Germany Coffee Market Overviews

Coffee is a type of drink made from roasted coffee beans, which are actually seeds of berries in the Coffea plant. Renowned for its rich smell, caffeine level, and stimulating impact, coffee is among the most widely used beverages globally. In Germany, coffee has a very strong cultural significance and is even more favored than beer. Germans drink over 160 liters of coffee per individual per year, and it is a daily item throughout families, offices, and cafés.Coffee's popularity in Germany is also driven by an intense café culture, the expansion of specialty coffee houses, and an increasing demand for sustainable, organic beans. Whether a morning booster, afternoon pick-me-up, or social event, coffee is at the center of everyday life. Trends like cold brew, single-origin coffee beans, and domestic brewing equipment have also caught up. Germany's status as one of Europe's largest coffee markets positions it as a center of trade, innovation, and consumption in the global coffee market.

Growth Drivers of the Germany Coffee Market

Increased Demand for Premium and Specialty Coffee

German consumers are increasingly moving towards premium, specialty coffee offerings. These include single-origin beans, organic coffees, and sustainably produced coffee. Increased value for artisanal, flavor variety, and fair trade has driven demand for high-end choices. Coffee houses, baristas, and roasters are important in creating consumer awareness and developing the coffee experience. The trend indicates wider changes in consumers' preferences for quality over quantity, corresponding to global coffee culture trends. March 2024, Paso Paso, a new German coffee roasting firm, launches an innovative business model in which coffee producers are owners and decision-makers. "Paso Paso - Farmer Owned Coffee" was established by Bram de Hoog, previous specialty coffee sourcing director at Ally Coffee, together with producers from Costa Rica, El Salvador, Ethiopia, and Nicaragua.Expanding Coffee Shop Culture and Urbanization

Germany's vibrant coffee culture, particularly in urban areas such as Berlin, Munich, and Hamburg, is a significant growth driver. Urbanization and growing middle-class populations have boosted disposable income and lifestyles. Coffee shops have become work and social centers, becoming attractive to younger generations. The café culture also spurs innovation in coffee drinks like cold brews, plant-based lattes, and artisan brewing techniques, setting the stage for a dynamic, competitive coffee retailing environment. Pret A Manger will have five new stores in downtown Berlin by the end of 2023 with franchise partner PM Nord as part of its German expansion.Development of E-Commerce and Home Brewing Trends

The transition towards online purchases has highly favoured the German coffee market. Customers increasingly prefer purchasing coffee, devices, and accessories online, particularly in the post-pandemic era. Further, the home brewing trend is fueling demand for grinders, espresso machines, and specialty coffee beans. Subscription schemes and direct-to-consumer sales are being used by brands to build relationships and guarantee repeat business. This do-it-yourself culture has turned the act of drinking coffee into an experience at home, thus fueling market growth. Sept 2022, A new online coffee platform, 60beans, has opened in Germany with simple access to specialty coffee worldwide with direct shipping to provide an interface between coffee enthusiasts and producers.Problematic Points in the Germany Coffee Market

Unstable Coffee Bean Prices and Supply Chain Interruptions

Coffee production is extremely climate, labor, and geopolitics-sensitive in export markets. These factors regularly induce price fluctuations, impacting the cost of import to German roasters and retailers. In addition, global supply chain bottlenecks - aggravated by climate change or political unrest - may result in delay and cost escalation, constricting margins and decreasing affordability for final consumers.Sustainability and Environmental Concerns

German consumers are environmentally aware, driving demand for environmentally friendly sourcing and packaging. Full transparency and traceability in the coffee supply chain is a challenge, though. Certification schemes such as Fairtrade and Rainforest Alliance assist, but at a cost and with compliance complexity that becomes an obstacle for smaller producers and suppliers. Balancing sustainability expectations with affordability and profit margins is a delicate tightrope to walk in the industry for firms.Germany Instant Coffee Market

Instant coffee is still a mainstay in most German homes because of its ease of use and low prices. Although it competes with fresh-ground and specialty coffees, instant ones are changing by offering higher-quality tasting varieties, freeze-dried versions, and single-serve packs. The segment is particularly favored among older audiences and office settings. Flavor and packaging innovations are sustaining demand even as the overall market trends toward premium and craft coffee consumption.Germany Ground Coffee Market

Ground coffee is the most widely consumed form in Germany, especially for traditional brewing methods like filter coffee. Its balance between convenience and quality appeals to a broad consumer base. German brands offer various roast levels and origin-specific blends to cater to diverse taste preferences. Despite rising competition from beans and pods, ground coffee maintains strong shelf presence in supermarkets and remains central to everyday coffee rituals in German households.Germany Whole Bean Coffee Market

The whole bean market is seeing strong growth due to heightened demand for home brewing and specialty coffee. Consumers are adopting grinding their own beans for better freshness and control over flavor. Whole beans are favored among coffee aficionados as they are perceived as more natural and personalized. Brands are seizing this opportunity by providing high-quality, organic, and single-origin bean options in-store and online. The segment resonates nicely with Germany's quality-driven coffee consumers.Germany Arabica Coffee Market

Arabica coffee holds sway in the German market because its smoother taste profile, reduced caffeine levels, and perceived higher quality make it outcompete Robusta. Sought after in both special and retail channels, Arabica is the go-to bean of high-end blends. Priced for its subtle flavor notes, it is in demand for filter coffee as well as espresso among German consumers. Increased emphasis on origin and methods of cultivation also puts Arabica at an advantage, with its higher chance of traceability and sustainability.Germany Robusta Coffee Market

Although less prevalent than Arabica, Robusta enjoys a strong presence in Germany's coffee market, especially in instant coffee and espresso mixtures. Its harsher flavor, greater caffeine concentration, and crema-strengthening properties drive popularity with some consumer groups and professional bartenders. Robusta beans are stronger against pests and climatic fluctuations and therefore suit manufacturers concerned with price and reliability. Increased awareness of flavor variety is fueling Robusta's comeback.Germany B2C Coffee Market

The retail-driven, subscription-based, and direct-to-consumer (D2C) platform-driven business-to-consumer (B2C) segment is strong in Germany. Consumers are on the rise purchasing coffee online or through supermarkets, e-commerce websites, and brand portals. Trends towards personalization, convenience, and brand loyalty are favoring the B2C channel. Startup companies and specialty roasters are increasing their market presence by providing customized blends and brewing tips, enhancing consumer interaction and sales in this fast-paced segment.Germany B2B Coffee Market

Germany's B2B coffee market is driven by cafés, restaurants, hotels, and office demand. The segment needs reliable supply, equipment services, and bespoke blends to satisfy the tastes of large and diverse consumer groups. Expansion in foodservice and hospitality sectors stimulates B2B sales, especially in metropolitan areas. Collaborations among coffee companies and hospitality companies guarantee stable demand. With companies prioritizing customer experience, quality coffee becomes an ever more important competitive edge.Market Segmentation

Product Type

- Instant Coffee

- Ground Coffee

- Coffee Pods and Capsules

- Whole Bean Coffee

Source

- Arabica

- Robusta

Distribution Channel

- B2C

- B2B

Key Players Analysis (Overviews, Key Persons, Recent Developments, SWOT Analysis, Revenue Analysis)

- Jab Holding Company

- Tchibo

- Nestle SA

- The Kraft Heinz Company

- JJ Darboven GmbH & Co. KG

- Alois Dallmayr KG

- Melitta Group

- Luigi Lavazza SpA

- Kruger GmbH & Co. KG

- Starbucks Corporation

- Peet's Coffee

- Jacobs Douwe Egberts Gb Ltd

Table of Contents

Companies Mentioned

The major companies profiled in this Germany Coffee market report include:- Jab Holding Company

- Tchibo

- Nestle SA

- The Kraft Heinz Company

- JJ Darboven GmbH & Co. KG

- Alois Dallmayr KG

- Melitta Group

- Luigi Lavazza SpA

- Kruger GmbH & Co. KG

- Starbucks Corporation

- Peet's Coffee

- Jacobs Douwe Egberts Gb Ltd

Methodology

In this report, for analyzing the future trends for the studied market during the forecast period, the publisher has incorporated rigorous statistical and econometric methods, further scrutinized by secondary, primary sources and by in-house experts, supported through their extensive data intelligence repository. The market is studied holistically from both demand and supply-side perspectives. This is carried out to analyze both end-user and producer behavior patterns, in the review period, which affects price, demand and consumption trends. As the study demands to analyze the long-term nature of the market, the identification of factors influencing the market is based on the fundamentality of the study market.

Through secondary and primary researches, which largely include interviews with industry participants, reliable statistics, and regional intelligence, are identified and are transformed to quantitative data through data extraction, and further applied for inferential purposes. The publisher's in-house industry experts play an instrumental role in designing analytic tools and models, tailored to the requirements of a particular industry segment. These analytical tools and models sanitize the data & statistics and enhance the accuracy of their recommendations and advice.

Primary Research

The primary purpose of this phase is to extract qualitative information regarding the market from the key industry leaders. The primary research efforts include reaching out to participants through mail, tele-conversations, referrals, professional networks, and face-to-face interactions. The publisher also established professional corporate relations with various companies that allow us greater flexibility for reaching out to industry participants and commentators for interviews and discussions, fulfilling the following functions:

- Validates and improves the data quality and strengthens research proceeds

- Further develop the analyst team’s market understanding and expertise

- Supplies authentic information about market size, share, growth, and forecast

The researcher's primary research interview and discussion panels are typically composed of the most experienced industry members. These participants include, however, are not limited to:

- Chief executives and VPs of leading corporations specific to the industry

- Product and sales managers or country heads; channel partners and top level distributors; banking, investment, and valuation experts

- Key opinion leaders (KOLs)

Secondary Research

The publisher refers to a broad array of industry sources for their secondary research, which typically includes, however, is not limited to:

- Company SEC filings, annual reports, company websites, broker & financial reports, and investor presentations for competitive scenario and shape of the industry

- Patent and regulatory databases for understanding of technical & legal developments

- Scientific and technical writings for product information and related preemptions

- Regional government and statistical databases for macro analysis

- Authentic new articles, webcasts, and other related releases for market evaluation

- Internal and external proprietary databases, key market indicators, and relevant press releases for market estimates and forecasts

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | July 2025 |

| Forecast Period | 2024 - 2033 |

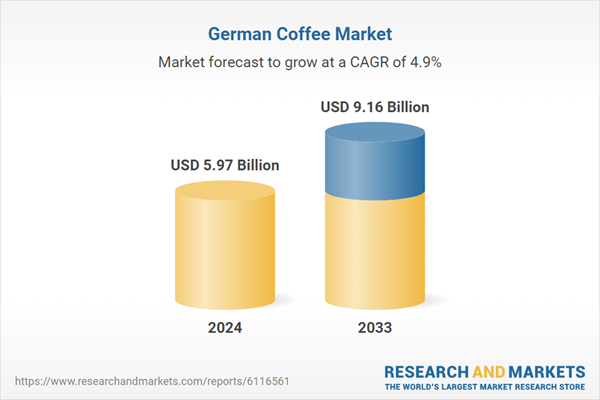

| Estimated Market Value ( USD | $ 5.97 Billion |

| Forecasted Market Value ( USD | $ 9.16 Billion |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Germany |

| No. of Companies Mentioned | 13 |