Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Their offerings included eco-friendly toilets and water-saving faucets, highlighting the brand’s dedication to environmental sustainability through water conservation and reduced carbon emissions. In the fiscal year 2022, Japan’s TOTO experienced substantial growth in Vietnam, reporting a 38% increase in profits. This surge was fueled by a strong recovery in domestic demand and the expansion of its production facilities. The performance highlights a notable shift in the Vietnamese market toward premium sanitary products, as consumer preferences continue to evolve.

Key Market Drivers

Rapid Urbanization and Infrastructure Development

Vietnam's swift urbanization and continuous infrastructure growth have greatly increased the demand for modern housing and commercial developments. As new urban areas emerge, the requirement for advanced sanitary ware and bathroom accessories has risen sharply, especially in newly built residences, hotels, and business establishments. According to the General Statistics Office, Vietnam's urban population is growing steadily, which is driving the demand for improved housing and commercial infrastructure. New apartment complexes, hotels, office spaces, and shopping malls are being built at an accelerated pace, each requiring modern sanitary ware and bathroom fittings.Additionally, government-led initiatives to enhance urban infrastructure, such as smart city development and new housing schemes, are further boosting demand. This ongoing construction boom is a significant catalyst for the growth of the sanitary ware and bathroom accessories market. The total number of households in Vietnam exceeded 27 million, highlighting the country’s substantial rural population relative to urban areas. From 2002 to 2022, Vietnam’s GDP per capita increased 3.6 times, reaching USD 4,179, while the poverty rate declined from 14% in 2010 to 5.7% in 2023. According to the World Bank, per capita income in Vietnam rose to USD 4,346.8 in 2023, contributing to the growth of the sanitary ware and bathroom accessories market in the country.

Key Market Challenges

Intense Market Competition and Price Pressure

One of the most significant challenges in Vietnam's sanitary ware and bathroom accessories market is the increasingly intense competition among both domestic and international brands. With the market’s expansion and growth prospects, numerous foreign players from countries such as China, Japan, Thailand, and Europe have entered, offering a wide range of products across price segments. Local manufacturers often struggle to compete with these brands in terms of product innovation, design, and technology. As a result, there is a price war that forces companies to lower margins to stay competitive.Many consumers in the mid and low-income brackets remain highly price-sensitive, pushing companies to prioritize cost over quality or innovation. This focus on affordability often affects brand differentiation and long-term sustainability. Moreover, some imported products - particularly from low-cost manufacturing hubs - undercut prices, leading to challenges in maintaining profitability for domestic brands. For manufacturers and retailers, striking the right balance between affordability, quality, and innovation remains a persistent obstacle.

Key Market Trends

Rising Demand for Smart and Touchless Bathroom Fixtures

One of the most prominent trends in Vietnam’s sanitary ware market is the increased adoption of smart and touchless bathroom fixtures. Products such as sensor-activated faucets, touchless toilets, and automated hand dryers are gaining popularity, particularly in urban households, commercial buildings, and hospitality sectors. This trend has been accelerated by heightened hygiene awareness in the post-COVID era, where minimizing physical contact with surfaces has become essential.Urban consumers are becoming more conscious of convenience and health safety, driving demand for these advanced solutions. Furthermore, many high-end residential and office projects now integrate smart sanitary ware as a standard feature, helping normalize their use. However, the higher cost of these smart fixtures limits adoption in mid-to-low income segments. Additionally, lack of technical expertise for maintenance and repairs may deter some consumers. Still, as production becomes more localized and economies of scale improve, prices are expected to fall, further boosting adoption.

Key Market Players

- Caesar bathroom

- Gessi SpA

- Innoci Vietnam

- Jaquar Group

- LIXIL Group

- Roca Sanitario, S.A

- TOTO Ltd.

- Viglacera Corporation

- Italisa (Vietnam) Co. Ltd.

- Thien Thanh Sanitaryware Joint Stock Company (Thien Thanh)

Report Scope:

In this report, the Vietnam Sanitary Ware and Bathroom Accessories Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Vietnam Sanitary Ware and Bathroom Accessories Market, By Product Type:

- Toilet/Water Closet

- Wash basin

- Cistern

- Faucets

- Showers

- Others

Vietnam Sanitary Ware and Bathroom Accessories Market, By Material:

- Ceramic

- Pressed Metal

- Acrylic Plastic & Perspex

- Others

Vietnam Sanitary Ware and Bathroom Accessories Market, By Region:

- Northern

- Southern

- Central

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Vietnam Sanitary Ware and Bathroom Accessories Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Caesar bathroom

- Gessi SpA

- Innoci Vietnam

- Jaquar Group

- LIXIL Group

- Roca Sanitario, S.A

- TOTO Ltd.

- Viglacera Corporation

- Italisa (Vietnam) Co. Ltd.

- Thien Thanh Sanitaryware Joint Stock Company (Thien Thanh)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 82 |

| Published | July 2025 |

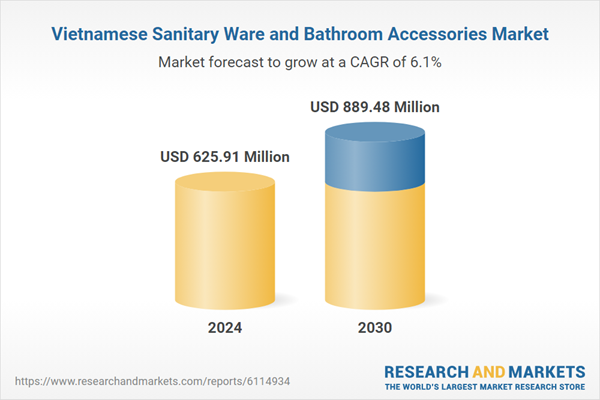

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 625.91 Million |

| Forecasted Market Value ( USD | $ 889.48 Million |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Vietnam |

| No. of Companies Mentioned | 10 |