Speak directly to the analyst to clarify any post sales queries you may have.

The Impregnating Paint for Motors Market is evolving quickly, driven by shifts in resin chemistry, curing innovations, and operational priorities. As electric motor manufacturing and maintenance face increasing technical and regulatory demands, the performance and sourcing of insulating varnishes are pivotal for long-term efficiency and compliance.

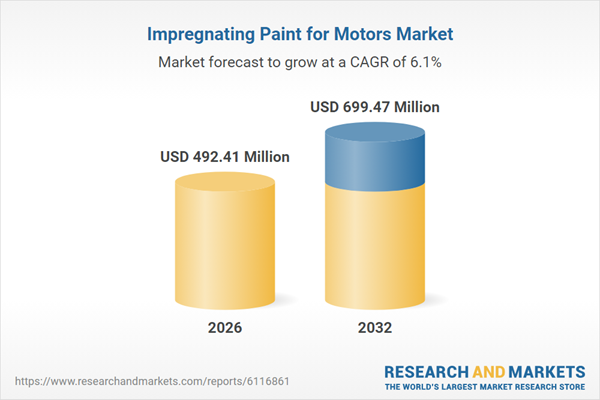

Market Snapshot: Impregnating Paint for Motors Market Growth

The global market for impregnating paint for motors is experiencing robust expansion, advancing from USD 463.27 million in 2025 to USD 492.41 million in 2026, and is anticipated to reach USD 699.47 million by 2032, supported by a CAGR of 6.06%. Market growth is shaped by advancing electrical insulation needs, tighter environmental regulations, and increased demand across automotive, industrial, and power sectors.

Scope & Segmentation

- Resin Chemistries: Covers epoxy systems, both bisphenol A and novolac types, saturated and unsaturated polyester variants, and aliphatic and aromatic polyurethane grades.

- Processing Technologies: Includes powder-based, solvent-based (aliphatic and aromatic), water-based, and UV/thermal curing approaches.

- Motor Types & Applications: Encompasses AC (induction, synchronous), DC (brushed, brushless) motors; use cases from new coil manufacturing to rewinding and preventive repair.

- Insulation Classes: Ranges from Class A to Class H, dictating thermal performance benchmarks and compatible curing processes.

- Regional Analysis: Segmented by Americas, Europe Middle East and Africa (EMEA), and Asia-Pacific, reflecting distinct regulatory, manufacturing, and demand drivers.

Key Takeaways for Senior Decision-Makers

- Performance requirements are intensifying—buyers increasingly seek solutions that combine high dielectric strength, thermal endurance, chemical resistance, and reliable adhesion.

- Resin and curing innovations enable thinner, faster-curing coatings, helping OEMs and suppliers meet class upgrades, environmental targets, and tighter maintenance cycles.

- Procurement focus is shifting beyond upfront cost to total cost of ownership, emphasizing life-cycle durability and compliance risk mitigation.

- Market segments are highly specialized—automotive electrification prioritizes high-performance and repairable coatings, while household and industrial users target cost-effectiveness and long-term reliability.

- Regional variations are structuring supplier and sourcing strategies; for example, Americas and Western Europe accelerate water-based and UV-curable adoption, while Asia-Pacific leverages both scale and innovation.

Tariff Impact on Sourcing and Operations

In 2025, newly imposed United States tariffs on insulation material inputs changed sourcing patterns, prompting rapid diversification among buyers and qualification of alternative suppliers. Manufacturers adjusted formulations and sourcing models—shifting toward local resin grades and non-solvent systems—to manage margin pressure and compliance exposure. This market inflection increased focus on dual-sourcing, inventory management, and tariff engineering, favoring hybrid supply-chain models balancing cost, regional agility, and resilience.

Methodology & Data Sources

This report uses a rigorous mixed-method approach. Insights are drawn from primary interviews with formulation scientists, procurement managers, and motor OEMs, supplemented by field visits and direct observation of coating processes. Secondary analysis includes review of technical literature, compliance standards, and laboratory test outcomes, with conclusions validated through triangulation and peer review.

Why This Report Matters

- Enables informed procurement and product development decisions by mapping out resin, curing, and compliance strategies across technical, regulatory, and regional lenses.

- Provides actionable guidance on navigating tariff impacts, supply-chain risk, and the shift toward total-cost-of-ownership frameworks.

- Equips leadership with the market context necessary for R&D prioritization, capital planning, and partnership evaluation within the insulation coatings value chain.

Conclusion

In a market defined by evolving specification, regulatory momentum, and resilient operations, the path to advantage lies in formulation flexibility, robust testing, and service-led support. Stakeholders that align innovation with reliability and supply stability will secure success as electrification and quality expectations rise.

Table of Contents

1.2. Market Segmentation & Coverage

1.3. Years Considered for the Study

1.4. Currency & Pricing

1.5. Language

1.6. Stakeholders

2.2. Determine: Research Design

2.3. Prepare: Research Instrument

2.4. Collect: Data Source

2.5. Analyze: Data Interpretation

2.6. Formulate: Data Verification

2.7. Publish: Research Report

2.8. Repeat: Report Update

4.2. Market Sizing & Forecasting

5.2. Innovations in waterborne impregnating paint formulations to meet stricter environmental regulations

5.3. Integration of nanoadditives in impregnation paints to enhance electrical insulation and thermal conductivity

5.4. Growing adoption of bio-based resin systems in motor impregnation to reduce carbon footprint

5.5. Advances in UV-curable impregnating coatings enabling rapid curing for improved industrial efficiency

5.6. Emergence of smart impregnating paints with self-healing properties and corrosion-sensing capabilities

5.7. Increasing collaboration between paint suppliers and motor OEMs for tailored formulation development

5.8. Shift towards low-volatile organic compound impregnating systems enhancing worker safety and compliance

5.9. Demand for high dielectric strength impregnating paints in high-speed high-power density motor applications

5.10. Development of hybrid epoxy-urethane impregnation systems delivering superior flexibility and adhesion properties

6.2. PESTLE Analysis

8.2. Epoxy

8.2.1. Bisphenol A

8.2.2. Novolac

8.3. Polyester

8.3.1. Saturated

8.3.2. Unsaturated

8.4. Polyurethane

8.4.1. Aliphatic

8.4.2. Aromatic

9.2. Powder Based

9.3. Solvent Based

9.3.1. Aliphatic Solvent

9.3.2. Aromatic Solvent

9.4. Water Based

10.2. AC Motor

10.2.1. Induction Motor

10.2.2. Synchronous Motor

10.3. DC Motor

10.3.1. Brushed Motor

10.3.2. Brushless Motor

11.2. New Coil Manufacturing

11.2.1. High Voltage

11.2.2. Low Voltage

11.3. Rewinding And Repair

11.3.1. Corrective Maintenance

11.3.2. Preventive Maintenance

12.2. Automotive

12.2.1. Commercial Vehicles

12.2.2. Passenger Vehicles

12.3. Household Appliances

12.4. Industrial

12.4.1. Manufacturing

12.4.2. Oil And Gas

12.5. Power Generation

13.2. Class A

13.3. Class B

13.4. Class F

13.5. Class H

14.2. Ambient Curing

14.3. Thermal Curing

14.3.1. Forced Air

14.3.2. Infrared

14.4. UV Curing

14.4.1. LED UV

14.4.2. Mercury Arc Lamp

15.2. United States

15.3. Canada

15.4. Mexico

15.5. Brazil

15.6. Argentina

16.2. United Kingdom

16.3. Germany

16.4. France

16.5. Russia

16.6. Italy

16.7. Spain

16.8. United Arab Emirates

16.9. Saudi Arabia

16.10. South Africa

16.11. Denmark

16.12. Netherlands

16.13. Qatar

16.14. Finland

16.15. Sweden

16.16. Nigeria

16.17. Egypt

16.18. Turkey

16.19. Israel

16.20. Norway

16.21. Poland

16.22. Switzerland

17.2. China

17.3. India

17.4. Japan

17.5. Australia

17.6. South Korea

17.7. Indonesia

17.8. Thailand

17.9. Philippines

17.10. Malaysia

17.11. Singapore

17.12. Vietnam

17.13. Taiwan

18.2. FPNV Positioning Matrix, 2024

18.3. Competitive Analysis

18.3.1. PPG Industries, Inc.

18.3.2. Akzo Nobel N.V.

18.3.3. Kansai Paint Co., Ltd.

18.3.4. Axalta Coating Systems Ltd.

18.3.5. The Sherwin-Williams Company

18.3.6. Nippon Paint Holdings Co., Ltd.

18.3.7. Jotun A/S

18.3.8. Allnex Belgium S.A.

18.3.9. Teknos Group Oy

18.3.10. Hempel A/S

20. ResearchStatistics

21. ResearchContacts

22. ResearchArticles

23. Appendix

FIGURE 2. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, 2018-2030 (USD MILLION)

FIGURE 3. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY REGION, 2024 VS 2025 VS 2030 (USD MILLION)

FIGURE 4. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

FIGURE 5. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY RESIN TYPE, 2024 VS 2030 (%)

FIGURE 6. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY RESIN TYPE, 2024 VS 2025 VS 2030 (USD MILLION)

FIGURE 7. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY TECHNOLOGY, 2024 VS 2030 (%)

FIGURE 8. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY TECHNOLOGY, 2024 VS 2025 VS 2030 (USD MILLION)

FIGURE 9. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY MOTOR TYPE, 2024 VS 2030 (%)

FIGURE 10. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY MOTOR TYPE, 2024 VS 2025 VS 2030 (USD MILLION)

FIGURE 11. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY APPLICATION, 2024 VS 2030 (%)

FIGURE 12. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY APPLICATION, 2024 VS 2025 VS 2030 (USD MILLION)

FIGURE 13. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY END USER, 2024 VS 2030 (%)

FIGURE 14. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY END USER, 2024 VS 2025 VS 2030 (USD MILLION)

FIGURE 15. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY INSULATION CLASS, 2024 VS 2030 (%)

FIGURE 16. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY INSULATION CLASS, 2024 VS 2025 VS 2030 (USD MILLION)

FIGURE 17. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY CURING METHOD, 2024 VS 2030 (%)

FIGURE 18. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY CURING METHOD, 2024 VS 2025 VS 2030 (USD MILLION)

FIGURE 19. AMERICAS IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY COUNTRY, 2024 VS 2030 (%)

FIGURE 20. AMERICAS IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

FIGURE 21. UNITED STATES IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY STATE, 2024 VS 2030 (%)

FIGURE 22. UNITED STATES IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY STATE, 2024 VS 2025 VS 2030 (USD MILLION)

FIGURE 23. EUROPE, MIDDLE EAST & AFRICA IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY COUNTRY, 2024 VS 2030 (%)

FIGURE 24. EUROPE, MIDDLE EAST & AFRICA IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

FIGURE 25. ASIA-PACIFIC IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY COUNTRY, 2024 VS 2030 (%)

FIGURE 26. ASIA-PACIFIC IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY COUNTRY, 2024 VS 2025 VS 2030 (USD MILLION)

FIGURE 27. IMPREGNATING PAINT FOR MOTORS MARKET SHARE, BY KEY PLAYER, 2024

FIGURE 28. IMPREGNATING PAINT FOR MOTORS MARKET, FPNV POSITIONING MATRIX, 2024

FIGURE 29. IMPREGNATING PAINT FOR MOTORS MARKET: RESEARCHAI

FIGURE 30. IMPREGNATING PAINT FOR MOTORS MARKET: RESEARCHSTATISTICS

FIGURE 31. IMPREGNATING PAINT FOR MOTORS MARKET: RESEARCHCONTACTS

FIGURE 32. IMPREGNATING PAINT FOR MOTORS MARKET: RESEARCHARTICLES

TABLE 2. UNITED STATES DOLLAR EXCHANGE RATE, 2018-2024

TABLE 3. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, 2018-2024 (USD MILLION)

TABLE 4. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, 2025-2030 (USD MILLION)

TABLE 5. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY REGION, 2018-2024 (USD MILLION)

TABLE 6. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY REGION, 2025-2030 (USD MILLION)

TABLE 7. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY COUNTRY, 2018-2024 (USD MILLION)

TABLE 8. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY COUNTRY, 2025-2030 (USD MILLION)

TABLE 9. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY RESIN TYPE, 2018-2024 (USD MILLION)

TABLE 10. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY RESIN TYPE, 2025-2030 (USD MILLION)

TABLE 11. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY EPOXY, BY REGION, 2018-2024 (USD MILLION)

TABLE 12. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY EPOXY, BY REGION, 2025-2030 (USD MILLION)

TABLE 13. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY BISPHENOL A, BY REGION, 2018-2024 (USD MILLION)

TABLE 14. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY BISPHENOL A, BY REGION, 2025-2030 (USD MILLION)

TABLE 15. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY NOVOLAC, BY REGION, 2018-2024 (USD MILLION)

TABLE 16. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY NOVOLAC, BY REGION, 2025-2030 (USD MILLION)

TABLE 17. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY EPOXY, 2018-2024 (USD MILLION)

TABLE 18. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY EPOXY, 2025-2030 (USD MILLION)

TABLE 19. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY POLYESTER, BY REGION, 2018-2024 (USD MILLION)

TABLE 20. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY POLYESTER, BY REGION, 2025-2030 (USD MILLION)

TABLE 21. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY SATURATED, BY REGION, 2018-2024 (USD MILLION)

TABLE 22. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY SATURATED, BY REGION, 2025-2030 (USD MILLION)

TABLE 23. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY UNSATURATED, BY REGION, 2018-2024 (USD MILLION)

TABLE 24. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY UNSATURATED, BY REGION, 2025-2030 (USD MILLION)

TABLE 25. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY POLYESTER, 2018-2024 (USD MILLION)

TABLE 26. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY POLYESTER, 2025-2030 (USD MILLION)

TABLE 27. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY POLYURETHANE, BY REGION, 2018-2024 (USD MILLION)

TABLE 28. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY POLYURETHANE, BY REGION, 2025-2030 (USD MILLION)

TABLE 29. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY ALIPHATIC, BY REGION, 2018-2024 (USD MILLION)

TABLE 30. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY ALIPHATIC, BY REGION, 2025-2030 (USD MILLION)

TABLE 31. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY AROMATIC, BY REGION, 2018-2024 (USD MILLION)

TABLE 32. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY AROMATIC, BY REGION, 2025-2030 (USD MILLION)

TABLE 33. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY POLYURETHANE, 2018-2024 (USD MILLION)

TABLE 34. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY POLYURETHANE, 2025-2030 (USD MILLION)

TABLE 35. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY TECHNOLOGY, 2018-2024 (USD MILLION)

TABLE 36. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY TECHNOLOGY, 2025-2030 (USD MILLION)

TABLE 37. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY POWDER BASED, BY REGION, 2018-2024 (USD MILLION)

TABLE 38. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY POWDER BASED, BY REGION, 2025-2030 (USD MILLION)

TABLE 39. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY SOLVENT BASED, BY REGION, 2018-2024 (USD MILLION)

TABLE 40. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY SOLVENT BASED, BY REGION, 2025-2030 (USD MILLION)

TABLE 41. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY ALIPHATIC SOLVENT, BY REGION, 2018-2024 (USD MILLION)

TABLE 42. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY ALIPHATIC SOLVENT, BY REGION, 2025-2030 (USD MILLION)

TABLE 43. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY AROMATIC SOLVENT, BY REGION, 2018-2024 (USD MILLION)

TABLE 44. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY AROMATIC SOLVENT, BY REGION, 2025-2030 (USD MILLION)

TABLE 45. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY SOLVENT BASED, 2018-2024 (USD MILLION)

TABLE 46. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY SOLVENT BASED, 2025-2030 (USD MILLION)

TABLE 47. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY WATER BASED, BY REGION, 2018-2024 (USD MILLION)

TABLE 48. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY WATER BASED, BY REGION, 2025-2030 (USD MILLION)

TABLE 49. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY MOTOR TYPE, 2018-2024 (USD MILLION)

TABLE 50. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY MOTOR TYPE, 2025-2030 (USD MILLION)

TABLE 51. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY AC MOTOR, BY REGION, 2018-2024 (USD MILLION)

TABLE 52. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY AC MOTOR, BY REGION, 2025-2030 (USD MILLION)

TABLE 53. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY INDUCTION MOTOR, BY REGION, 2018-2024 (USD MILLION)

TABLE 54. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY INDUCTION MOTOR, BY REGION, 2025-2030 (USD MILLION)

TABLE 55. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY SYNCHRONOUS MOTOR, BY REGION, 2018-2024 (USD MILLION)

TABLE 56. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY SYNCHRONOUS MOTOR, BY REGION, 2025-2030 (USD MILLION)

TABLE 57. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY AC MOTOR, 2018-2024 (USD MILLION)

TABLE 58. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY AC MOTOR, 2025-2030 (USD MILLION)

TABLE 59. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY DC MOTOR, BY REGION, 2018-2024 (USD MILLION)

TABLE 60. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY DC MOTOR, BY REGION, 2025-2030 (USD MILLION)

TABLE 61. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY BRUSHED MOTOR, BY REGION, 2018-2024 (USD MILLION)

TABLE 62. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY BRUSHED MOTOR, BY REGION, 2025-2030 (USD MILLION)

TABLE 63. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY BRUSHLESS MOTOR, BY REGION, 2018-2024 (USD MILLION)

TABLE 64. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY BRUSHLESS MOTOR, BY REGION, 2025-2030 (USD MILLION)

TABLE 65. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY DC MOTOR, 2018-2024 (USD MILLION)

TABLE 66. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY DC MOTOR, 2025-2030 (USD MILLION)

TABLE 67. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

TABLE 68. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

TABLE 69. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY NEW COIL MANUFACTURING, BY REGION, 2018-2024 (USD MILLION)

TABLE 70. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY NEW COIL MANUFACTURING, BY REGION, 2025-2030 (USD MILLION)

TABLE 71. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY HIGH VOLTAGE, BY REGION, 2018-2024 (USD MILLION)

TABLE 72. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY HIGH VOLTAGE, BY REGION, 2025-2030 (USD MILLION)

TABLE 73. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY LOW VOLTAGE, BY REGION, 2018-2024 (USD MILLION)

TABLE 74. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY LOW VOLTAGE, BY REGION, 2025-2030 (USD MILLION)

TABLE 75. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY NEW COIL MANUFACTURING, 2018-2024 (USD MILLION)

TABLE 76. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY NEW COIL MANUFACTURING, 2025-2030 (USD MILLION)

TABLE 77. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY REWINDING AND REPAIR, BY REGION, 2018-2024 (USD MILLION)

TABLE 78. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY REWINDING AND REPAIR, BY REGION, 2025-2030 (USD MILLION)

TABLE 79. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY CORRECTIVE MAINTENANCE, BY REGION, 2018-2024 (USD MILLION)

TABLE 80. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY CORRECTIVE MAINTENANCE, BY REGION, 2025-2030 (USD MILLION)

TABLE 81. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY PREVENTIVE MAINTENANCE, BY REGION, 2018-2024 (USD MILLION)

TABLE 82. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY PREVENTIVE MAINTENANCE, BY REGION, 2025-2030 (USD MILLION)

TABLE 83. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY REWINDING AND REPAIR, 2018-2024 (USD MILLION)

TABLE 84. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY REWINDING AND REPAIR, 2025-2030 (USD MILLION)

TABLE 85. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY END USER, 2018-2024 (USD MILLION)

TABLE 86. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY END USER, 2025-2030 (USD MILLION)

TABLE 87. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY AUTOMOTIVE, BY REGION, 2018-2024 (USD MILLION)

TABLE 88. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY AUTOMOTIVE, BY REGION, 2025-2030 (USD MILLION)

TABLE 89. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY COMMERCIAL VEHICLES, BY REGION, 2018-2024 (USD MILLION)

TABLE 90. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY COMMERCIAL VEHICLES, BY REGION, 2025-2030 (USD MILLION)

TABLE 91. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY PASSENGER VEHICLES, BY REGION, 2018-2024 (USD MILLION)

TABLE 92. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY PASSENGER VEHICLES, BY REGION, 2025-2030 (USD MILLION)

TABLE 93. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY AUTOMOTIVE, 2018-2024 (USD MILLION)

TABLE 94. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY AUTOMOTIVE, 2025-2030 (USD MILLION)

TABLE 95. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY HOUSEHOLD APPLIANCES, BY REGION, 2018-2024 (USD MILLION)

TABLE 96. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY HOUSEHOLD APPLIANCES, BY REGION, 2025-2030 (USD MILLION)

TABLE 97. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY INDUSTRIAL, BY REGION, 2018-2024 (USD MILLION)

TABLE 98. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY INDUSTRIAL, BY REGION, 2025-2030 (USD MILLION)

TABLE 99. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY MANUFACTURING, BY REGION, 2018-2024 (USD MILLION)

TABLE 100. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY MANUFACTURING, BY REGION, 2025-2030 (USD MILLION)

TABLE 101. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY OIL AND GAS, BY REGION, 2018-2024 (USD MILLION)

TABLE 102. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY OIL AND GAS, BY REGION, 2025-2030 (USD MILLION)

TABLE 103. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY INDUSTRIAL, 2018-2024 (USD MILLION)

TABLE 104. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY INDUSTRIAL, 2025-2030 (USD MILLION)

TABLE 105. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY POWER GENERATION, BY REGION, 2018-2024 (USD MILLION)

TABLE 106. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY POWER GENERATION, BY REGION, 2025-2030 (USD MILLION)

TABLE 107. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY INSULATION CLASS, 2018-2024 (USD MILLION)

TABLE 108. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY INSULATION CLASS, 2025-2030 (USD MILLION)

TABLE 109. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY CLASS A, BY REGION, 2018-2024 (USD MILLION)

TABLE 110. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY CLASS A, BY REGION, 2025-2030 (USD MILLION)

TABLE 111. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY CLASS B, BY REGION, 2018-2024 (USD MILLION)

TABLE 112. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY CLASS B, BY REGION, 2025-2030 (USD MILLION)

TABLE 113. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY CLASS F, BY REGION, 2018-2024 (USD MILLION)

TABLE 114. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY CLASS F, BY REGION, 2025-2030 (USD MILLION)

TABLE 115. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY CLASS H, BY REGION, 2018-2024 (USD MILLION)

TABLE 116. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY CLASS H, BY REGION, 2025-2030 (USD MILLION)

TABLE 117. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY CURING METHOD, 2018-2024 (USD MILLION)

TABLE 118. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY CURING METHOD, 2025-2030 (USD MILLION)

TABLE 119. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY AMBIENT CURING, BY REGION, 2018-2024 (USD MILLION)

TABLE 120. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY AMBIENT CURING, BY REGION, 2025-2030 (USD MILLION)

TABLE 121. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY THERMAL CURING, BY REGION, 2018-2024 (USD MILLION)

TABLE 122. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY THERMAL CURING, BY REGION, 2025-2030 (USD MILLION)

TABLE 123. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY FORCED AIR, BY REGION, 2018-2024 (USD MILLION)

TABLE 124. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY FORCED AIR, BY REGION, 2025-2030 (USD MILLION)

TABLE 125. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY INFRARED, BY REGION, 2018-2024 (USD MILLION)

TABLE 126. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY INFRARED, BY REGION, 2025-2030 (USD MILLION)

TABLE 127. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY THERMAL CURING, 2018-2024 (USD MILLION)

TABLE 128. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY THERMAL CURING, 2025-2030 (USD MILLION)

TABLE 129. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY UV CURING, BY REGION, 2018-2024 (USD MILLION)

TABLE 130. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY UV CURING, BY REGION, 2025-2030 (USD MILLION)

TABLE 131. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY LED UV, BY REGION, 2018-2024 (USD MILLION)

TABLE 132. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY LED UV, BY REGION, 2025-2030 (USD MILLION)

TABLE 133. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY MERCURY ARC LAMP, BY REGION, 2018-2024 (USD MILLION)

TABLE 134. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY MERCURY ARC LAMP, BY REGION, 2025-2030 (USD MILLION)

TABLE 135. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY UV CURING, 2018-2024 (USD MILLION)

TABLE 136. GLOBAL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY UV CURING, 2025-2030 (USD MILLION)

TABLE 137. AMERICAS IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY RESIN TYPE, 2018-2024 (USD MILLION)

TABLE 138. AMERICAS IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY RESIN TYPE, 2025-2030 (USD MILLION)

TABLE 139. AMERICAS IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY EPOXY, 2018-2024 (USD MILLION)

TABLE 140. AMERICAS IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY EPOXY, 2025-2030 (USD MILLION)

TABLE 141. AMERICAS IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY POLYESTER, 2018-2024 (USD MILLION)

TABLE 142. AMERICAS IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY POLYESTER, 2025-2030 (USD MILLION)

TABLE 143. AMERICAS IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY POLYURETHANE, 2018-2024 (USD MILLION)

TABLE 144. AMERICAS IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY POLYURETHANE, 2025-2030 (USD MILLION)

TABLE 145. AMERICAS IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY TECHNOLOGY, 2018-2024 (USD MILLION)

TABLE 146. AMERICAS IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY TECHNOLOGY, 2025-2030 (USD MILLION)

TABLE 147. AMERICAS IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY SOLVENT BASED, 2018-2024 (USD MILLION)

TABLE 148. AMERICAS IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY SOLVENT BASED, 2025-2030 (USD MILLION)

TABLE 149. AMERICAS IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY MOTOR TYPE, 2018-2024 (USD MILLION)

TABLE 150. AMERICAS IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY MOTOR TYPE, 2025-2030 (USD MILLION)

TABLE 151. AMERICAS IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY AC MOTOR, 2018-2024 (USD MILLION)

TABLE 152. AMERICAS IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY AC MOTOR, 2025-2030 (USD MILLION)

TABLE 153. AMERICAS IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY DC MOTOR, 2018-2024 (USD MILLION)

TABLE 154. AMERICAS IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY DC MOTOR, 2025-2030 (USD MILLION)

TABLE 155. AMERICAS IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

TABLE 156. AMERICAS IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

TABLE 157. AMERICAS IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY NEW COIL MANUFACTURING, 2018-2024 (USD MILLION)

TABLE 158. AMERICAS IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY NEW COIL MANUFACTURING, 2025-2030 (USD MILLION)

TABLE 159. AMERICAS IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY REWINDING AND REPAIR, 2018-2024 (USD MILLION)

TABLE 160. AMERICAS IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY REWINDING AND REPAIR, 2025-2030 (USD MILLION)

TABLE 161. AMERICAS IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY END USER, 2018-2024 (USD MILLION)

TABLE 162. AMERICAS IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY END USER, 2025-2030 (USD MILLION)

TABLE 163. AMERICAS IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY AUTOMOTIVE, 2018-2024 (USD MILLION)

TABLE 164. AMERICAS IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY AUTOMOTIVE, 2025-2030 (USD MILLION)

TABLE 165. AMERICAS IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY INDUSTRIAL, 2018-2024 (USD MILLION)

TABLE 166. AMERICAS IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY INDUSTRIAL, 2025-2030 (USD MILLION)

TABLE 167. AMERICAS IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY INSULATION CLASS, 2018-2024 (USD MILLION)

TABLE 168. AMERICAS IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY INSULATION CLASS, 2025-2030 (USD MILLION)

TABLE 169. AMERICAS IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY CURING METHOD, 2018-2024 (USD MILLION)

TABLE 170. AMERICAS IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY CURING METHOD, 2025-2030 (USD MILLION)

TABLE 171. AMERICAS IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY THERMAL CURING, 2018-2024 (USD MILLION)

TABLE 172. AMERICAS IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY THERMAL CURING, 2025-2030 (USD MILLION)

TABLE 173. AMERICAS IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY UV CURING, 2018-2024 (USD MILLION)

TABLE 174. AMERICAS IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY UV CURING, 2025-2030 (USD MILLION)

TABLE 175. AMERICAS IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY COUNTRY, 2018-2024 (USD MILLION)

TABLE 176. AMERICAS IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY COUNTRY, 2025-2030 (USD MILLION)

TABLE 177. UNITED STATES IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY RESIN TYPE, 2018-2024 (USD MILLION)

TABLE 178. UNITED STATES IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY RESIN TYPE, 2025-2030 (USD MILLION)

TABLE 179. UNITED STATES IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY EPOXY, 2018-2024 (USD MILLION)

TABLE 180. UNITED STATES IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY EPOXY, 2025-2030 (USD MILLION)

TABLE 181. UNITED STATES IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY POLYESTER, 2018-2024 (USD MILLION)

TABLE 182. UNITED STATES IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY POLYESTER, 2025-2030 (USD MILLION)

TABLE 183. UNITED STATES IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY POLYURETHANE, 2018-2024 (USD MILLION)

TABLE 184. UNITED STATES IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY POLYURETHANE, 2025-2030 (USD MILLION)

TABLE 185. UNITED STATES IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY TECHNOLOGY, 2018-2024 (USD MILLION)

TABLE 186. UNITED STATES IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY TECHNOLOGY, 2025-2030 (USD MILLION)

TABLE 187. UNITED STATES IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY SOLVENT BASED, 2018-2024 (USD MILLION)

TABLE 188. UNITED STATES IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY SOLVENT BASED, 2025-2030 (USD MILLION)

TABLE 189. UNITED STATES IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY MOTOR TYPE, 2018-2024 (USD MILLION)

TABLE 190. UNITED STATES IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY MOTOR TYPE, 2025-2030 (USD MILLION)

TABLE 191. UNITED STATES IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY AC MOTOR, 2018-2024 (USD MILLION)

TABLE 192. UNITED STATES IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY AC MOTOR, 2025-2030 (USD MILLION)

TABLE 193. UNITED STATES IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY DC MOTOR, 2018-2024 (USD MILLION)

TABLE 194. UNITED STATES IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY DC MOTOR, 2025-2030 (USD MILLION)

TABLE 195. UNITED STATES IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

TABLE 196. UNITED STATES IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

TABLE 197. UNITED STATES IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY NEW COIL MANUFACTURING, 2018-2024 (USD MILLION)

TABLE 198. UNITED STATES IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY NEW COIL MANUFACTURING, 2025-2030 (USD MILLION)

TABLE 199. UNITED STATES IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY REWINDING AND REPAIR, 2018-2024 (USD MILLION)

TABLE 200. UNITED STATES IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY REWINDING AND REPAIR, 2025-2030 (USD MILLION)

TABLE 201. UNITED STATES IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY END USER, 2018-2024 (USD MILLION)

TABLE 202. UNITED STATES IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY END USER, 2025-2030 (USD MILLION)

TABLE 203. UNITED STATES IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY AUTOMOTIVE, 2018-2024 (USD MILLION)

TABLE 204. UNITED STATES IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY AUTOMOTIVE, 2025-2030 (USD MILLION)

TABLE 205. UNITED STATES IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY INDUSTRIAL, 2018-2024 (USD MILLION)

TABLE 206. UNITED STATES IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY INDUSTRIAL, 2025-2030 (USD MILLION)

TABLE 207. UNITED STATES IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY INSULATION CLASS, 2018-2024 (USD MILLION)

TABLE 208. UNITED STATES IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY INSULATION CLASS, 2025-2030 (USD MILLION)

TABLE 209. UNITED STATES IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY CURING METHOD, 2018-2024 (USD MILLION)

TABLE 210. UNITED STATES IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY CURING METHOD, 2025-2030 (USD MILLION)

TABLE 211. UNITED STATES IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY THERMAL CURING, 2018-2024 (USD MILLION)

TABLE 212. UNITED STATES IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY THERMAL CURING, 2025-2030 (USD MILLION)

TABLE 213. UNITED STATES IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY UV CURING, 2018-2024 (USD MILLION)

TABLE 214. UNITED STATES IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY UV CURING, 2025-2030 (USD MILLION)

TABLE 215. UNITED STATES IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY STATE, 2018-2024 (USD MILLION)

TABLE 216. UNITED STATES IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY STATE, 2025-2030 (USD MILLION)

TABLE 217. CANADA IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY RESIN TYPE, 2018-2024 (USD MILLION)

TABLE 218. CANADA IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY RESIN TYPE, 2025-2030 (USD MILLION)

TABLE 219. CANADA IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY EPOXY, 2018-2024 (USD MILLION)

TABLE 220. CANADA IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY EPOXY, 2025-2030 (USD MILLION)

TABLE 221. CANADA IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY POLYESTER, 2018-2024 (USD MILLION)

TABLE 222. CANADA IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY POLYESTER, 2025-2030 (USD MILLION)

TABLE 223. CANADA IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY POLYURETHANE, 2018-2024 (USD MILLION)

TABLE 224. CANADA IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY POLYURETHANE, 2025-2030 (USD MILLION)

TABLE 225. CANADA IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY TECHNOLOGY, 2018-2024 (USD MILLION)

TABLE 226. CANADA IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY TECHNOLOGY, 2025-2030 (USD MILLION)

TABLE 227. CANADA IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY SOLVENT BASED, 2018-2024 (USD MILLION)

TABLE 228. CANADA IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY SOLVENT BASED, 2025-2030 (USD MILLION)

TABLE 229. CANADA IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY MOTOR TYPE, 2018-2024 (USD MILLION)

TABLE 230. CANADA IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY MOTOR TYPE, 2025-2030 (USD MILLION)

TABLE 231. CANADA IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY AC MOTOR, 2018-2024 (USD MILLION)

TABLE 232. CANADA IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY AC MOTOR, 2025-2030 (USD MILLION)

TABLE 233. CANADA IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY DC MOTOR, 2018-2024 (USD MILLION)

TABLE 234. CANADA IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY DC MOTOR, 2025-2030 (USD MILLION)

TABLE 235. CANADA IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

TABLE 236. CANADA IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

TABLE 237. CANADA IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY NEW COIL MANUFACTURING, 2018-2024 (USD MILLION)

TABLE 238. CANADA IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY NEW COIL MANUFACTURING, 2025-2030 (USD MILLION)

TABLE 239. CANADA IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY REWINDING AND REPAIR, 2018-2024 (USD MILLION)

TABLE 240. CANADA IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY REWINDING AND REPAIR, 2025-2030 (USD MILLION)

TABLE 241. CANADA IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY END USER, 2018-2024 (USD MILLION)

TABLE 242. CANADA IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY END USER, 2025-2030 (USD MILLION)

TABLE 243. CANADA IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY AUTOMOTIVE, 2018-2024 (USD MILLION)

TABLE 244. CANADA IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY AUTOMOTIVE, 2025-2030 (USD MILLION)

TABLE 245. CANADA IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY INDUSTRIAL, 2018-2024 (USD MILLION)

TABLE 246. CANADA IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY INDUSTRIAL, 2025-2030 (USD MILLION)

TABLE 247. CANADA IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY INSULATION CLASS, 2018-2024 (USD MILLION)

TABLE 248. CANADA IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY INSULATION CLASS, 2025-2030 (USD MILLION)

TABLE 249. CANADA IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY CURING METHOD, 2018-2024 (USD MILLION)

TABLE 250. CANADA IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY CURING METHOD, 2025-2030 (USD MILLION)

TABLE 251. CANADA IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY THERMAL CURING, 2018-2024 (USD MILLION)

TABLE 252. CANADA IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY THERMAL CURING, 2025-2030 (USD MILLION)

TABLE 253. CANADA IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY UV CURING, 2018-2024 (USD MILLION)

TABLE 254. CANADA IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY UV CURING, 2025-2030 (USD MILLION)

TABLE 255. MEXICO IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY RESIN TYPE, 2018-2024 (USD MILLION)

TABLE 256. MEXICO IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY RESIN TYPE, 2025-2030 (USD MILLION)

TABLE 257. MEXICO IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY EPOXY, 2018-2024 (USD MILLION)

TABLE 258. MEXICO IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY EPOXY, 2025-2030 (USD MILLION)

TABLE 259. MEXICO IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY POLYESTER, 2018-2024 (USD MILLION)

TABLE 260. MEXICO IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY POLYESTER, 2025-2030 (USD MILLION)

TABLE 261. MEXICO IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY POLYURETHANE, 2018-2024 (USD MILLION)

TABLE 262. MEXICO IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY POLYURETHANE, 2025-2030 (USD MILLION)

TABLE 263. MEXICO IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY TECHNOLOGY, 2018-2024 (USD MILLION)

TABLE 264. MEXICO IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY TECHNOLOGY, 2025-2030 (USD MILLION)

TABLE 265. MEXICO IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY SOLVENT BASED, 2018-2024 (USD MILLION)

TABLE 266. MEXICO IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY SOLVENT BASED, 2025-2030 (USD MILLION)

TABLE 267. MEXICO IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY MOTOR TYPE, 2018-2024 (USD MILLION)

TABLE 268. MEXICO IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY MOTOR TYPE, 2025-2030 (USD MILLION)

TABLE 269. MEXICO IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY AC MOTOR, 2018-2024 (USD MILLION)

TABLE 270. MEXICO IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY AC MOTOR, 2025-2030 (USD MILLION)

TABLE 271. MEXICO IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY DC MOTOR, 2018-2024 (USD MILLION)

TABLE 272. MEXICO IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY DC MOTOR, 2025-2030 (USD MILLION)

TABLE 273. MEXICO IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

TABLE 274. MEXICO IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY APPLICATION, 2025-2030 (USD MILLION)

TABLE 275. MEXICO IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY NEW COIL MANUFACTURING, 2018-2024 (USD MILLION)

TABLE 276. MEXICO IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY NEW COIL MANUFACTURING, 2025-2030 (USD MILLION)

TABLE 277. MEXICO IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY REWINDING AND REPAIR, 2018-2024 (USD MILLION)

TABLE 278. MEXICO IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY REWINDING AND REPAIR, 2025-2030 (USD MILLION)

TABLE 279. MEXICO IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY END USER, 2018-2024 (USD MILLION)

TABLE 280. MEXICO IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY END USER, 2025-2030 (USD MILLION)

TABLE 281. MEXICO IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY AUTOMOTIVE, 2018-2024 (USD MILLION)

TABLE 282. MEXICO IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY AUTOMOTIVE, 2025-2030 (USD MILLION)

TABLE 283. MEXICO IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY INDUSTRIAL, 2018-2024 (USD MILLION)

TABLE 284. MEXICO IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY INDUSTRIAL, 2025-2030 (USD MILLION)

TABLE 285. MEXICO IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY INSULATION CLASS, 2018-2024 (USD MILLION)

TABLE 286. MEXICO IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY INSULATION CLASS, 2025-2030 (USD MILLION)

TABLE 287. MEXICO IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY CURING METHOD, 2018-2024 (USD MILLION)

TABLE 288. MEXICO IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY CURING METHOD, 2025-2030 (USD MILLION)

TABLE 289. MEXICO IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY THERMAL CURING, 2018-2024 (USD MILLION)

TABLE 290. MEXICO IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY THERMAL CURING, 2025-2030 (USD MILLION)

TABLE 291. MEXICO IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY UV CURING, 2018-2024 (USD MILLION)

TABLE 292. MEXICO IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY UV CURING, 2025-2030 (USD MILLION)

TABLE 293. BRAZIL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY RESIN TYPE, 2018-2024 (USD MILLION)

TABLE 294. BRAZIL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY RESIN TYPE, 2025-2030 (USD MILLION)

TABLE 295. BRAZIL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY EPOXY, 2018-2024 (USD MILLION)

TABLE 296. BRAZIL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY EPOXY, 2025-2030 (USD MILLION)

TABLE 297. BRAZIL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY POLYESTER, 2018-2024 (USD MILLION)

TABLE 298. BRAZIL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY POLYESTER, 2025-2030 (USD MILLION)

TABLE 299. BRAZIL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY POLYURETHANE, 2018-2024 (USD MILLION)

TABLE 300. BRAZIL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY POLYURETHANE, 2025-2030 (USD MILLION)

TABLE 301. BRAZIL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY TECHNOLOGY, 2018-2024 (USD MILLION)

TABLE 302. BRAZIL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY TECHNOLOGY, 2025-2030 (USD MILLION)

TABLE 303. BRAZIL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY SOLVENT BASED, 2018-2024 (USD MILLION)

TABLE 304. BRAZIL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY SOLVENT BASED, 2025-2030 (USD MILLION)

TABLE 305. BRAZIL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY MOTOR TYPE, 2018-2024 (USD MILLION)

TABLE 306. BRAZIL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY MOTOR TYPE, 2025-2030 (USD MILLION)

TABLE 307. BRAZIL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY AC MOTOR, 2018-2024 (USD MILLION)

TABLE 308. BRAZIL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY AC MOTOR, 2025-2030 (USD MILLION)

TABLE 309. BRAZIL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY DC MOTOR, 2018-2024 (USD MILLION)

TABLE 310. BRAZIL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY DC MOTOR, 2025-2030 (USD MILLION)

TABLE 311. BRAZIL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY APPLICATION, 2018-2024 (USD MILLION)

TABLE 312. BRAZIL IMPREGNATING PAINT FOR MOTORS MARKET SIZE, BY APPLI

Companies Mentioned

- 3M Company

- Aditya Birla Management Corporation Pvt. Ltd.

- Akzo Nobel N.V.

- ALTANA AG

- Ashland Global Holdings Inc.

- Atul Ltd

- Axalta Coating Systems Ltd.

- BASF SE

- DAW SE

- Dow Inc.

- DuPont

- Harman Bawa Pvt. Ltd.

- Hempel A/S

- Henkel AG & Co. KGaA

- Huntsman International LLC

- Jotun Group

- Kansai Paint Co., Ltd.

- KUKDO Chemical Co., Ltd.

- Nan Ya Plastics Corporation

- Nippon Paint Holdings Co., Ltd.

- Olin Corporation

- PPG Industries, Inc.

- RPM International Inc.

- The Sherwin-Williams Company

- Von Roll Holding AG

- Wacker Chemie AG

- Westlake Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 184 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 492.41 Million |

| Forecasted Market Value ( USD | $ 699.47 Million |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 27 |