The soil compaction equipment market is a foundational segment within the construction and infrastructure industry, supporting projects that demand stable ground conditions for structural integrity. These machines - ranging from rammers and plate compactors to heavy-duty rollers - are essential for compacting soil, gravel, asphalt, and other surfaces to reduce voids and increase load-bearing capacity. The market is closely tied to trends in urbanization, road construction, and real estate development, as well as in agriculture where compactors are used for soil bed preparation. As governments across the globe continue to invest in public infrastructure and housing, demand for reliable and versatile compaction machinery remains strong. The market is also seeing increased emphasis on efficiency, operator safety, and fuel economy, pushing manufacturers to integrate advanced features like telematics, GPS tracking, and vibration monitoring systems. With sustainability also gaining attention, electric and hybrid models are beginning to gain traction. As projects become more complex and timelines more compressed, the importance of robust and high-performance soil compaction equipment has never been greater, ensuring consistent soil density and surface stability across applications.

In 2024, the soil compaction equipment market witnessed a wave of modernization as construction firms sought smarter, greener, and more operator-friendly machinery. Leading manufacturers introduced new models with digital compaction control systems, allowing operators to monitor compaction metrics in real-time and reduce over-compaction or under-compaction errors. This not only improved performance but also reduced fuel consumption and operational wear. Electric compactors began entering niche urban and indoor markets where emissions and noise levels are tightly regulated. Moreover, rental companies expanded their fleets with compact and maneuverable models suited for small construction sites, landscaping, and utility work. The adoption of automation features such as automatic vibration adjustment and smart diagnostics became more common, particularly in mid - to high-end segments. On the geopolitical front, infrastructure stimulus programs in Asia-Pacific, the Middle East, and parts of Latin America created fresh demand for heavy rollers and pneumatic-tired compactors. The year also saw growing interest in predictive maintenance technologies that use sensors to anticipate equipment failure, reducing downtime and maintenance costs. Collectively, these developments highlighted a shift toward data-driven, eco-conscious, and productivity-focused equipment solutions across the soil compaction market.

Looking into 2025 and beyond, the soil compaction equipment market is poised to benefit from sustained infrastructure investment, digital integration, and environmental regulations. Governments are expected to continue prioritizing road rehabilitation, airport expansion, and smart city development, all of which require high-quality soil preparation. Equipment manufacturers are likely to invest more in autonomous and semi-autonomous compaction systems, enabling machines to operate with minimal human intervention on large-scale projects. Advancements in machine learning and IoT connectivity will support the development of adaptive compaction systems that respond dynamically to soil type, moisture levels, and terrain variability. Electrification will expand beyond light-duty equipment, with battery-powered rollers and hybrid solutions increasingly available for larger construction sites. Sustainability benchmarks, such as carbon footprint tracking and emission compliance, will become standard in procurement processes. In agriculture, smart compactors integrated with GPS and agronomic data may see wider adoption for soil bed optimization. As urban environments become denser and more regulated, compact, noise-controlled, and precision-guided equipment will define the next phase of innovation. The market’s future will hinge on how well manufacturers align engineering excellence with the evolving needs of environmentally and digitally conscious end users.

Key Insights: Soil Compaction Equipment Market

- Digital compaction control systems are becoming standard, allowing operators to track soil density in real time, improve uniformity, and reduce rework through data-driven decision-making on-site.

- Electric and hybrid compaction machines are gaining momentum in urban and environmentally sensitive zones, offering reduced noise, lower emissions, and compliance with green building standards.

- Autonomous and remote-controlled compactors are emerging for large infrastructure projects, enhancing safety and productivity in hazardous or hard-to-reach environments.

- Predictive maintenance technology using sensors and analytics is reducing downtime and extending machine lifespan by identifying issues before they escalate into failures.

- Compact and multipurpose machines are in demand for tight workspaces and landscaping projects, catering to urbanization trends and labor efficiency requirements.

- Rising infrastructure investments globally, especially in roads, railways, and airports, are fueling consistent demand for soil compaction machinery across public and private sectors.

- Increased urbanization is driving the need for efficient soil stabilization and surface preparation in compact urban job sites and underground utility projects.

- Growing emphasis on sustainable construction practices is encouraging the adoption of low-emission and fuel-efficient compaction equipment in regulatory-conscious markets.

- Technological advancements in equipment design are improving operational ease, reducing fatigue, and increasing the productivity of machine operators in both small and large projects.

- High capital costs for technologically advanced and electric models continue to limit adoption among small contractors and in cost-sensitive markets, slowing widespread modernization of equipment fleets.

Soil Compaction Equipment Market Segmentation

By Product Type:

- Hydraulic Compactors

- Vibratory Rollers

- Plate Compactors

By Application:

- Road Construction

- Landfill

- Agriculture

- Site Development

By End User:

- Construction Companies

- Municipalities

- Agricultural Sector

By Technology:

- Manual

- Automated

By Distribution Channel:

- Online

- Offline

By Geography:

- North America (USA, Canada, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Rest of Europe)

- Asia-Pacific (China, India, Japan, Australia, Vietnam, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Soil Compaction Equipment Market Size Data, Trends, Growth Opportunities, and Restraining Factors:

- This comprehensive Soil Compaction Equipment market report delivers updated market size estimates from 2024 to 2034, offering in-depth analysis of the latest Soil Compaction Equipment market trends, short-term and long-term growth drivers, competitive landscape, and new business opportunities. The report presents growth forecasts across key Soil Compaction Equipment types, applications, and major segments, alongside detailed insights into the current Soil Compaction Equipment market scenario to support companies in formulating effective market strategies.

- The Soil Compaction Equipment market outlook thoroughly examines the impact of ongoing supply chain disruptions and geopolitical issues worldwide. Factors such as trade tariffs, regulatory restrictions, production losses, and the emergence of alternatives or substitutes are carefully considered in the Soil Compaction Equipment market size projections. Additionally, the analysis highlights the effects of inflation and correlates past economic downturns with current Soil Compaction Equipment market trends, providing actionable intelligence for stakeholders to navigate the evolving Soil Compaction Equipment business environment with precision.

Soil Compaction Equipment Market Competition, Intelligence, Key Players, and Winning Strategies to 2034:

- The 2025 Soil Compaction Equipment Market Research Report identifies winning strategies for companies to register increased sales and improve market share.

- Opinions from senior executives from leading companies in the Soil Compaction Equipment market are imbibed thoroughly and the Soil Compaction Equipment industry expert predictions on the economic downturn, technological advancements in the Soil Compaction Equipment market, and customized strategies specific to a product and geography are mentioned.

- The Soil Compaction Equipment market report is a source of comprehensive data and analysis of the industry, helping businesses to make informed decisions and stay ahead of the competition. The Soil Compaction Equipment market study assists investors in analyzing On Soil Compaction Equipment business prospects by region, key countries, and top companies' information to channel their investments.

- The report provides insights into consumer behavior and preferences, including their buying patterns, brand loyalty, and factors influencing their purchasing decisions. It also includes an analysis of the regulatory environment and its impact on the Soil Compaction Equipment industry. Shifting consumer demand despite declining GDP and burgeoning interest rates to control surging inflation is well detailed.

What's Included in the Report?

- Global Soil Compaction Equipment market size and growth projections, 2024-2034

- North America Soil Compaction Equipment market size and growth forecasts, 2024-2034 (United States, Canada, Mexico)

- Europe market size and growth forecasts, 2024-2034 (Germany, France, United Kingdom, Italy, Spain)

- Asia-Pacific Soil Compaction Equipment market size and growth forecasts, 2024-2034 (China, India, Japan, South Korea, Australia)

- Middle East Africa Soil Compaction Equipment market size and growth estimate, 2024-2034 (Middle East, Africa)

- South and Central America Soil Compaction Equipment market size and growth outlook, 2024-2034 (Brazil, Argentina, Chile)

- Soil Compaction Equipment market size, share and CAGR of key products, applications, and other verticals, 2024-2034

- Short- and long-term Soil Compaction Equipment market trends, drivers, challenges, and opportunities

- Soil Compaction Equipment market insights, Porter’s Five Forces analysis

- Profiles of 5 leading companies in the industry - overview, key strategies, financials, product portfolio and SWOT analysis

- Latest market news and developments

Key Questions Answered in This Report:

- What is the current Soil Compaction Equipment market size at global, regional, and country levels?

- What is the market penetration of different types, Applications, processes/technologies, and distribution/sales channels of the Soil Compaction Equipment market?

- What will be the impact of economic slowdown/recission on Soil Compaction Equipment demand/sales?

- How has the global Soil Compaction Equipment market evolved in past years and what will be the future trajectory?

- What is the impact of growing inflation, Russia-Ukraine war on the Soil Compaction Equipment market forecast?

- What are the Supply chain challenges for Soil Compaction Equipment?

- What are the potential regional Soil Compaction Equipment markets to invest in?

- What is the product evolution and high-performing products to focus in the Soil Compaction Equipment market?

- What are the key driving factors and opportunities in the industry?

- Who are the key players in Soil Compaction Equipment market and what is the degree of competition/Soil Compaction Equipment market share?

- What is the market structure /Soil Compaction Equipment Market competitive Intelligence?

Available Customizations:

The standard syndicate report is designed to serve the common interests of Soil Compaction Equipment Market players across the value chain, and include selective data and analysis from entire research findings as per the scope and price of the publication.However, to precisely match the specific research requirements of individual clients, several customization options are offered to include the data and analysis of interest in the final deliverable.

Some of the customization requests are as mentioned below:

- Segmentation of choice - Clients can seek customization to modify/add a market division for types/applications/end-uses/processes of their choice.

- Soil Compaction Equipment Pricing and Margins Across the Supply Chain, Soil Compaction Equipment Price Analysis / International Trade Data / Import-Export Analysis.

- Supply Chain Analysis, Supply-Demand Gap Analysis, PESTLE Analysis, Macro-Economic Analysis, and other Soil Compaction Equipment market analytics.

- Processing and manufacturing requirements, Patent Analysis, Technology Trends, and Product Innovations.

- Further, the client can seek customization to break down geographies as per their requirements for specific countries/country groups such as South East Asia, Central Asia, Emerging and Developing Asia, Western Europe, Eastern Europe, Benelux, Emerging and Developing Europe, Nordic countries, North Africa, Sub-Saharan Africa, Caribbean, The Middle East and North Africa (MENA), Gulf Cooperation Council (GCC) or any other.

- Capital Requirements, Income Projections, Profit Forecasts, and other parameters to prepare a detailed project report to present to Banks/Investment Agencies.

Additional support:

- All the data presented in tables and charts of the report is provided in a separate Excel document

- Print authentication allowed on purchase of online versions

- 10% free customization to include any specific data/analysis to match the requirement

- 7 days of analyst support

This product will be delivered within 1-3 business days.

Table of Contents

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 150 |

| Published | August 2025 |

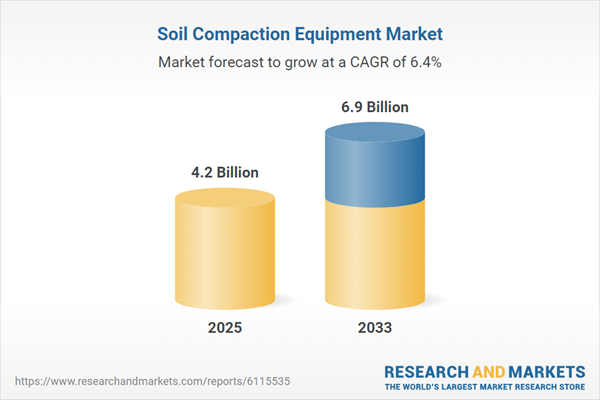

| Forecast Period | 2025 - 2033 |

| Estimated Market Value ( USD | $ 4.2 Billion |

| Forecasted Market Value ( USD | $ 6.9 Billion |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | Global |