Speak directly to the analyst to clarify any post sales queries you may have.

The commercial aerospace bearings market is evolving rapidly, shaped by technical innovation, regulatory demands, and supply chain complexity. This report delivers actionable intelligence for senior decision-makers navigating the strategic challenges and opportunities in sourcing and applying aerospace bearing solutions across global fleets.

Market Snapshot: Commercial Aerospace Bearings Market Overview

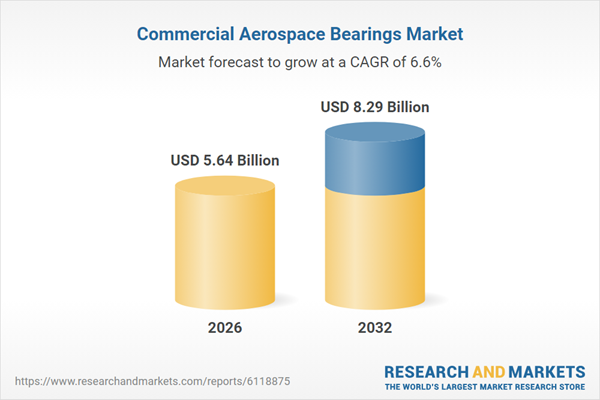

The Commercial Aerospace Bearings Market grew from USD 5.30 billion in 2025 to USD 5.64 billion in 2026, and is expected to reach USD 8.29 billion by 2032, at a CAGR of 6.60%. This steady growth trajectory reflects continued investment in modern aircraft, rising standards for operational reliability, and the ongoing need to reduce lifecycle costs.

Scope & Segmentation

This analysis covers all critical dimensions of the commercial aerospace bearings landscape, providing insights on technology, sourcing strategies, and end-use applications across major regions.

- Bearing Types: Includes ball, roller, plain, and fluid bearings, each aligned with specific technical roles and inspection needs.

- Material Choices: Focuses on ceramic, composite, and advanced steel alloys, examining trade-offs in fatigue resistance, temperature tolerance, and weight savings.

- Application Areas: Explores usage in engine and APU environments, flight control systems, and landing gear, connecting performance priorities to design decisions.

- End-Use Segments: Compares aftermarket needs for flexibility and quick turnaround with OEM preferences for integration and long-term consistency.

- Regional Coverage: Analyses market and supplier trends in the Americas, Europe Middle East & Africa, and Asia-Pacific, highlighting how local regulatory, technical, and economic factors drive procurement decisions.

- Enabling Technologies: Reviews the role of advanced materials, surface treatments, precision finishing, additive manufacturing, and digital condition monitoring in shaping product and service capabilities.

Key Takeaways

- Increasing technical demands and regulatory scrutiny require bearings that deliver reliability under extreme loads and high temperatures, influencing material and geometric choices in design.

- Advanced manufacturing methods, such as additive processes and enhanced surface finishing, enable complex geometries while supporting tighter tolerances for propulsion and actuation systems.

- Lifecycle performance considerations are shifting MRO and OEM collaboration earlier in the product development process, resulting in maintenance-friendly designs and smarter aftermarket strategies.

- Segmenting by bearing type and material directly shapes supplier qualification, risk management, and competitive positioning within both original equipment and aftermarket channels.

- Regional market dynamics impact everything from test infrastructure investment to procurement resilience, as organizations look to diversify suppliers and localize key manufacturing steps.

- Leading manufacturers combine expertise in advanced metallurgy with digital traceability and non-destructive evaluation to meet evolving certification, safety, and service expectations.

Tariff Impact & Supply Chain Adaptation

Recent tariff measures have catalyzed structural changes in sourcing, driving stakeholders to localize manufacturing and invest in regional supplier qualification to hedge against price volatility. These policy-driven shifts have heightened the importance of dual-sourcing, inventory management, and flexible procurement agreements. Forward-looking risk teams are enhancing scenario planning and investing in tooling portability to ensure readiness for sudden regulatory changes.

Methodology & Data Sources

This report leverages a mixed-methods approach that includes primary interviews with engineers, procurement leaders, and maintenance planners, alongside technical reviews and supplier capability audits. The analysis integrates real-world perspectives with documented standards, ensuring that all findings are validated for both operational feasibility and technical rigor.

Why This Report Matters

- Enables senior executives to make informed sourcing, qualification, and regional investment decisions by providing segment-specific and regionally contextualized insights.

- Supports supplier resilience planning by identifying best practices for qualification flexibility, dual-sourcing, and lifecycle risk reduction across aircraft fleets.

- Equips commercial and technical teams with actionable recommendations for integrating engineering innovation with robust procurement and maintenance strategies.

Competitive Landscape: How Leading Players Achieve Differentiation

Key manufacturers focus on integrating advanced material science, expert surface engineering, and digital monitoring tools. Strategic partnerships between bearing specialists and system integrators foster closer alignment between component design and system-level requirements. Those investing in localized production and flexible manufacturing footprints gain agility—critical for managing changing policy environments and strengthening customer loyalty. Suppliers that provide digital traceability and robust condition monitoring distinguish themselves in both the OEM and MRO segments, supporting long-term fleet reliability and cost control.

Regional Dynamics and Operational Strategies

Market characteristics and operational priorities differ significantly across regions. The Americas offer a mature supplier base and advanced certification infrastructure, underpinning quick-turn MRO solutions. Europe, Middle East & Africa excels in system integration and high-precision manufacturing, with a focus on legacy fleets and complex qualification programs. The Asia-Pacific region leverages scale, rapid capacity growth, and selective investment in value-added processes to shorten lead times and manage tariff exposure. These variations shape regional strategies for sourcing, testing, and aftermarket service footprint.

Conclusion

Commercial aerospace bearings now represent proactive technical assets rather than procurement commodities. Integrating technical innovation, robust qualification, and resilient sourcing is essential for meeting modern fleet expectations and regulatory requirements. Executives who act on cross-functional insights will position their organizations for sustained competitiveness in this evolving market.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

16. China Commercial Aerospace Bearings Market

Companies Mentioned

- AB SKF

- AST Bearings

- Barden Corporation

- GGB Bearing Technology

- JTEKT Corporation

- Kaman Corporation

- MinebeaMitsumi Inc.

- National Precision Bearings

- New Hampshire Ball Bearings, Inc.

- NSK Ltd.

- NTN Corporation

- Pacamor Kubar Bearings

- RBC Bearings Incorporated

- Rexnord Corporation

- RKB Bearing Industries

- Roller Bearing Company of America, Inc.

- Schaeffler Technologies AG & Co. KG

- The Timken Company

- Thomson Industries, Inc.

- UMBRAGROUP S.p.A.

- Wafangdian Bearing Group Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 198 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 5.64 Billion |

| Forecasted Market Value ( USD | $ 8.29 Billion |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |