansa Technik

- Oracle Corporation

- Ramco Systems Ltd.

- SAP SE

- Swiss AviationSoftware Ltd. (Swiss-AS)

- Ultramain Systems

- Veryon

Table Information

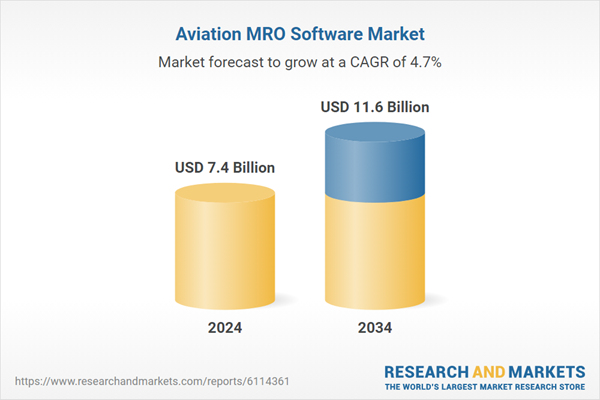

| Report Attribute | Details |

|---|---|

| No. of Pages | 170 |

| Published | July 2025 |

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 7.4 Billion |

| Forecasted Market Value ( USD | $ 11.6 Billion |

| Compound Annual Growth Rate | 4.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 19 |