Speak directly to the analyst to clarify any post sales queries you may have.

Rollover car wash systems are becoming integrated, software-enabled service platforms that prioritize uptime, consistency, and customer experience

Rollover car wash systems are evolving from single-purpose machinery into integrated service platforms that blend mechanics, chemistry, water management, and software into a repeatable customer outcome. In a market shaped by labor constraints, rising utility costs, and heightened expectations for vehicle-safe cleaning, operators are turning to rollover formats because they can deliver consistent quality in compact footprints while offering attractive upgrade paths over time. As a result, the category is no longer defined only by brush versus touchless debates; it is defined by how reliably a site can produce a premium wash experience with minimal intervention.At the same time, customer behavior is reshaping decision criteria for owners and equipment buyers. Membership programs, digital receipts, app-enabled upsells, and loyalty integrations are pushing even smaller sites to adopt capabilities once limited to larger chains. This shift places new emphasis on automation maturity, remote monitoring, and service responsiveness, particularly as uptime becomes a primary determinant of revenue protection. Consequently, system selection now requires balancing cleaning performance, vehicle safety, energy and water use, total cost of ownership, and the ability to integrate with payment and site-management tools.

This executive summary frames the most important forces influencing the rollover car wash system landscape, focusing on technology trajectories, cost and supply-chain pressures, segmentation dynamics, regional patterns, and competitive behavior. It is intended to support executives, investors, and operating leaders who need to make confident decisions about equipment modernization, network expansion, supplier selection, and go-to-market positioning in a fast-professionalizing category.

Digitization, sustainability mandates, and service-model reinvention are reshaping how rollover systems are designed, operated, and differentiated

The landscape is undergoing transformative shifts driven by a convergence of digitization, sustainability imperatives, and a rethinking of how sites are staffed and serviced. First, automation has moved beyond basic cycle controls into sensor-informed, data-driven wash optimization. Modern systems increasingly rely on vehicle profiling, pressure and flow regulation, and adaptive application of chemistry to improve cleaning outcomes while reducing rewash rates and chemical overuse. This evolution is reinforced by better human-machine interfaces and simplified maintenance routines that lower training requirements.Second, the definition of “premium” is changing. Consumers are placing greater value on vehicle-surface safety, consistent drying, and fast, predictable service. Operators, in turn, are investing in components that improve perceived quality-quieter operation, better lighting, improved bay signage, and more intuitive user prompts-because these elements lift conversion and retention even when price competition is intense. As a result, OEMs and integrators are treating the entire bay as a coordinated experience rather than a set of independent subsystems.

Third, connectivity is becoming a baseline expectation. Remote diagnostics, predictive maintenance alerts, and cloud dashboards are being used to reduce downtime and to coordinate field service more efficiently. This is especially important as equipment complexity increases and qualified technicians remain scarce in many markets. With better telemetry, both manufacturers and operators can shift from reactive repairs to planned interventions, improving parts planning and minimizing service disruption.

Finally, sustainability has shifted from marketing language to operational requirement. Water restrictions, wastewater compliance, and energy costs are forcing sites to modernize reclaim systems, optimize rinse steps, and select chemistry that performs in lower-water regimes. In parallel, corporate and municipal procurement policies increasingly reward demonstrable reductions in water and chemical intensity. Taken together, these shifts are pushing the category toward modular, upgradeable architectures in which a site can adopt digital controls, water management, or drying improvements without replacing the entire installation.

United States tariff dynamics in 2025 may reshape rollover system sourcing, pricing stability, and lifecycle service strategies across the supply chain

United States tariff actions expected to influence 2025 purchasing cycles are likely to have a cumulative impact across equipment costs, sourcing strategies, and lead-time management for rollover car wash systems. Many critical inputs-industrial motors, drives, pumps, valves, stainless and aluminum components, control electronics, sensors, wiring harnesses, and certain plastics-are exposed either directly through imported finished goods or indirectly through upstream materials and subassemblies. When tariffs raise landed costs or introduce pricing volatility, manufacturers and distributors often respond with staged price adjustments, revised product configurations, and tighter quotation validity windows.For operators, the most immediate effect is a shift in the economics of refresh and expansion projects. Budgeting becomes less predictable, and the trade-off between repairing legacy equipment versus replacing it can change quickly if parts pricing escalates. Additionally, tariff-driven uncertainty can accelerate pre-buy behavior, where buyers bring forward purchases to secure current pricing. That dynamic can strain installation and service capacity, creating secondary constraints that matter as much as the equipment bill.

Manufacturers are likely to deepen dual-sourcing and regionalization strategies to protect continuity. This can include qualifying alternate suppliers for electronics and fabricated components, increasing the use of domestically available materials, and redesigning certain assemblies to improve interchangeability. While these moves can enhance resilience, they also require validation cycles that may temporarily lengthen lead times for specific models or options. In response, more suppliers are expected to standardize platforms and reduce SKU proliferation, which helps them manage inventory risk and stabilize production.

Over the longer term, the tariff environment can catalyze investment in U.S.-based assembly, localized kitting, and service-part stocking to shorten replenishment cycles. Operators will benefit from suppliers that can clearly articulate country-of-origin exposure, provide transparent parts availability commitments, and offer service-level agreements that account for supply shocks. Ultimately, the cumulative impact is not only about price; it is about the operational risk profile of maintaining high uptime in a category where missed days of service translate into immediate revenue loss.

Segmentation insights show demand is shaped by type, application, components, technology, integration needs, and end-user operating priorities

Key segmentation patterns reveal how purchase decisions differ depending on what the buyer is optimizing for, and where the system sits within the broader site economics. Across type, the market continues to separate into touchless architectures that emphasize vehicle-surface safety and perceived modernity, and friction-based designs that prioritize stubborn soil removal, each increasingly enhanced by hybrid approaches that use targeted contact alongside controlled high-pressure applications. The choice is less ideological than it once was, because modern chemistry and application control narrow the performance gap, making uptime, maintenance intensity, and customer preference more decisive.By application, demand diverges meaningfully between retail sites serving individual consumers and fleet-oriented use cases that prioritize repeatability, scheduling, and cost-per-wash discipline. Retail operators tend to invest more aggressively in user experience, payment integration, and upgrade paths that support memberships and premium add-ons. Fleet and commercial users, on the other hand, often prioritize durability, predictable cycle times, and process control that ensures consistent results across vehicle classes, especially when vehicles return to service quickly.

Looking at component, differentiators are shifting toward drying performance, water management, and control systems that reduce human involvement. Operators increasingly evaluate brush materials, nozzle design, and chemical delivery systems through the lens of total maintenance workload rather than upfront cost. Water reclaim and filtration components have become strategic in regions where restrictions or high water prices are shaping operating margins, while controllers and sensors are central to remote troubleshooting and consistency.

Within technology, the momentum is toward programmable logic and sensor fusion that enable adaptive wash profiles, coupled with connectivity that allows remote parameter adjustments and performance tracking. This is reinforced by payment and access integration, where compatibility with POS, mobile payments, license-plate recognition workflows, and membership management platforms can materially affect throughput and customer conversion. Finally, end-user distinctions matter: independent operators value simplicity and service support, multi-site chains value standardization and analytics, and petroleum or convenience-adjacent sites value fast transactions and minimal bay friction. These segmentation dynamics collectively show that the winning offerings are those that align cleaning outcomes with operational simplicity, not merely those that claim superior wash performance.

Regional insights across Americas, EMEA, and Asia-Pacific highlight how water policy, climate, urban density, and retail models shape adoption

Regional dynamics underscore how environmental regulation, real estate constraints, climate conditions, and consumer expectations shape rollover system requirements. In the Americas, operators frequently prioritize throughput and reliability, especially where rollover bays complement high-traffic retail sites. Water availability and wastewater compliance vary widely by state and municipality, which makes reclaim readiness and configurable rinse strategies particularly important in drought-prone areas. Competitive pressure from conveyor formats also pushes rollover sites to emphasize consistent drying and a compelling premium package.Across Europe, Middle East & Africa, the diversity of operating environments creates distinct requirements by sub-region, yet common themes include tighter environmental standards and a strong focus on space efficiency. European markets tend to reward low-consumption designs, quieter operation, and robust safety and compliance features. In parts of the Middle East, high temperatures, dust load, and water considerations elevate the importance of filtration, chemical efficacy, and durable components that tolerate harsh operating conditions. Across Africa, where infrastructure variability can be a factor, resilience, serviceability, and simplified maintenance procedures can be decisive.

In Asia-Pacific, growth and modernization are shaped by urban density, consumer technology adoption, and the pace of retail site expansion. Compact footprints and fast installation timelines can favor rollover systems, particularly when paired with digital payment and localized user interfaces. Climate variability, from humid coastal regions to dustier inland geographies, changes the balance between pre-soak, pressure, and drying needs. As operators scale networks, standardization and remote monitoring become increasingly valuable, enabling consistent quality and centralized oversight across dispersed sites.

Across regions, a unifying trend is the rising importance of compliance-ready water management and digitally enabled operations. Suppliers that can tailor configurations to local constraints-while maintaining a stable core platform-are better positioned to win multi-site deployments and long-term service relationships.

Competitive insights emphasize modular product platforms, digital integration, and superior lifecycle service as the key levers of differentiation

Company activity in rollover car wash systems reflects a competitive blend of mechanical innovation, digital enablement, and service network strength. Leading manufacturers are investing in modular platforms that support configuration flexibility-allowing operators to tailor wash packages, drying, and water reclaim options without moving to entirely new architectures. This approach helps protect customer investments and enables staged modernization, which resonates in an environment where parts availability and installation windows are critical.Another key differentiator is the maturity of after-sales support. Companies that pair robust equipment with strong field service coverage, training programs, and remote diagnostic capabilities are better able to defend customer relationships, particularly among multi-site operators that demand standardized uptime. Increasingly, suppliers are packaging preventive maintenance schedules, consumables management, and performance reporting into service offerings that look more like lifecycle partnerships than transactional support.

Digital capabilities also separate competitors. Firms that integrate seamlessly with site management tools, payment systems, and loyalty ecosystems reduce friction for operators and open the door to recurring software and services relationships. In parallel, manufacturers are refining wash profiles and chemistry partnerships to improve cleaning consistency while reducing water and chemical intensity. The most competitive companies treat chemistry, applicators, and controls as one system, supported by data and field learnings.

Finally, distributor and installer ecosystems remain influential. Even strong products can underperform if installation quality is inconsistent or if local service coverage is thin. As a result, many companies are strengthening certification programs and tightening quality controls to protect brand performance in the field. This focus on execution-how systems perform day after day-has become as important as headline features in winning and retaining accounts.

Actionable recommendations focus on standardization, uptime-centered service agreements, digital operations, and sustainability as margin protection

Industry leaders can strengthen outcomes by treating rollover investments as a unified operating system spanning equipment, chemistry, water, and digital customer touchpoints. Start by defining a site-level objective function-such as minimizing downtime, maximizing perceived quality, or reducing water intensity-and then select configurations that directly support that priority. This prevents feature accumulation that increases maintenance burden without improving customer outcomes.Next, standardize for scale wherever possible. Multi-site operators should narrow equipment variants, controller versions, and core consumables to reduce training complexity and simplify parts stocking. Even single-site operators benefit from standard operating procedures that specify daily checks, periodic calibrations, and response playbooks for common faults. Standardization also improves the usefulness of remote monitoring because performance baselines become comparable.

Leaders should also renegotiate the supplier relationship around uptime. Service-level commitments, technician response expectations, and parts availability assurances matter more than incremental capex differences when a bay is a primary revenue engine. Where feasible, structure agreements that include preventive maintenance, remote troubleshooting, and operator training refreshers. In parallel, invest in telemetry and dashboards that connect wash performance to business outcomes such as rewash rates, chemical consumption, and customer conversion.

Finally, align sustainability actions with operational resilience. Water reclaim, filtration, and chemistry optimization should be approached as margin protection tools, not only compliance measures. Document water and energy practices to prepare for tightening municipal requirements and to support site approvals. When combined with a disciplined service model and a modern digital experience, these actions can turn a rollover bay into a dependable, premium asset rather than a maintenance-heavy necessity.

Methodology combines stakeholder interviews, technical and regulatory review, and triangulated analysis to ensure decision-ready findings

The research methodology integrates primary engagement with market participants and structured secondary analysis to build a decision-oriented view of the rollover car wash system ecosystem. Primary inputs include interviews and discussions with equipment manufacturers, distributors, installers, chemical providers, site operators, and service technicians to capture real-world operating challenges, purchasing criteria, and technology adoption patterns. These inputs are used to validate how product features translate into measurable operational outcomes such as consistency, maintainability, and bay availability.Secondary research synthesizes publicly available technical documentation, regulatory and compliance references, trade publications, patent activity signals, import and supply-chain context, and company communications such as product catalogs and service materials. This layer helps map technology roadmaps, identify common platform architectures, and understand how water policy, environmental compliance, and safety standards influence system design and deployment.

Analysis is then structured through triangulation. Claims about performance drivers and adoption barriers are cross-checked across multiple stakeholder types to reduce bias and isolate patterns that persist across geographies and operating models. Segmentation logic is applied to interpret how different buyers prioritize trade-offs, while regional analysis accounts for climate, infrastructure, labor conditions, and regulatory constraints.

Finally, findings are reviewed for internal consistency and practical relevance. The outcome is a framework that helps decision-makers compare solution paths, evaluate supplier capabilities, and anticipate operational risks tied to service, parts, and compliance. The emphasis throughout is on actionable insight that can be implemented in sourcing, site design, and ongoing operations.

Conclusion consolidates how digital control, lifecycle service, and water-smart operations define the new playbook for rollover systems

The rollover car wash system category is moving decisively toward integrated solutions that blend mechanical effectiveness with digital control, water stewardship, and service-led reliability. As operators face tighter labor availability and higher expectations for consistent quality, they are prioritizing systems that reduce variability and make performance easier to manage across shifts and sites. This is pushing suppliers to deliver modular platforms, stronger remote diagnostics, and better integration with payments and site management tools.Tariff-related uncertainty and broader supply-chain pressures add a layer of complexity that elevates the importance of parts availability, standardized platforms, and transparent lifecycle support. In parallel, sustainability has become inseparable from profitability as water and energy intensity increasingly shape operating margins and compliance risk. These forces collectively reward operators and vendors who can design for resilience, not just for initial performance.

The most successful strategies will be those that connect segmentation realities-type, application, components, technology, integration, and end-user priorities-with regional constraints and customer expectations. Leaders who invest in uptime-centered service models, data-informed operations, and scalable standardization will be better positioned to deliver a premium experience while protecting cost discipline over the long run.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

18. China Rollover Car Wash System Market

Companies Mentioned

The key companies profiled in this Rollover Car Wash System market report include:- Alfred Kärcher SE & Co. KG

- Autec S.p.A.

- Belanger Inc.

- Coleman Hanna Carwash Systems

- D&S Car Wash Equipment Co.

- EHRLE GmbH & Co. KG

- Hydro Engineering, Inc.

- Istobal S.A.

- MacNeil Wash Systems Inc.

- Motor City Wash Works Inc.

- Oasis Car Wash Systems

- Otto Christ AG

- PDQ Manufacturing, Inc.

- Ryko Solutions Inc.

- Sonny's Enterprises LLC

- Tommy Car Wash Systems

- WashTec AG

- Washworld Inc.

- Zhengzhou Shinewash Technology Co., Ltd.

Table Information

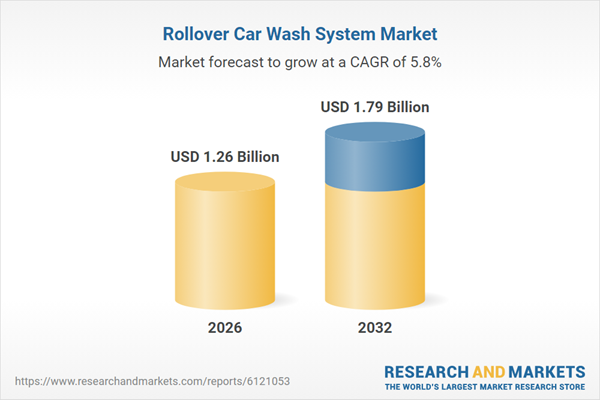

| Report Attribute | Details |

|---|---|

| No. of Pages | 188 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 1.26 Billion |

| Forecasted Market Value ( USD | $ 1.79 Billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 20 |