Executive Summary and Middle East & Africa Well Intervention Market Analysis:

According to the International Energy Agency (IEA), the Middle East and Africa generated ~95% of their electricity from oil and gas in 2023. Thermal plants in the region consume more than 290 billion cubic meters of gas (i.e., more than one-third of domestic gas production) and 1.75 million barrels of oil per day. In November 2023, Shell Egypt announced the completion of drilling of the first well - Mina West, located in the Northeast El-Amriya block in the Mediterranean Sea - in its three-well exploration campaign. Prominent factors driving the growth of the well intervention market in the Middle East and Africa region include rising onshore and offshore oil and gas drilling activities, the discovery of new locations to establish drilling wells, and increasing output targets for offshore oil and gas production. Oil- and gas-producing economies in the Middle East and North Africa rely heavily on fossil fuels, which raises the carbon intensity of their electricity generation by approximately a fifth compared to the global average. In May 2023, the Abu Dhabi National Oil Company (ADNOC) granted three contracts totaling US$ 4 billion to reduce carbon emissions and reach a production capacity of 5 million barrels per day by 2030. The contracts are valid for 5 years with a 2-year extension option, entailing ADNOC's onshore and offshore operations. Thus, the growing emphasis on the adoption of practices promoting carbon-neutral oil and gas production is anticipated to offer lucrative growth opportunities to the well intervention market in the Middle East and Africa in the coming years.Middle East & Africa Well Intervention Market Segmentation Analysis:

Key segments that contributed to the derivation of the well intervention market analysis are service, application, intervention, and well type.Based on service, the Middle East & Africa well intervention market is segmented into logging and bottomhole survey, tubing or packer failure and repair, and stimulation. The logging and bottomhole survey held the largest share of the market in 2023.

In terms of application, the Middle East & Africa well intervention market is bifurcated into onshore and onshore. The onshore segment held a larger share of the market in 2023.

By intervention, the Middle East & Africa well intervention market is categorized into light, medium, and heavy. The light segment held the largest share of the market in 2023.

Based well type, the Middle East & Africa well intervention market is bifurcated into horizontal and vertical. The vertical segment held a larger share of the market in 2023.

Middle East & Africa Well Intervention Market Outlook

Subsea well intervention, leveraging new technologies and innovative approaches, holds exciting growth avenues for the well intervention market players. Technologies meant to aid in subsea operations are designed to enhance their safety, increase their efficiency, and optimize their cost-effectiveness. Advanced data collection and analysis techniques play a critical role in subsea well interventions. Real-time monitoring systems collect massive amounts of data from subsea sensors and provide insights into the health and performance of wells. By using data analytics, engineers can detect anomalies, predict potential problems, and optimize intervention strategies. This data-driven approach enables proactive maintenance and minimizes the risk of unplanned downtime, improving the overall reliability and productivity of subsea oil and gas wells.Oil and gas companies these days operate on tight margins. Therefore, a key goal is to maximize production from existing facilities as efficiently and economically as possible. A strategic well intervention program can help achieve this goal. The pre-planning of these processes includes evaluating candidates, intervention methods, and expected value. For example, an artificial intelligence (AI) and automation solution from SLB solutions is claimed to decrease the well review time from 3 days per well to a few hours for an entire field, allowing the operators to save up to 90% on well review time. Thus, subsea well intervention and the integration of AI and related technologies to automate intervention processes are likely to bring new growth trends in the well intervention market in the future.

Middle East & Africa Well Intervention Market Country Insights

Based on country, the Middle East & Africa well intervention market comprises Saudi Arabia, the UAE, Iran, Kuwait, Qatar, and the Rest of Middle East & Africa. The Rest of Middle East & Africa held the largest share in 2023.South Africa, Nigeria, Oman, Iraq, and Egypt are among the major countries in the Rest of Middle East and Africa. These countries account for a small portion of the well-intervention market in the Middle East and Africa. In January 2023, Masirah Oil, a subsidiary of Singapore-based Rex International, announced the completion of an offshore drilling campaign in Oman's Block 50. In October 2023, KCA Deutag, a leading drilling, engineering, and technology partner, announced its first locally made rig in Oman during a ceremony of Petroleum Development Oman (PDO). Further, in November 2023, Shell Egypt announced the successful completion of the drilling of the Mina West well in the Northeast El-Amriya block in the Mediterranean Sea. Thus, the rising offshore and onshore drilling activities to discover new exploration sites, and ambitious targets set for oil and gas production outputs bolster the well intervention market growth in the Rest of Middle East and Africa.

Middle East & Africa Well Intervention Market Company Profiles

Some of the key players operating in the market include Halliburton Co, Baker Hughes Co, Weatherford International Plc, Expro Group Holdings NV, Oceaneering International Inc, Archer Ltd, Schlumberger NV, Forum Energy Technologies Inc, Helix Energy Solutions Group Inc, and Trican Well Service Ltd., among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.Middle East & Africa Well Intervention Market Research Methodology:

The following methodology has been followed for the collection and analysis of data presented in this report.Secondary Research

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:Company websites, annual reports, financial statements, broker analyses, and investor presentations. Industry trade journals and other relevant publications. Government documents, statistical databases, and market reports. News articles, press releases, and webcasts specific to companies operating in the market. Note: All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

Primary Research

The publisher conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis, and gain valuable insights. These research interviews are designed to:Validate and refine findings from secondary research. Enhance the expertise and market understanding of the analysis team. Gain insights into market size, trends, growth patterns, competitive dynamics, and future prospects. Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

Industry stakeholders: Vice Presidents, business development managers, market intelligence managers, and national sales managers External experts: Valuation specialists, research analysts, and key opinion leaders with industry-specific expertise

Reasons to Buy

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the Middle East & Africa well intervention market.

- Highlights key business priorities to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the Middle East & Africa well intervention market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth Middle East & Africa market trends and outlook coupled with the factors driving the Middle East & Africa well intervention market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution.

Table of Contents

Companies Mentioned

- Halliburton Co

- Baker Hughes Co

- Weatherford International Plc

- Expro Group Holdings NV

- Oceaneering International Inc

- Archer Ltd

- Schlumberger NV

- Forum Energy Technologies Inc

- Helix Energy Solutions Group Inc

- Trican Well Service Ltd

Table Information

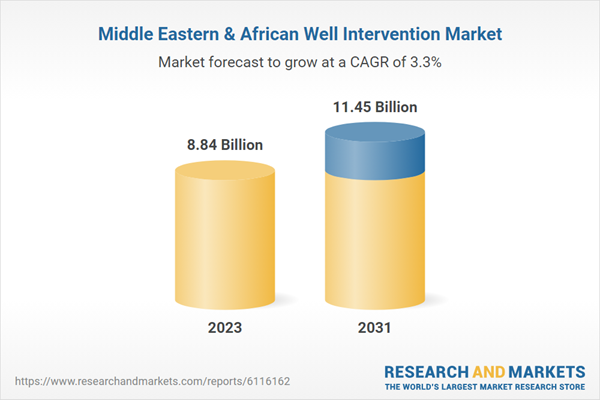

| Report Attribute | Details |

|---|---|

| No. of Pages | 147 |

| Published | July 2025 |

| Forecast Period | 2023 - 2031 |

| Estimated Market Value ( USD | $ 8.84 Billion |

| Forecasted Market Value ( USD | $ 11.45 Billion |

| Compound Annual Growth Rate | 3.3% |

| Regions Covered | Africa, Middle East |

| No. of Companies Mentioned | 10 |