Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Smart fault detection is essential for maintaining grid stability, preventing large-scale outages, and improving the resilience of power transmission systems. Unlike traditional fault detection methods that rely on static protection schemes and post-event diagnostics, smart systems utilize real-time data acquisition, machine learning algorithms, and cloud-based platforms to enable predictive maintenance, immediate fault localization, and faster service restoration. These systems can identify a range of disturbances including short circuits, line-to-ground faults, equipment failures, and environmental disruptions such as lightning strikes or vegetation intrusion.

The integration of smart sensors with SCADA (Supervisory Control and Data Acquisition), DMS (Distribution Management Systems), and wide-area monitoring systems enhances situational awareness across the transmission grid. This market encompasses various components including intelligent electronic devices (IEDs), fault indicators, line sensors, digital relays, and software platforms designed for analytics and grid automation. The increasing complexity of modern power grids - driven by the integration of renewable energy sources, electrification of infrastructure, and decentralization of power generation - has made smart fault detection a critical requirement. Moreover, as energy demand continues to rise globally, the need for uninterrupted and high-quality power supply has placed greater emphasis on proactive fault management and network reliability.

Key Market Drivers

Rising Need for Grid Reliability and Resilience Amid Aging Infrastructure

The increasing demand for grid reliability and resilience is a key driver propelling the growth of the smart fault detection system market for power transmission. Many developed economies are facing the challenge of aging transmission infrastructure, which is more prone to faults, outages, and performance degradation. As transmission networks age, the likelihood of equipment failure and line disturbances increases, leading to power interruptions, equipment damage, and high maintenance costs. In response, utilities and transmission operators are actively seeking advanced fault detection systems that can identify, isolate, and address faults in real-time to maintain uninterrupted power flow.Smart fault detection systems enable predictive maintenance by continuously monitoring grid parameters such as voltage, current, and frequency, thereby identifying irregularities before they escalate into critical failures. These systems leverage sensor-based technologies, real-time analytics, and intelligent automation to swiftly detect anomalies and reduce the mean time to repair (MTTR).

The ability to quickly localize and isolate faults not only minimizes service disruptions but also significantly reduces operational costs associated with manual inspections and reactive maintenance. Additionally, the increasing frequency and intensity of extreme weather events - such as storms, wildfires, and heatwaves - further highlight the need for resilient transmission networks. Smart fault detection systems help mitigate the impact of these events by providing grid operators with real-time visibility and control, enabling faster response and recovery.

With rising expectations for uninterrupted power supply from both residential and commercial users, and with critical infrastructure like hospitals, data centers, and communication hubs relying on consistent electricity, the integration of smart fault detection technologies becomes a strategic imperative. As utilities continue to modernize their infrastructure under digital transformation and grid automation initiatives, smart fault detection systems are positioned as essential tools to ensure system reliability, extend asset lifespan, and uphold service quality across increasingly complex and dynamic power networks.

Over 60% of the world’s transmission and distribution infrastructure is more than 25 years old, leading to increased failure risks. Power outages cost the global economy approximately USD 150 billion annually due to lost productivity and damage. Grid downtime has increased by nearly 30% in many developed nations over the past decade. More than 45% of utilities worldwide have identified aging infrastructure as their top operational challenge. Global investment in grid modernization and resilience is projected to surpass USD 800 billion by 2030. Climate-related disruptions to power grids have risen by 40% in the past 10 years, intensifying the need for more robust systems. Over 70% of utilities plan to adopt advanced fault detection, automation, or microgrid systems in the next five years to enhance resilience.

Key Market Challenges

High Initial Investment and Deployment Costs

The smart fault detection system for power transmission market faces a significant challenge in the form of high initial investment and deployment costs. The integration of smart technologies - such as intelligent electronic devices (IEDs), IoT-based sensors, AI-driven analytics, and high-speed communication networks - into existing power transmission infrastructure requires considerable capital expenditure. Upgrading legacy grid systems to accommodate these technologies often involves substantial retrofitting, replacement of outdated equipment, and implementation of complex communication protocols and data processing platforms. Additionally, smart fault detection systems demand advanced software platforms for real-time monitoring, analytics, and automated control, which involve licensing fees, customization, and continuous updates.Many utilities, particularly in developing and underfunded regions, struggle with budget constraints, making it difficult to justify such high capital investments, especially when traditional systems are still functional. Even in more advanced markets, the cost of full-scale deployment across large transmission networks can be prohibitive, leading to segmented or partial implementation, which limits the effectiveness and coverage of smart fault detection. Moreover, the need for skilled personnel to manage and operate these systems adds to operational costs, as utilities must invest in training or hiring technically qualified staff. The challenge is further amplified by the long ROI periods associated with smart grid investments, which can deter short-term focused utility boards and private stakeholders.

While the long-term benefits of improved reliability, reduced outage time, and predictive maintenance are clear, the upfront financial barrier often delays or discourages adoption. Without substantial funding support, incentives, or financing models, utilities may be reluctant to transition fully to smart fault detection systems, especially in regions where profit margins are thin or infrastructure funding is limited. As a result, the market must navigate this financial hurdle by promoting cost-effective solutions, modular implementations, and business models that spread out costs over time - such as leasing, performance-based contracts, or public-private partnerships. Addressing the high cost challenge will be crucial for widespread deployment and market maturity, especially in cost-sensitive regions where infrastructure development is critical for grid stability and energy security.

Key Market Trends

Integration of AI and Machine Learning in Smart Fault Detection Systems

The Smart Fault Detection System for Power Transmission market is witnessing a significant trend in the integration of artificial intelligence (AI) and machine learning (ML) technologies, revolutionizing how utilities monitor and maintain grid infrastructure. These advanced technologies are enabling predictive analytics capabilities that go beyond traditional threshold-based detection methods, allowing systems to learn from historical data and dynamically identify complex fault patterns in real time. By continuously analyzing sensor data, voltage variations, thermal changes, and waveform anomalies, AI-driven models can forecast potential faults or deteriorating components, enabling proactive maintenance and reducing downtime.This trend is being increasingly adopted by grid operators and utility companies to optimize operational efficiency, minimize unplanned outages, and extend the lifespan of transmission equipment. Furthermore, the use of machine learning facilitates adaptive learning, where systems improve accuracy and reduce false alarms over time, thereby enhancing decision-making for grid reliability. This approach also allows for real-time visualization of grid conditions through intuitive dashboards, improving situational awareness for grid operators. The scalability of AI-based systems makes them ideal for large, complex grid infrastructures where manual inspection is impractical.

Moreover, advancements in edge computing are making it possible to embed AI capabilities directly at the device level, reducing latency and bandwidth usage by processing data locally. As the power transmission industry continues to digitize, the convergence of AI with IoT-enabled sensors and communication protocols is reshaping fault detection into a more intelligent, autonomous, and self-healing grid system.

This not only reduces maintenance costs but also supports utilities in meeting stringent regulatory requirements for reliability and resilience. As AI and ML algorithms become more sophisticated, utilities will benefit from enhanced fault classification, improved localization accuracy, and faster response times, thereby transforming grid management into a highly responsive and data-driven process. This trend is expected to accelerate as more governments and private players invest in modernizing aging grid infrastructure with intelligent systems capable of learning, adapting, and predicting faults well before they evolve into system failures.

Key Market Players

- ABB Ltd.

- Siemens AG

- General Electric (GE) Grid Solutions

- Schneider Electric SE

- Eaton Corporation

- SEL (Schweitzer Engineering Laboratories)

- Mitsubishi Electric Corporation

- NR Electric Co., Ltd.

- Landis+Gyr

- Toshiba Energy Systems & Solutions Corporation

Report Scope:

In this report, the Global Smart Fault Detection System For Power Transmission Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Smart Fault Detection System For Power Transmission Market, By Technology:

- Artificial Intelligence

- Machine Learning

- Data Analytics

- IoT Integration

Smart Fault Detection System For Power Transmission Market, By Application:

- Power Generation

- Power Distribution

- Renewable Energy Sources

- Transmission Lines

Smart Fault Detection System For Power Transmission Market, By End-User:

- Utilities

- Manufacturing

- Transportation

- Commercial Buildings

Smart Fault Detection System For Power Transmission Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

- Turkey

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Smart Fault Detection System For Power Transmission Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional Market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- ABB Ltd.

- Siemens AG

- General Electric (GE) Grid Solutions

- Schneider Electric SE

- Eaton Corporation

- SEL (Schweitzer Engineering Laboratories)

- Mitsubishi Electric Corporation

- NR Electric Co., Ltd.

- Landis+Gyr

- Toshiba Energy Systems & Solutions Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | July 2025 |

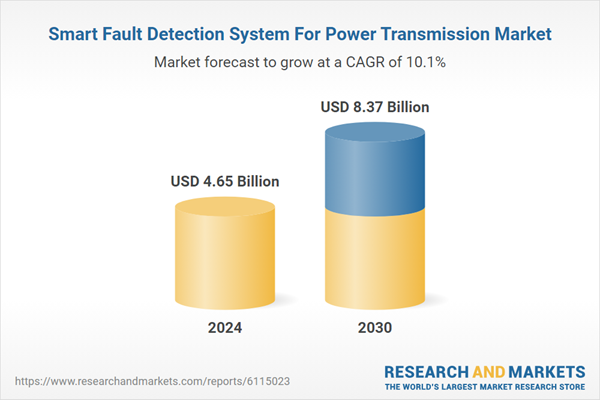

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.65 Billion |

| Forecasted Market Value ( USD | $ 8.37 Billion |

| Compound Annual Growth Rate | 10.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |