Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

These services are crucial in preventing costly turbine downtimes, minimizing performance degradation, and extending the operational life of wind assets. The market also includes the use of advanced materials such as carbon fiber composites and epoxy resins for blade restoration, alongside innovative technologies like digital twin modeling, remote monitoring, and predictive maintenance algorithms. Both onshore and offshore wind farms contribute to market demand, although offshore blades face harsher environmental stressors and thus require more frequent and specialized repair interventions. Service providers in this market cater to original equipment manufacturers (OEMs), independent power producers, asset managers, and utility companies, offering both scheduled and emergency repair solutions.

Key Market Drivers

Aging Wind Turbine Fleet Demands Increased Maintenance and Refurbishment Services

The increasing age of wind turbine installations across major renewable energy-producing regions is a primary driver for the growth of the renewables blade repair & maintenance market. As thousands of turbines commissioned over a decade ago begin to reach or exceed their expected 15-20-year design lifespan, the need for regular inspection, maintenance, and component refurbishment - particularly of the blades - has intensified. Wind turbine blades are subjected to severe mechanical stress, environmental degradation, and fatigue from continuous exposure to ultraviolet radiation, ice, sand, rain, and fluctuating wind loads. These conditions gradually erode the blade surface, weaken structural integrity, and increase the risk of operational failures. Instead of outright replacement, which can be prohibitively expensive and logistically complex, asset owners are turning to cost-effective repair and maintenance solutions to extend the lifespan of blades, reduce downtime, and maximize return on investment.Additionally, many older turbines are not being decommissioned but repowered, meaning they are retrofitted with modern components while reusing existing towers and foundations. In such scenarios, maintaining the existing blades or modifying them becomes essential. Furthermore, with a growing number of wind farms shifting from initial warranty coverage to post-warranty operational phases, turbine owners are increasingly responsible for ensuring continuous performance and safety through proactive maintenance. The global installed capacity of wind power is immense and continues to expand annually, resulting in a cumulative base of aging infrastructure that fuels steady demand for specialized blade inspection, crack repair, composite material reinforcement, lightning protection system upgrades, and aerodynamic surface refinishing.

Technological advancements in blade inspection using drones, AI-based damage detection, and rope-access technician solutions are also making it more viable for operators to regularly monitor and address blade wear, thus stimulating market activity for repair and maintenance services. As the pressure to maintain turbine performance and avoid costly blade failure grows, particularly in offshore environments where access is limited and repairs are more expensive, the demand for tailored repair solutions is expected to rise sharply, making aging turbine infrastructure a significant driver of this market. Over 35% of the global wind turbine fleet is now over 10 years old, requiring more frequent inspection and servicing.

Nearly 25% of turbines globally are approaching or exceeding their design life of 20-25 years, increasing the demand for refurbishment. The global installed wind capacity surpassed 950 GW in 2024, with a significant portion installed before 2015, now entering the aging phase. Maintenance costs can rise by 20-30% after the first 10 years of operation due to wear and fatigue in blades and mechanical components.

Blade repair needs are expected to grow by over 40% globally by 2030 as older turbines experience more surface erosion, cracks, and lightning damage. Retrofitting and refurbishment services for aging wind assets are forecast to cover over 70 GW of global capacity annually by the end of the decade. Older turbines experience performance degradation of up to 1.6% annually, prompting operators to invest in component upgrades and blade maintenance. Over $15 billion is estimated to be spent annually on turbine O&M (Operations & Maintenance) globally, with a growing share dedicated to aging assets.

Key Market Challenges

High Cost and Logistical Complexities in Remote and Offshore Locations

One of the most significant challenges facing the Renewables Blade Repair & Maintenance Market is the high cost and logistical complexities associated with performing repairs and maintenance in remote and offshore locations. Wind turbines, particularly those situated offshore or in isolated regions, present formidable access difficulties due to their physical inaccessibility and exposure to harsh environmental conditions such as high winds, corrosive saltwater, and extreme temperatures. These turbines require specialized vessels, lifting equipment, and skilled technicians trained for both high-altitude and marine operations, which significantly drives up operational costs.Additionally, the mobilization and demobilization of repair crews and equipment to these distant sites can take several days, increasing the downtime of turbines and leading to revenue loss for operators. Weather conditions can also delay or cancel scheduled maintenance windows, making it difficult to adhere to predefined service schedules and reducing overall maintenance efficiency. Furthermore, the limited availability of offshore vessels and helicopters creates a bottleneck in maintenance operations, further exacerbating scheduling issues. The problem is compounded by a shortage of technicians who possess the niche skills required for blade repairs, especially those involving composite materials and aerodynamic surfaces. Many of these technicians must be trained in advanced techniques such as resin injection, blade rebalancing, and structural integrity assessments.

Additionally, environmental regulations may limit the use of certain repair substances or techniques, requiring operators to adopt alternative methods that are often more expensive or less effective. This challenge of access, cost, and compliance places a considerable burden on companies trying to maintain performance and profitability while ensuring operational safety and adherence to quality standards in remote and offshore wind farms. It also limits scalability, as companies are hesitant to expand to new offshore locations without assured support infrastructure. As a result, despite the increasing demand for renewable energy, the difficulties of blade repair and maintenance in such challenging environments remain a major impediment to the smooth functioning and longevity of wind energy projects globally.

Key Market Trends

Integration of Predictive Maintenance through Advanced Sensor Technologies

One of the most transformative trends shaping the renewables blade repair and maintenance market is the integration of predictive maintenance strategies using advanced sensor technologies and data analytics. Traditional methods of maintenance often relied on scheduled inspections or reactive measures following visible damage or performance drop-offs. However, with the proliferation of IoT-enabled sensors, SCADA (Supervisory Control and Data Acquisition) systems, and edge computing capabilities, operators can now monitor wind turbine blades in real-time for vibration anomalies, micro-cracks, erosion, delamination, and lightning strikes. These sensor systems generate continuous data streams that are analyzed through machine learning algorithms to predict potential failures before they escalate into costly downtimes or catastrophic structural failures.This trend is further supported by the rise in digital twin models that simulate blade performance under various environmental conditions, helping maintenance teams optimize inspection cycles and resource deployment. The increasing reliability of drones and autonomous robots for aerial and close-up inspections also enhances predictive analytics by providing high-resolution imagery and thermal mapping of blade surfaces without halting turbine operations.

This significantly reduces the operational costs associated with manual inspections while ensuring higher uptime and turbine availability. Furthermore, the trend aligns with asset lifecycle extension goals, allowing operators to proactively repair and reinforce blades rather than opting for complete replacements, which are more expensive and logistically challenging. As wind energy becomes a more dominant source of electricity globally, especially in offshore and remote locations, the need for intelligent, automated, and cost-efficient maintenance systems will accelerate the adoption of predictive maintenance technologies, reshaping the way blade servicing is managed across utility-scale renewable installations.

Key Market Players

- LM Wind Power (GE Renewable Energy business)

- Siemens Gamesa Renewable Energy, S.A.

- Vestas Wind Systems A/S

- Nordex SE

- Tethys Energy Services Ltd.

- Rope Partner Inc.

- Gev Wind Power Services Inc.

- MFG Energy Services (Molded Fiber Glass Companies)

- Altitec Group Ltd.

- Borea Construction ULC

Report Scope:

In this report, the Global Renewables Blade Repair & Maintenance Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Renewables Blade Repair & Maintenance Market, By Service Type:

- Inspection

- Repair

- Preventive Maintenance

- Blade Replacement

- Consulting & Diagnostics

Renewables Blade Repair & Maintenance Market, By Technology:

- Drone-Based Inspection

- Rope & Manual Access

- Robotics & Automated Solutions

- Thermal Imaging & Ultrasound

- Others

Renewables Blade Repair & Maintenance Market, By Location of Service:

- Onshore Wind Turbines

- Offshore Wind Turbines

Renewables Blade Repair & Maintenance Market, By Blades Material Type:

- Glass Fiber Reinforced Polymer (GFRP)

- Carbon Fiber Reinforced Polymer (CFRP)

- Hybrid Materials

Renewables Blade Repair & Maintenance Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

- Turkey

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Renewables Blade Repair & Maintenance Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional Market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- LM Wind Power (GE Renewable Energy business)

- Siemens Gamesa Renewable Energy, S.A.

- Vestas Wind Systems A/S

- Nordex SE

- Tethys Energy Services Ltd.

- Rope Partner Inc.

- Gev Wind Power Services Inc.

- MFG Energy Services (Molded Fiber Glass Companies)

- Altitec Group Ltd.

- Borea Construction ULC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 188 |

| Published | August 2025 |

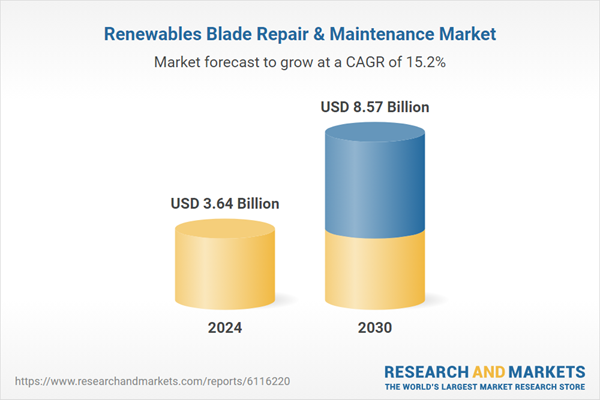

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.64 Billion |

| Forecasted Market Value ( USD | $ 8.57 Billion |

| Compound Annual Growth Rate | 15.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |