Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

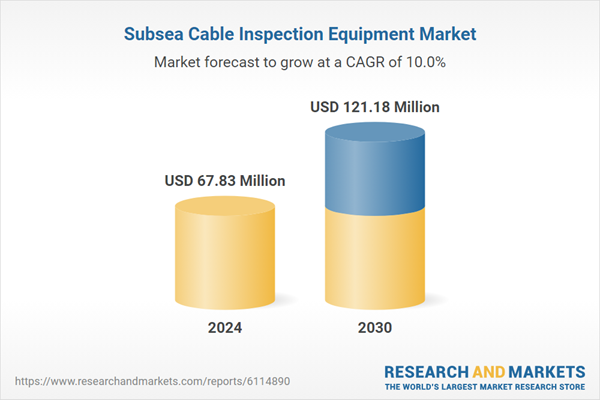

The global Subsea Cable Inspection Equipment Market is witnessing significant growth due to the increasing deployment of subsea cables for power transmission, telecommunications, and offshore energy infrastructure. Subsea cables are critical assets that require regular monitoring and maintenance to ensure uninterrupted operation and structural integrity, particularly in harsh underwater environments. As offshore wind farms, intercontinental communication networks, and undersea power projects expand, the demand for reliable, advanced inspection technologies is rising. These cables often traverse thousands of kilometers across the ocean floor, and any disruption can lead to severe economic and operational consequences. This growing dependency on subsea cables has prompted both public and private stakeholders to invest in specialized inspection equipment and services to detect faults, wear, or potential threats such as corrosion, sediment shifts, or marine activities.

Technological advancements in autonomous underwater vehicles (AUVs), remotely operated vehicles (ROVs), sonar systems, and high-definition imaging tools are playing a pivotal role in reshaping the market landscape. ROVs and AUVs equipped with sensors and cameras enable real-time monitoring and high-precision inspection of cables located at extreme depths and remote locations.

Furthermore, the integration of AI and data analytics software has enhanced cable tracking, anomaly detection, and predictive maintenance capabilities, reducing inspection costs and improving operational efficiency. These innovations are particularly relevant for sectors such as offshore wind energy, which is expanding rapidly in regions like Europe, North America, and Asia Pacific. In fact, offshore renewable energy projects are becoming one of the largest consumers of subsea cable inspection solutions, driving sustained demand in the market.

Key Market Drivers

Growth in Offshore Renewable Energy Projects

The rapid expansion of offshore renewable energy, especially wind power, is a major driver for subsea cable inspection equipment. Offshore wind capacity has more than tripled over the past five years, reaching over 45 GW globally. In 2023 alone, over 20 GW of new offshore wind capacity was added, requiring extensive subsea cable networks. On average, each offshore wind project installs 80-120 km of subsea power cables, all of which need regular inspection for safety and efficiency. Approximately 35-40% of cable failures in wind farms are due to mechanical damage or seabed movement, making proactive inspection essential.The average offshore wind farm undergoes cable inspection 2-3 times per year, up from once per year five years ago. Additionally, more than 70 new offshore wind projects are currently under construction, further accelerating the demand for cable inspection technologies. Countries like the UK, Germany, China, and South Korea are leading the charge, with their offshore wind investments expected to increase by over 60% in the next three years. This surge in infrastructure requires advanced, reliable subsea inspection tools such as ROVs and sonar systems to ensure safe power transmission, prevent costly downtimes, and comply with regulatory standards.

Key Market Challenges

High Cost of Equipment and Operations

One of the primary challenges in the subsea cable inspection equipment market is the high capital and operational costs associated with deploying and maintaining inspection systems. Remotely Operated Vehicles (ROVs) and Autonomous Underwater Vehicles (AUVs), which are commonly used for inspection, can cost upwards of USD 500,000-1 million per unit, depending on depth capabilities, sensor integration, and AI software compatibility. Additionally, support systems such as launch and recovery equipment, navigation tools, and real-time data processing units add to the overall expense.Operational costs also remain steep due to the need for highly trained operators, maintenance personnel, and support vessels. A typical offshore inspection campaign can cost USD 50,000-100,000 per day, especially in deep-sea or turbulent environments. This makes it financially unviable for smaller service providers and regional players to enter or scale operations.

Moreover, the costs of breakdowns and unplanned downtime are significant. A malfunctioning inspection system during a mission can lead to delays, re-deployment, and financial losses. For many developing economies and mid-sized firms, these costs limit the adoption of advanced subsea inspection systems. While service-based models are emerging, the upfront investment barrier still slows broader market penetration.

Key Market Trends

Shift Toward Modular and Portable Inspection Systems

Another significant trend is the movement toward compact, modular, and portable subsea cable inspection equipment. Traditionally, inspection systems have been large, vessel-dependent, and difficult to deploy without significant infrastructure. However, recent advancements in miniaturization and modular design are enabling smaller inspection firms and offshore developers to carry out localized inspections more cost-effectively.Modern inspection tools are now being built with interchangeable modules, allowing users to customize their systems based on specific project requirements - such as depth rating, sensor type, or camera resolution. These modular systems are lighter, easier to transport, and faster to deploy, especially in shallow or nearshore environments. Many units can now be launched from small boats or even shorelines, removing the need for expensive vessels and large crews.

Moreover, plug-and-play software configurations mean operators can quickly integrate new tools like acoustic sensors, fiber-optic trackers, or environmental monitors. In emerging markets, these compact solutions are enabling regional players to enter the market with lower capital investment. The portability also supports quicker response times in emergency cable inspection scenarios, such as after natural disasters or ship anchor damage. This trend toward lightweight, modular equipment is transforming accessibility and agility in the subsea inspection industry.

Key Market Players

- Fugro N.V.

- Oceaneering International, Inc.

- DeepOcean Group

- Saab Seaeye Ltd.

- Teledyne Marine

- Nexans

- Prysmian Group

- Subsea 7 S.A.

- EIVA A/S

- Global Marine Group

Report Scope:

In this report, the Global Subsea Cable Inspection Equipment Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Subsea Cable Inspection Equipment Market, By Type:

- ROVs

- AUVs

- Sonar Systems

- Camera Systems

- Others

Subsea Cable Inspection Equipment Market, By Application:

- Power Cable Inspection

- Telecommunication Cable Inspection

- Oil & Gas Subsea Infrastructure

- Renewable Energy

- Others

Subsea Cable Inspection Equipment Market, By Deployment Mode:

- Vehicle-Mounted

- Towed Systems

- Diver-Assisted Systems

- Stationary / Fixed Systems

Subsea Cable Inspection Equipment Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- South America

- Brazil

- Argentina

- Colombia

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Subsea Cable Inspection Equipment Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Fugro N.V.

- Oceaneering International, Inc.

- DeepOcean Group

- Saab Seaeye Ltd.

- Teledyne Marine

- Nexans

- Prysmian Group

- Subsea 7 S.A.

- EIVA A/S

- Global Marine Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | July 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 67.83 Million |

| Forecasted Market Value ( USD | $ 121.18 Million |

| Compound Annual Growth Rate | 9.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |