Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

They are widely used in industries such as oil & gas, chemical processing, environmental monitoring, power generation, pharmaceuticals, and food & beverage, where accurate gas measurement is critical for safety, compliance, and operational efficiency. AI integration facilitates predictive maintenance by analyzing trends and detecting equipment deterioration early, thereby minimizing downtime and operational risks. These systems also support remote monitoring and control, enabling real-time decision-making through cloud-based platforms and IoT connectivity. With increasing regulatory pressures related to emissions control and workplace safety, AI-based gas analyzers are becoming essential tools for compliance monitoring and environmental reporting. Moreover, the growing complexity of industrial processes and the need for high-throughput, real-time analytics are encouraging organizations to transition from legacy gas monitoring systems to intelligent, automated alternatives.

Key Market Drivers

Growing Demand for Real-Time and Predictive Emission Monitoring in Industrial Sectors

The increasing demand for real-time and predictive emission monitoring in various industrial sectors is a major driver of the AI-based gas analyzer market. Industries such as oil & gas, petrochemicals, power generation, and manufacturing are under mounting regulatory pressure to reduce air pollutants and greenhouse gas emissions. Conventional gas analyzers, while effective, often fall short in providing instantaneous, highly accurate data interpretation and long-term predictive analytics. AI-based gas analyzers bridge this gap by utilizing machine learning algorithms to analyze vast volumes of sensor data in real time, identifying trends and anomalies that traditional systems might overlook. These systems can not only measure gas concentrations with precision but also predict potential equipment failures or process inefficiencies that could lead to increased emissions.This capability enables industries to implement proactive maintenance and make data-driven operational decisions that improve efficiency and reduce environmental impact. Additionally, AI-based systems can adapt to changing environmental and operational conditions, continuously learning from new data inputs, thus improving over time and reducing the need for human intervention. The implementation of digital twins and edge AI in gas monitoring allows facilities to simulate and forecast emissions under various operating scenarios, enhancing regulatory compliance and sustainability initiatives. Furthermore, the integration of these AI-enabled gas analyzers with industrial control systems and cloud-based platforms supports centralized data visualization and remote diagnostics.

As governments globally strengthen environmental regulations and increase penalties for non-compliance, industries are turning to intelligent, automated solutions to monitor and control emissions more effectively. The need for precise, continuous, and actionable gas monitoring data is pushing organizations to adopt AI-based gas analyzers as a standard part of their emission control infrastructure, thus driving market expansion. Over 70% of global industrial facilities are expected to adopt real-time emission monitoring systems by 2030.

The market for predictive emission monitoring systems (PEMS) is projected to grow at a CAGR of over 10% globally through 2030. More than 50% of oil & gas and chemical plants worldwide are integrating AI-driven predictive monitoring tools to reduce compliance risks. Industrial emissions account for over 20 billion metric tons of CO₂ annually, driving increased demand for continuous monitoring solutions. Governments in over 80 countries are tightening emissions regulations, pushing industries toward advanced monitoring technologies.

Key Market Challenges

Data Integration Complexity and Infrastructure Limitations

One of the primary challenges facing the AI-based gas analyzer market is the complexity of integrating AI algorithms with existing gas sensing infrastructure, particularly in legacy industrial systems. Many facilities still rely on conventional gas detection and analysis hardware that lacks the interoperability and digital architecture needed to support AI integration. Upgrading these systems to be compatible with AI-based analyzers often involves significant investment in new sensors, communication networks, and cloud-based platforms, which can be cost-prohibitive for small and medium-sized enterprises. Additionally, AI-based gas analyzers depend heavily on high-quality, real-time data to perform accurate gas composition analysis, pattern recognition, and predictive diagnostics.However, inconsistent data inputs due to sensor calibration issues, environmental noise, and signal degradation can severely impact the performance of machine learning models. Ensuring the reliability, accuracy, and consistency of input data across various gas types and operating conditions requires robust infrastructure that is not universally available, especially in remote or harsh industrial environments. Moreover, many companies lack the in-house technical expertise needed to manage AI systems, analyze outputs, or integrate insights into operational decision-making. This leads to underutilization of AI capabilities and poor return on investment. Another concern is the lack of standardized communication protocols and data formats, which complicates the aggregation and interpretation of data from multi-vendor gas sensing systems.

As AI platforms require vast and diverse datasets for training and validation, the siloed nature of industrial data becomes a significant bottleneck. In regions with limited digital maturity, such as parts of Southeast Asia, Latin America, and Africa, the market faces additional hurdles in terms of internet connectivity, data storage capacity, and access to cloud computing infrastructure. Furthermore, integrating AI tools into regulated environments like pharmaceuticals, petrochemicals, or food safety requires strict validation procedures and compliance with data integrity regulations, adding further cost and complexity. This entire landscape of integration difficulties, data reliability concerns, and technical skill gaps poses a considerable challenge to the widespread adoption of AI-based gas analyzers, particularly in industries with tight operational budgets and regulatory constraints.

Key Market Trends

Integration of Edge AI for Real-Time Gas Analysis in Industrial Environments

A key trend shaping the AI-Based Gas Analyzer Market is the rapid integration of edge AI computing to enable real-time, on-site gas analysis in industrial environments. Traditional gas analyzers often rely on cloud-based data processing or require manual interpretation of sensor outputs, which can result in delayed response times and limited situational awareness. Edge AI revolutionizes this process by embedding machine learning models directly into the analyzer hardware, allowing instantaneous analysis of gas compositions, concentrations, and anomalies at the source. This is particularly valuable in hazardous or remote industrial zones such as oil refineries, chemical plants, mining operations, and power stations, where timely gas detection is critical for safety and operational efficiency.Edge AI-equipped analyzers are capable of continuously learning from operational patterns, adjusting to environmental conditions, and reducing false positives by intelligently distinguishing between normal and abnormal gas readings. These systems also support multi-gas detection and pattern recognition for complex mixtures, enabling better predictive maintenance and early warning systems. Additionally, edge-based systems reduce reliance on internet connectivity, offering a reliable solution for sites with limited or unstable network access. This decentralized approach not only minimizes latency but also reduces bandwidth costs and enhances data privacy and security.

Manufacturers are responding to this trend by developing compact, ruggedized, and AI-enabled gas analyzers with user-friendly interfaces that require minimal human intervention. This movement toward real-time, intelligent gas sensing at the edge is transforming how industrial facilities manage air quality, detect emissions, and comply with safety regulations. As industrial automation advances, the convergence of AI and edge computing will continue to redefine expectations around speed, accuracy, and scalability in gas analysis applications.

Key Market Players

- ABB Ltd.

- Siemens AG

- Emerson Electric Co.

- Thermo Fisher Scientific Inc.

- Honeywell International Inc.

- General Electric Company (GE Measurement & Control)

- Teledyne Technologies Incorporated

- Servomex Group Ltd. (a Spectris company)

- Nova Analytical Systems, Inc.

- Horiba, Ltd.

Report Scope:

In this report, the Global AI Based Gas Analyzer Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:AI Based Gas Analyzer Market, By Application:

- Environmental Monitoring

- Industrial Safety

- Emission Testing

- Process Control

AI Based Gas Analyzer Market, By Technology:

- Infrared Spectroscopy

- Gas Chromatography

- Electrochemical Sensors

- Photoionization Detection

AI Based Gas Analyzer Market, By End-User:

- Chemical Industry

- Oil & Gas

- Power Generation

- Automotive

AI Based Gas Analyzer Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

- Turkey

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global AI Based Gas Analyzer Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional Market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- ABB Ltd.

- Siemens AG

- Emerson Electric Co.

- Thermo Fisher Scientific Inc.

- Honeywell International Inc.

- General Electric Company (GE Measurement & Control)

- Teledyne Technologies Incorporated

- Servomex Group Ltd. (a Spectris company)

- Nova Analytical Systems, Inc.

- Horiba, Ltd.

Table Information

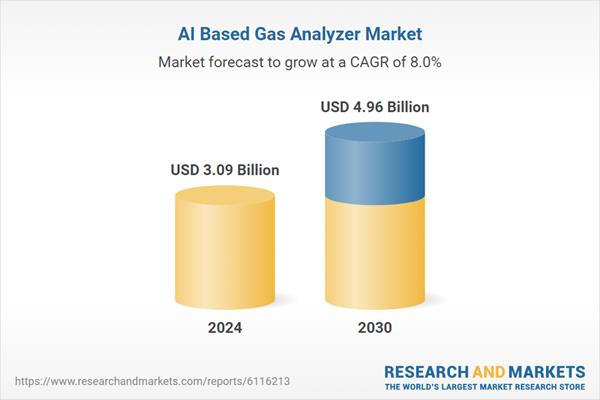

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | August 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.09 Billion |

| Forecasted Market Value ( USD | $ 4.96 Billion |

| Compound Annual Growth Rate | 8.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |