Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The Marine Signaling Devices Market refers to the industry focused on the manufacturing, distribution, and utilization of devices designed to communicate warnings, alerts, and position information in marine environments. These signaling devices are essential for ensuring the safety of vessels, passengers, and cargo, particularly in situations involving navigation, collision avoidance, distress communication, and search-and-rescue operations. The market encompasses a wide range of products including visual signaling devices (such as signal flags, strobes, and flares), audible devices (such as horns and bells), and advanced electronic signaling systems (such as Automatic Identification Systems, Global Positioning Systems, and distress beacons).

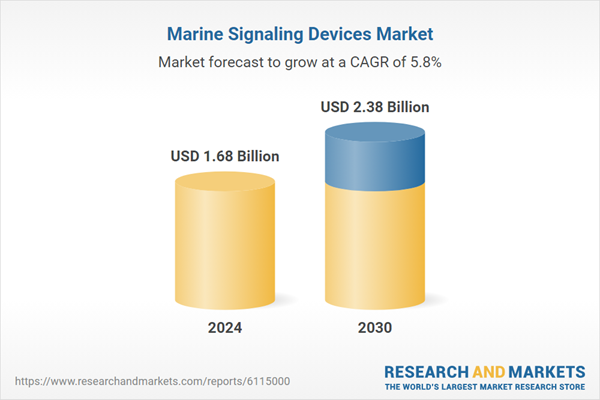

The market is expected to experience robust growth in the coming years due to increasing maritime safety regulations set by global and regional authorities such as the International Maritime Organization, as well as national coast guards. The expansion of international maritime trade and the rise in commercial shipping activities are creating a significant demand for reliable signaling solutions. Additionally, growth in the recreational boating industry, coupled with rising consumer awareness regarding maritime safety, is contributing to increased adoption of signaling devices across non-commercial segments.

Technological advancements are further transforming the market, with manufacturers integrating GPS, satellite communication, and automation features into signaling devices to enhance their effectiveness and user convenience. Smart marine signaling devices with real-time tracking, remote monitoring, and automated distress transmission capabilities are gaining popularity among end users. These innovations are expected to replace traditional manual systems, increasing operational efficiency and improving response times in emergencies.

Moreover, as offshore oil and gas exploration activities increase, so does the demand for advanced signaling solutions to ensure the safety of personnel and assets in hazardous marine environments. Government investments in port infrastructure and coastal surveillance also support the market's expansion. Given these trends, the Marine Signaling Devices Market is poised for sustained growth, driven by regulatory mandates, technological evolution, and rising global maritime activity.

Key Market Drivers.

Stringent Maritime Safety Regulations Driving Compliance

The Marine Signaling Devices Market is experiencing significant growth due to the enforcement of stringent maritime safety regulations globally, which mandate the use of advanced signaling devices to ensure vessel and crew safety. Regulatory bodies such as the International Maritime Organization (IMO) and regional authorities like the U.S. Coast Guard require vessels to be equipped with signaling devices, including visual and audible systems, to comply with standards like the Safety of Life at Sea (SOLAS) and Marine Pollution (MARPOL) conventions.These regulations aim to prevent collisions, facilitate search and rescue operations, and enhance communication during emergencies, compelling ship operators to invest in reliable signaling equipment. The growing emphasis on maritime safety, driven by rising incidents of accidents and environmental concerns, has led to increased adoption of devices such as radar reflectors, distress flares, and VHF radios. In commercial shipping, where cargo and passenger vessels operate in high-traffic sea routes, the need for effective signaling to avoid collisions and ensure navigational safety is critical.

Additionally, naval and defense sectors are prioritizing advanced signaling systems to enhance operational security. Emerging economies, particularly in Asia-Pacific, are aligning with global standards, further boosting demand as their maritime industries expand. The threat of hefty fines and penalties for non-compliance, coupled with the need to maintain operational licenses, drives shipowners to upgrade outdated systems with modern signaling technologies. The integration of these devices into vessel safety protocols ensures compliance with evolving regulations, fostering market growth. As governments worldwide continue to tighten safety standards and conduct rigorous inspections, the Marine Signaling Devices Market is poised for sustained expansion, driven by the necessity to meet regulatory requirements and protect maritime ecosystems.

In 2024, the IMO reported that 85% of commercial vessels globally were required to carry SOLAS-compliant signaling devices, with 12,000 new vessels equipped annually. Non-compliance fines in the U.S. reached USD50,000 per incident, prompting 90% of U.S.-registered cargo ships to upgrade signaling systems, contributing to 1.5 million units installed worldwide in 2023.

Key Market Challenges

High Costs and Integration Complexities

A significant challenge affecting the Marine Signaling Devices Market is the high cost associated with acquiring and integrating advanced signaling technologies. As the market evolves from basic visual and audible devices to more complex electronic and automated signaling systems, the capital investment required has risen considerably. Modern signaling devices, which include satellite-based distress transmitters, GPS-enabled emergency beacons, and integrated Automatic Identification Systems, involve not only costly equipment but also the expense of installation, calibration, and periodic maintenance. For many small- to mid-sized marine operators - particularly those in fishing, recreational boating, or small-scale coastal logistics - these costs can be a major deterrent to adoption.The complexity of integrating new signaling technologies with existing vessel infrastructure presents another layer of difficulty. Many vessels currently in service, especially older ones, operate with legacy systems that are not compatible with modern signaling technology. Retrofitting these vessels often requires significant customization and technical expertise, which increases installation times and introduces risks of interoperability failures. Furthermore, integration becomes increasingly complicated as signaling devices evolve to communicate with smart vessel systems and Internet of Things networks. These integrations require robust cybersecurity protocols, real-time data processing, and synchronization with other onboard technologies.

The operational downtime caused by installation or system errors also impacts productivity and profitability, particularly for commercial fleets that depend on tight scheduling. Moreover, training crews to understand and operate newly integrated systems adds to the financial and time-related burden. If manufacturers do not prioritize the development of scalable, modular, and easy-to-integrate signaling solutions, the market could continue to see slow uptake, especially in price-sensitive and technically underserved segments. A streamlined, cost-effective approach to deployment will be essential in overcoming these financial and technical barriers.

Key Market Trends

Regulatory Acceleration Driving Adoption of Advanced Technologies

Governments and international maritime organizations are tightening safety and environmental regulations, significantly increasing the demand for advanced signaling solutions. Commercial vessels, offshore platforms, fishing fleets, and recreational boats are now required to equip modern electronic signaling devices - such as GPS-enabled distress beacons, Automatic Identification Systems (AIS), and LED-based navigation lights - under international safety mandates.These regulations not only ensure passenger and crew safety but also help prevent sea collisions and streamline search-and-rescue operations. As a result, demand is shifting away from traditional pyrotechnic signals, which pose disposal and environmental challenges. Vessel owners are upgrading to costlier yet safer and compliant systems, reinforcing regulations as the primary driver for technology uptake in the sector.

Key Market Players

- Danita Electronics

- Aqua Signal (part of Glamox Group)

- Kahlenberg Industries, Inc.

- Perko Inc.

- Jotron AS

- Ocean Signal (A brand of ACR Electronics)

- ACR Electronics, Inc.

- Lalizas S.A.

- Wärtsilä Corporation

- Icom Inc.

Report Scope:

In this report, the Global Marine Signaling Devices Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Marine Signaling Devices Market, By Type:

- Visual Signaling Devices

- Audible Signaling Devices

- Electronic Signaling Devices

- Pyrotechnic Signaling Devices

Marine Signaling Devices Market, By Distribution Channel:

- Online

- Offline

Marine Signaling Devices Market, By End User:

- Coastal Navigation

- Offshore Operations

- Inland Waterways

- Ports and Harbors

Marine Signaling Devices Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- South America

- Brazil

- Argentina

- Colombia

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Marine Signaling Devices Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Danita Electronics

- Aqua Signal (part of Glamox Group)

- Kahlenberg Industries, Inc.

- Perko Inc.

- Jotron AS

- Ocean Signal (A brand of ACR Electronics)

- ACR Electronics, Inc.

- Lalizas S.A.

- Wärtsilä Corporation

- Icom Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | July 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.68 Billion |

| Forecasted Market Value ( USD | $ 2.38 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |