Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Microcontrollers serve as the brain for numerous automotive applications, including powertrain control, infotainment, ADAS (Advanced Driver Assistance Systems), and battery management in EVs. Vietnam’s urbanization and rising disposable incomes have led to a booming passenger vehicle segment, and this consumer shift toward technologically equipped, safer, and energy-efficient vehicles has made microcontrollers a critical component. Additionally, global OEMs and Tier-1 suppliers are expanding operations in Vietnam due to favorable policies, competitive labor costs, and strategic proximity to ASEAN markets. The country’s burgeoning electronics manufacturing sector, backed by foreign direct investments (FDIs) from major semiconductor companies like Intel and Samsung, further strengthens the supply chain for automotive microcontrollers.

Key Market Drivers

Rise of Electric Vehicle Adoption in Vietnam

Electric vehicles are becoming a central pillar of Vietnam’s automotive future, primarily driven by environmental policies and rising fuel costs. The country aims to reduce greenhouse gas emissions by 9% by 2030 and 27% with international support, which makes the promotion of EVs essential. In this regard, the microcontroller market benefits immensely as EVs require a higher number of microcontrollers per vehicle than traditional internal combustion engine (ICE) vehicles - for tasks ranging from battery management systems (BMS), motor control units, regenerative braking systems, to thermal management. Vietnam-based automaker VinFast is playing a transformative role in this domain.In 2023, the company announced its ambition to cease producing ICE vehicles entirely and focus exclusively on EVs. The government is also incentivizing the sector through preferential tax rates, reduced registration fees for EVs, and plans to set up EV charging infrastructure across major cities. As per data from the Vietnam Automobile Manufacturers’ Association (VAMA), EV sales in Vietnam grew rapidly.

By the end of 2024, VinFast achieved total domestic sales of 87,000 units, representing a 150% increase compared to 2023 and making it the best-selling automotive brand in the Vietnamese market. This exponential growth trajectory is expected to continue, especially in the BEV and PHEV categories. Given that each EV can contain 50 to 100 microcontrollers depending on the model, compared to 30 to 60 in ICE vehicles, the rise in EV adoption directly translates into a spike in microcontroller demand. This trend supports high-bit-size microcontrollers (especially 32-bit), which are essential for managing complex EV operations, thus adding further depth to the market potential.

Key Market Challenges

Semiconductor Supply Chain Constraints

One of the biggest challenges facing Vietnam’s automotive microcontrollers market is the global semiconductor shortage that has lingered post-pandemic. Despite efforts to localize manufacturing, Vietnam remains highly dependent on imports for high-end semiconductor wafers and microcontroller units (MCUs), which are primarily produced in Taiwan, South Korea, Japan, and China. During peak shortages in 2021-22, automakers in Vietnam reported production cuts ranging from 20% to 40% due to the unavailability of electronic components. Although the situation has improved marginally, vulnerabilities remain.Automotive MCUs have longer qualification cycles and require high reliability, making it difficult to rapidly ramp up alternative suppliers. Small and mid-sized OEMs in Vietnam, lacking strong bargaining power in global supply chains, are particularly vulnerable to price volatility and shipment delays. These disruptions affect not just manufacturing timelines but also vehicle pricing and consumer satisfaction. Without stronger upstream investments in semiconductor fabrication and MCU packaging capabilities within Vietnam, this dependency will continue to act as a structural bottleneck.

Key Market Trends

Shift Toward 32-Bit Microcontrollers for EV and ADAS Applications

There is a clear shift in demand from lower-bit microcontrollers (8-bit and 16-bit) toward more powerful 32-bit MCUs inVietnam, driven by the rise of EVs and complex ADAS systems. These 32-bit units offer superior processing power, memory capabilities, and energy efficiency, enabling real-time decision-making required for autonomous features and battery management.According to NXP and Renesas, more than 60% of their automotive microcontroller shipments in 2023 were 32-bit variants, and this proportion is expected to grow further. In Vietnam, as local OEMs like VinFast aim to launch globally competitive electric cars, they are adopting high-end MCUs that support sophisticated software stacks, OTA updates, and secure communication protocols. 32-bit MCUs also integrate more peripherals, reducing the need for multiple chips and streamlining vehicle architecture. This transition will become a dominant trend, especially as Vietnamese vehicles evolve from basic transport solutions to smart, connected platforms.

Key Market Players

- Toshiba Corporation

- Maxim Integrated

- Cypress Semiconductor Corporation

- Analog Devices Inc.

- Infineon Technologies AG

- ON Semiconductor

- Maxim Integrated

- STMicroelectronics

- Rohm Semiconductor

- Renesas Electronics Corporation

Report Scope:

In this report, the Vietnam Automotive Microcontrollers market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Vietnam Automotive Microcontrollers Market, By Vehicle Type:

- Passenger Cars

- Commercial Vehicle

Vietnam Automotive Microcontrollers Market, By Electric Vehicle Type:

- BEV

- HEV

- PHEV

- FCEV

Vietnam Automotive Microcontrollers Market, By Technology:

- Park Assist System

- ACC

- TPMS

- Blind Spot Detection System

Vietnam Automotive Microcontrollers Market, By Connectivity:

- V2V Connectivity

- V2I Connectivity

- V2C Connectivity

Vietnam Automotive Microcontrollers Market, By Bit Size:

- 8-Bit

- 16-Bit

- 32-Bit

Vietnam Automotive Microcontrollers Market, By Region:

- North Vietnam

- South Vietnam

- Central Vietnam

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Vietnam Automotive Microcontrollers market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Toshiba Corporation

- Maxim Integrated

- Cypress Semiconductor Corporation

- Analog Devices Inc.

- Infineon Technologies AG

- ON Semiconductor

- Maxim Integrated

- STMicroelectronics

- Rohm Semiconductor

- Renesas Electronics Corporation

Table Information

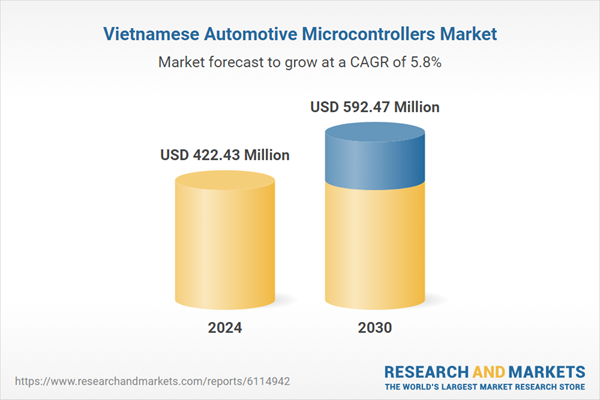

| Report Attribute | Details |

|---|---|

| No. of Pages | 70 |

| Published | July 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 422.43 Million |

| Forecasted Market Value ( USD | $ 592.47 Million |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Vietnam |

| No. of Companies Mentioned | 10 |