Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

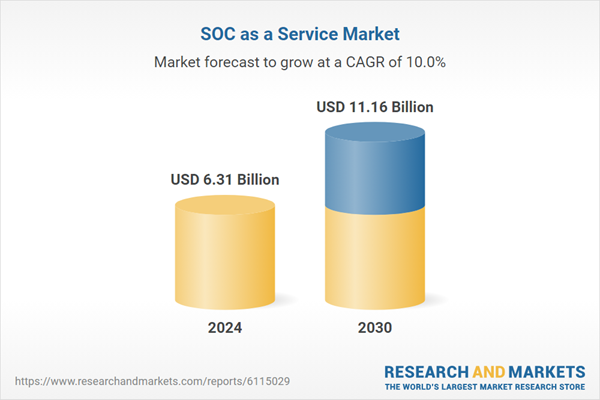

The market is rising steadily due to the increasing sophistication of cyber threats, including ransomware, phishing, and advanced persistent threats, which demand continuous vigilance. Small and medium enterprises, often lacking dedicated cybersecurity teams, find SOC as a Service an effective solution for mitigating risks and achieving regulatory compliance. Additionally, the growing trend of remote work, cloud adoption, and digital transformation initiatives has expanded the attack surface for organizations, further driving demand for outsourced SOC services that offer scalability, rapid deployment, and expert support.

The market is expected to witness accelerated growth driven by advancements in artificial intelligence, machine learning, and automation within security services. These technologies enable service providers to offer more proactive and predictive security capabilities, improving threat detection accuracy and response times. Furthermore, as regulatory frameworks around data protection and cybersecurity tighten globally, organizations will increasingly turn to SOC as a Service providers to meet compliance requirements efficiently. The combination of rising cyber risks, operational cost savings, and technology-driven service enhancements positions the Global SOC as a Service market for significant expansion in the coming years.

Key Market Drivers

Rising Sophistication of Cyber Threats

The evolving landscape of cyber threats has emerged as a primary driver for the growth of the Global SOC as a Service Market. Modern cyberattacks have become highly targeted, leveraging sophisticated techniques such as polymorphic malware, advanced persistent threats, and AI-driven attacks that bypass traditional security measures. These evolving threats demand advanced security operations capable of real-time monitoring, quick detection, and immediate response. SOC as a Service providers are equipped with advanced threat intelligence platforms and skilled analysts, offering clients enhanced protection against attacks that could result in financial losses, data breaches, and operational disruptions.The increasing integration of cloud services, IoT devices, and remote work environments has expanded the attack surface for organizations worldwide. With cybercriminals exploiting these vulnerabilities, enterprises are turning to outsourced SOC services to gain continuous threat visibility and timely responses without the burden of building expensive in-house infrastructure.

As cyberattacks grow in frequency and complexity, SOC as a Service stands out as a strategic investment to ensure business continuity and safeguard digital assets. In 2024, the European Union Agency for Cybersecurity (ENISA) reported that 77% of organizations globally encountered targeted cyberattacks, most requiring advanced threat detection and immediate response. This emphasizes the urgent business need for SOC as a Service providers that deliver real-time monitoring, expert analysis, and rapid incident management to counter evolving and persistent threats.

Key Market Challenges

Data Privacy Concerns and Sovereignty Regulations

One of the most pressing challenges faced by the Global SOC as a Service Market is the growing concern over data privacy and data sovereignty regulations. As SOC as a Service operates on a model that often involves cloud-based monitoring and remote data analysis, sensitive organizational and customer information is frequently transferred, stored, or processed by third-party providers. This raises significant apprehensions among businesses, especially in sectors such as finance, healthcare, and government, where compliance with strict data protection laws is mandatory.Various countries and regions have implemented stringent data localization laws requiring that data generated within their jurisdiction remains stored and processed locally. The European Union’s General Data Protection Regulation (GDPR), China’s Cybersecurity Law, and India’s Data Protection Bill are prime examples of regulations that impose complex requirements on data handling. These laws make multinational SOC as a Service operations complicated, potentially requiring service providers to establish localized data centers or partner with regional entities - steps that increase operational costs and reduce the economies of scale that make SOC as a Service attractive.

Clients are increasingly demanding transparency and accountability regarding how their data is accessed, monitored, and stored by SOC as a Service providers. The fear of unauthorized access, data misuse, or breaches involving third-party vendors creates a trust barrier that may slow down adoption rates, particularly among risk-averse organizations. Service providers must navigate varying regulatory landscapes, customize service delivery models for different jurisdictions, and invest heavily in compliance measures, legal frameworks, and client trust-building activities. This ongoing complexity places both operational and financial pressures on SOC as a Service vendors, making regulatory compliance and data sovereignty an enduring challenge. As regulations continue to evolve, providers must remain agile, which can divert focus from core threat monitoring capabilities and impact profitability in the long term.

Key Market Trends

Increasing Adoption of AI-Driven Security Operations

The integration of artificial intelligence into SOC as a Service platforms has emerged as a transformative trend, reshaping the way organizations approach security operations. AI-driven tools enhance the efficiency and accuracy of threat detection, enabling SOC providers to analyze vast datasets in real time and identify potential risks faster than human analysts alone. Machine learning algorithms allow systems to learn from historical threats, adapt to evolving attack patterns, and offer predictive insights that bolster proactive defense strategies. This not only improves the effectiveness of security operations but also reduces the response time to critical incidents, making AI a pivotal factor in the growing relevance of SOC as a Service.AI-driven automation within SOC services streamlines routine security tasks, such as log analysis, anomaly detection, and alert triaging, freeing security analysts to focus on more complex investigations. Automated workflows facilitate quicker threat containment and remediation actions, ensuring that organizations can respond swiftly to breaches without manual delays. As cyberattacks become more sophisticated, the use of AI and machine learning in SOC as a Service is expected to rise steadily, driving innovation in service delivery models. Providers that effectively integrate AI into their operations are likely to achieve a competitive advantage, offering clients enhanced protection and operational efficiency.

Key Market Players

- IBM Corporation

- AT&T Inc.

- NTT Security Holdings Corporation

- Broadcom Inc.

- Secureworks Inc.

- Thales Group

- Verizon Communications Inc.

- Fortinet, Inc.

Report Scope:

In this report, the Global SOC as a Service Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:SOC as a Service Market, By Service Type:

- Prevention Services

- Detection Services

- Incident Response Services

SOC as a Service Market, By Offering:

- Fully Managed

- Co-managed

SOC as a Service Market, By Application:

- Network Security

- Cloud Security

- Endpoint Security

- Application Security

- Others

SOC as a Service Market, By End Use:

- BFSI

- Healthcare

- Government

- Manufacturing

- Energy & Utilities

- IT & Telecom

- Transportation & Logistics

- Others

SOC as a Service Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- South America

- Brazil

- Colombia

- Argentina

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global SOC as a Service Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- IBM Corporation

- AT&T Inc.

- NTT Security Holdings Corporation

- Broadcom Inc.

- Secureworks Inc.

- Thales Group

- Verizon Communications Inc.

- Fortinet, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | July 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 6.31 Billion |

| Forecasted Market Value ( USD | $ 11.16 Billion |

| Compound Annual Growth Rate | 9.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |