Executive Summary and Asia Pacific Well Intervention Market Analysis:

The well intervention market in Asia Pacific is segmented into China, India, Australia, South Korea, Indonesia, Malaysia, and the Rest of Asia Pacific. The region is a significant consumer of oil and gas, with China and India being the largest consumers. Rapid industrialization, urbanization, and population growth have driven the demand for energy in the region. Nonetheless, Asia Pacific is also home to substantial oil and gas reserves. Countries such as China, India, Malaysia, Indonesia, and Australia have significant domestic production capacities. In addition, the discovery and construction of new offshore oil and gas fields across different countries are the key factors driving the demand for well intervention services across Asia Pacific. In July 2023, Petronas, the Malaysian government company, announced 6 new locations for offshore oil and gas facilities. In July 2022, the Philippines announced its plan to redevelop its 30-year-old Cadlao Oil Field, which would provide a boost to its offshore oil production capacity in the coming years. Similarly, in May 2022, The Hoang Long joint operating company in Vietnam secured a jack-up drilling rig for their planned offshore development wells in the Cuu Long basin. Such developments are expected to drive the growth of the well intervention market in Asia Pacific in the coming years.Asia Pacific Well Intervention Market Segmentation Analysis:

Key segments that contributed to the derivation of the well intervention market analysis are service, application, intervention, and well type.Based on service, the Asia Pacific well intervention market is segmented into logging and bottomhole survey, tubing or packer failure and repair, and stimulation. The logging and bottomhole survey held the largest share of the market in 2023.

In terms of application, the Asia Pacific well intervention market is bifurcated into onshore and offshore. The offshore segment held a larger share of the market in 2023.

By intervention, the Asia Pacific well intervention market is categorized into light, medium and heavy. The light segment held the largest share of the market in 2023.

Based well type, the Asia Pacific well intervention market is bifurcated into horizontal and vertical. The vertical segment held a larger share of the market in 2023.

Asia Pacific Well Intervention Market Outlook

Well intervention using simulation technologies involves the use of specialized software programs or physical models that are carefully created to replicate a variety of operations inside the well. These operations span the drilling, completion, and production phases of a well's life cycle. The primary purpose of these simulators is to provide a realistic, reliable, and safe environment for training, strategic planning, and improving intervention activities. Simulation software and programs can replicate various well intervention methods, including wireline services, coiled tubing services, hydraulic workover, snubbing, and fishing services. Their capabilities are extended to mimic the behavior of an oil and gas well and its adjacent formation under various operational scenarios. These scenarios include fluctuations in well pressure and temperature, changes in well geometry, and changes in reservoir properties. In addition, the simulators can accurately reproduce the responses of various intervention tools and devices such as pumps, valves, and sensors. This allows operators to practice precise operation and placement of well intervention tools in a controlled and safe environment.The integration of well intervention simulators brings a variety of benefits to the oil and gas industry. These simulators play an essential role in reducing the risk of accidents by allowing oil and gas operators to hone their skills in a risk-free environment. They also contribute to greater operational efficiency by providing operators with a platform to refine their techniques and strategies. Moreover, digital twin technology, creating virtual representations of physical assets and processes, is becoming increasingly crucial in subsea well interventions. Digital twins provide real-time insights into well performance and further enable engineers to simulate and optimize intervention operations. By using digital twins, engineers can test different intervention scenarios, identify potential risks, and optimize workflow. These virtual tests minimize the need for physical testing and save time and resources while increasing the safety and efficiency of subsea well operations. Additionally, these software simulators facilitate the improvement of the overall quality of well intervention jobs throughout the well lifecycle. They allow operators to identify potential problems and evaluate various intervention strategies before implementing them in real-field scenarios. They not only contribute to time and cost savings but also increase the safety and efficiency of assets. Moreover, the oil and gas industries can proactively address challenges associated with well intervention operations and ensure optimal performance through refined processes, ultimately improving the sustainability and success of oil and gas operations. Thus, the integration of simulation technologies is expected to bring significant growth opportunities in the well intervention market in the coming years.

Asia Pacific Well Intervention Market Country Insights

Based on country, the Asia Pacific well intervention market comprises Australia, China, India, South Korea, Indonesia, Malaysia, and the Rest of Asia Pacific. India held the largest share in 2023.India operated 60 onshore and 16 offshore oil and gas rigs in 2023, compared to 64 and 13, respectively, in 2022. Crude oil production in India accounted for 4.9 million metric tons during April to May 2024. The oil and gas sector is one of India's eight core industries and plays an important role in decision-making for all other major economic sectors. India's economic growth is linked to its energy needs. Therefore, the demand for oil and gas is expected to increase, making the sector quite favorable for investment. India retained its place as the world's third-largest oil consumer in 2023. As a relatively small oil producer with limited potential for near-term growth, India's domestic production covered only 13% of India's supply needs. In 2023, domestic crude oil production averaged around 700 thousand barrels per day. As per the India Brand Equity Foundation, the oil and gas industry is expected to attract US$ 25 billion in investment in exploration and production of oil and gas. The rise in initiatives toward increasing oil and gas production is anticipated to fuel the demand for well intervention in the coming years.

Asia Pacific Well Intervention Market Company Profiles

Some of the key players operating in the market include Halliburton Co, Baker Hughes Co, Weatherford International Plc, Expro Group Holdings NV, Oceaneering International Inc, Archer Ltd, Schlumberger NV, Forum Energy Technologies Inc, Helix Energy Solutions Group Inc, and Trican Well Service Ltd., among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.Asia Pacific Well Intervention Market Research Methodology:

The following methodology has been followed for the collection and analysis of data presented in this report.Secondary Research

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:Company websites, annual reports, financial statements, broker analyses, and investor presentations. Industry trade journals and other relevant publications. Government documents, statistical databases, and market reports. News articles, press releases, and webcasts specific to companies operating in the market. Note: All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

Primary Research

The publisher conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis, and gain valuable insights. These research interviews are designed to:Validate and refine findings from secondary research. Enhance the expertise and market understanding of the analysis team. Gain insights into market size, trends, growth patterns, competitive dynamics, and future prospects. Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

Industry stakeholders: Vice Presidents, business development managers, market intelligence managers, and national sales managers External experts: Valuation specialists, research analysts, and key opinion leaders with industry-specific expertise

Reasons to Buy

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the Asia Pacific well intervention market.

- Highlights key business priorities to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the Asia Pacific well intervention market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth Asia Pacific market trends and outlook coupled with the factors driving the Asia Pacific well intervention market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution.

Table of Contents

Companies Mentioned

- Halliburton Co

- Baker Hughes Co

- Weatherford International Plc

- Expro Group Holdings NV

- Oceaneering International Inc

- Archer Ltd

- Schlumberger NV

- Forum Energy Technologies Inc

- Helix Energy Solutions Group Inc

- Trican Well Service Ltd

Table Information

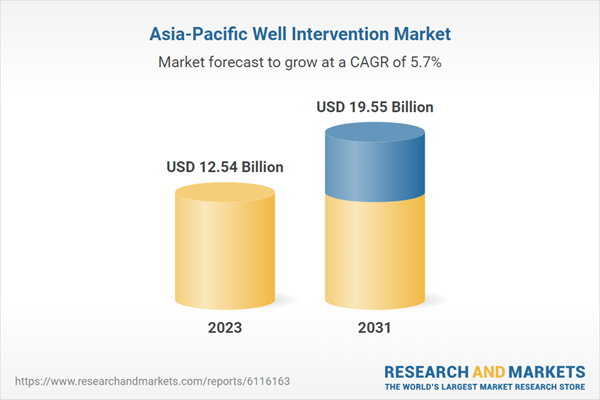

| Report Attribute | Details |

|---|---|

| No. of Pages | 150 |

| Published | July 2025 |

| Forecast Period | 2023 - 2031 |

| Estimated Market Value ( USD | $ 12.54 Billion |

| Forecasted Market Value ( USD | $ 19.55 Billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Asia Pacific |

| No. of Companies Mentioned | 10 |