Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

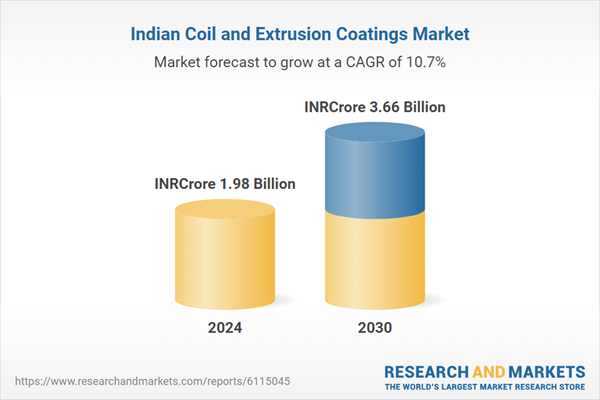

The market is well-positioned for long-term growth, supported by structural economic reforms, diversification across industrial verticals, and increasing demand for high-performance, environmentally sustainable coatings. As end-user industries shift toward value-added, durable, and compliant materials, manufacturers are expected to leverage this opportunity by scaling up technological advancements, offering application-specific formulations, and expanding localized manufacturing infrastructure to strengthen their market footprint.

Key Market Drivers

Rapid Urbanization and Infrastructure Development

Rapid urbanization and infrastructure development are among the most influential macroeconomic forces propelling the growth of the India Coil and Extrusion Coatings Market. Urbanization in India is accelerating at a significant pace, with official projections indicating that by 2036, approximately 40% of the country’s population will be living in urban centers. This demographic shift is expected to create sustained demand for urban infrastructure, modern housing, and commercial developments, thereby intensifying the need for advanced construction materials, including pre-coated metals and extrusion-coated components used in façades, roofing, and structural systems.In these projects, pre-painted metal sheets, aluminum extrusions, and architectural profiles coated with coil and extrusion coatings are extensively used in roofing, façades, cladding, window frames, curtain walls, and doors. These coated materials offer aesthetic uniformity, resistance to corrosion, UV protection, and minimal maintenance, making them highly suitable for long-term infrastructure needs. As a result, the demand for top-quality coatings that ensure color durability and weatherability has increased significantly.

India has approved the development of 12 new industrial smart cities and complementary infrastructure projects under the National Industrial Corridor Development Programme (NICDP), signaling a strategic move to strengthen the country's manufacturing and logistics backbone. These smart cities will collectively attract an investment of INR 286.02 billion (US$3.41 billion), focusing on the creation of integrated industrial ecosystems equipped with next-generation utilities and transport connectivity. Additionally, pre-engineered buildings (PEBs) and modular construction methods, which rely heavily on pre-coated steel components, are being increasingly adopted for their speed and cost-efficiency.

These developments are not limited to tier-1 cities; tier-2 and tier-3 cities are also witnessing infrastructure expansion, widening the market scope for coil and extrusion coatings. As urban infrastructure becomes more complex and performance-driven, there is growing emphasis on using materials that combine both functionality and aesthetics. Coatings that deliver enhanced scratch resistance, thermal insulation, anti-corrosive properties, and color fastness are in high demand for use in building exteriors exposed to India’s diverse and harsh climatic conditions. This shift toward long-life, energy-efficient building materials is accelerating the need for premium-grade polyester, SMP, and PVDF-based coatings.

Additionally, the demand for coatings in vibrant colors, textured finishes, and metallic sheens is rising among architects and developers focused on modern, visually distinct buildings. In 2023, warehousing space absorption across Tier II and III cities surged by 41%, reaching 16.4 million square feet, up from 11.6 million square feet in 2022. This sharp increase reflects the growing shift of logistics, e-commerce, and third-party supply chain operators toward emerging consumption hubs beyond the metro regions, driven by cost efficiencies, improved connectivity, and expanding regional demand. Facilities such as logistics parks, cold storage units, and assembly plants use a wide range of metal panels and structural extrusions that are factory-coated for speed of installation and lifecycle performance. Coil and extrusion coatings in these applications offer durability, quick turnaround, and cost-efficiency, helping operators minimize future maintenance and energy costs

Key Market Challenges

High Dependency on Imported Raw Materials and Resin Technologies

A key challenge for the Indian coil and extrusion coatings industry is its reliance on imported raw materials, especially in the case of high-performance resins, specialty pigments, and advanced additives. Resins such as fluoropolymers (PVDF) and silicone-modified polyesters, which are essential for premium applications, are not widely produced in India and must be sourced internationally. Currency volatility, logistics bottlenecks, and import tariffs can lead to cost fluctuations, which impact product pricing and overall competitiveness especially for domestic manufacturers catering to cost-sensitive segments.This dependency also limits the industry's ability to quickly scale or customize solutions, especially in times of geopolitical disruption or global supply shortages, as witnessed during the COVID-19 pandemic and subsequent freight crises. Until India builds a robust, localized raw material ecosystem, this over-reliance will continue to act as a constraint on product innovation and pricing stability.

Key Market Trends

Transition Toward High-Performance and Functional Coatings

One of the most prominent trends is the rising preference for high-performance and functional coil and extrusion coatings that go beyond basic aesthetics and corrosion resistance. End-users are increasingly seeking advanced surface functionalities such as: Self-cleaning properties, Anti-microbial finishes, Thermal reflectivity and energy efficiency, Anti-graffiti and scratch resistance. This trend is particularly visible in smart buildings, hospitals, food-processing units, cold storage infrastructure, and transport systems, where coatings must perform under aggressive environmental and hygiene standards.The demand for custom-engineered coatings including multi-layered systems and hybrid chemistries is growing among architects and OEMs looking for unique performance specifications. This evolution reflects the shift from commodity coatings to value-added, engineered materials, reshaping product development pipelines.

Key Market Players

- JSW

- Akzo Nobel

- AP-PPG

- Kansai nerolac

- Berger Paints

- PPG-AP

Report Scope:

In this report, the India Coil and Extrusion Coatings Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Coil and Extrusion Coatings Market, By Type:

- Topcoats

- Primers

- Backing Coats

- Specialties

India Coil and Extrusion Coatings Market, By Resin:

- Polyester

- Silicone Modifier Polyester

- Fluorocarbon (PVDF)

- Polyurethane

- Plastisol

- Epoxy

- Others

India Coil and Extrusion Coatings Market, By End User:

- Architecture

- Automobile

- Consumer Durables

- Furniture

- Others

India Coil and Extrusion Coatings Market, By Region:

- North India

- South India

- East India

- West India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Coil and Extrusion Coatings Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Key Market Players

- JSW

- Akzo Nobel

- AP-PPG

- Kansai nerolac

- Berger Paints

- PPG-AP

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | July 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( INRCrore | INRCrore 1.98 Billion |

| Forecasted Market Value ( INRCrore | INRCrore 3.66 Billion |

| Compound Annual Growth Rate | 10.7% |

| Regions Covered | India |

| No. of Companies Mentioned | 7 |