Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

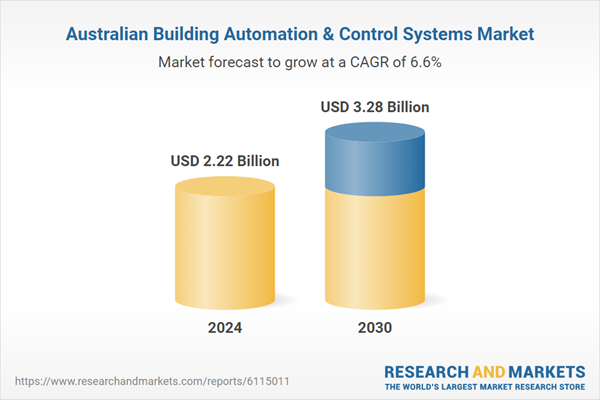

The Australia Building Automation & Control Systems (BACS) market is witnessing significant growth, driven by increasing demand for energy-efficient buildings, smart infrastructure development, and government regulations mandating sustainability standards. As the country continues to urbanize, commercial and residential property developers are turning to automation technologies to optimize energy consumption, reduce operational costs, and enhance occupant comfort. The BACS market in Australia integrates advanced technologies such as IoT, AI, and machine learning with traditional control systems to manage HVAC, lighting, security, and energy systems more efficiently. These systems enable real-time monitoring and control, predictive maintenance, and data-driven decision-making, contributing to both environmental goals and cost reduction.

Key Market Drivers

Regulatory Push & Sustainability Mandates

Australia’s energy-efficiency landscape is heavily shaped by regulatory frameworks. Under National Construction Code (NCC) regulations, for example, approximately 90% of new building approvals require a NatHERS energy rating of 6 stars or above. The NABERS scheme sets benchmarks for commercial ENERGY ratings, with government tenants pushing for 4.5-star minimum ratings in leased properties. Over 550 Green Star-certified projects, representing more than 8 million m² of floor area, further demonstrate demand for automated systems that support these standards.In Melbourne’s “1200 Buildings” retrofit initiative, roughly 25% of commercial premises were retrofitted between 2008-2013, targeting a 38% energy reduction - saving over 383,000 tonnes of CO₂ annually. Private-sector uptake of smart controls is also rising: a survey indicated 89% of building owners cited incentives as influential for automation investment, and 45% identified regulations as a major driver. These quantitative benchmarks highlight how compliance pressures are a primary catalyst for adopting BACS.

Key Market Challenges

High Initial Investment Costs

One of the most pressing challenges in the Australian BACS market is the high capital expenditure required for system deployment. While long-term operational savings are considerable, the upfront costs associated with purchasing, installing, and integrating automation systems can be prohibitive - especially for small to mid-sized buildings and older structures. Retrofitting existing buildings often requires extensive rewiring, replacing outdated infrastructure, or even overhauling entire HVAC and lighting systems. These costs can be difficult to justify, particularly in a market where return on investment may take several years to realize.Additionally, newer technologies such as AI-driven predictive analytics, digital twins, or fully integrated cloud-based platforms tend to come with higher licensing fees and ongoing software subscription charges. Budget constraints in the public sector and among small businesses may limit large-scale adoption. Many decision-makers still view BACS as a luxury rather than a necessity, which slows market penetration, particularly in Tier II and Tier III regions.

Despite the government offering some incentives through programs like the National Energy Productivity Plan and various state-based energy efficiency schemes, these are often insufficient to significantly ease the financial burden on early adopters. Until technology costs decrease further or more robust funding mechanisms are introduced, high initial investments will remain a substantial barrier to widespread implementation of building automation solutions in Australia.

Key Market Trends

Integration of AI and Predictive Analytics in Building Systems

Artificial intelligence and predictive analytics are reshaping the BACS landscape in Australia, enabling systems to shift from reactive to proactive control. AI algorithms analyze data collected from sensors, occupancy patterns, weather forecasts, and historical performance to predict equipment behavior and optimize system operations before inefficiencies occur. For instance, AI-integrated HVAC systems can anticipate cooling or heating needs based on occupancy and external temperature trends, leading to smoother performance and energy savings of up to 20%.Predictive maintenance is another area gaining traction. Sensors detect early signs of equipment wear or malfunction, triggering service alerts before failures occur. This minimizes downtime, extends equipment lifespan, and cuts maintenance costs by 15-30%. Additionally, AI-driven dashboards are providing building managers with actionable insights that help them fine-tune energy consumption, water usage, and even space utilization.

In sectors like healthcare and commercial real estate, these smart capabilities are becoming essential, ensuring operational efficiency and compliance with health and safety standards. The emergence of digital twins - virtual models of physical assets - further enhances the ability to simulate building performance under various conditions, improving design, operations, and future retrofits.

As Australia’s built environment grows more data-centric, AI and analytics will become standard features in next-generation BACS deployments, offering long-term strategic value beyond traditional control systems.

Key Market Players

- Siemens AG

- Honeywell International

- Schneider Electric

- Johnson Controls

- ABB Ltd.

- Legrand SA

- Bosch Security Systems

- Carrier (UTC)

- Crestron Electronics

- Lutron Electronics

Report Scope:

In this report, the Australia Building Automation & Control Systems Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Australia Building Automation & Control Systems Market, By Component:

- HVAC

- Lighting Systems

- Electronic Security

- Energy Management System

Australia Building Automation & Control Systems Market, By Communication Protocol:

- Wired

- Wireless

Australia Building Automation & Control Systems Market, By End User:

- IT/ITEs

- Residential

- Commercial

- Hospitality

- Industrial

- Retail

- Hospital

- Others

Australia Building Automation & Control Systems Market, By Region:

- New South Wales

- Victoria

- Queensland

- Western Australia

- South Australia

- Tasmania

- Australian Capital Territory

- Northern Territory

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Australia Building Automation & Control Systems Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Siemens AG

- Honeywell International

- Schneider Electric

- Johnson Controls

- ABB Ltd.

- Legrand SA

- Bosch Security Systems

- Carrier (UTC)

- Crestron Electronics

- Lutron Electronics

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 77 |

| Published | July 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.22 Billion |

| Forecasted Market Value ( USD | $ 3.28 Billion |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Australia |

| No. of Companies Mentioned | 10 |