Speak directly to the analyst to clarify any post sales queries you may have.

A compelling overview of parallel synchronous condensers revealing their strategic role in preserving grid stability, enabling renewables, and enhancing operational flexibility

Parallel synchronous condensers have emerged as a critical enabler of modern grid stability, offering reactive power support, voltage regulation, and inertia-like behavior without the complexities of traditional rotating generation units. These devices, often retrofitted into existing substations or integrated as stand-alone installations, provide operators with a flexible toolset to manage the increasing variability introduced by high penetrations of inverter-based resources. As utilities and system operators pursue decarbonization targets and retire conventional synchronous plants, the role of synchronous condensers as non-fuel-dependent stability assets is becoming more prominent.Deployment decisions are driven by the need to maintain short-term frequency response, stabilize voltage across weak grids, and reduce curtailment of renewable energy. In addition, the technology supports prolonged grid operations under contingency conditions by offering controlled reactive power and damping of oscillations. From a project delivery perspective, parallel synchronous condensers present a unique value proposition: they provide many of the dynamic system services of spinning machines while enabling modular installation patterns that can be optimized for site constraints and grid topology. Consequently, planners and engineers increasingly view these condensers as strategic infrastructure investments that bridge the reliability gap during the energy transition, enabling higher shares of renewables without compromising operational security.

In practice, successful integration of synchronous condensers requires coordinated planning across transmission, distribution, and generation stakeholders. Site selection, protection coordination, control integration, and commissioning protocols must be synchronized with grid operator procedures. Moreover, as controls evolve and digital interfaces proliferate, the capacity to harmonize condenser behavior with wide-area control schemes and distributed energy resource management systems becomes a crucial competency. Ultimately, the technology’s appeal rests on its ability to deliver deterministic, grid-scale stability services in a way that aligns with modern grid objectives of resiliency, flexibility, and decarbonization.

How technology advances, regulatory evolution, and commercial innovation are jointly reshaping investment, procurement, and operational practices for grid stability assets

The landscape for grid stabilization and ancillary services is undergoing transformative shifts driven by evolving generation mixes, regulatory reform, and advances in power electronics. As thermal and nuclear fleets retire or reduce synchronous online hours, system inertia and fault current contributions decline, creating new operational constraints. In response, system operators and project sponsors are pivoting toward non-traditional solutions that replicate synchronous properties without reliance on combustion-based resources. This shift is not merely technical; it is reshaping procurement practices, system planning methodologies, and vendor engagement models.Simultaneously, rapid improvements in control systems, sensor networks, and communication protocols are enabling synchronous condensers to operate with greater precision and predictability. Where earlier deployments emphasized raw rotating mass, contemporary designs integrate advanced excitation systems, grid-forming control strategies, and condition-based maintenance platforms. These technological upgrades allow condensers to be scaled and tuned to specific grid needs, whether providing fast reactive support at a coastal interconnection or offering sustained voltage regulation in industrial corridors.

Policy trajectories and market rule adjustments are also accelerating adoption. Regulators are increasingly recognizing reactive power and inertia-equivalent services as essential grid attributes, prompting new performance-based procurement frameworks. As a result, procurement windows are evolving from simple equipment purchases to outcome-driven contracting that emphasizes service delivery over asset ownership. In effect, this creates fertile ground for novel commercial models, including long-term service agreements, availability-based contracting, and hybrid financing structures that share operational risk. Taken together, these technological, regulatory, and commercial shifts are redefining how grid stability is secured and how investments in grid-edge infrastructure are prioritized.

Assessing the multifaceted consequences of recent United States tariff measures on supply chains, procurement strategies, and delivery timelines for grid stabilization assets

Recent tariff actions and trade policy shifts intended to protect domestic manufacturing capacity have measurable implications for procurement, supply chain configuration, and project timelines for grid infrastructure, including synchronous condensers. Tariffs affect upstream component flows such as excitation systems, bearings, transformers, and power electronic modules, altering vendor cost structures and prompting firms to reassess global sourcing strategies. In many cases, manufacturers and integrators respond by reconfiguring bill-of-materials offerings, localizing critical subassemblies, or negotiating alternative procurement channels to mitigate exposure and preserve delivery schedules.In addition to direct cost impacts, tariff measures can introduce greater volatility in lead times and contracting certainty. Project developers may encounter longer negotiation cycles as suppliers seek to re-price contracts or secure tariff waivers, and decision-makers may find risk premiums embedded in supplier bids. Consequently, procurement teams are increasingly focused on contractual safeguards such as fixed-price clauses, indexed cost adjustments, and supply continuity guarantees. These instruments help align expectations, but they also require a higher degree of due diligence around supplier balance sheets, manufacturing footprints, and contingency planning.

Longer term, tariffs encourage investment in domestic capability and supplier diversification. To the extent policies are stable and predictable, they can catalyze capital deployment in local manufacturing, test facilities, and workforce training, supporting broader resilience objectives. However, the transition to a more distributed supply base has its own challenges: capital intensity, regulatory permitting, and workforce constraints can slow capacity ramp-up. Therefore, stakeholders must weigh short-term procurement impacts against prospective gains in supply security, recognizing that tariff-driven reshoring is a strategic process that unfolds over multiple investment cycles.

Detailed segmentation-driven perspectives that reveal how output rating, end use, excitation type, installation setting, and cooling approach dictate design and procurement priorities

Segmentation insights illuminate how deployment strategies, technical configurations, and procurement approaches vary across distinct asset attributes and applications. When examined through the lens of output rating, installations spanning less than 50 MVA, between 50 and 100 MVA, and greater than 100 MVA reveal divergent engineering trade-offs and siting considerations. Smaller units typically emphasize footprint efficiency and simplified commissioning, supporting localized voltage support and industrial plant resilience, whereas mid-range units are often optimized for substation integration with balanced transportability and performance. Larger condensers, by contrast, are positioned to deliver system-level services across wide transmission corridors and therefore require more extensive mechanical foundations, auxiliary systems, and interconnection coordination.End-use segmentation further clarifies deployment drivers. Distribution applications prioritize compact installations, rapid response to distribution-level voltage events, and minimal maintenance footprints. Generation-side deployments focus on enabling higher renewable penetration and stabilizing plant output, with generation subcategories such as hydro, nuclear, renewable, and thermal each posing unique interfacing requirements. Hydro and nuclear contexts often demand rigorous fault-current and protection compatibility, while renewable-dominated sites require fast control response and seamless integration with inverter control schemes. Thermal applications may emphasize compatibility with existing cooling and excitation infrastructures. Transmission-focused condensers are often specified for higher continuous duty and for participation in ancillary service markets, requiring robust remote-control capabilities and stringent reliability measures.

Excitation technology choices-brush, brushless, or solid state-affect lifecycle maintenance profiles, dynamic response characteristics, and cost-to-operate. Brush systems have legacy appeal and established maintenance practices, brushless designs reduce moving-part maintenance, and solid-state excitation offers greatest control granularity and faster response. Installation environment-indoor versus outdoor-drives enclosure design, cooling strategies, and maintenance access planning. Cooling method selection, including air-cooled, air-to-air heat exchangers, and oil-cooled variants, impacts thermal management, noise profiles, and auxiliary system design. Within oil-cooled approaches, options such as mineral oil and synthetic oil create additional considerations for fire safety, environmental compliance, and operational longevity. Each segmentation axis informs procurement specifications and lifecycle planning, such that a holistic understanding of these dimensions is essential to align technical choices with operational objectives.

Regional demand patterns and operational drivers across the Americas, Europe Middle East & Africa, and Asia-Pacific that determine deployment models and technical specifications

Regional dynamics are shaping where and how synchronous condensers are deployed, driven by differing grid architectures, regulatory frameworks, and energy transition pathways. In the Americas, large interconnections with diverse generation mixes are prioritizing grid services that enable renewables integration and transmission reliability, often favoring solutions that can be deployed relatively quickly to address emergent stability needs. Market participants there are balancing utility procurement cycles with growing interest in service-based contracting and local manufacturing to minimize exposure to external trade disruptions.The Europe, Middle East & Africa region presents a mosaic of needs. In some European systems, strong policy pressure for decarbonization combined with aging synchronous fleets has accelerated demand for inertia-supporting solutions, prompting advanced technical specifications and performance-based contracting. In parts of the Middle East, rapid load growth and industrial development require condensers that can withstand high ambient temperatures and particular grid fault characteristics. African grids, meanwhile, are often focused on reliability improvements and rural integration, with project designs tailored to logistical constraints and staged deployment approaches that prioritize modularity and maintainability.

Asia-Pacific encompasses a broad spectrum of deployment contexts, from dense urban networks with strict emissions and noise limits to fast-expanding transmission systems that require high-capacity, long-duration stability solutions. Rapid renewable expansion in this region creates acute needs for reactive power and voltage stabilization, and many utilities are experimenting with hybrid models that pair condensers with synchronous generators or energy storage. Across all regions, local regulatory frameworks, interconnection standards, and workforce capabilities influence technology choices, installation timelines, and the viability of different commercial models.

How engineering depth, supply chain resilience, integrated delivery models, and digital service offerings determine competitive advantage among firms serving the grid stability market

Competitive dynamics among firms operating in the synchronous condenser space are defined by a combination of engineering excellence, supply chain robustness, and service delivery models. Leading equipment manufacturers and systems integrators differentiate through deep domain expertise in rotating machines, advanced excitation systems, and grid-interface controls, while also developing aftermarket service capabilities to support long-term availability. In addition, firms that invest in localized manufacturing, testing facilities, and training programs often secure an advantage when procurement criteria emphasize supply assurance and rapid commissioning.Partnerships between original equipment manufacturers, engineering procurement and construction firms, and utilities are becoming more common as projects demand integrated delivery that spans design, civil works, interconnection, and long-term service agreements. Component suppliers of transformers, bearings, and power electronics play a critical role in overall system reliability, and collaborative supplier ecosystems that enable tighter design integration tend to deliver superior lifecycle outcomes. Furthermore, companies offering digital monitoring, predictive maintenance, and remote diagnostic services add value by reducing unplanned outages and optimizing maintenance intervals.

Innovation is also influencing competitive positioning. Firms that blend traditional electromechanical expertise with modern control algorithms, condition-based monitoring, and retrofit solutions are well placed to capture opportunities where utilities seek to extend asset life or upgrade existing infrastructure. Additionally, commercial acumen in structuring outcome-based contracts, financing solutions, and risk-sharing arrangements differentiates providers that can move beyond equipment sales to become long-term operational partners for grid operators and large industrial customers.

Actionable strategies for executives to strengthen technical adaptability, fortify supply chains, and adopt outcome-driven commercial models that ensure reliable grid services

Industry leaders should adopt a strategic posture that emphasizes technical flexibility, supply chain resilience, and outcome-based contracting to capitalize on accelerating demand for grid stabilization solutions. First, investing in modular designs and control architectures that allow rapid tuning for site-specific grid characteristics can shorten deployment cycles and reduce integration risk. This technical flexibility should be complemented by strong engineering support during interconnection studies and commissioning phases to ensure predictable system performance.Second, supply chain strategies must be diversified with explicit contingencies for key components. Establishing multi-sourcing agreements, qualifying secondary suppliers, and pursuing selective local content where feasible can mitigate tariff exposure and lead-time volatility. Leaders should also evaluate inventory strategies and contractual instruments that lock in critical component availability without imposing excessive capital burdens. Collaborative procurement consortia and pooled logistics arrangements can be effective in spreading risk across projects.

Third, commercial models should evolve toward performance-based outcomes that align supplier incentives with system reliability goals. Structuring contracts around availability metrics, reactive power delivery, and response times helps bridge the gap between equipment procurement and operational expectations. Moreover, integrating digital monitoring and predictive maintenance into service agreements enhances asset uptime and delivers measurable operational benefits. Finally, executives should invest in workforce capability building, regulatory engagement, and scenario planning to adapt to evolving policy landscapes and to ensure that deployment programs remain resilient to external shocks.

A rigorous mixed-methods research framework combining expert interviews, field validations, standards review, and scenario analysis to produce actionable and defensible insights

The research approach blends qualitative and quantitative methodologies to develop a comprehensive view of technology performance, supply chain dynamics, and adoption drivers. Primary research includes structured interviews with grid operators, utility planners, system integrators, and equipment manufacturers to validate technical assumptions, service requirements, and procurement preferences. These expert engagements are complemented by field visits to representative installation sites and factory walkthroughs to assess manufacturing practices, test procedures, and quality assurance protocols.Secondary research encompasses a rigorous review of technical standards, interconnection guidelines, regulatory filings, and publicly available project documentation to map prevailing practices and compliance regimes. The methodology also incorporates cross-validation through comparative case studies, which examine deployments across different grid contexts to identify transferable lessons and recurring failure modes. Scenario analysis is used to stress-test supply chain responses under varying tariff regimes, lead-time disruptions, and policy shifts, enabling robust recommendations tailored to multiple potential futures.

To ensure rigor and relevance, findings are triangulated across data sources and subjected to peer review by domain experts. Sensitivity checks on key qualitative inputs provide transparency around assumptions, while curated performance matrices and vendor capability assessments support practical decision-making. This mixed-methods framework is designed to produce actionable intelligence that blends technical depth with strategic clarity for planners and procurement teams.

Summative reflections on how synchronous condensers function as a strategic bridge for maintaining reliability and enabling the clean energy transition while managing deployment risks

Parallel synchronous condensers represent a pragmatic pathway to safeguard grid stability as power systems transition toward higher shares of inverter-based generation. Their capacity to deliver reactive power, support voltage profiles, and emulate inertia-like behavior addresses fundamental operational challenges arising from conventional fleet retirements. Importantly, successful outcomes depend not only on equipment selection but on integrated planning, robust procurement practices, and collaborative commercial models that emphasize service delivery and lifecycle performance.Looking ahead, the interplay between technological innovation, policy settings, and supply chain evolution will determine the pace and shape of adoption. Operators that proactively align technical specifications with evolving interconnection standards, that adopt diversified sourcing strategies, and that embrace outcome-based contracts will reduce project risk and accelerate integration timelines. Equally, manufacturers and integrators that invest in digital services, localization, and performance guarantees will be better positioned to meet utility needs.

In sum, the strategic importance of synchronous condensers lies in their role as both a technical and commercial bridge during the energy transition. By converging engineering rigor with resilient procurement and service-oriented contracting, stakeholders can harness these assets to maintain reliable, flexible, and decarbonized power systems.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

16. China Parallel Synchronous Condensers Market

Companies Mentioned

- ABB Ltd.

- Alstom SA

- Amsco U.S. Inc.

- Andritz AG

- Beijing Power Equipment Group Co., Ltd.

- Brush Electrical Machines Ltd.

- Cummins Inc.

- Eaton Corporation plc

- Emerson Electric Co.

- EnerSys Arizona Inc.

- Fuji Electric Co., Ltd.

- General Electric Company

- Hitachi, Ltd.

- Hyundai Heavy Industries Co., Ltd.

- Kirloskar Electric Company Ltd.

- Mitsubishi Electric Corporation

- Nidec Industrial Solutions

- Regal Beloit Corporation

- Rockwell Automation, Inc.

- Schneider Electric SE

- Shanghai Electric Group Company Limited

- Siemens AG

- Toshiba Corporation

- Voith GmbH & Co. KGaA

- Voith Hydro GmbH & Co. KG

- Weg S.A.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 186 |

| Published | January 2026 |

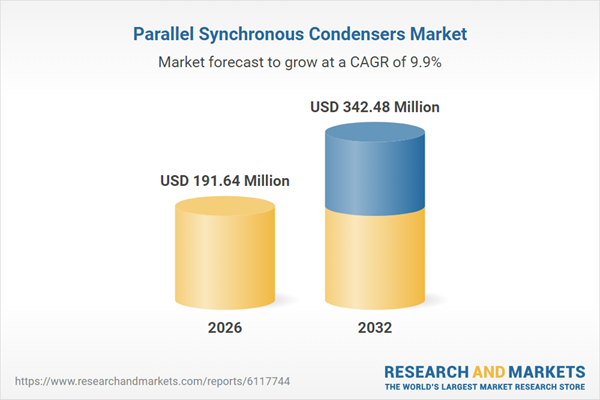

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 191.64 Million |

| Forecasted Market Value ( USD | $ 342.48 Million |

| Compound Annual Growth Rate | 9.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |