Speak directly to the analyst to clarify any post sales queries you may have.

A strategic overview of the band saw blades sector clarifying material innovations, operational drivers, and procurement imperatives shaping industry decisions

The band saw blades sector operates at the intersection of materials science, precision manufacturing, and industrial demand. Innovations in tooth geometry and substrate composition have extended blade life and cutting performance, while automation and digital process controls have tightened tolerances and reduced variability across production environments. These technological and material advances have reshaped procurement criteria for end users across heavy industry, light manufacturing, and specialty processing sectors.Dynamics within supply chains have become increasingly relevant to strategic planning. Sourcing of specialized alloys and carbide grades, along with access to diamond coating processes, imposes both logistics and quality control considerations. Manufacturers are balancing vertical integration with strategic supplier partnerships to protect margins and preserve delivery reliability. Concurrently, customer requirements emphasize repeatability, operator safety, and lower total cost of ownership rather than simple unit price competition.

This introduction frames the subsequent analysis by emphasizing the practical implications of material decisions, tooth form selection, and technology adoption. By focusing on real-world operational outcomes and procurement priorities, the discussion intends to equip leaders and technical buyers with a clear appreciation of where value is created and how industry participants are responding to evolving performance and sustainability agendas.

How innovations in materials, tooth geometry, automation, and supply resilience are collectively redefining value and competitive advantage in the industry

Recent years have seen transformative shifts that go beyond incremental improvements, with several converging trends redefining competitive advantage. Material engineering strides-such as optimized bi-metal laminates and refined carbide tips-have materially improved fatigue resistance and edge retention, enabling operations to run longer cycles between blade changeovers. At the same time, tooth configuration innovation, exemplified by variable tooth and wavy tooth geometries, has optimized chip evacuation and surface finish in applications that span metals, composites, and dense polymers.Automation and adaptive machinery controls have accelerated change by enabling consistent cutting parameters and real-time feedback. These technological enablers reduce operator dependency and allow less-skilled labor to achieve higher-quality outcomes, thereby expanding the addressable user base for advanced blade solutions. Parallel to these advances, heightened focus on sustainability and occupational safety has pushed manufacturers to adopt cleaner production processes and to develop blades with lower lifecycle environmental impacts.

Supply-chain resilience has also emerged as a strategic differentiator. Firms investing in diversified sourcing, localized stocking, and predictive maintenance programs capture uptime advantages in volatile operating contexts. Taken together, these shifts are reshaping value propositions: vendors compete not only on product attributes but also on service models, data-driven maintenance offerings, and outcomes-based guarantees that align with customer performance metrics.

Assessment of the cumulative effects of 2025 trade tariffs on procurement, inventory strategy, and regional production decisions across the supply chain

The imposition of trade tariffs in 2025 introduced immediate adjustments in global procurement strategies and supplier relations. Organizations reliant on cross-border sourcing responded by recalibrating supplier portfolios to mitigate cost and delivery exposures. Some manufacturers accelerated qualification of alternate suppliers closer to demand centers, while others sought to absorb short-term cost increases through internal efficiency gains and product redesigns that reduced dependency on tariff-affected inputs.Operationally, tariff-driven changes influenced inventory policies and capital allocation. Firms extended safety stocks for critical blade grades and increased investments in local finishing and coating capabilities to preserve product margins. In parallel, distributors and aftermarket suppliers adapted pricing strategies and service offerings to maintain customer retention during a period of higher input price volatility. Procurement functions deepened engagement with engineering teams to identify substitution opportunities that preserved performance while easing import dependencies.

Strategically, the tariff environment catalyzed longer-term conversations about regional manufacturing footprints and technological sovereignty. Decision-makers weighed the benefits of nearshoring versus maintaining global supplier relationships, with an eye to retaining industrial knowledge and maintaining access to advanced metallurgical expertise. The cumulative impact was to accelerate structural changes in procurement, production planning, and supplier collaboration models across the value chain.

Segment-specific implications for product development, service models, and procurement decisions across materials, tooth designs, technologies, end users, and sales channels

Segment-level dynamics reveal differentiated demand drivers and technical priorities that inform product design and go-to-market strategies. Based on material, the field spans bi-metal constructions prized for toughness and fatigue resistance, carbide-tipped configurations used where hardness and edge retention matter, carbon steel options serving general-purpose cutting needs, and diamond-tipped blades reserved for abrasive or ultra-hard substrates that require exceptional wear resistance. These material choices cascade into application suitability, lifecycle costs, and required maintenance regimes.Based on tooth configuration, decision frameworks pivot on hook tooth geometries that favor aggressive material removal, variable tooth profiles that balance cut rate with finish quality, and wavy tooth designs optimized for thin or delicate workpieces where vibration damping and burr reduction are critical. Based on technology, the adoption split between automatic systems and manual operations defines both blade specification and service models; automated environments demand tighter tolerances and more consistent blade metallurgy, while manual operations prioritize ease of handling and straightforward re-sharpening routines.

Based on end user, tailored product development addresses the aerospace and defense sector’s emphasis on certification and traceability, the automotive industry’s demand for cycle efficiency and robustness, construction sector needs for versatility and durability on-site, food and beverage requirements for sanitary finishes and contamination controls, and furniture production’s focus on surface quality and throughput. Based on sales channel, offline distribution through authorized dealers and service partners remains critical for full-service value propositions, while online channels enable rapid replenishment and broaden reach, particularly for standardized commodity blade types.

Understanding these segmentation perspectives together allows suppliers to map product portfolios to explicit operational needs, prioritize R&D investments, and design service offerings that resonate with the varied expectations of technical buyers and procurement teams.

Comparative regional dynamics and how supply, certification, and service strategies differ across Americas, Europe Middle East & Africa, and Asia-Pacific markets

Regional dynamics shape competitive tactics and investment priorities in meaningful ways. In the Americas, demand patterns reflect a blend of heavy industrial usage and advanced fabrication activities; this region emphasizes reliable supply chains, integration with local manufacturing ecosystems, and compatibility with a wide range of steel and alloy grades. As a result, suppliers that combine technical support, aftermarket services, and local inventory capabilities tend to win stronger footholds in the industrial and automotive clusters.Europe, Middle East & Africa presents a heterogeneous landscape where regulatory frameworks, high-precision manufacturing pockets, and infrastructure projects coexist. Manufacturers focus on compliance, certifications, and specialized blade geometries for industries such as aerospace, defense, and high-end fabrication. The region also shows a marked interest in sustainability credentials and process efficiency, prompting suppliers to highlight lifecycle impacts, recyclability, and energy-efficient production techniques when engaging with buyers.

Asia-Pacific comprises diverse markets ranging from high-volume manufacturing hubs to rapidly modernizing fabrication sectors. Here, competitive dynamics favor scale, cost-efficient production, and rapid product iteration. Suppliers that can combine localized production with robust quality systems and rapid distribution often capture market opportunities across consumer goods, electronics, and construction applications. Across all regions, regionalization of supply and emphasis on service differentiation have become deciding factors in buyer selection processes.

How R&D, manufacturing precision, and integrated aftermarket services combine to create competitive advantage among leading band saw blade suppliers

Competitive positioning among leading companies is defined by a combination of metallurgical expertise, manufacturing flexibility, service offerings, and channel relationships. Firms that invest in R&D to refine edge geometries, coating chemistries, and bonding techniques gain a measurable advantage in high-value segments where uptime and finish quality drive purchasing decisions. In parallel, companies that offer comprehensive aftermarket services-such as re-tipping, reconditioning, and predictive maintenance analytics-create recurring revenue streams and strengthen customer loyalty.Operational excellence in production, including consistent heat treatment and precision tooth grinding, directly impacts perceived quality. Strategic investments in automation and quality control systems reduce defect rates and improve batch consistency, which is particularly important for customers with strict tolerance and traceability requirements. Distribution strategy also matters: partner networks that combine technical training, tooling support, and localized inventory help shorten lead times and reduce downtime for customers.

Finally, companies that effectively translate technical performance into tangible business outcomes-such as reduced cycle times, lower total cost of ownership, or improved surface quality-tend to secure premium positioning. Strategic collaboration with OEMs, tooling integrators, and industrial service providers further expands addressable applications and provides avenues for co-development, which in turn supports long-term differentiation.

A pragmatic set of strategic priorities that align materials innovation, supply resilience, and service-led commercial models to strengthen market position and customer outcomes

Industry leaders should prioritize a coordinated blend of product innovation, supply resilience, and customer-centric service models to capture value in an evolving environment. Investment in material science and tooth geometry optimization will yield tangible operational benefits for end users and support premium pricing for differentiated solutions. Parallel investments in coating technologies and finishing processes can extend blade life and open opportunities in abrasive and composite cutting applications.On the supply side, diversifying supplier bases and developing localized finishing or coating capabilities reduces exposure to tariff-induced disruptions and short-term logistics volatility. Leaders should also formalize predictive maintenance and blade lifecycle programs that leverage operational data to minimize unplanned downtime. These service offerings can be monetized as subscription or outcome-based arrangements that tie supplier performance to buyer productivity metrics.

Commercially, combining offline service networks with efficient e-commerce replenishment creates a hybrid channel strategy that addresses both high-touch, technical sales and rapid, transactional purchases. Finally, embedding sustainability criteria-such as recyclable materials, low-emission manufacturing, and extended lifecycle designs-into product roadmaps will resonate with buyers increasingly evaluated on ESG metrics and regulatory compliance.

A transparent, triangulated research approach combining primary technical interviews and secondary production and technology trend analysis to ensure actionable insights

The research underpinning this executive summary synthesizes primary interviews, targeted supplier and buyer dialogues, and an analysis of production and technology trends observed across manufacturing and fabrication sectors. Primary qualitative inputs were gathered from technical managers, procurement leaders, and operations specialists to validate product performance attributes and to identify service expectations in diverse applications. These direct engagements ensured that product-level insights reflect real-world operating constraints and decision criteria.Secondary investigation focused on technical literature, patent activity, and observable shifts in manufacturing practices relevant to blade metallurgy and tooth design. Observations of equipment automation trends and aftermarket service models provided context for how blades are specified, sold, and maintained in practice. Cross-referencing multiple evidence streams helped ensure robust interpretation of supply chain adaptations and regional differentiation.

An emphasis on triangulation guided the methodology: claims from industry participants were corroborated against production process indicators and supplier capability signals. This approach supported balanced conclusions while minimizing reliance on single-source assertions. Transparency in data sources and clear articulation of analytical boundaries were prioritized to enable readers to evaluate the applicability of insights to their specific operational contexts.

Concluding synthesis emphasizing the interplay between technical innovation, supply strategy, and service delivery as the foundation for durable competitive advantage

In closing, the band saw blades landscape has matured into a technically sophisticated market where material selection, tooth geometry, and service delivery determine competitive outcomes. Supply-chain considerations and regional strategies now play equally important roles as product-level performance in shaping customer choices. Firms that integrate metallurgical innovation with service models and resilient sourcing will be best positioned to meet the exacting demands of modern manufacturing while capturing value beyond commodity pricing.Operational buyers and business leaders should interpret blade selection through the lens of total operational impact, including changeover time, maintenance frequency, and end-product quality. Vendors that succeed will articulate clear value propositions tied to measurable outcomes, support those claims with localized service capabilities, and maintain agile production systems that respond quickly to evolving application needs.

This conclusion underscores the imperative for coordinated action across R&D, operations, and commercial functions. By aligning technical innovation with pragmatic supply strategies and buyer-centric service offerings, market participants can translate engineering advances into durable competitive advantage and operational improvements for their customers.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Band Saw Blades Market

Companies Mentioned

The key companies profiled in this Band Saw Blades market report include:- Dakin-Flathers Ltd

- Ellis Mfg, Inc.

- Forrest Mfg. Co.

- Hakansson Saws India Pvt. Ltd.

- ITL Industries Limited

- Micor Tooling by LSAB Group

- MK Morse Company

- Munkfors

- Olson Saw

- Pilana Metal Sro

- Rohan Tools Center

- Rontgen Metalworking Solutions Pvt. Ltd.

- Simmons Knife & Saw

- Simonds International

- The L.S. Starrett Company

- Tsune Seiki Co., LTD.

- Umiya Engineering Works

- WIKUS-Sägenfabrik Wilhelm H. Kullmann GmbH & Co GmbH & Co. KG

- York Saw & Knife Company, Inc.

- ZHEJIANG GENHONT TEC CO.,LTD

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 196 |

| Published | January 2026 |

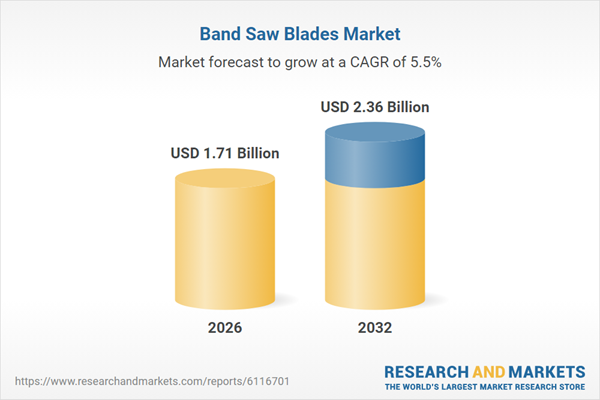

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 1.71 Billion |

| Forecasted Market Value ( USD | $ 2.36 Billion |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |