Speak directly to the analyst to clarify any post sales queries you may have.

A strategic orientation to macitentan tablets describing clinical profile, therapeutic positioning, and the operational factors shaping adoption across care pathways

Macitentan tablets represent a differentiated endothelin receptor antagonist utilized in the management of pulmonary arterial hypertension, addressing a critical need for durable therapies that improve hemodynamic parameters and patient functional status. The compound’s pharmacologic profile, dosing options, and oral administration route have made it a central therapeutic option for clinicians seeking sustained receptor blockade with an acceptable tolerability profile. As clinical practice evolves, macitentan’s relevance is shaped by comparative safety considerations, combination therapy strategies, and broader efforts to optimize long-term outcomes for patients living with this progressive disease.This introduction frames the medicine within the broader care pathway, highlighting how diagnostic advances, multidisciplinary disease management, and patient-centric service models influence therapeutic choice. Emphasis on real-world tolerability, adherence, and the logistics of chronic outpatient administration inform commercial priorities and clinical messaging. Transitional dynamics-from regulatory milestones to shifts in reimbursement criteria-mediate how stakeholders approach market entry, formulary negotiation, and physician education. The result is a landscape where clinical differentiation must be matched by supply reliability, payer engagement, and evidence-generation strategies to maintain and expand appropriate use.

An incisive examination of how diagnostic innovation, combination therapeutics, digital health, and evidence demands are redefining competitive advantage in the macitentan landscape

The macitentan landscape is undergoing transformative shifts driven by technology-enabled diagnosis, evolving therapeutic paradigms, and a tighter intersection between clinical evidence and payer policy. Advances in noninvasive imaging and biomarkers shorten the time to accurate diagnosis, enabling earlier initiation of targeted therapies and increasing the proportion of patients managed in outpatient specialty clinics rather than inpatient settings. At the same time, a growing emphasis on combination therapy has reframed product value propositions; treatments that demonstrate complementary mechanisms or tolerability advantages now compete on both efficacy and the ability to integrate into multidrug regimens.Parallel to clinical change, digital health and telemedicine are reshaping patient follow-up and adherence programs. Remote monitoring tools allow earlier detection of clinical deterioration and support treatment optimization without increasing hospital visits. These capabilities create new opportunities for manufacturers and payers to collaborate on value-based approaches that link reimbursement to outcomes. In addition, regulatory and policy trends emphasize post-marketing evidence generation and risk management, prompting companies to invest in pragmatic trials and real-world evidence to substantiate differentiation. Taken together, these shifts favor players that can align clinical, commercial, and evidence-generation strategies while maintaining supply chain resilience and engagement across the continuum of care.

A pragmatic analysis of how proposed United States tariff adjustments for two thousand twenty-five could shift supply chains, sourcing decisions, and access dynamics for macitentan therapies

Tariff policy adjustments in the United States slated for two thousand twenty-five have the potential to reverberate across the pharmaceutical supply chain in ways that extend beyond headline duty rates. Manufacturers of macitentan tablets depend on globally sourced active pharmaceutical ingredients, excipients, and finished formulations, and incremental tariff burdens can alter sourcing economics, incentivize supplier diversification, and accelerate localized manufacturing investments. When import costs rise, companies may re-evaluate their network design to prioritize regional API production or contract manufacturing arrangements that reduce exposure to cross-border duties and shipping volatility.The cumulative impact of tariff changes also affects downstream stakeholders. Payers and healthcare providers may face altered procurement dynamics as hospital and retail pharmacies adjust purchasing practices in response to cost pressures. Manufacturers aiming to preserve patient access while protecting commercial returns may pursue cost-efficiency measures, renegotiation of supplier contracts, or adjustments to packaging and distribution strategies. In parallel, tariffs can influence the timing and geographic sequencing of product launches, particularly for entities considering where to register and commence supply for new or generic formulations. Ultimately, tariff-driven stress tests reveal vulnerabilities in inventory planning and contractual flexibility, underscoring the importance of scenario planning and supply chain visibility to sustain continuity of therapy for patients.

A nuanced segmentation-driven perspective explaining how patient type, clinical indication, therapy modality, dosage, brand status, end user, and distribution channels inform strategic priorities

Segmentation-driven insight clarifies where clinical need intersects with commercial opportunity and informs tailored strategies across the continuum of care. Based on Patient Type, market considerations differ between adult and pediatric populations because prevalence, dosing paradigms, and safety monitoring can diverge substantially; pediatric care pathways often require specialized centers and distinct adherence support, while adult programs scale differently within ambulatory networks. Based on Indication, therapeutic priorities vary across connective tissue disease associated pulmonary arterial hypertension, idiopathic pulmonary arterial hypertension, and shunt associated pulmonary arterial hypertension, with each subgroup exhibiting different progression patterns, comorbidity profiles, and responses to combination regimens.Based on Therapy Type, the strategic calculus for manufacturers changes when positioning macitentan as monotherapy versus combination therapy; combination paradigms demand data demonstrating additive benefit and safety compatibility, and they necessitate coordination with other therapeutic stakeholders. Based on Dosage Strength, availability of both 10 mg and 5 mg formulations influences prescriber flexibility, titration strategies, and adherence considerations. Based on Brand Type, branded versus generic macitentan dynamics shape pricing, market access negotiation, and physician and patient perceptions of value and reliability. Based on End User, distribution and commercialization tactics differ when engaging ambulatory care centers, hospitals, and specialty clinics because procurement practices, formulary controls, and clinical workflows are unique to each setting. Based on Distribution Channel, the interplay between offline channels and online pharmacies, with offline subdivided into hospital and retail pharmacy, affects patient access pathways, inventory management, and opportunities for integrated services that support adherence and outcomes monitoring.

A regional intelligence overview clarifying how distinct regulatory, reimbursement, and clinical practice environments in the Americas, EMEA, and Asia-Pacific require tailored go-to-market approaches

Regional dynamics exert a powerful influence on supply chains, regulatory interactions, and commercial strategy, requiring differentiated approaches across major geographies. In the Americas, payer negotiation frameworks, hospital procurement processes, and a highly consolidated specialty care ecosystem prioritize robust value dossiers, pharmacoeconomic evidence, and close engagement with integrated delivery networks. Manufacturers operating in this region often focus on outcomes-based contracting and rapid deployment of patient support infrastructure to mitigate barriers to therapy initiation and long-term adherence.In Europe, Middle East & Africa, heterogeneity in regulatory requirements and reimbursement pathways calls for localized regulatory planning, adaptive pricing strategies, and partnership models that leverage regional distributors and specialty pharmacies. Pricing pressures and reference pricing mechanisms in certain European markets increase the importance of therapeutic differentiation and real-world effectiveness data. In the Asia-Pacific region, diverse manufacturing capabilities, varying regulatory maturity, and expanding specialty care access create opportunities for regional production, tiered pricing strategies, and investment in education programs to raise diagnostic awareness. Across all regions, geopolitical factors, local clinical guidelines, and the maturity of outpatient specialty care determine how stakeholders prioritize launch sequencing, supply investments, and evidence generation.

A strategic companies-focused assessment describing how originator stewardship, generic entry planning, manufacturing partnerships, and patient services shape competitive positioning

Competitive dynamics for macitentan tablets reflect a mix of originator stewardship, patent lifecycles, and the gradual emergence of generic entrants, each influencing positioning and market behavior. The originator’s role typically centers on sustaining clinical leadership through post-approval evidence, safety monitoring, and collaboration with specialty centers to maintain prescriber preference. As patent expiries and regulatory pathways for generics progress, companies preparing to introduce biosimilar or small-molecule equivalents focus on manufacturing scale-up, API sourcing, and rapid registration strategies to capture segments where price sensitivity predominates.Across strategic archetypes, successful companies invest in multi-stakeholder engagement-clinicians, payers, and patient advocacy groups-to build a narrative around clinical value and access. Contract manufacturing organizations and specialized distributors play a key role in enabling rapid geographic expansion, while manufacturers that emphasize patient services, adherence programs, and digital support differentiate around real-world outcomes. Licensing deals, co-promotion agreements, and selective regional partnerships remain effective levers to accelerate market entry and navigate local regulatory requirements. Ultimately, the competitive environment rewards organizations that combine clinical credibility with operational excellence and flexible commercialization models.

A pragmatic set of prioritised actions for manufacturers and stakeholders to secure supply resilience, evidence leadership, and differentiated commercialization for macitentan

For industry leaders aiming to strengthen their position in the macitentan landscape, a set of actionable recommendations can translate insight into competitive advantage. First, prioritize supply chain resilience by mapping critical API and excipient dependencies, establishing multi-sourcing agreements, and evaluating regional manufacturing options to mitigate tariff and logistics volatility. Second, align evidence-generation investments with payer expectations by designing pragmatic post-marketing studies and real-world data initiatives that demonstrate value across key indications and in combination regimens.Third, develop differentiated commercial programs that integrate clinician education, patient support services, and digital adherence tools to improve persistence and clinical outcomes. Fourth, tailor market entry sequencing by region, leveraging local partnerships to navigate heterogeneous regulatory and reimbursement landscapes while optimizing launch timing. Fifth, proactively plan for generic entry through lifecycle management strategies, such as formulation improvements, authorized generics, or strategic licensing, to preserve revenue streams and maintain market share in price-sensitive segments. These recommendations require cross-functional coordination among medical affairs, supply chain, commercial, and regulatory teams, and they should be implemented through clear governance and milestone-based project management to ensure timely execution.

A transparent description of the multi-method research design integrating clinical evidence review, stakeholder interviews, and supply chain mapping to ground strategic conclusions

The research underpinning these insights combines systematic evidence review, stakeholder interviews, and supply chain analysis to produce a robust and defensible perspective. Clinical literature and regulatory documents were reviewed to understand therapeutic positioning, safety signals, and indication-specific nuances. Interviews with clinicians, payers, and pharmacy procurement leaders provided context on prescribing behavior, reimbursement priorities, and operational constraints that influence access and adoption.Operational assessments included supplier mapping, manufacturing footprint evaluation, and distribution channel analysis to uncover vulnerabilities and strategic levers. Competitive benchmarking drew on public disclosures and product labeling information to profile originator strategies and potential generic entrants. Throughout the process, triangulation of primary and secondary inputs was used to validate findings and ensure practical relevance for commercial decision-makers. This methodological approach supports actionable recommendations by connecting clinical realities to commercial levers and operational imperatives.

A concluding synthesis that integrates clinical differentiation, operational resilience, and regional strategy to guide strategic decisions for macitentan stakeholders

In conclusion, macitentan tablets occupy a strategic position in the therapeutic armamentarium for pulmonary arterial hypertension, characterized by clinically meaningful differentiation, multiple dosage options, and broad relevance across key indications. The evolving landscape is shaped by diagnostic advances, combination therapy norms, digital health-enabled adherence strategies, and regulatory expectations for real-world evidence. Tariff and trade policy considerations introduce an additional layer of supply chain complexity, reinforcing the need for flexible sourcing and manufacturing strategies.To succeed, organizations must synchronize clinical value narratives with pragmatic operational planning, ensuring that evidence-generation, pricing strategy, and supply continuity are mutually reinforcing. Regional heterogeneity demands customized approaches that respect local regulatory and reimbursement realities. Ultimately, the most resilient and competitive stakeholders will be those that translate scientific differentiation into measurable clinical and economic outcomes while maintaining the operational agility to navigate policy and market inflection points.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

19. China Macitentan Tablets Market

Companies Mentioned

- Actelion Pharmaceuticals Ltd.

- Alembic Pharmaceuticals Limited

- Aurobindo Pharma Limited

- Cipla Limited

- Dr. Reddy's Laboratories Ltd.

- Glenmark Pharmaceuticals Ltd.

- Hetero Labs Limited

- Johnson & Johnson

- Lupin Limited

- Mylan N.V.

- Sun Pharmaceutical Industries Ltd.

- Torrent Pharmaceuticals Ltd.

- Zydus Cadila

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | January 2026 |

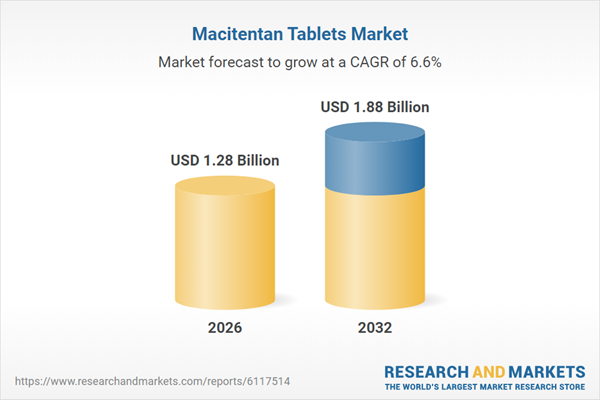

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 1.28 Billion |

| Forecasted Market Value ( USD | $ 1.88 Billion |

| Compound Annual Growth Rate | 6.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |