Speak directly to the analyst to clarify any post sales queries you may have.

Why imaging filter cubes have become the hidden determinant of signal fidelity, throughput, and integration speed in modern imaging systems

Imaging filter cubes sit at the heart of modern fluorescence and multispectral imaging, orchestrating how excitation light reaches a sample and how emission light is separated and routed to detectors. By combining excitation and emission filters with a dichroic beamsplitter in a compact, alignment-ready package, the filter cube turns an optical bench challenge into a repeatable module that instrument builders can integrate with confidence. As life science labs push for faster throughput and cleaner signal separation, and as industrial and clinical workflows demand greater automation, the humble cube has become a performance bottleneck or an enabling advantage depending on design and supply choices.In practice, filter cubes are no longer treated as static accessories. They are increasingly specified as mission-critical subsystems that determine sensitivity, background rejection, channel-to-channel crosstalk, and overall system stability. This is especially evident in applications that depend on ratiometric measurements, multiplexed fluorescence, or quantitative assays, where small spectral shifts or angle-dependent effects can create downstream uncertainty. Consequently, procurement and engineering teams are converging earlier in the development cycle to align optical specifications, coating durability, and mechanical tolerances with the realities of lead times and serviceability.

At the same time, the market is being reshaped by faster iteration cycles in imaging instruments, from benchtop research microscopes to compact devices built for point-of-care and production environments. These shifts elevate the importance of modularity, repeatable alignment, and documented performance across batches. As the sections that follow show, competitive advantage increasingly comes from managing tradeoffs among spectral performance, mechanical integration, supplier quality systems, and regional supply resilience.

The landscape is shifting as multiplexed fluorescence, modular instruments, and supply chain strategy redefine what “good enough” filter cubes mean

The imaging filter cube landscape is undergoing a set of transformative shifts that reach beyond incremental improvements in filter coatings. One of the most consequential changes is the move from single-plex fluorescence toward multiplexed and multimodal imaging. As researchers and developers pack more channels into a single acquisition, the acceptable margin for spectral leakage narrows. This raises demand for steeper edge transitions, tighter bandpass tolerances, and well-characterized angle sensitivity, because even slight deviations can propagate into quantification errors.In parallel, instrument architectures are evolving. More systems now incorporate LED engines with rapidly switchable wavelengths, laser-based illumination for high sensitivity, and increasingly sophisticated camera sensors with higher quantum efficiency. These upgrades change the spectral and power conditions that filters must tolerate over long operating lives. As a result, photostability, coating durability under higher irradiance, and environmental robustness against humidity and cleaning agents are moving from “nice to have” attributes to qualification requirements.

Another structural shift is the growing emphasis on modularity and rapid configuration. Users want to swap channels, experiment with new fluorophores, or repurpose an imaging platform without extensive realignment. That preference favors cube designs that standardize mechanical interfaces, minimize tilt-induced spectral shift, and maintain repeatable positioning. Vendors that can provide validated interchangeability, consistent lot-to-lot performance, and clear documentation reduce integration friction for OEMs and support faster product refresh cycles.

Finally, supply chain strategy has become a design input. Coated optics depend on specialized deposition capacity, substrate sourcing, and stringent quality control. Recent disruptions have made lead-time volatility and regional concentration risk visible to instrument makers. Consequently, the landscape is shifting toward dual-sourcing, localized finishing where feasible, and closer supplier collaboration on design-for-manufacturability. This is not simply about cost; it is about safeguarding performance consistency, service continuity, and the ability to scale when a platform succeeds.

How anticipated 2025 United States tariffs could compound across coated optics, assemblies, and qualification cycles, reshaping sourcing decisions

United States tariffs anticipated in 2025 introduce a cumulative impact that extends beyond straightforward landed-cost increases for imported optical components. Imaging filter cubes are assemblies with value distributed across coated filters, dichroic elements, mounts, adhesives, and precision housings. When tariffs touch multiple points in that bill of materials, cost pressure compounds and can force redesign decisions rather than simple price pass-through. For OEMs with tight cost targets, the practical response often involves revisiting specifications, qualifying alternates, or shifting certain finishing steps to different jurisdictions.The more subtle effect is on time-to-market and qualification cadence. Optical assemblies are typically validated through a chain of documentation and testing that includes spectral verification, fluorescence performance checks, and mechanical fit assessments. If tariffs accelerate supplier switching, engineering teams may be pulled into repeated validation loops, delaying launches or consuming resources intended for new feature development. This dynamic can be particularly acute for regulated or quality-managed environments where change control is rigorous and traceability expectations are high.

Tariffs can also reshape negotiations across the supply chain. Some suppliers may push for longer-term commitments to justify capacity allocation or to stabilize pricing in the face of policy uncertainty. In response, buyers are likely to ask for clearer cost breakdowns, alternate-incoterm scenarios, and contingency plans tied to tariff changes. Over time, this can shift relationships from transactional purchasing toward more strategic partnerships, especially where a supplier can offer both performance assurance and logistics flexibility.

In addition, tariffs can influence where integration occurs. Even when core coating capacity remains offshore, there may be incentives to perform assembly, testing, or final kitting closer to U.S. customers to reduce exposure, shorten delivery cycles, and improve responsiveness for field replacements. However, executing that strategy requires investment in metrology, clean handling, and process controls to maintain optical performance. The cumulative impact, therefore, is not merely financial; it re-weights decisions across design, supplier qualification, inventory policy, and after-sales support.

Segmentation insights show why cube selection diverges by use case, integration model, and performance tolerance, not simply by price or brand

Segmentation patterns in imaging filter cubes reveal that performance requirements diverge sharply once you consider how the cube is used, who integrates it, and what constraints dominate the system design. When viewed through product type, demand tends to separate between standard catalog cubes that serve established fluorophore sets and custom cubes engineered for differentiated channel stacks or proprietary chemistries. The former win when speed and proven compatibility matter, while the latter become critical where multiplexing, unique passbands, or space-constrained architectures create integration challenges that off-the-shelf solutions cannot solve.Looking across component configuration, differences in excitation filter, emission filter, and dichroic selection are often driven by the illumination source and detector strategy. Systems relying on LED engines typically value channel purity and repeatability across switching events, while laser-driven platforms can place more stress on coatings and require tighter control of back-reflections and ghosting. These realities shape how buyers prioritize transmission efficiency, blocking depth, edge steepness, and long-term coating durability.

End-use segmentation further clarifies why “one best cube” is a misconception. In life science research, flexibility and channel variety can outweigh absolute ruggedness, provided spectral performance is reliable. In clinical and diagnostic contexts, reproducibility, traceability, and validated interchangeability become dominant because workflows depend on consistency across instruments and over time. In industrial imaging and machine vision, robustness to vibration, temperature variation, and cleaning routines rises in importance, and mechanical interfaces can matter as much as spectral characteristics.

From the perspective of sales channel and customer type, OEM integration creates a different buying logic than aftermarket or lab-driven purchasing. OEMs tend to care about long-term supply continuity, batch consistency, and documentation packages that support their own quality systems. By contrast, end users replacing or expanding channels often value availability, compatibility with existing frames, and clear guidance on fluorophore matching. Across segmentation dimensions, the strongest insight is that winning offerings align optical performance targets with integration realities, and they minimize the hidden costs of qualification, rework, and downtime.

Regional insights reveal how Americas, Europe, Middle East & Africa, and Asia-Pacific priorities diverge across quality, speed, and resilience needs

Regional dynamics in imaging filter cubes are shaped by where instruments are designed, where coated optics capacity is concentrated, and how quickly customers expect configuration changes and service support. In the Americas, strong demand from life science research, biotechnology tooling, and diagnostic instrument development reinforces a preference for dependable lead times and clear quality documentation. Buyers in this region also tend to weigh tariff exposure and logistics resilience heavily, which can elevate the value of local testing, assembly, or safety stock strategies when supply volatility rises.In Europe, a mix of research intensity, established microscopy ecosystems, and quality-managed manufacturing environments tends to emphasize traceability, repeatability, and compliance-aligned documentation. This can translate into higher scrutiny of coating durability, environmental robustness, and standardized mechanical interfaces that enable cross-platform compatibility. Additionally, procurement teams often favor suppliers that can support stable long-term programs and provide consistent performance over multi-year instrument lifecycles.

The Middle East and Africa present a different profile where investment in healthcare infrastructure, academic research capacity, and industrial inspection is expanding but can be uneven across countries. In this context, serviceability and channel availability may be as important as maximizing performance at the margin. Solutions that balance robust optical performance with practical support models, training, and dependable replenishment can gain traction, particularly where instruments must operate reliably with limited local service depth.

In Asia-Pacific, the landscape is strongly influenced by a combination of large-scale manufacturing ecosystems, fast-moving instrument development, and growing research output. This region often shows strong appetite for rapid iteration and cost-performance optimization, while simultaneously building deeper capabilities in precision optics and coatings. As competition intensifies, differentiation increasingly depends on the ability to deliver consistent quality at scale, support OEM customization, and shorten the cycle from specification to validated production-ready assemblies.

Company insights highlight differentiation through repeatable coatings, system-level optical design support, and lifecycle continuity for OEM programs

Competitive positioning among key companies in the imaging filter cube space is increasingly defined by how well suppliers combine optical design expertise with disciplined manufacturing control. Customers are no longer evaluating vendors purely on peak transmission curves; they are assessing whether a supplier can repeatedly deliver the same spectral performance across lots, maintain tight mechanical tolerances, and provide documentation that accelerates incoming inspection and system-level validation. Companies that invest in metrology, process control, and clear change-management practices reduce integration risk and become preferred partners for OEM programs.Another differentiator is the breadth and coherence of the product ecosystem. Suppliers that offer harmonized excitation and emission filters, dichroics, cube housings, and complementary accessories can simplify qualification and reduce interoperability surprises. This ecosystem approach is particularly valuable for multiplexed imaging, where channel interactions can produce unexpected artifacts unless the full optical stack is engineered as a system. Vendors with strong applications engineering support can also translate fluorophore requirements into robust specifications, helping customers avoid over-constraining designs or inadvertently introducing angle sensitivity issues.

Customization capability is also becoming a clearer competitive boundary. As more instruments pursue differentiated channel sets or compact optical paths, demand rises for custom passbands, unique dichroic cut points, and mechanically tailored housings. However, customization must be paired with manufacturability. The strongest companies tend to formalize custom workflows with design reviews, tolerance models, and verification protocols that keep schedules predictable and ensure that first articles closely match production intent.

Finally, service and lifecycle support increasingly matter. Imaging platforms may stay in the field for years, and customers need confidence that replacement cubes will match the original performance envelope. Companies that can ensure continuity of materials, coatings, and test methods-and that can propose controlled equivalency solutions when components must change-are better positioned to win long-lived programs and reduce total cost of ownership for their customers.

Actionable recommendations to de-risk qualification, build tariff-ready sourcing, and improve optical performance consistency across product lifecycles

Industry leaders can reduce risk and accelerate product cycles by treating imaging filter cubes as strategic subsystems rather than late-stage commodities. The first recommendation is to tighten cross-functional alignment early, ensuring optical engineering, procurement, and quality teams share a single specification set that reflects actual system tolerances. This includes defining acceptable spectral shift with incidence angle, setting blocking requirements tied to detector sensitivity, and documenting how performance will be verified at incoming inspection. When these decisions are made upfront, supplier selection becomes clearer and re-qualification churn drops.Next, leaders should build resilience into sourcing and design. Dual-sourcing is valuable, but only when it is operationally real: alternates must be validated against the same test protocols, and mechanical interchangeability should be demonstrated rather than assumed. Where feasible, standardizing cube footprints and mounting interfaces across product lines can create flexibility to absorb supply shocks or tariff-driven cost changes without forcing optical redesign. In parallel, inventory policy should reflect the true criticality of cubes, because a low-cost component can still halt shipment if it is on the critical path.

A third recommendation is to invest in verification discipline that scales. Suppliers’ datasheets often present idealized curves, so leaders benefit from insisting on batch-level spectral test reports, clear lot traceability, and stability expectations over temperature and humidity ranges relevant to the end environment. For multiplexed systems, it is also wise to validate cubes under realistic illumination power and switching patterns to catch photostability issues before field deployment.

Finally, organizations should negotiate supplier relationships around shared outcomes, not only unit price. Contract structures that include change notification windows, agreed test methods, and defined equivalency criteria can protect programs from unpleasant surprises. As tariffs and logistics uncertainty persist, suppliers that can offer alternate routing, local testing, or flexible kitting options may deliver more value than a marginally lower initial price.

Methodology grounded in technical trend mapping, value-chain interviews, and triangulation to convert optical complexity into decisions leaders can act on

The research methodology for this executive summary is built to translate a technically complex component category into decision-relevant insights for both engineering and commercial stakeholders. The approach begins with structured secondary research to map technology trends in fluorescence and multispectral imaging, including advances in coating processes, illumination sources, detector sensitivity, and instrument modularity. This step is used to establish a grounded view of performance requirements and integration constraints that shape filter cube selection.Primary research complements this foundation through interviews and structured discussions with stakeholders across the value chain, such as component suppliers, optical engineers, product managers, procurement leaders, and quality professionals. These conversations are designed to surface practical drivers and pain points, including qualification timelines, repeatability challenges, documentation needs, and supply continuity expectations. Particular attention is paid to how customers validate spectral performance in real systems and what failure modes most often drive redesign or returns.

To ensure consistency, the analysis uses triangulation across sources and stakeholder perspectives. Where claims vary, emphasis is placed on convergence-patterns repeated across multiple interviews, technical documentation sets, and observed procurement behaviors. The research also applies a segmentation lens to connect requirements to use cases, preventing overgeneralization and ensuring that conclusions reflect how priorities change by application, integration model, and regional procurement realities.

Finally, findings are synthesized into practical themes and recommendations. The objective is not to overwhelm readers with raw technical detail, but to provide a coherent narrative linking technology shifts, trade pressures, and customer expectations to the strategic choices leaders must make in design, sourcing, and lifecycle management.

Conclusion tying together technology-driven performance demands, tariff-era supply resilience, and the new standard for cube lifecycle governance

Imaging filter cubes have moved from being interchangeable accessories to being decisive enablers of modern imaging performance and product agility. As multiplexing expands and instrument platforms evolve, the cube’s spectral precision, mechanical stability, and coating durability directly influence data quality, usability, and long-term service outcomes. These realities elevate the importance of disciplined specifications and repeatable verification practices.At the same time, external pressures such as tariff uncertainty and supply chain concentration are reshaping how organizations think about sourcing and qualification. The cumulative impact is a market where engineering decisions and procurement strategies are tightly coupled, and where resilience is built through early alignment, validated alternates, and supplier relationships structured around continuity and transparency.

Ultimately, organizations that treat filter cubes as strategic modules-optimized for system-level performance and supported by lifecycle governance-will be better positioned to accelerate development cycles, reduce field risk, and adapt quickly as imaging modalities and application demands continue to evolve.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Imaging Filter Cube Market

Companies Mentioned

The key companies profiled in this Imaging Filter Cube market report include:- Agilent Technologies Inc.

- ASML Holding N.V.

- Barco NV

- Bio-Rad Laboratories Inc.

- Bruker Corporation

- Cairn Research Ltd.

- Canon Inc.

- Chroma Technology Corp

- Danaher Corporation

- Esaote S.p.A.

- Evident Scientific

- FUJIFILM Holdings Corporation

- GE HealthCare Technologies Inc.

- Hologic, Inc.

- IDEX Health & Science LLC

- Konica Minolta, Inc.

- Koninklijke Philips N.V.

- Leica Microsystems

- Nikon Corporation

- Olympus Corporation

- PerkinElmer Inc.

- Shanghai Optics

- Shimadzu Corporation

- Siemens Healthineers AG

- Thorlabs Inc

Table Information

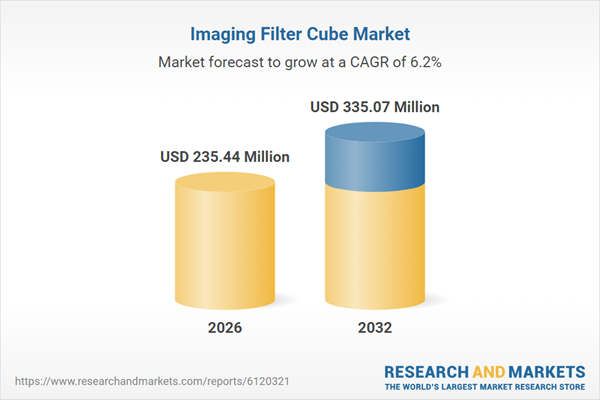

| Report Attribute | Details |

|---|---|

| No. of Pages | 184 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 235.44 Million |

| Forecasted Market Value ( USD | $ 335.07 Million |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |