Speak directly to the analyst to clarify any post sales queries you may have.

Uncovering the Evolving Dynamics of the Global Dates Industry Through Strategic Analysis of Consumer Preferences and Supply Chain Innovations

The global dates industry is undergoing a profound transformation as shifting consumer preferences, supply chain complexities, and regulatory developments converge to reshape competitive dynamics and growth trajectories. As the consumption of functional foods accelerates, dates have emerged as a nutritional and versatile ingredient, piquing the interest of innovators across food and beverage, confectionery, cosmetics, and pharmaceutical applications.Against this backdrop, a holistic understanding of evolving demand patterns, variety preferences, and distribution channels has never been more critical. The proliferation of digital retail platforms is expanding market reach while intensifying the need for robust e-commerce strategies. Simultaneously, sustainability concerns are driving investments in ethical sourcing and traceability, underscoring the industry’s responsibility to strengthen social and environmental stewardship throughout the value chain.

This executive summary distills the key forces catalyzing change in the global dates landscape. It synthesizes insights into emergent production technologies, transformative shifts in trade policies, and the nuanced interplay of regional and consumer dynamics. The goal is to equip stakeholders-from growers and processors to distributors and brand owners-with a clear, strategic perspective that informs decision-making and unlocks new avenues for growth.

Exploring Transformational Drivers Reshaping the Dates Industry Landscape Through Technological, Digital, and Sustainability Innovations

Rapid innovation across cultivation techniques and post-harvest handling is redefining cost structures and product quality benchmarks. Producers are adopting precision irrigation and greenhouse cultivation to optimize yields of premium varieties, responding to surging demand for Medjool’s rich sweetness and Ajwa’s antioxidant properties. Concurrently, the rise of value-added formats-such as date pastes, powders, and syrups-is broadening application scopes beyond traditional snacking into bakery, confections, and nutritional supplements.Digitalization is disrupting traditional trade routes, as e-commerce platforms enable direct-to-consumer engagement and data-driven marketing. This shift is empowering nimble players to differentiate through storytelling, traceability credentials, and customized product bundles. Moreover, the industry’s sustainability imperative is fueling adoption of circular economy principles, from harnessing date pits for biofuel and animal feed to reducing food waste through intelligent packaging solutions.

Regulatory developments and consumer advocacy are further elevating quality and safety standards. Certifications for organic cultivation, fair trade, and non-GMO status are becoming prerequisites for market entry in developed economies. As a result, stakeholders are forging strategic alliances and investing in third-party audits to bolster credibility and navigate an increasingly complex compliance landscape.

Assessing the Cumulative Consequences of United States Tariffs Enacted in 2025 on Global Dates Trade Flows and Competitive Strategies

The introduction of targeted tariffs by the United States in 2025 has triggered a cascade of strategic adjustments across the global dates supply chain. Import duties on key varieties have elevated landed costs, prompting importers to renegotiate contracts with origin suppliers or pivot to alternative sourcing regions. These shifts have intensified competitive pressures on exporters from North Africa and the Middle East, who must now balance price competitiveness with quality differentiation.In response, some distributors have overhauled logistics networks to consolidate shipments and achieve economies of scale, while others have absorbed a portion of the tariff burden to preserve market share among value-sensitive consumers. The tariff environment has also accelerated investments in local production initiatives, with emerging players in the Americas and Asia-Pacific seeking to develop domestic date orchards that mitigate import dependency.

Despite the headwinds, premium segments have demonstrated resilience, as health-focused consumers exhibit willingness to pay for ethically sourced and organic-certified dates. However, volume-oriented channels face margin compression, motivating many participants to diversify portfolios through private-label partnerships and co-branding collaborations that leverage existing distribution footprints.

Illuminating Comprehensive Segmentation Insights Across Dates Types Varieties Forms Applications and Distribution Channels to Guide Strategic Positioning

An in-depth segmentation analysis reveals starkly divergent trajectories across dates varieties, types, and formats. Dry, semi-dry, and soft dates each serve distinct consumption occasions: dry dates dominate baking and confectionery formulations, semi-dry varieties cater to snacking applications, and soft dates are prized for direct consumption and premium desserts. Varietal preferences further shape market dynamics, with Medjool and Sukkari commanding higher price premiums, while Ajwa and Barhi often attract niche health-conscious segments.In the realm of processed forms, chopped and diced dates integrate seamlessly into baked goods, whereas date paste and powder have gained traction as natural sweeteners and functional ingredients in beverages. Syrups and pitted whole dates continue to support traditional culinary uses and direct-to-consumer enjoyment. End-use applications span animal feed, where byproducts like pits and stems create circular value, to cosmetics and pharmaceuticals that leverage antioxidant and emollient properties. Within the food and beverage sector, bakery products, beverages, and confectionery constitute the largest consumption hubs.

Distribution channels exhibit contrasting growth profiles: offline retail anchors accessibility through convenience stores, specialty shops, and supermarkets or hypermarkets, while online platforms-including brand websites and e-commerce marketplaces-offer rapid scalability and data-driven personalization. Each channel demands tailored engagement strategies and logistical frameworks to optimize reach, margin, and customer experience.

Highlighting Distinct Regional Perspectives and Growth Drivers across the Americas Europe Middle East & Africa and Asia-Pacific Markets

Regional landscapes present distinct growth opportunities influenced by consumption patterns, logistical infrastructures, and regulatory regimes. In the Americas, rising health-and-wellness trends are elevating direct consumption of premium soft dates, while localized production experiments in California and Mexico are advancing supply chain resilience. Meanwhile, North American retail channels are embracing experiential marketing through in-store tastings and thematic packaging.The Europe, Middle East & Africa region maintains its status as the historical epicenter of date cultivation and consumption. North African producers in Tunisia and Algeria remain key exporters, sustained by proximity to European markets. Simultaneously, Gulf Cooperation Council countries continue to influence global flavor preferences, driving demand for luxury varietals and gifting formats. Regulatory focus on pesticide residues and food safety standards has heightened, compelling origin markets to adopt rigorous testing protocols.

Asia-Pacific is emerging as a high-potential frontier, propelled by expanding middle-income populations in India, China, and Southeast Asia. E-commerce penetration is catalyzing adoption, especially among younger, urban demographics seeking healthful snack alternatives. Local players are entering partnerships with established exporters to introduce fortified and flavored date products tailored to regional taste profiles.

Revealing Insights into Strategic Initiatives and Competitive Positioning of Key Industry Players Driving Innovation and Growth

Leading participants have crystallized competitive advantage through a blend of product innovation, vertical integration, and strategic alliances. Several top-tier exporters have invested in state-of-the-art processing facilities to ensure consistent quality and extend shelf life across diverse climatic transit routes. Others have pursued organic and Fair Trade certifications, tapping premium-valued segments and reinforcing brand trust among ethically minded consumers.Digital pioneers have distinguished themselves by deploying direct-to-consumer platforms and subscription models, enabling data collection on flavor preferences and consumption occasions. Collaborative ventures between growers and nutraceutical firms are unlocking novel applications, from anti-inflammatory supplements to high-protein snack bars, expanding the functional foods frontier.

Supply chain integration remains a pivotal lever: major players are forging end-to-end partnerships with logistics providers to streamline cold chain couriers and optimize cross-border compliance. Mergers and acquisitions have also accelerated, as entities seek scale in key origin regions or complementary capabilities in downstream processing and packaging.

Providing Actionable Strategic Recommendations to Enhance Traceability Drive Product Innovation Embrace Sustainability and Expand Digital Engagement

To harness emerging opportunities, industry leaders must prioritize end-to-end traceability by integrating blockchain or IoT-based tracking solutions, thereby bolstering consumer confidence and meeting stringent regulatory requirements. Furthermore, investment in value-added research and development-particularly for functional derivatives and fortified extracts-can unlock new revenue streams and support premium price positioning.Leveraging digital marketing and e-commerce strategies will be essential to capture younger and health-focused demographics. Omnichannel engagement, including social commerce collaborations and interactive content, can strengthen brand loyalty and drive repeat purchases. Concurrently, sustainability must be embedded at the core of corporate strategy. Adopting regenerative agriculture practices, reducing post-harvest losses through cold storage innovations, and valorizing byproducts for animal feed or bioenergy generation will enhance operational resilience and social license to operate.

Finally, forging cross-sector partnerships with food service operators, nutraceutical developers, and cosmetics brands can accelerate diversification and drive scale. Collaborative product development initiatives will enable faster time-to-market and shared investment risk, positioning leaders to outpace competitors in an increasingly dynamic global landscape.

Outlining the Rigorous Multi-Phase Research Methodology Employed to Ensure Analytical Reliability and Actionable Market Insights

This study integrates a comprehensive, multi-phase research methodology designed to deliver robust and reliable market insights. The process commenced with a systematic review of secondary sources, including industry publications, regulatory filings, and trade association reports, to establish a foundational understanding of market structure and historical developments.Subsequently, a series of primary interviews was conducted with key stakeholders spanning growers, processors, distributors, and end-user segments. These qualitative discussions were complemented by data triangulation techniques, cross-verifying quantitative estimates through multiple independent sources. Supply chain mapping was employed to delineate distribution routes and identify potential bottlenecks or cost drivers.

Advanced analytics were utilized to assess tariff impact scenarios and evaluate regional consumption trends, while thematic analysis distilled emerging megatrends. Throughout the process, rigorous validation protocols were maintained, including peer review by subject matter experts and iterative feedback loops with industry practitioners to ensure analytical integrity and actionable relevance.

Synthesizing Key Findings and Strategic Imperatives to Equip Stakeholders with a Clear Forward-Looking Perspective on the Dates Industry

This executive summary has synthesized the core dynamics shaping the global dates industry, from the ripple effects of U.S. tariffs to the nuanced segmentation trends that inform targeted growth strategies. By examining transformative shifts in cultivation technologies, digital distribution, and sustainability imperatives, we have illuminated the strategic levers that will define competitive advantage moving forward.Regional analyses underscore the importance of tailored market approaches: emerging domestic production in the Americas, heritage consumption patterns in Europe, Middle East & Africa, and rapid uptake in Asia-Pacific each demand distinct engagement models. The profiling of leading firms highlights the efficacy of innovation ecosystems, vertical integration, and digital outreach in capturing value across the dates value chain.

Ultimately, the ability to translate these insights into coherent, forward-looking strategies will determine which organizations thrive in an increasingly complex and opportunity-rich environment. Stakeholders equipped with this comprehensive perspective can better navigate uncertainty, optimize resource allocation, and unlock new pathways for sustainable growth.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Dates Market

Companies Mentioned

The key companies profiled in this Dates market report include:- AGTHIA PJSC

- Al Barakah Dates Factory

- Al Foah by Agthia Group PJSC

- Al Wathba Marionnet L.L.C.

- Ario Trading Co.

- Barakat Al Madinah

- Bateel International Llc

- Best Food Company LLC

- Boudjebel VACPA

- DELLA LUXURY PRODUCTS PVT LTD

- Hadiklaim - Israel Date Growers' Cooperative

- Haifa Dattes

- Ithmar Taiba Dates Company

- Joolies LLC

- Jurassic Fruit GmbH

- Lion Dates Impex Pvt. Ltd.

- MOON DATES by NOUR FRUIT Company

- Natural Delights by Bard Valley Medjool Date Growers Association

- Oasis Date LLC

- Olam International Ltd.

- Royal Palm Group

- Urjoon Al Aaliya

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 184 |

| Published | January 2026 |

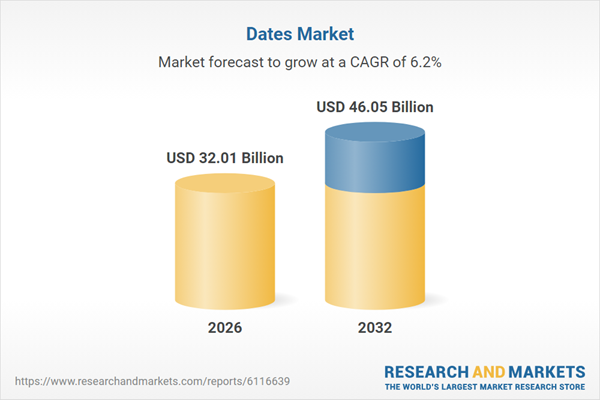

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 32.01 Billion |

| Forecasted Market Value ( USD | $ 46.05 Billion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 23 |