Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Co-refining is emerging as a strategic solution for energy companies seeking to decarbonize operations, meet increasingly stringent emissions regulations, and align with global climate targets while maintaining operational efficiency and fuel quality standards. The process typically involves hydroprocessing, fluid catalytic cracking, or other refinery configurations that allow for the seamless integration of bio-based and fossil inputs, with minimal modifications to existing systems. This flexibility has made co-refining an attractive option for both large-scale petroleum refiners and renewable energy stakeholders, enabling them to scale up renewable fuel production without compromising refinery economics or product performance.

Key Market Drivers

Rising Demand for Low-Carbon Fuels Across Transportation and Industrial Sectors

The global push toward decarbonization and sustainable energy consumption is significantly driving the demand for low-carbon fuels, positioning co-refining as a highly attractive solution for both refiners and fuel consumers. As governments and regulatory agencies tighten emissions standards across aviation, marine, road transport, and industrial operations, there is increasing pressure to substitute conventional fossil fuels with cleaner alternatives.Co-refining allows petroleum refineries to integrate renewable feedstocks - such as used cooking oil, animal fats, and algae oil - into their existing infrastructure to produce drop-in fuels that are chemically indistinguishable from conventional fuels but with a significantly lower carbon footprint. This ability to leverage existing refining assets without the need for building entirely new biorefineries offers a cost-effective and scalable approach to meet clean fuel demand.

Sectors like aviation, which face limited electrification opportunities, are especially reliant on sustainable aviation fuel (SAF) that can be efficiently produced via co-processing methods. Similarly, heavy-duty transportation and shipping industries are exploring renewable diesel and marine biofuels that comply with international decarbonization mandates. The increased uptake of carbon intensity reduction programs, renewable fuel standards, and voluntary corporate sustainability goals is further boosting market momentum.

Co-refining also supports energy security by diversifying the feedstock base while making use of regional biomass availability, which helps in reducing dependency on imported crude oil. The growing global emphasis on life-cycle GHG emissions reductions is making co-refined fuels a central component in long-term fuel mix strategies. As consumers and industries transition toward greener alternatives, the ability of co-refining to deliver low-carbon fuels at scale without disrupting existing fuel supply chains provides a strong and sustainable growth opportunity for refiners and technology providers alike.

Global demand for low-carbon fuels is expected to grow at a CAGR of over 10% through 2035. Over 80 countries have set targets to increase the share of low-carbon fuels in their national energy mix. Biofuels and synthetic fuels are projected to displace over 15 million barrels of oil equivalent per day by 2040. Industrial adoption of low-carbon fuels is expected to reduce global CO₂ emissions by over 1 gigaton annually by 2050. Investment in low-carbon fuel infrastructure is projected to exceed $500 billion globally by 2040.

Key Market Challenges

Feedstock Availability and Supply Chain Complexity

One of the primary challenges facing the co-refining market is the inconsistent and limited availability of suitable renewable feedstocks, which directly impacts the scalability and reliability of co-refining operations. Unlike conventional crude oil, which benefits from well-established, globalized supply chains and storage infrastructure, renewable feedstocks such as used cooking oil, animal fats, tall oil, and various non-edible vegetable oils often come from fragmented, localized, and highly variable sources. These feedstocks are often seasonally available and influenced by agricultural output, regional policies, and competing demand from other sectors like biodiesel or oleochemicals.This inconsistent supply adds complexity to procurement, transportation, and storage logistics, increasing operational risk for refiners who aim to integrate co-processing into their existing operations. Additionally, contamination risks, quality variability, and the need for pretreatment further complicate the feedstock supply chain, often requiring investment in new processing units or pretreatment facilities. For refiners, maintaining consistent operational efficiency becomes difficult when input materials fluctuate in composition and volume, ultimately leading to suboptimal co-refining yields. The lack of a harmonized global certification and traceability system for renewable feedstocks also presents challenges related to sustainability verification and regulatory compliance, particularly in regions with strict greenhouse gas accounting rules.

Moreover, competition for high-quality feedstocks is intensifying as more countries and corporations adopt low-carbon fuel targets, driving up prices and limiting access to reliable supply, especially for smaller or emerging market players. The logistics around transporting perishable or sensitive bio-feedstocks further strain infrastructure, especially in regions lacking established supply networks or adequate cold-chain facilities. In rural and emerging economies, where the majority of agricultural feedstock is sourced, transportation infrastructure may be inadequate to support industrial-scale co-refining needs.

As global demand for renewable fuels increases, the gap between feedstock supply and required input volumes is expected to widen unless new, sustainable, and scalable feedstock sources - such as algae, municipal waste, or lignocellulosic biomass - are commercialized. However, these next-generation feedstocks are still in early stages of development and face technological, regulatory, and economic barriers to widespread adoption. Overall, the challenge of feedstock availability and supply chain complexity poses a significant bottleneck to the growth and long-term viability of the co-refining market, necessitating coordinated investment, policy support, and innovation in feedstock diversification and logistics infrastructure.

Key Market Trends

Increasing Integration of Bio-Based Feedstocks into Existing Refinery Infrastructure

The Co-Refining Market is witnessing a transformative trend driven by the increasing integration of bio-based feedstocks, such as used cooking oil, animal fats, and vegetable oils, into existing petroleum refinery infrastructure. This shift is fueled by global efforts to decarbonize the energy sector without incurring the massive capital expenditures associated with constructing entirely new biorefineries. Oil refiners are recognizing the value of leveraging their existing assets - processing units, pipelines, and distribution systems - to accommodate renewable feedstocks while maintaining the operational efficiencies of large-scale facilities.Co-processing enables refiners to incrementally transition toward sustainable fuel production by blending biogenic materials with fossil-based streams during hydroprocessing, fluid catalytic cracking, or thermal conversion processes. This strategy not only reduces greenhouse gas emissions from transportation fuels but also ensures product consistency, as renewable fuels produced via co-refining are chemically indistinguishable from their petroleum-based counterparts and require no changes to vehicle engines or fuel distribution infrastructure. The trend also aligns with tightening regulatory mandates and carbon reduction targets set by various governments, which are incentivizing refiners to incorporate renewable content into fuel streams. Moreover, as supply chains for sustainable feedstocks mature and global availability increases, refiners have greater flexibility in sourcing cost-effective bio-oils and fats.

The rising cost of carbon credits and the emergence of low-carbon fuel standards in regions such as North America, Europe, and Asia-Pacific are further motivating refiners to scale up co-refining operations. Additionally, advancements in catalyst technology and process engineering are helping to overcome previous limitations in feedstock variability, operational stability, and equipment corrosion. These technological improvements are enhancing the viability of high-throughput co-processing operations that meet fuel quality standards without disrupting core refinery functions.

As traditional fossil fuel demand begins to plateau and refineries seek new revenue streams in a low-carbon economy, co-refining emerges as a strategic approach to future-proof operations and remain competitive in an evolving energy landscape. This trend reflects a pragmatic pathway for refineries to bridge the gap between today’s fossil-dependent fuel systems and tomorrow’s renewable energy mix, with minimal disruption and maximum capital efficiency.

Key Market Players

- Neste Oyj

- TotalEnergies SE

- Shell plc

- Chevron Corporation

- ExxonMobil Corporation

- Repsol S.A.

- BP p.l.c.

- ENI S.p.A.

- Valero Energy Corporation

- Preem AB

Report Scope:

In this report, the Global Co-Refining Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Co-Refining Market, By Technology:

- Hydrotreating

- Hydrocracking

- Distillation

Co-Refining Market, By Feedstock Type:

- Crude Oil

- Vegetable Oils

- Waste Oils

- Plastic Waste

Co-Refining Market, By End-User Industry:

- Petroleum Refining

- Biodiesel Production

- Chemical Manufacturing

Co-Refining Market, By Process Type:

- Batch Processing

- Continuous Processing

Co-Refining Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

- Turkey

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Co-Refining Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional Market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Neste Oyj

- TotalEnergies SE

- Shell plc

- Chevron Corporation

- ExxonMobil Corporation

- Repsol S.A.

- BP p.l.c.

- ENI S.p.A.

- Valero Energy Corporation

- Preem AB

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | July 2025 |

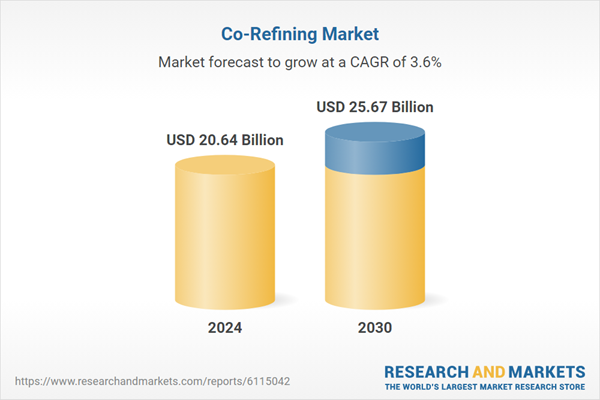

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 20.64 Billion |

| Forecasted Market Value ( USD | $ 25.67 Billion |

| Compound Annual Growth Rate | 3.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |