Speak directly to the analyst to clarify any post sales queries you may have.

Foundational overview of gasoline direct injection tube technical roles regulatory pressures and commercial implications shaping supplier and OEM decision pathways

Gasoline direct injection tubes are core components of modern fuel delivery systems, carrying pressurized gasoline from pumps and rails to injectors with exacting reliability. These tubes must satisfy stringent requirements across material integrity, fatigue resistance, dimensional precision, and compatibility with high-pressure, high-temperature environments. As engine architectures evolved toward higher injection pressures and tighter tolerances to meet fuel efficiency and emissions mandates, tube technologies concurrently advanced to enable durable connections between pumps, rails, and injectors.This executive summary introduces the operational, regulatory, and material contexts that define current supplier and OEM decision-making. It explores how suppliers engineer for pressures ranging from sub-100 bar applications up to those exceeding 200 bar, and how material choices such as alloy steel, stainless steel, and plastic-lined constructions influence durability, corrosion resistance, and manufacturability. The introduction also frames aftermarket dynamics and original equipment considerations, connecting technical features to purchasing, warranty, and service outcomes. By clarifying these fundamentals early, readers can appreciate the intersection of product engineering, vehicle segmentation, and channel prioritization that drives strategic moves across the value chain.

Transitioning from technical framing, the introduction sets up subsequent analysis on market forces. It highlights how regulatory tightening, changes in vehicle fleets, and macro trade policy converge to reshape sourcing strategies, supplier footprints, and R&D priorities. The objective here is to provide a clear baseline so decision-makers can interpret subsequent sections with the appropriate technical and commercial lens, enabling alignment between immediate operational choices and longer-term resilience planning.

How evolving engine architectures regulatory intensity and advanced materials manufacturing converge to redefine reliability supply chain and aftermarket dynamics for fuel tubes

The landscape for gasoline direct injection tubes is undergoing several convergent shifts that are transformative rather than incremental. Advances in engine downsizing and turbocharging have increased demand for components capable of withstanding elevated pressures and cyclic loading. In parallel, stringent emissions regulations and fuel-economy targets have pushed OEMs to pursue injection systems with tighter control over spray timing and pressure, which in turn places higher reliability demands on tubes and connections. As a result, engineering priorities have moved from simple containment to integrated system performance where tube metallurgy, flange design, and joining technologies are co-optimized with rail and injector design.At the same time, materials science is enabling a move away from single-solution approaches. Alloy steel and stainless steel remain important for high-pressure integrity, while plastic-lined constructions offer corrosion resistance and weight advantages for specific routes and retrofitted applications. Manufacturing technologies such as precision bending, orbital forming, and automated welding are being adopted to improve repeatability and reduce rework. Furthermore, digitalization in production monitoring and the use of real-time quality analytics are reducing defect rates and enabling closer traceability throughout the supply chain.

Another major shift is the changing role of aftermarket channels and serviceability. With growing vehicle complexity, authorized dealer networks are emphasizing OEM-qualified replacements and warranty traceability, while independent channels compete on lead times and cost-competitive repairs. In addition, supply chain risk management practices have matured; organizations are increasingly balancing just-in-time inventory with strategic safety stocks, nearshored production, and dual-sourcing arrangements. Consequently, business models that integrate engineering support, quality certification, and responsive logistics are outperforming purely price-driven alternatives.

Assessing the compound supply chain pricing and strategic sourcing consequences of recent tariff actions on fuel tube procurement and program resilience

United States tariff measures implemented in the referenced policy cycle have exerted a compounding influence on the gasoline direct injection tubes supply chain, affecting sourcing decisions and commercial calculus across the value chain. Tariff-induced cost differentials prompted many OEMs and Tier suppliers to reassess existing supplier contracts, accelerating conversations about nearshoring, production localization, and inventory buffering. These strategic responses are not uniform; they vary by product complexity, material composition, and whether the customer is an original equipment manufacturer or an aftermarket distributor.For high-pressure components such as injector high-pressure tubes and common rail fuel pipes that rely on alloy steel or stainless steel, tariff pressure intensified the cost sensitivity related to imported raw material and finished assemblies. In consequence, procurement teams prioritized suppliers with domestic manufacturing capability or those willing to absorb compliance complexity through established import mitigation strategies. Conversely, plastic-lined tubes and assemblies with simpler manufacturing pathways were more readily redirected through lower-tariff shipping lanes or alternative suppliers in different jurisdictions, reflecting differentiated elasticity across materials and product types.

Tariffs also affected vehicle segmentation strategies. Commercial vehicle platforms, particularly heavy commercial vehicle programs with long lifecycles and centralized procurement, tended to absorb short-term cost increases through contract renegotiation and vehicle program cost models. Passenger car programs, where unit volumes and cost targets are more acute, often prompted suppliers to propose design-to-cost initiatives, material substitutions, or process innovations to offset tariff-related margins compressions. Within sales channels, original equipment contracts frequently included clauses for cost pass-through or revised pricing structures, while aftermarket participants faced more direct margin pressures, leading to shifts in distribution focus and promotional activity.

Overall, the cumulative tariff impact catalyzed supplier diversification, greater emphasis on regional manufacturing footprints, and an acceleration in technical collaboration between OEMs and suppliers to identify cost-effective material and process alternatives without compromising performance. These changes have become embedded considerations in procurement playbooks and program risk assessments, and they continue to influence contractual structures and investment decisions across the ecosystem.

Strategic product material vehicle channel and pressure distinctions that determine manufacturing focus validation protocols and commercial prioritization for fuel tubes

Segmentation provides a practical lens for converting technical differentiation into actionable product strategies and commercial choices. When viewed through product type, distinctions among common rail fuel pipes, fuel distribution lines, and injector high-pressure tubes are pivotal because each plays a different role in system pressure containment, routing complexity, and connection architecture. Common rail pipes demand high dimensional accuracy and fatigue resistance; fuel distribution lines prioritize routing flexibility and corrosion resistance; injector high-pressure tubes require exceptional pressure retention and connection integrity. These product-level requirements lead to different investment profiles for tooling, quality inspection, and testing protocols.Material segmentation further shapes supplier capabilities and lifecycle outcomes. Alloy steel offers favorable strength-to-weight ratios and is often chosen for high-pressure rails, while stainless steel provides superior corrosion resistance suited to long-term serviceability and stringent warranty regimes. Plastic-lined solutions combine corrosion resistance with reduced weight, appealing in routes where chemical compatibility and thermal isolation reduce downstream maintenance. Each material class has distinct fabrication, joining, and inspection requirements, which directly influence lead times and capital intensity for manufacturers.

Vehicle type segmentation is equally instructive because usage profiles and procurement practices diverge between commercial vehicles and passenger cars. Commercial vehicle platforms, including both heavy and light commercial vehicles, endure harsher duty cycles and prioritize durability and reparability, which favors materials and connection designs validated for sustained high-pressure operation. Passenger cars, spanning compact, midsize, and luxury segments, present a varied set of priorities: compact platforms often require cost-optimized tubes and efficient assembly integration, midsize vehicles balance cost and performance, and luxury vehicles emphasize premium materials and refined noise-vibration-harshness characteristics.

Sales channel differentiation between aftermarket and original equipment has operational implications for inventory, certification, and traceability. Original equipment purchasers require vendor qualifications, PPAP-level documentation, and synchronized just-in-time deliveries, while authorized dealer and independent aftermarket channels focus on parts availability, warranty validation, and compatibility across model years. Lastly, pressure range segmentation-distinguishing high pressure above 200 bar, medium pressure between 100 and 200 bar, and low pressure below 100 bar-dictates wall thickness, fitting specifications, and test regimes, resulting in discrete manufacturing streams and targeted validation procedures. Together, these segmentation axes guide where suppliers should allocate engineering resources, manufacturing capacity, and commercial attention to optimize fit-for-purpose offerings.

How regional manufacturing concentration regulatory priorities and vehicle mix drive differentiated sourcing logistics and product development strategies across global regions

Regional dynamics exert a powerful influence on sourcing, design preferences, and strategic investments. In the Americas, demand is shaped by a mix of legacy light- and heavy-vehicle production centers, an emphasis on durability for long-haul commercial applications, and a procurement environment that increasingly values nearshored capacity. Consequently, manufacturers in the region are emphasizing domestic supply, streamlined logistics, and program-level partnerships to mitigate trade frictions and ensure predictable delivery windows.In Europe Middle East and Africa, regulatory stringency and a diversified vehicle mix drive a focus on advanced materials and precision engineering. The region's technical emphasis on emissions reduction and fuel efficiency translates into strong requirements for high-pressure systems and corrosion-resistant solutions. Suppliers there often prioritize R&D collaboration with OEM engineering teams and maintain robust quality management systems to align with stringent homologation processes.

Asia-Pacific continues to be a major hub for both production and innovation, hosting an extensive supplier ecosystem that spans raw material producers to precision tube fabricators. The region’s production scale supports a wide range of material and pressure configurations, and rapid program development cycles enable quicker design iterations. Manufacturers leverage this scale to serve global platforms while also responding to region-specific preferences in vehicle segmentation, notably compact and midsize passenger cars, as well as a growing light commercial vehicle segment. Taken together, these regional dynamics underscore the need for geographically tailored strategies that reconcile logistics, regulatory compliance, and proximity to core assembly plants.

Competitive positioning built on scale precision manufacturing material partnerships and service integration that determines program wins and aftermarket relevance

Competitive dynamics among companies in this sector are characterized by a balance between scale-based advantages and niche technical expertise. Large Tier suppliers benefit from breadth of program participation, validated manufacturing systems, and established OEM relationships that support multi-program supply agreements. Their scale enables investments in precision forming equipment, automated welding cells, and comprehensive test facilities that validate performance across pressure ranges and material types. At the same time, specialized manufacturers and tooling experts play a critical role by delivering bespoke solutions for complex routing, unique flange interfaces, or high-pressure applications where standardization is impractical.Strategic partnerships between material producers and tube fabricators have become more common, enabling accelerated material qualification cycles and co-developed corrosion-resistant liners or advanced alloy formulations. Similarly, collaboration between suppliers and OEM engineering teams is increasingly important for early integration of tube routing and fastening strategies into vehicle architecture, reducing late-stage redesigns. Service-oriented companies that combine inventory management, authorized distribution networks, and warranty analytics provide aftermarket customers with differentiated value propositions by lowering downtime risk and ensuring parts traceability.

Investment behavior among companies reflects a dual focus on operational excellence and technological differentiation. Capital expenditures prioritize high-precision forming, end-fitting automation, and non-destructive testing capabilities, while R&D investments target material science, joining methods, and lightweighting without sacrificing pressure integrity. This combination of scale, specialization, and collaborative development defines competitive positioning and determines which companies can effectively capture program wins in both OEM and aftermarket channels.

Practical dual sourcing engineering integration and digital traceability measures leaders should implement to strengthen resilience reduce cost exposure and accelerate time to market

Industry leaders can translate insight into advantage through a set of actionable steps that align engineering, procurement, and commercial functions. First, prioritize dual-sourcing strategies for critical materials and finished assemblies to reduce single-source exposure while negotiating long-term partnerships with suppliers that demonstrate certified domestic or nearshore capability. This approach preserves continuity of supply and supports faster response to tariff or logistics disruptions. Second, invest in material validation and joint development programs that explore substitutions such as plastic-lined constructions where appropriate, enabling cost-performance trade-offs without undermining durability or safety.Third, integrate design-for-manufacture principles early in vehicle program cycles to minimize costly late-stage changes. By co-locating supplier engineering resources with OEM teams during concept and detailed design phases, organizations can reduce iteration cycles and ensure tubes are optimized for routing, vibration tolerance, and assembly ergonomics. Fourth, enhance aftermarket channel strategies by establishing clear traceability, warranty documentation, and prioritized inventory programs for authorized dealers, while offering calibrated support packages to independent aftermarket partners to maintain service accessibility and customer satisfaction.

Finally, strengthen supply chain visibility through digital tooling that tracks material provenance, production quality metrics, and logistics milestones. Coupling real-time analytics with scenario planning enables rapid tariff-impact assessments and supports data-driven decisions about inventory posture and production allocation. Taken together, these measures create a resilient operating model that balances cost efficiency with technical performance and customer service commitments.

Multimethod research combining primary interviews factory-level observation and technical validation to map supply chain routes and engineer-aligned segmentation analysis

The research approach underpinning this analysis combined primary and secondary methods to deliver a well-rounded perspective on technical, commercial, and regional dynamics. Primary research included structured discussions with procurement leads, engineering managers, and aftermarket operations personnel to capture first-hand accounts of sourcing decisions, quality challenges, and channel behaviors. These interviews were complemented by factory visits and process walkdowns where feasible, enabling direct observation of manufacturing practices such as precision bending, automated end-fitting, and testing protocols for different pressure classes.Secondary research encompassed technical literature, regulatory documents, materials specifications, and public disclosures from manufacturers to validate material properties, typical joining methods, and homologation requirements. Supply chain mapping was conducted to identify common raw material routes, typical points of assembly concentration, and logistics choke points. Triangulation of primary and secondary inputs ensured consistency and highlighted areas of divergence that warranted deeper inquiry.

Analytical methods included segmentation analysis across product type, material, vehicle type, sales channel, and pressure range to reveal distinct commercial and technical patterns. Scenario analysis was used to evaluate the relative impact of trade policy shifts and regional production changes on sourcing decisions. Throughout the research cycle, findings were peer-reviewed by subject-matter experts and cross-checked against operational benchmarks to ensure practical relevance and technical accuracy.

Conclusive synthesis emphasizing material manufacturing and supply chain integration as the decisive factors shaping long term competitiveness in fuel tube programs

The synthesis of technical and commercial evidence underscores that gasoline direct injection tubes are not merely commodity conduits but strategic components whose material selection, manufacturing precision, and regional sourcing materially influence vehicle program outcomes. Technical imperatives such as pressure rating, corrosion resistance, and fatigue life remain core determinants of design choices, while commercial and regulatory forces shape how those choices are funded and implemented. As a result, successful participants will be those who integrate materials expertise, manufacturing capability, and supply chain strategy into coherent program-level offerings.Looking ahead, the most impactful levers for stakeholders involve proactive supply chain design, early supplier integration into vehicle architecture, and targeted investments in validating alternative materials and production technologies. Organizations that take these levers seriously will be better positioned to manage trade policy volatility, satisfy evolving regulatory requirements, and meet the differentiated needs of commercial vehicle, passenger car, OEM, and aftermarket customers. In sum, the industry’s trajectory favors strategic partnerships, technical differentiation, and operational resilience as the key pathways to sustained competitiveness.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Gasoline direct injection Tubes Market

Companies Mentioned

- Aisin Seiki Co., Ltd.

- Alleima AB

- Aptiv Plc

- BorgWarner Inc.

- Centravis

- Continental AG

- Denso Corporation

- Fischer Group

- Hitachi Astemo, Ltd.

- Keihin Corporation

- Mannesmann Stainless Tubes GmbH

- Marelli Holdings Co., Ltd.

- Mitsubishi Electric Corporation

- Park-Ohio Holdings Corporation

- Plymouth Tube Company

- Robert Bosch GmbH

- Stanadyne Holdings, Inc.

- TI Fluid Systems plc

- Usui International Corporation

- Vitesco Technologies Group AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 189 |

| Published | January 2026 |

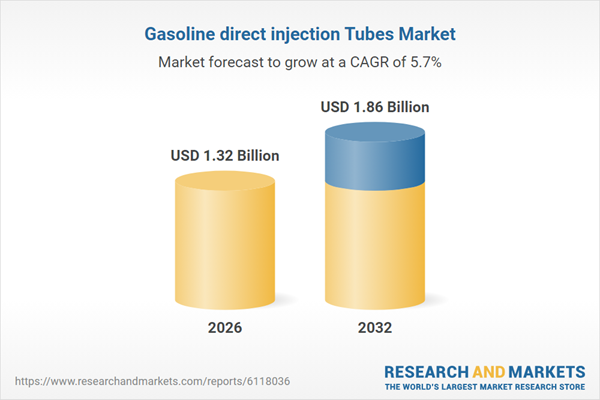

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 1.32 Billion |

| Forecasted Market Value ( USD | $ 1.86 Billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |