Mexico Smart Camera Industry Overview

Increased urbanization and increased security concerns are driving a rapid evolution in the smart camera market in Mexico. Monitoring of homes, businesses, and public areas is changing as a result of the move away from conventional surveillance techniques and toward intelligent, networked camera systems. To offer improved security, real-time monitoring, and automated alerts, these smart cameras incorporate cutting-edge technology including artificial intelligence (AI), facial recognition, motion detection, and cloud connectivity. Growing awareness of safety requirements and government programs to update urban infrastructure through smart city projects further encourage adoption.Major cities such as Mexico City, Monterrey, and Guadalajara are at the forefront of adopting smart camera solutions, incorporating them into public safety, transportation, and commercial security frameworks. Smart home security systems are becoming more and more popular among residential users for convenience and peace of mind, while the commercial sector is aggressively implementing smart cameras to maximize asset protection and loss prevention. The market for smart cameras in Mexico is growing due to improvements in camera technology and growing integration with IoT platforms, which provide more advanced, scalable, and affordable security solutions for a range of applications.

Key Factors Driving the Mexico Smart Camera Market Growth

Urbanization and Government Initiatives:

By making large investments in smart city initiatives, the Mexican government is greatly contributing to the growth of the smart camera market. These programs, which use the installation of vast video surveillance networks to improve public safety and urban management, are concentrated in major cities like Mexico City, Monterrey, and Guadalajara. In order to improve emergency response, deter crime, and monitor traffic, these projects entail setting up extensive smart camera systems throughout cities. To better monitor and control urban security, Mexico City, for instance, has increased camera coverage through the expansion of its video surveillance infrastructure. In addition to enhancing safety, this increasing investment in public infrastructure encourages the use of cutting-edge surveillance technologies, which fuels the expansion of Mexico's smart camera market as a whole.Technological Developments:

Mexico's smart camera adoption and capabilities are being greatly enhanced by the swift advancement of technology. Advanced features like facial recognition, motion detection, and behavior analysis are made possible by the integration of artificial intelligence (AI) and machine learning (ML) into these systems. By proactively identifying threats, these intelligent features help security systems lower false alarms and enhance incident response. Additionally, outdated analog systems are being replaced by more popular Internet Protocol (IP) cameras, which offer remote access for real-time monitoring and higher definition photos. The growing popularity of IP-based solutions also makes it simpler to integrate them with cloud services and other digital platforms. When combined, these technical advancements increase the efficacy and usability of smart cameras, propelling market growth.Demand from the business Sector:

In order to improve security and operational effectiveness, smart camera systems are becoming more and more popular in Mexico's business sector. High-definition cameras with remote access and real-time monitoring features are being installed by stores, lodging facilities, and dining establishments. This tendency is particularly noticeable in tourist hotspots like Cancún and Los Cabos, where safeguarding visitors and property is of utmost importance. These smart camera installations simplify operational management while assisting companies in preventing theft, keeping an eye on consumer behavior, and guaranteeing personnel safety. The need for sophisticated surveillance technologies increases in tandem with the expansion of the commercial sector and the heightened level of competition. The expansion of the smart camera market in Mexico is largely being driven by the increasing investment from retail and hospitality enterprises.Challenges in the Mexico Smart Camera Market

High Initial Costs:

Purchasing hardware, software licenses, and expert installation services is a significant upfront investment needed to implement smart camera systems. This initial expense may be a significant deterrent, especially for small and medium-sized businesses (SMEs) with tight budgets. The total cost of ownership is increased beyond installation by continuing expenditures for software upgrades, system maintenance, and sporadic hardware upgrades. The adoption of advanced surveillance technologies is slowed down by these financial demands for many businesses, particularly those operating in price-sensitive markets or regions. Furthermore, the expense factor may make it more difficult to access the newest features and advancements, which could increase the divide between big businesses and smaller competitors. In order to increase market penetration and encourage wider adoption, affordability must be addressed.Privacy Issues and Regulatory Compliance:

Since continuous surveillance may be viewed as invasive, the public has serious privacy concerns about the increasing usage of smart cameras. As a result, regulatory agencies that uphold stringent privacy and data protection regulations are now paying closer attention. Companies using smart camera systems need to make sure they abide by these rules in order to stay out of trouble with the law and keep customers' trust. Careful control over the collection, storage, and sharing of video data is necessary to navigate the complexity of data privacy legislation. Any violations or abuses may result in harsh fines, legal action, and harm to one's image. As a result, one of the biggest challenges facing the smart camera market is striking a balance between privacy rights and security benefits.Mexico Smart Camera Market Overview by Regions

Urbanization, government initiatives, and business demand are driving the robust growth of the Mexico smart camera market in major cities like Mexico City, Monterrey, and Guadalajara, while emerging regions progressively embrace cutting-edge surveillance technologies. The following provides a market overview by regions:Northern Mexico Smart Camera Market

The market for smart cameras in northern Mexico is expanding significantly due to factors like urbanization, security concerns, and technology improvements. Leading cities like Tijuana and Monterrey are incorporating smart surveillance systems to improve urban management and public safety. Because IP-based cameras provide remote monitoring and high-resolution imagery, they are widely used. In order to increase security and operational effectiveness, the commercial sector - which includes the retail and hospitality sectors - is also investing more and more in smart camera solutions. The need for sophisticated monitoring technologies in the area is further supported by government programs to modernize infrastructure and encourage smart city initiatives. Northern Mexico is positioned as a major player in the nation's smart camera market due to this confluence of factors.Central Mexico Smart Camera Market

The market for smart cameras in Central Mexico is expanding significantly due to factors like urbanization, security concerns, and technology improvements. Leading cities like Puebla, Querétaro, and León are incorporating smart surveillance systems to improve urban administration and public safety. Because IP-based cameras provide remote monitoring and high-resolution imagery, they are widely used. In order to increase security and operational effectiveness, the commercial sector - which includes the retail and hospitality sectors - is also investing more and more in smart camera solutions. The need for sophisticated monitoring technologies in the area is further supported by government programs to modernize infrastructure and encourage smart city initiatives. Central Mexico is positioned as a major player in the nation's smart camera market due to this confluence of factors.Southern Mexico Smart Camera Market

The market for smart cameras in southern Mexico is gradually expanding due to factors like urbanization, tourism, and security requirements. Smart surveillance systems are being adopted by cities like Mérida, Oaxaca, and Villahermosa more frequently in an effort to improve public safety and efficiently manage urban areas. The need for cutting-edge security solutions to guarantee the protection of tourists and locals is being driven by the tourism industry, particularly in places like Huatulco and Puerto Escondido. Furthermore, it is becoming more popular to include machine learning (ML) and artificial intelligence (AI) into surveillance systems, allowing for capabilities like real-time analytics and facial recognition. Notwithstanding these developments, obstacles including limited infrastructure and financial resources in some places could slow implementation. However, Southern Mexico's market is still growing due to the region's continued urbanization and emphasis on security.Market Segmentation

Component

- Image Sensor

- Lens

- Memory

- Processor

Sensor Type

- CCD Sensors

- CMOS Sensors

End User

- Commercial

- Industrial

- Residential

- Military and Defense

- Others

Regions

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Company Analysis (Overviews, Key Persons, Recent Developments, SWOT Analysis, Revenue Analysis)

- Samsung Electronics Co. Ltd

- Canon Inc.

- Bosch Security Systems (Robert Bosch LLC)

- Sony Corporation

- Panasonic Corporation

- Olympus Corporation

- TP-Link Corporation

- Zebra Technologies

- IMAGO Technologies

- Philips NV

Table of Contents

Companies Mentioned

The major companies profiled in this Mexico Smart Camera market report include:- Samsung Electronics Co. Ltd

- Canon Inc.

- Bosch Security Systems (Robert Bosch LLC)

- Sony Corporation

- Panasonic Corporation

- Olympus Corporation

- TP-Link Corporation

- Zebra Technologies

- IMAGO Technologies

- Philips NV

Methodology

In this report, for analyzing the future trends for the studied market during the forecast period, the publisher has incorporated rigorous statistical and econometric methods, further scrutinized by secondary, primary sources and by in-house experts, supported through their extensive data intelligence repository. The market is studied holistically from both demand and supply-side perspectives. This is carried out to analyze both end-user and producer behavior patterns, in the review period, which affects price, demand and consumption trends. As the study demands to analyze the long-term nature of the market, the identification of factors influencing the market is based on the fundamentality of the study market.

Through secondary and primary researches, which largely include interviews with industry participants, reliable statistics, and regional intelligence, are identified and are transformed to quantitative data through data extraction, and further applied for inferential purposes. The publisher's in-house industry experts play an instrumental role in designing analytic tools and models, tailored to the requirements of a particular industry segment. These analytical tools and models sanitize the data & statistics and enhance the accuracy of their recommendations and advice.

Primary Research

The primary purpose of this phase is to extract qualitative information regarding the market from the key industry leaders. The primary research efforts include reaching out to participants through mail, tele-conversations, referrals, professional networks, and face-to-face interactions. The publisher also established professional corporate relations with various companies that allow us greater flexibility for reaching out to industry participants and commentators for interviews and discussions, fulfilling the following functions:

- Validates and improves the data quality and strengthens research proceeds

- Further develop the analyst team’s market understanding and expertise

- Supplies authentic information about market size, share, growth, and forecast

The researcher's primary research interview and discussion panels are typically composed of the most experienced industry members. These participants include, however, are not limited to:

- Chief executives and VPs of leading corporations specific to the industry

- Product and sales managers or country heads; channel partners and top level distributors; banking, investment, and valuation experts

- Key opinion leaders (KOLs)

Secondary Research

The publisher refers to a broad array of industry sources for their secondary research, which typically includes, however, is not limited to:

- Company SEC filings, annual reports, company websites, broker & financial reports, and investor presentations for competitive scenario and shape of the industry

- Patent and regulatory databases for understanding of technical & legal developments

- Scientific and technical writings for product information and related preemptions

- Regional government and statistical databases for macro analysis

- Authentic new articles, webcasts, and other related releases for market evaluation

- Internal and external proprietary databases, key market indicators, and relevant press releases for market estimates and forecasts

LOADING...

Table Information

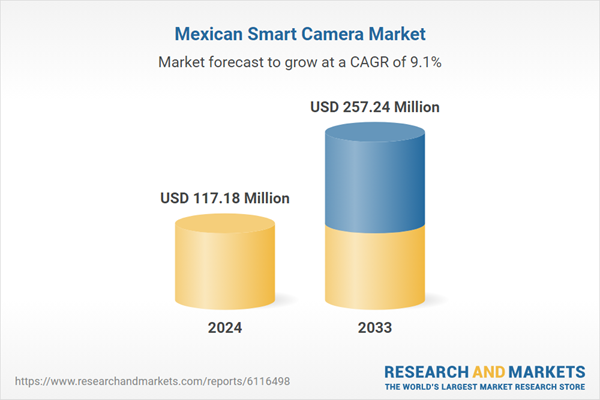

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | July 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 117.18 Million |

| Forecasted Market Value ( USD | $ 257.24 Million |

| Compound Annual Growth Rate | 9.1% |

| Regions Covered | Mexico |

| No. of Companies Mentioned | 11 |