Rapid urbanization across developing regions continues to accelerate the market’s expansion. Nations in Asia-Pacific, Latin America, and parts of Africa are witnessing a surge in residential, industrial, and commercial construction driven by rising populations and disposable incomes. Public and private investments are backing large-scale infrastructure and housing initiatives to meet long-term demands, making these regions critical hotspots for market growth. These initiatives are not only aimed at bridging the existing infrastructure gap but also at preparing urban areas for projected population booms and economic expansion. Governments are rolling out strategic urban development programs, including smart cities and energy-efficient housing, while private sector stakeholders are injecting capital into mixed-use developments, industrial parks, and transit-oriented construction.

The concrete accelerators segment held a 55.5% share in 2024. This segment’s dominance is linked to the growing preference for faster, high-yield construction workflows. These admixtures are ideal for cold weather conditions or when projects face compressed timelines. Precast and modular building techniques benefit significantly from accelerator use due to their rapid curing properties, which lower costs and increase site productivity. Accelerators are also vital for applications such as retaining walls, where speed and efficiency are crucial for meeting project schedules.

The liquid form segment held a 74.3% share in 2024. Its popularity stems from easy handling, consistent mixing, and effective integration into current construction workflows. These admixtures perform particularly well in large-scale infrastructure and prefabrication environments, where consistent concrete curing is essential for seamless project execution. Fast-drying capabilities in liquid accelerators are highly valued in both residential and industrial sectors as they enhance productivity and maintain structural integrity under time constraints.

United States Concrete Accelerators and Retarders Market was valued at USD 770.6 million in 2024. A resurgence in construction activity, supported by substantial infrastructure funding under federal initiatives, is driving demand for next-gen concrete additives. The focus on environmentally responsible and energy-efficient building practices has fueled the adoption of modern accelerators and retarders, enhancing both sustainability and performance. With contractors prioritizing durability, curing speed, and energy savings, the U.S. is a major contributor to market expansion.

Leading players shaping the industry include GCP Applied Technologies Inc., Euclid Chemical, Sika AG, and BASF SE. Key strategies adopted by companies in the concrete accelerators and retarders market focus on expanding product portfolios, enhancing R&D, and forming strategic alliances. Major firms are investing in environmentally friendly additives that improve performance while aligning with green building standards. Collaborations with construction firms and infrastructure developers allow these companies to customize solutions for specific project demands. In addition, digital platforms and smart logistics are being leveraged to streamline supply chains and ensure rapid product delivery. Players are also targeting emerging markets with tailored offerings to capture regional growth opportunities and expand their global footprint.

Comprehensive Market Analysis and Forecast

- Industry trends, key growth drivers, challenges, future opportunities, and regulatory landscape

- Competitive landscape with Porter’s Five Forces and PESTEL analysis

- Market size, segmentation, and regional forecasts

- In-depth company profiles, business strategies, financial insights, and SWOT analysis

This product will be delivered within 2-4 business days.

Table of Contents

Companies Mentioned

- BASF SE

- Bisley & Company Pty Ltd

- Cementaid International Group

- CEMEX S.A.B. de C.V.

- Chryso Group (Saint-Gobain)

- Euclid Chemical Company

- Fosroc International Ltd

- Fritz-Pak Corporation

- GCP Applied Technologies Inc

- Henan Kingsun Chemical Co., Ltd.

- Mapei S.p.A.

- Master Builders Solutions

- Peters Chemical Company

- Shandong Wanshan Chemical Co., Ltd

- Sika AG

- Yara International ASA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 220 |

| Published | July 2025 |

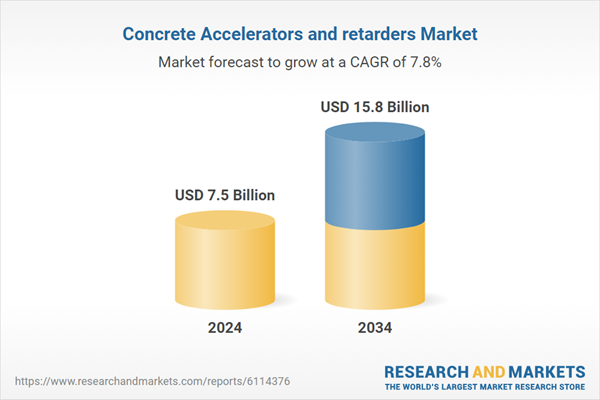

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 7.5 Billion |

| Forecasted Market Value ( USD | $ 15.8 Billion |

| Compound Annual Growth Rate | 7.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |