Speak directly to the analyst to clarify any post sales queries you may have.

An integrated overview of how clinical demand, regulatory priorities, and digital innovation are reshaping microcomputer infusion pump design, procurement, and clinical adoption

The microcomputer-controlled infusion pump has evolved from a point device to a clinical automation platform that intersects care delivery, patient safety, and digital health. Advances in embedded processing power, sensor fusion, and software-driven safety checks have permitted pumps to transcend their historical roles of simple volumetric dispensers, positioning them as nodes in hospital information systems and home-care ecosystems. This introduction frames the broader landscape by outlining the convergence of clinical demand for precision dosing, regulatory emphasis on error reduction, and the rising expectations for connectivity and remote management.Providers now expect infusion systems to support closed-loop workflows, integrate with electronic medical records, and provide audit trails that satisfy compliance and reimbursement requirements. At the same time, manufacturers must balance hardware reliability with software agility, ensuring that firmware updates and cybersecurity measures coexist with stringent medical device regulations. Procurement teams are increasingly evaluating total cost of ownership, device interoperability, and ease of use for caregivers when choosing between ambulatory, bedside, and implantable options.

This overview sets the stage for deeper analysis by highlighting how technical, clinical, and commercial vectors intersect. It prepares readers to assess how innovation pathways, reimbursement dynamics, and supply chain realities will shape strategic priorities for stakeholders across clinical, manufacturing, and distribution functions.

How intelligent device architectures, secure connectivity, and outcome-aligned commercial models are remaking clinical workflows and supplier strategies in infusion therapy

The landscape for microcomputer infusion pumps is undergoing several transformative shifts driven by technology integration, clinical expectations, and operational economics. First, embedded intelligence and software-centric architectures are enabling dose-error mitigation strategies and smarter alerting logic that reduce alarm fatigue while improving patient safety. This shift is accompanied by a new emphasis on cybersecurity and software lifecycle management, where secure update mechanisms and incident response plans are as essential as hardware reliability.Second, connectivity is redefining where and how infusion devices are used. Cloud-enabled telemetry and remote monitoring capabilities are allowing clinicians to supervise infusion therapy outside the traditional hospital ward, expanding the scope of ambulatory and home-based care. Third-party ecosystem integration is becoming a differentiator, with successful vendors demonstrating seamless interoperability with infusion libraries, EMRs, and clinical asset management systems.

Finally, business models are evolving to reflect the service value of connected devices. Vendors are exploring outcome-based contracts, managed service offerings, and asset-as-a-service propositions that align incentives across providers, payers, and manufacturers. These combined shifts are accelerating product roadmaps toward more modular, software-upgradeable platforms that can adapt to changing clinical protocols and care models.

Assessing how cross-border trade measures and tariff-driven supply chain adjustments are altering manufacturing footprints, procurement risk, and clinical device availability

The policy landscape affecting cross-border trade and medical device sourcing has introduced new layers of complexity for manufacturers and providers that rely on globalized supply chains. Tariff actions and trade policy adjustments influence upstream cost structures for components such as microcontrollers, sensors, and specialized polymers, and they create incentives for supply reconfiguration. Procurement teams are responding by re-evaluating supplier diversity, nearshoring component production, and negotiating contractual clauses that address duty exposure and lead-time variability.Operationally, increased tariff pressures have driven manufacturers to reassess global manufacturing footprints and to pursue localization strategies for key assemblies and final integration. This trend has implications for qualification timeframes, regulatory submissions tied to manufacturing site changes, and capital allocation for localized tooling and validation. Health systems face corresponding procurement trade-offs between short-term cost pressures and longer-term availability and service reliability, prompting closer collaboration with strategic suppliers to maintain continuity of care.

In addition to cost and supply considerations, tariff-driven shifts affect innovation cycles by influencing decisions about where to site research and development activities. Organizations that accelerate localization may gain supply resilience but must manage a temporary slowdown in time-to-market while new facilities meet quality and regulatory standards. Throughout this complex context, stakeholders are prioritizing contractual flexibility, scenario planning, and enhanced transparency in supplier roadmaps to mitigate the cumulative effects of policy shifts on device availability and clinical operations.

A detailed segmentation framework linking product type, end-user environment, clinical application, delivery modality, enabling technologies, and portability to product strategy and adoption pathways

A pragmatic segmentation lens reveals how product design, user context, clinical application, delivery modality, enabling technologies, and portability dictate differentiation and adoption pathways for infusion systems. Product type distinctions between ambulatory pumps, implantable pumps, syringe pumps, and volumetric pumps frame technical requirements and clinical workflows, while the further split of ambulatory solutions into backpack and wearable pumps highlights divergent ergonomics, battery strategies, and patient mobility considerations.End user segmentation across ambulatory care centers, clinics, home care settings, and hospitals describes where value is extracted and what support models are required; hospitals emphasize integration, redundancy, and compliance, whereas home care settings prioritize simplicity, remote supervision, and durability. Application segmentation-spanning anesthesia, nutrition, oncology, and pain management-drives dosing complexity, safety features, and the necessity for therapy-specific libraries and protocols. Delivery mode distinctions such as bolus infusion, continuous infusion, and intermittent infusion determine pump hardware capabilities, reservoir designs, and alarm logic.

Technology-based segmentation underscores the role of connectivity stacks and intelligent functions. IoT-enabled devices that support asset tracking and predictive analytics enable operations teams to monitor utilization and anticipate maintenance needs, while smart pumps that deliver dose error reduction and patient safety alerts reduce bedside medication errors. Wireless connectivity that provides cloud integration and remote monitoring creates opportunities for centralized oversight and telehealth synergies. Finally, portability segmentation between fixed pumps and portable pumps, and the further delineation of portable units into battery-operated and mains-powered configurations, affects power management, form factor trade-offs, and the choice of materials for durability. Mapping product development, regulatory strategy, and go-to-market tactics to these segment dimensions clarifies where incremental investment yields the greatest clinical and commercial return.

How distinct regional regulatory environments, procurement behaviors, and care delivery models across the Americas, Europe Middle East & Africa, and Asia-Pacific influence adoption and supplier strategy

Regional dynamics shape the competitive environment, regulatory expectations, and provider priorities in meaningful ways. In the Americas, health systems emphasize integration with existing hospital information systems, value-based procurement considerations, and a strong focus on patient safety programs that drive demand for dose-error reduction technologies and robust clinical libraries. This has prompted suppliers to prioritize interoperability features and service agreements that support large hospital networks and distributed ambulatory care providers.Europe, Middle East & Africa presents a mosaic of regulatory regimes and reimbursement models that influence product acceptance and post-market surveillance requirements. Providers in this region place a premium on compliance, lifecycle documentation, and multiyear service commitments. Variations in clinical practice patterns and infrastructure readiness also create differentiated opportunities for remotely managed and lower-power portable solutions that can function effectively in constrained settings.

Asia-Pacific is characterized by a mix of rapidly modernizing health systems and wide variability in procurement sophistication. Demand for cost-effective, easy-to-deploy solutions is strong, particularly for home care and clinic-based infusion therapy. Suppliers that can combine manufacturing efficiency, localization strategies, and scalable connectivity offerings are better positioned to capture diverse clinical and commercial opportunities across the region.

Competitive dynamics where legacy device expertise, cloud-enabled services, strategic partnerships, and clinician-centered implementation determine supplier relevance and long-term contracts

Competitive dynamics in the infusion pump arena are shaped by legacy device expertise, software and connectivity capabilities, and the ability to deliver integrated clinical solutions. Established device manufacturers retain advantages in regulatory experience, global service networks, and clinician familiarity, which supports continued uptake in hospital settings where integration with EMRs and pharmacy systems is essential. Newer entrants and niche specialists are differentiating through focused clinical features, user experience improvements, and cloud-enabled service offerings that reduce the burden on hospital IT teams.Partnerships and acquisitions continue to be strategic levers, enabling companies to augment clinical decision support, extend remote monitoring capabilities, and accelerate time-to-market for connected platforms. Providers are also scrutinizing supplier roadmaps for software update policies, cybersecurity practices, and commitment to interoperability standards. The suppliers that demonstrate transparent post-market support processes and deliver robust training and implementation services are more likely to secure long-term contracts with multi-site provider groups. Ultimately, success will hinge on aligning technical capability with reliable service delivery and clear clinical outcomes.

Practical priorities for device manufacturers and health systems that align cybersecurity, interoperability, regional supply resilience, and service-based commercial models to accelerate adoption

Industry leaders should prioritize investments that simultaneously reduce clinical risk and enable scalable deployments across care settings. First, embed rigorous software development lifecycle practices and cybersecurity-by-design to ensure devices remain secure, maintainable, and certifiable across jurisdictions. Second, strengthen interoperability through adherence to standards and by providing open APIs and validated connectors to popular electronic medical records and clinical asset management systems, thereby reducing integration friction for provider IT teams.Third, design commercial offers that combine hardware, software updates, and service-level agreements into transparent total-care packages that alleviate procurement uncertainty. Fourth, accelerate regionalization strategies for manufacturing and service delivery to address tariff-induced supply constraints while maintaining consistent quality and regulatory compliance. Fifth, expand capabilities in predictive maintenance and asset tracking to improve uptime and lower operating costs for providers, leveraging IoT telemetry to support proactive support models. By executing on these priorities, organizations can deliver demonstrable safety improvements, predictable service economics, and a clear migration path to next-generation clinical workflows.

A methodological blueprint that blends primary clinical and technical interviews with triangulated secondary evidence and rigorous validation to ensure robust, actionable insights

The research approach combined structured primary engagement with clinicians, biomedical engineers, procurement leaders, and device manufacturers with systematic secondary analysis of regulatory publications, standards guidance, and technology white papers. Primary inputs included semi-structured interviews to capture clinical pain points, technology validation needs, and procurement criteria, complemented by technical briefings with engineering and regulatory teams to understand product architectures and compliance pathways.Secondary research synthesized publicly available regulatory guidance, device safety communications, standards specifications, and peer-reviewed clinical literature to validate themes emerging from primary conversations. Findings were triangulated across sources to ensure consistency and to identify gaps in evidence. Segment mapping was conducted by cross-referencing clinical application requirements, user environment constraints, and device capabilities to develop actionable insights. Quality assurance processes included reviewer reconciliation, factual verification against source documents, and an internal audit of methodological assumptions to maintain transparency and reproducibility.

Final synthesis emphasizing how integrated engineering excellence, interoperability, and resilient sourcing convert device innovations into measurable clinical and operational value

In conclusion, the microcomputer infusion pump landscape is at an inflection point where device intelligence, secure connectivity, and adaptable commercial models determine clinical and commercial success. Clinical stakeholders demand solutions that reduce medication errors, integrate with digital health infrastructure, and enable safe therapy outside traditional inpatient settings. At the same time, manufacturers must navigate policy-driven supply chain shifts, evolving regulatory expectations, and the operational realities of supporting distributed device fleets.Strategic winners will be those that integrate robust engineering practices with service-oriented commercial structures, prioritize interoperability, and adopt manufacturing and sourcing approaches that enhance resilience. By focusing on patient safety, clinician workflow optimization, and predictable service economics, stakeholders can unlock the next wave of adoption across hospitals, ambulatory centers, clinics, and home care environments. The path forward requires coordinated investment in technology, operations, and partnerships to translate device capability into measurable clinical value.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

18. China Microcomputer Infusion Pump Market

Companies Mentioned

- ACE Medical Co., Ltd.

- Ambu A/S

- Arcomed AG

- B. Braun Melsungen AG

- Baxter International Inc.

- Becton, Dickinson and Company

- Chemyx Inc.

- Deltran

- Fresenius Kabi AG

- Halyard Health

- ICU Medical, Inc.

- Insulet Corporation

- Johnson & Johnson

- Medtronic PLC

- Micrel Medical Devices

- Moog Inc.

- Nipro Corporation

- Shenzhen Comen Medical Instruments Co., Ltd.

- Shenzhen MedRena Biotech Co., Ltd.

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Smiths Medical

- SOOIL Development Co., Ltd.

- Terumo Corporation

- Ypsomed Holding AG

- Zyno Medical LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 196 |

| Published | January 2026 |

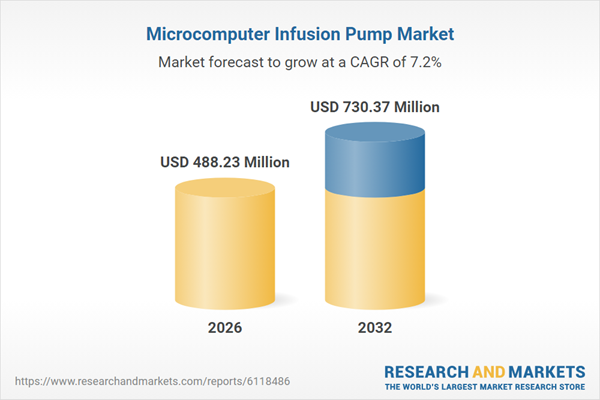

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 488.23 Million |

| Forecasted Market Value ( USD | $ 730.37 Million |

| Compound Annual Growth Rate | 7.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |