Speak directly to the analyst to clarify any post sales queries you may have.

Comprehensive contextual overview of how technological refinement, consumer preferences, and distribution evolution are redefining inhalation mosquito lamp adoption

The inhalation mosquito killer lamp segment has evolved beyond basic pest control into a category defined by technological refinement, integrated user experiences, and regulatory attention. Adoption trends reflect a convergence of public health priorities, urbanization, and consumer demand for quieter, safer, and more energy-efficient devices. Product developers have increasingly emphasized design aesthetics and ease of use to appeal to residential buyers while optimizing durability, serviceability, and compliance for commercial deployments.As households and institutions seek alternatives to chemical insecticides, electrical and light-based solutions have moved to the forefront. Manufacturers and distributors are responding by diversifying form factors and enhancing safety mechanisms. Meanwhile, distribution strategies and after-sales ecosystems are adapting to omnichannel buyer journeys, intensifying competition among pure-play online retailers, traditional brick-and-mortar outlets, and hybrid fulfillment models. This report frames these dynamics and sets the stage for deeper analysis of drivers, constraints, and actionable strategies.

Analytical synthesis of innovation, regulatory pressure, distribution convergence, and smart integration that collectively transform competitive priorities and customer expectations

Multiple transformative shifts are reshaping the competitive and operational landscape for inhalation mosquito killer lamps, creating new priorities for manufacturers and buyers alike. First, innovation in emission control and targeted attractant technologies has improved selectivity and reduced collateral impact on non-target insects, prompting designers to balance efficacy with environmental considerations. Second, energy efficiency and noise reduction have become differentiating factors as consumers integrate these devices into living spaces and commercial environments where comfort is paramount.Concurrently, regulatory frameworks and public health initiatives have elevated product safety and performance verification, incentivizing investments in certification and compliance testing. Distribution is also shifting: traditional offline channels such as electronics retailers, specialty outlets, and supermarkets are coordinating more closely with brand-owned digital storefronts and large third-party platforms to deliver consistent product information and after-sales services. Finally, integration with smart-home ecosystems and subscription-based service models is accelerating, encouraging manufacturers to prioritize firmware security, interoperability, and data privacy as core product attributes.

Insightful analysis of how 2025 tariff actions in the United States reshaped sourcing, pricing, and production strategies across the inhalation mosquito lamp value chain

The tariff measures introduced in 2025 in the United States have altered cost structures and sourcing strategies across the supply chain, generating a wave of operational recalibrations for manufacturers, distributors, and retailers. Firms reliant on component imports have evaluated the trade-offs between absorbing added costs, selectively passing them to customers, or relocating manufacturing steps to mitigate exposure. Procurement teams have accelerated supplier diversification efforts, with an emphasis on nearshoring and multi-sourcing strategies to reduce tariff vulnerability and shorten lead times.These policy changes have also influenced product design choices by incentivizing modular architectures that allow higher-value components to be produced domestically while retaining lower-cost assemblies overseas. Retail pricing and promotional strategies have shifted toward value communication, highlighting safety certifications, energy efficiency, and long-term total cost of ownership to justify premium positioning. In parallel, strategic partnerships and co-investments in regional manufacturing hubs have emerged as realistic pathways to sustain margin profiles and maintain service levels amidst ongoing trade policy uncertainty.

Multidimensional segmentation insights that reconcile distribution, application, end-user profiles, technological approaches, and product form factors to inform strategic prioritization

Segmentation analysis reveals nuanced demand drivers and channel behaviors that guide product positioning and go-to-market choices. Examining distribution channels shows a bifurcation between offline and online performance, where offline presence across electronics stores, specialty shops, and supermarkets or hypermarkets remains crucial for tactile evaluation and impulse purchase, while online sales through company operated websites and third-party platforms enable broader reach, subscription services, and data-driven personalization. This duality requires manufacturers to optimize packaging, demonstration assets, and warranty policies to suit both in-store and digital touchpoints.Application distinctions between indoor and outdoor use create distinct product requirements and regulatory expectations. Indoor deployments, whether in commercial settings or residential environments, prioritize quieter operation, aesthetic integration, and low ozone or chemical byproducts, whereas outdoor units must withstand weather exposure, exhibit greater coverage, and adhere to different safety guidelines. End user segmentation into commercial and residential archetypes further refines feature sets; commercial customers such as healthcare facilities, hospitality venues, offices, and retail establishments prioritize reliability, serviceability, and compliance, while residential buyers in individual households or multi-family units emphasize ease of installation, low maintenance, and design fit.

Technology-based segmentation underscores clear trade-offs: electrocuting devices deliver immediate insect elimination but raise concerns about noise and byproduct management; ionization approaches focus on attracting and neutralizing pests with minimal disturbance; ultraviolet light systems exploit insect phototaxis while varying in wavelength and intensity to balance effectiveness and non-target impacts. Product type differentiation between built-in, portable, standalone, and wall-mounted units enables tailored propositions for fixed infrastructure installations, flexible room-to-room use, point-of-sale convenience, and discreet wall integration. Together, these segmentation lenses provide a multi-dimensional framework for prioritizing R&D, channel investments, and messaging strategies to address distinct buyer needs and operating environments.

Granular regional analysis highlighting distinct consumer behaviors, regulatory environments, and manufacturing advantages across the Americas, EMEA, and Asia-Pacific territories

Regional dynamics reveal distinct demand patterns, regulatory environments, and supply chain configurations across the major global territories. In the Americas, urban density, consumer preference for convenience-focused solutions, and well-established retail networks drive demand for portable and aesthetically refined products, while procurement cycles in commercial sectors emphasize compliance with health and safety standards. Evolving trade policies and manufacturing considerations also influence sourcing strategies and partnerships within the region.The Europe, Middle East & Africa grouping presents a heterogeneous landscape where regulatory rigor in parts of Europe contrasts with rapidly developing infrastructure requirements in segments of the Middle East and Africa. Buyers in these areas place a premium on certification, environmental performance, and long-term reliability, creating opportunities for premiumized products and service contracts. In contrast, the Asia-Pacific region combines advanced manufacturing capabilities with diverse consumer preferences, enabling rapid iteration on cost-efficient designs and the scaling of smart-enabled offerings. Urbanization and public health initiatives in several Asia-Pacific markets continue to stimulate institutional procurement while also expanding adoption among households.

Strategic competitive landscape overview describing how product differentiation, omnichannel distribution, and partnerships determine leadership and niche opportunities

Competitive dynamics center on a mix of established consumer electronics brands, specialized pest control manufacturers, and innovative technology entrants. Leading firms differentiate through investments in proprietary attractant systems, energy efficiency enhancements, and integrated safety features that enable deployment across varied use cases. Strategic partnerships have become common as manufacturers align with component suppliers, firmware developers, and certified service providers to deliver cohesive product ecosystems.In addition to product differentiation, distribution strategies shape competitive advantage. Companies that maintain strong omnichannel footprints, supported by responsive after-sales service and clear warranty propositions, tend to secure higher retention among both commercial and residential customers. New entrants often compete on focused niches-such as ultra-quiet devices for bedrooms or ruggedized outdoor units for hospitality venues-while incumbents emphasize scale, brand recognition, and compliance track records. Collectively, these dynamics have intensified emphasis on product lifecycle management, data-driven customer insights, and strategic alliances that accelerate route-to-market and enhance long-term resilience.

Actionable strategic playbook advising leaders to combine modular product design, strengthened omnichannel operations, and resilient sourcing to capture long-term competitive advantage

Industry leaders should pursue a coordinated set of actions that blend product innovation, supply chain resilience, and commercial channel optimization. Prioritize modular design approaches that allow critical components to be localized while preserving cost advantages for commoditized subassemblies. Simultaneously, accelerate certification and third-party testing to preempt regulatory scrutiny and reinforce trust among institutional buyers.On the commercial front, strengthen omnichannel capabilities by harmonizing product information, warranty handling, and demonstration assets between offline retailers, company-operated digital storefronts, and major third-party platforms. Invest in targeted product variants for indoor residential comfort, outdoor durability, and commercial-grade serviceability to address the most pressing buyer pain points. Leverage data from online interactions and service records to inform iterative product improvements, predictive maintenance offerings, and subscription services that enhance lifetime value. Finally, cultivate strategic manufacturing partnerships and nearshoring options to reduce exposure to trade policy volatility while preserving the ability to scale production rapidly when demand conditions shift.

Transparent explanation of the mixed-method research approach combining stakeholder interviews, technical audits, regulatory review, and channel behavior analysis to validate insights

This research synthesizes qualitative and quantitative inputs derived from primary stakeholder interviews, technical product audits, regulatory filings, and a structured review of distribution channel behaviors. Primary engagements included discussions with procurement officers, product managers, distribution partners, and technical specialists to surface emergent performance requirements and purchasing rationales. Technical audits assessed device safety mechanisms, emission profiles, and power consumption characteristics, ensuring that product claims align with documented specifications.Secondary evidence was drawn from publicly available regulatory guidance, industry standards, and trade policy announcements to map compliance obligations and tariff impacts. Channel analysis combined observed retail assortment patterns with platform-level listing and review characteristics to identify buyer expectations and post-purchase behaviors. The methodology adopted cross-validation across sources to strengthen conclusions and prioritized transparency in assumptions, limitation acknowledgment, and traceability of insights to original evidence streams.

Conclusive synthesis that underscores the imperative to align product safety, channel strategy, and sourcing flexibility to navigate emergent industry dynamics and build durable advantage

The inhalation mosquito killer lamp category stands at an inflection point where technological advancement, regulatory pressures, and shifting distribution practices converge to create new pathways for value creation. Device makers that balance efficacy with safety, prioritize interoperable smart features, and adapt distribution to meet nuanced buyer journeys will gain durable advantages. Policy and tariff developments underscore the importance of flexible sourcing and localized manufacturing strategies to protect margins and ensure supply continuity.Looking ahead, the most successful participants will be those who translate segmentation insights into focused product portfolios, cultivate strong omnichannel presence, and invest in post-sale service and data-driven lifecycle management. By aligning product development, compliance, and commercial execution around these priorities, stakeholders can better navigate emerging challenges and capitalize on growth opportunities across residential and commercial applications.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

16. China Inhalation Mosquito Killer Lamp Market

Companies Mentioned

- Aspectek, LLC

- Black+Decker

- Chuangji

- DynaTrap Solutions, LLC

- Flowtron

- Green Life

- Greenyellow

- Hoont

- INVICTUS International

- KAZ-Stinger

- Koninklijke Philips N.V.

- Koolatron

- Midea Group Co., Ltd.

- OPPLE Lighting Co., Ltd.

- Panasonic Corporation

- PIC Corporation

- Remaig

- S. C. Johnson & Son, Inc.

- Shenzhen Yankon Lighting Co., Ltd.

- Spectrum Brands Holdings, Inc.

- TBI Pro

- Thermacell Repellents

- Tonmas

- Woodstream Corporation

- Yongtong Electronics

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 187 |

| Published | January 2026 |

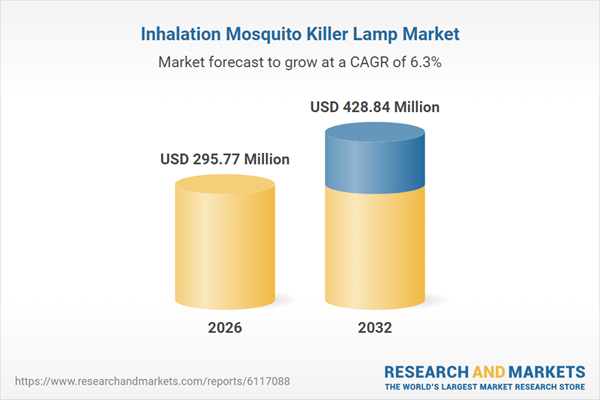

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 295.77 Million |

| Forecasted Market Value ( USD | $ 428.84 Million |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |