Meanwhile, the expansion of electric vehicle production has introduced new requirements for lightweight and corrosion-resistant fasteners, creating fresh opportunities for product innovation. Increased spending on public infrastructure, especially in transportation and energy, further reinforces long-term demand across both emerging and established economies. As construction materials and methods become more advanced, so too does the need for fasteners that can match the strength and safety standards of next-generation structures.

The automotive sector emerged as the leading application segment in 2024, holding a 30% share, and is expected to grow at a CAGR of 3.9% through 2034. Automotive manufacturers rely on a variety of fastening solutions to connect and secure vehicle assemblies, including under-the-hood components and structural systems. These fasteners are produced in different materials such as steel alloys, plastics, and other composites, and are tailored in various finishes, shapes, and colors to suit specific automotive requirements.

The steel segment is forecasted to grow at a CAGR of 3.7% during 2025-2034. Steel fasteners are extensively used due to their strength, affordability, and adaptability in industrial settings. Available in multiple grades, steel is selected based on application needs and is often treated through processes like galvanizing, zinc plating, or chrome coating to improve durability and corrosion resistance. Stainless steel holds a strong market presence due to its composition of nickel, chromium, and low carbon, making it highly corrosion-resistant and structurally stable over time.

Asia Pacific Industrial Fasteners Market generated USD 65.1 billion in 2024. This region is poised to grow at a CAGR of 3.9% from 2025 to 2034. Manufacturing hubs across the region are experiencing steady demand increases, particularly with national initiatives that promote domestic production across the automotive and infrastructure sectors. Growing output in these industries is propelling the requirement for high-quality industrial fasteners. The expansion of regional distribution networks is also improving product availability and accessibility.

Key companies in the Industrial Fasteners Market include Buckeye Fasteners Company, Huyett, Penn Engineering, Portland Bolt, Accurate Manufactured Products Group, KD Fasteners, Hillman, National Bolt & Nut, Stanley Engineered Fastening, TR Fastenings, Dale Fastener Supply, Midwest Fastener, Birmingham Fastener, Baden Steelbar & Bolt, and American Fastener Technologies. To strengthen market presence, leading companies in the industrial fasteners space are focusing on product line diversification by introducing specialized fasteners tailored for EVs, aerospace, and modular construction. Strategic expansion into emerging markets, supported by robust distribution partnerships and localized manufacturing, is enabling wider customer reach. Companies are also investing in advanced materials and surface treatment innovations to improve product performance under demanding conditions. Many firms are integrating automation and digitalization within manufacturing operations to enhance efficiency and reduce production time.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

- Accurate Manufactured Products Group

- American Fastener Technologies

- Baden Steelbar & Bolt

- Birmingham Fastener

- Buckeye Fasteners Company

- Dale Fastener Supply

- Hillman

- Huyett

- KD Fasteners

- Midwest Fastener

- National Bolt & Nut

- Penn Engineering

- Portland Bolt

- Stanley Engineered Fastening

- TR Fastenings

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 220 |

| Published | July 2025 |

| Forecast Period | 2024 - 2034 |

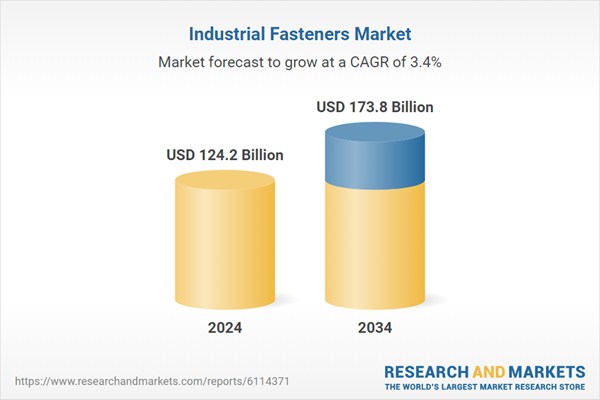

| Estimated Market Value ( USD | $ 124.2 Billion |

| Forecasted Market Value ( USD | $ 173.8 Billion |

| Compound Annual Growth Rate | 3.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |