Speak directly to the analyst to clarify any post sales queries you may have.

A strategic introduction explaining why advanced oscilloscope test software is essential for rigorous validation, automation, and collaboration in complex electronics development environments

Oscilloscope test software plays a pivotal role across modern electronics development, enabling engineers and researchers to visualize, analyze, and validate complex signal behaviors with precision. Today’s testing environments demand software that integrates tightly with both bench hardware and automated test systems, supports advanced signal decoding, and offers robust waveform analysis capabilities. These capabilities reduce diagnostic time, enhance reproducibility, and support compliance with evolving protocol standards across industries ranging from telecommunications to aerospace.As system complexity grows, the software layer has become a differentiator in how organizations manage validation cycles and accelerate time to insight. Engineers rely on features such as automated remote control, repeatable scriptable test sequences, and sophisticated signal decoding to reproduce intermittent faults and validate system interoperability. The introduction of cloud-enabled workflows and hybrid deployment options further extends collaboration among distributed teams, enabling centralized test libraries and shared analytics without sacrificing the deterministic behavior required for high-assurance testing.

This introductory framing clarifies why every stage of product lifecycle-from early-stage research laboratories to production validation-benefits from software that balances depth of analysis, operational automation, and compatibility with a diverse array of measurement instruments. Readers should view the following sections as a strategic roadmap that links technical capabilities with organizational priorities and regional considerations that affect procurement and deployment choices.

Key transformative shifts reshaping oscilloscope test software driven by higher bandwidth instruments, automated validation, modular architectures, and remote orchestration capabilities

The landscape for oscilloscope test software has evolved through several transformative shifts driven by changes in hardware, connectivity, and development practices. First, the proliferation of higher-bandwidth instrumentation and multi-domain sensors has pushed software to handle greater data volumes while preserving real-time responsiveness. This trend demands more efficient data pipelines, smarter on-instrument pre-processing, and selective storage strategies to ensure engineers can derive actionable insights without overwhelming infrastructure.Second, the adoption of standards-based protocol stacks and the need for interoperability testing have elevated the importance of comprehensive signal decoding and compliance test suites embedded within software. Test engineers now expect software to not only capture signals but to contextualize them against evolving protocol specifications and to automate conformance checks where feasible. Third, the move toward automated test frameworks and remote operation has shifted emphasis to reliable remote-control and orchestration capabilities, enabling continuous integration-style testing for hardware-in-the-loop scenarios. These capabilities support reproducible test flows and reduce manual intervention, accelerating development cycles.

Finally, software architectures are increasingly modular and API-driven, enabling integration with orchestration platforms, analytics engines, and cloud services. This composability fosters extensibility, allowing organizations to layer domain-specific analysis modules and to scale testing across distributed teams. Taken together, these shifts represent a structural rebalancing from instrument-centric workflows to software-enabled, networked test ecosystems that prioritize speed, repeatability, and traceable compliance.

Assessment of how recent tariff adjustments have altered procurement dynamics, supplier strategies, and the value of software portability across global electronics testing operations

Recent tariff policies originating from trade adjustments have introduced new frictions into global electronics supply chains, affecting component availability and the total cost of imported measurement instruments and subassemblies. These adjustments have, in turn, influenced procurement strategies among buyers of test equipment and associated software, prompting closer scrutiny of total cost of ownership and supplier diversification. Test software providers have responded by emphasizing compatibility with a broader range of instruments and by enhancing virtualization and emulation capabilities that reduce dependence on imported hardware for certain stages of development.Organizations have adjusted their deployment approaches to mitigate tariff-driven uncertainties, placing greater value on software that can operate effectively across cloud and on-premises environments and that supports remote access to shared test assets. This flexibility allows teams to centralize computational workloads in tariff-neutral regions while maintaining local control over sensitive measurement points. Additionally, the potential for increased costs has accelerated the adoption of software licensing models that decouple functionality from specific hardware assets, enabling more flexible redistribution of tools across international engineering teams.

Policy shifts have also underscored the importance of resilient supplier relationships, local partner ecosystems, and modular test architectures that permit rapid substitution of instrument providers without extensive revalidation. In practice, this has made robust instrument abstraction layers, hardware-agnostic APIs, and comprehensive validation test suites more valuable, as they reduce migration costs and support continuity amid changing trade conditions. Organizations that prioritize portability and interoperability in their test toolchains are best positioned to absorb tariff-related impacts while maintaining development cadence.

Actionable segmentation insights revealing how software types, deployment choices, organizational scale, and vertical-specific requirements intersect to shape procurement priorities and product roadmaps

Understanding segmentation is critical to aligning product offerings with customer needs, and the landscape can be viewed across several intersecting dimensions. Based on Software Type, the domain encompasses Compliance & Protocol Testing Software, Remote Control & Automation Software, Signal Decoding Software, and Waveform Analysis Software, each addressing distinct stages of validation from standards verification to deep time-domain analysis. Based on Deployment Type, adoption patterns diverge between Cloud and On-Premises deployments, with cloud solutions offering collaborative analytics and centralized test archives while on-premises options preserve data sovereignty and deterministic instrument control.Based on Organization Size, requirements vary between Large Enterprises and Small And Medium Enterprises, where large organizations often demand extensive integration, multi-site orchestration, and enterprise licensing flexibility, and smaller engineering teams prioritize ease of use, affordable licensing, and rapid time to operational value. Based on End-User Industry, the diversity of use cases spans Aerospace & Defense, Automotive, Education & Academia, Electronics & Semiconductor, Power & Energy, Research Laboratories, and Telecommunications, each imposing unique regulatory, performance, and traceability needs on test software. The confluence of these dimensions reveals patterns: solutions that offer modular licensing and hardware abstraction appeal across sizes and industries, while domain-specific decoding and compliance suites remain indispensable for regulated verticals.

Strategic segmentation analysis indicates that vendors who can combine deep protocol expertise with flexible deployment models and tiered licensing will better serve organizations navigating heterogeneous instrument fleets and geographically distributed teams. Tailoring product roadmaps to reflect the differing priorities of these segments-whether stringent certification in aerospace or rapid prototyping in academia-will improve alignment between capabilities and buyer priorities.

Regional strategic implications highlighting how procurement preferences, compliance regimes, and support ecosystems differ across the Americas, Europe Middle East & Africa, and Asia-Pacific markets

Regional considerations shape procurement preferences, regulatory constraints, and partner ecosystems, creating distinct strategic priorities for solution providers and enterprise buyers. In the Americas, purchasing tends to emphasize rapid adoption of cloud-enabled workflows, strong aftermarket support, and integration with established industrial and research partners, reflecting a mature demand environment with emphasis on innovation velocity. In Europe, Middle East & Africa, buyers place premium value on compliance with regional certification regimes, data protection considerations, and long-term supplier relationships, driving demand for on-premises deployments and detailed traceability features.In Asia-Pacific, investment in domestic manufacturing and dense electronics ecosystems has fostered a large base of both sophisticated labs and high-volume production environments. This region often prioritizes cost-effective scalability, localized support networks, and flexible licensing models that can accommodate rapid iteration. Cross-region vendor strategies must therefore balance centralized feature development with localized deployment and support approaches to meet a spectrum of needs. Connectivity and collaboration features that enable distributed validation across these regions, combined with modular architectures that respect varying regulatory and operational constraints, will be especially valuable for organizations operating across multiple geographies.

Overall, geographic differentiation suggests that technical roadmaps and go-to-market strategies should be adapted to regional strengths: cloud-centric capabilities and rapid innovation in the Americas, compliance and data governance in Europe, Middle East & Africa, and scalable, cost-aware solutions in Asia-Pacific.

Competitive company dynamics showing how integration expertise, protocol maintenance, and partnership ecosystems determine vendor differentiation and long-term enterprise relationships

Key companies in the oscilloscope test software arena are differentiating through a combination of deep instrumentation integration, advanced signal processing algorithms, and flexible deployment and licensing approaches. Leading providers invest in modular architectures that expose robust APIs, enabling third-party analytics and bespoke automation layers. These firms also prioritize cross-platform compatibility, ensuring their software can operate with a wide array of oscilloscope hardware and test instruments, which reduces lock-in and improves appeal to multi-vendor laboratories.Competitors further distinguish themselves by embedding compliance and protocol test suites that are regularly updated to reflect changes in telecommunications, automotive, and aerospace standards. This ongoing maintenance is critical for customers who require rigorous conformance testing and traceable validation artifacts for certification. Additionally, companies that have built remote-control and orchestration capabilities enable distributed test execution and integration with continuous validation pipelines, which appeals to development organizations adopting DevOps-inspired hardware test practices.

Partnerships with instrument manufacturers, integrators, and systems houses remain a central axis of competitive advantage, as they provide channels for pre-integrated solutions and localized support. Firms that combine strong technical depth with clear enterprise engagement models-offering professional services, training, and custom integration-tend to secure long-term relationships with large customers and research institutions. For buyers, assessing vendor roadmaps, update cadences, and support commitments is essential to ensure alignment with long-term validation strategies.

Practical and prioritized recommendations for vendors and enterprise buyers to invest in portability, automation, certification tooling, and regional partnerships to secure competitive advantage

Industry leaders should prioritize architectural flexibility and open integration points to remain resilient amid shifting hardware suppliers and regulatory landscapes. Investing in hardware-agnostic APIs and abstraction layers reduces migration costs when instrument vendors change and accelerates adoption by engineering organizations that maintain heterogeneous test fleets. Complementing this with modular licensing and cloud-ready architectures enables teams to scale capability footprints as projects evolve, while preserving the option for secure on-premises operation where compliance or latency constraints demand it.Leaders should also accelerate capabilities around automated compliance testing and certified decoding modules to reduce manual validation overhead and to support accelerated certification timelines. Building repeatable, scriptable test libraries and exposing them through version-controlled repositories encourages reproducibility and knowledge transfer across teams. Moreover, strengthening professional services and training offerings will shorten onboarding cycles and enhance product stickiness, especially for regulated industries where traceability and documented procedures are paramount.

Finally, forging stronger regional partner networks and enhancing support models will improve responsiveness and local compliance, particularly in regions with specific regulatory or procurement practices. By balancing technical investments in portability and automation with commercial strategies that emphasize flexible licensing and localized enablement, industry leaders can convert current disruptions into opportunities for deeper customer engagement and long-term retention.

Clear explanation of the mixed-methods research approach combining hands-on evaluations, practitioner interviews, technical standards review, and transparent validation criteria to ensure actionable findings

The research underpinning this executive summary integrates qualitative and quantitative inputs drawn from a structured review of product documentation, technical white papers, standards bodies, and practitioner interviews with test engineers and procurement leaders. Primary inputs included detailed product architecture reviews and hands-on validation scenarios designed to evaluate interoperability across representative instrument models and deployment topologies. These hands-on evaluations focused on protocol decoding accuracy, automation and orchestration reliability, remote-control performance, and the fidelity of waveform analysis functions under realistic signal conditions.Secondary research encompassed synthesis of publicly available technical standards, regulatory guidance, and industry press regarding instrumentation trends and policy developments. Triangulation was used to validate claims of capability and to contextualize vendor positioning relative to typical buyer requirements. Where appropriate, case study material drawn from anonymized customer engagements illustrates typical deployment patterns and the operational benefits of specific feature sets. Throughout the process, emphasis was placed on reproducibility of evaluation scenarios, explicit documentation of test parameters, and transparency around assumptions used when interpreting vendor claims.

This mixed-methods approach ensures that conclusions are grounded in both technical verification and practitioner perspectives, offering readers a balanced understanding of capabilities, limitations, and practical considerations for procurement and deployment.

A concise conclusion emphasizing the enduring importance of portability, automation, and compliance-focused capabilities in oscilloscope test software for long-term engineering resilience

In closing, oscilloscope test software sits at the intersection of instrumentation capability and software-enabled productivity, and its strategic importance continues to grow as systems increase in complexity and regulatory expectations tighten. The most impactful software solutions will be those that marry rigorous signal analysis and protocol compliance capabilities with flexible deployment models and robust integration frameworks. These attributes reduce time to insight, lower the operational burden of validation, and provide resilience against supply chain and policy disruptions.Decision-makers should weigh three enduring priorities when evaluating solutions: portability across heterogeneous instrument fleets, automation that supports reproducible and continuous validation, and strong support for compliance workflows in regulated verticals. Aligning procurement choices to these priorities will help organizations maintain development velocity while ensuring traceable, defensible validation artifacts. Vendors that focus on open, modular architectures and invest in regional enablement and partner ecosystems will be best positioned to support the varied needs of global engineering organizations.

Overall, adopting a strategic approach to test software procurement-one that emphasizes interoperability, automation, and alignment with industry-specific requirements-will deliver enduring value as product complexity and testing demands continue to evolve.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

16. China Oscilloscope Test Software Market

Companies Mentioned

- ADLINK Technology Inc.

- AlazarTech

- Analog Devices, Inc.

- Anritsu Corporation

- B&K Precision Corporation

- BitScope Designs Pty Ltd

- Cleverscope Ltd.

- Dataman, Inc.

- Digilent Inc.

- Fluke Corporation

- Hioki E.E. Corporation

- Keysight Technologies

- National Instruments Corporation

- Perytech Inc.

- Pico Technology Ltd.

- Rigol Technologies, Inc.

- Rohde & Schwarz GmbH & Co. KG

- Siglent Technologies Co., Ltd.

- Spectrum Instrumentation GmbH

- Tektronix, Inc.

- Teledyne LeCroy

- Vitrek LLC

Table Information

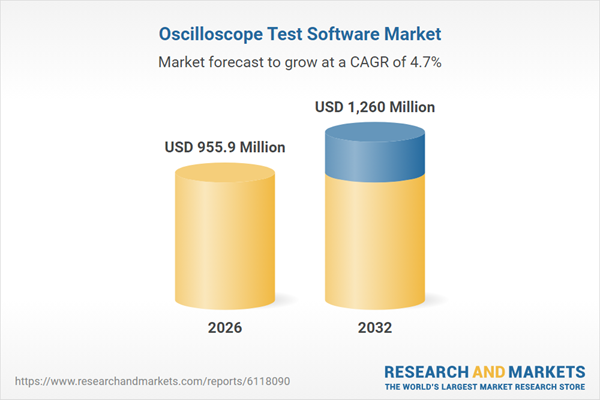

| Report Attribute | Details |

|---|---|

| No. of Pages | 197 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 955.9 Million |

| Forecasted Market Value ( USD | $ 1260 Million |

| Compound Annual Growth Rate | 4.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 22 |