Speak directly to the analyst to clarify any post sales queries you may have.

Why low-value consumables now define hospital operating discipline, shaping care continuity, cost control, and supply resilience at the point of use

Hospitals rely on a broad set of consumables that keep care pathways moving: items that touch nearly every patient encounter, appear in thousands of daily transactions, and shape both clinical workflow and supply chain stability. Within this universe, “low-value consumables” occupy a paradoxical role. Unit prices are typically modest, yet the cumulative operational impact can be substantial because these products are purchased frequently, stored widely, and handled by diverse clinical teams. As a result, small inefficiencies in standardization, utilization, or logistics can cascade into meaningful cost and complexity.In today’s environment, low-value consumables are no longer treated as background spend. They have become a strategic lever for hospital leaders balancing budget constraints, workforce shortages, infection prevention expectations, and the demand for consistent patient experience. Moreover, procurement teams are increasingly accountable for more than price. They must deliver product availability, reduce clinician burden, ensure compliance with safety standards, and demonstrate that purchasing decisions support quality initiatives.

This executive summary frames the hospitals low-value consumables landscape through a practical lens: what is changing, why it matters now, and how leaders can respond. It emphasizes operational realities such as SKU proliferation, backorder risk, supplier concentration, and the growing need to document value beyond unit cost. It also highlights how policy and trade dynamics, including 2025 tariff developments in the United States, can alter sourcing choices and contracting strategies.

Taken together, the market is best understood as a continuous optimization challenge rather than a one-time sourcing event. Hospitals that treat low-value consumables as a system-spanning clinical preference management, inventory design, data governance, and supplier collaboration-are better positioned to deliver both resilience and measurable improvement.

Transformative shifts redefining low-value consumables, from transactional purchasing to data-driven standardization and resilience-first supply models

The landscape is shifting from transactional buying toward integrated category management built around utilization, standardization, and clinical alignment. Historically, low-value consumables were managed with limited visibility: price files, periodic bids, and ad hoc substitutions during shortages. Today, hospitals are building tighter governance, using cross-functional committees to rationalize SKUs, define clinically acceptable alternates, and reduce variation across departments. This change reflects a broader recognition that complexity is itself a cost driver, particularly when staff time is scarce.At the same time, supply chain resilience has become a core requirement rather than a differentiator. Disruptions over the last several years exposed vulnerabilities such as single-source dependencies, limited domestic manufacturing, and opaque tier-two supplier networks. Hospitals and health systems are responding by prioritizing dual sourcing where feasible, demanding clearer commitments on allocation and lead times, and incorporating service-level expectations into agreements. This is transforming the buyer-supplier relationship from price-first to performance-and-continuity.

Digitization is also reshaping how low-value consumables are managed. Automated replenishment, item master normalization, and tighter integration between ERP systems and clinical documentation are improving visibility into consumption patterns. As hospitals push for accurate charge capture and reduced waste, they are linking inventory movement to care episodes more directly. Consequently, suppliers that can support data readiness-through standardized labeling, better product metadata, and interoperable catalog management-are gaining influence.

In parallel, sustainability and safety expectations are becoming non-negotiable. Hospitals are scrutinizing packaging volume, recyclability, and lifecycle considerations even for lower-cost items. Infection prevention and patient safety teams are also elevating requirements related to material compatibility, sterility assurance, and quality controls. These pressures encourage product redesign, packaging optimization, and transparent quality management systems.

Finally, consolidation dynamics are redefining competitive behavior. Health systems are increasing contract leverage through network aggregation and enterprise-wide standardization, while distributors and group purchasing structures are evolving their value propositions beyond negotiated pricing. This environment rewards suppliers that can prove consistent fulfillment, scalable service, and operational support for conversions, not just competitive quotes.

How United States tariff developments in 2025 reshape sourcing, contracting clauses, and landed-cost discipline for hospital low-value consumables

United States tariff actions in 2025 are intensifying focus on cost-to-serve, supplier geography, and contract flexibility across low-value consumable categories. Even when individual items absorb only modest tariff-related increases, the aggregate effect across high-velocity purchasing can pressure operating budgets and create friction in long-term agreements. Hospital procurement teams are responding by examining total landed cost more rigorously, including freight, duty exposure, and the administrative burden of frequent price changes.One immediate impact is renewed interest in regionalized sourcing and domestic or nearshore alternatives where quality and supply assurance can be maintained. For certain consumables, buyers are seeking manufacturers with diversified production footprints to reduce exposure to abrupt policy shifts. This does not imply an automatic pivot away from global sourcing, but it does encourage multi-country manufacturing strategies and clearer traceability. As a result, suppliers that can document origin, maintain stable lead times, and provide credible continuity plans are better positioned in competitive evaluations.

Tariff volatility also alters negotiation dynamics. Hospitals increasingly prefer contracting language that clarifies when price adjustments are permitted, how changes are communicated, and what documentation is required. In response, vendors are refining escalation clauses and building more transparent cost justification frameworks. This is particularly important for low-value consumables because frequent price exceptions can create outsized workload for materials management teams and accounts payable functions.

Additionally, distributors may adjust assortment strategies when tariff exposure changes margin structures. If certain imported items become less attractive to stock, hospitals can experience shifts in availability, substitution frequency, and lead time variability. That reality reinforces the importance of pre-approved alternates and clinically aligned substitution protocols, which reduce last-minute decision-making at the unit level.

Over the medium term, tariff pressure may accelerate packaging redesign and product standardization. Suppliers looking to protect affordability can pursue lighter packaging, optimized case packs, and manufacturing efficiencies. Meanwhile, hospitals can offset tariff-driven increases through utilization control, conversion to standardized product families, and tighter inventory discipline. In effect, tariffs act less as a single event and more as a forcing function for structural improvements in how low-value consumables are sourced and managed.

Segmentation insights that explain why low-value consumables differ by clinical criticality, sterility needs, workflow fit, and sourcing flexibility

Segmentation reveals that low-value consumables do not behave like a single category; they vary widely in clinical criticality, substitution tolerance, and logistics intensity. When viewed by product type, high-velocity basics tend to reward standardization because performance requirements are well understood and clinical preferences are often manageable through evidence-led evaluation. In contrast, specialized disposables used in niche procedures can be more sensitive to clinician preference and compatibility with existing equipment, making conversions more complex and requiring stronger change management.When examined by material composition and design characteristics, the segmentation highlights how infection prevention requirements and patient comfort influence purchasing decisions. Items with direct patient contact may face heightened scrutiny around skin compatibility, sterility assurance, and latex or allergen considerations. Meanwhile, products with stronger sustainability pressure may be segmented by packaging format or recyclability potential, influencing supplier selection even when unit price differences appear small.

Looking through the lens of sterility and intended use environment, segmentation underscores that clinical risk governs substitution more than cost. Consumables used in sterile fields typically require more robust validation and tighter lot control, which can reduce sourcing flexibility and heighten the value of dependable suppliers. Non-sterile, general-care items may offer broader substitution options, creating greater leverage for buyers to rationalize SKUs and consolidate vendors.

Segmenting by end-use department and site of care also clarifies why utilization varies across hospitals. Emergency departments, operating suites, inpatient wards, and outpatient clinics each have distinct consumption patterns driven by workflow, case mix, and staffing models. Items that appear interchangeable on paper can create different time burdens depending on how they are stocked, opened, and documented. Consequently, product decisions increasingly incorporate labor impact, not just clinical function.

Finally, segmentation by procurement and distribution channel highlights where operational friction emerges. Central distribution models can reduce variation but may struggle when clinical units demand rapid access to frequently used items. Unit-based replenishment approaches can improve responsiveness but may increase shrink, expiration, or undocumented usage if controls are weak. These segmentation insights suggest that the best strategies align product standardization with the realities of each care setting, ensuring that governance, logistics, and clinical acceptance move together rather than in isolation.

{{SEGMENTATION_LIST}}

Regional insights connecting procurement maturity, logistics reliability, and policy pressures to the way hospitals manage low-value consumables portfolios

Regional dynamics shape low-value consumables through differences in regulatory expectations, manufacturing footprints, logistics reliability, and hospital procurement maturity. In the Americas, large integrated delivery networks tend to drive enterprise standardization and contract consolidation, while ongoing pressure to maintain service levels amid labor constraints elevates interest in replenishment automation and clinician-friendly product design. Trade policy sensitivity also increases attention to supplier diversity and total landed cost discipline.In Europe, the intersection of sustainability mandates, public procurement requirements, and quality expectations influences how hospitals evaluate packaging, waste reduction, and supplier transparency. Tendering processes can intensify competition, but they also elevate the importance of documented compliance, product traceability, and standardized specifications. Consequently, suppliers that can demonstrate environmental responsibility alongside consistent quality are often advantaged.

Across the Middle East and parts of Africa, infrastructure variability and distribution capabilities can be decisive. Some markets emphasize rapid hospital expansion and modernization, which increases demand for dependable supply partners, predictable lead times, and training support for product conversions. In settings where import dependence is high, continuity planning and robust distributor relationships play an outsized role in reducing stockout risk.

In Asia-Pacific, manufacturing concentration, evolving regulatory frameworks, and fast-growing healthcare delivery models create a complex landscape. Hospitals may balance cost sensitivity with rising expectations for quality and infection prevention, while supply chains can vary from highly sophisticated to fragmented depending on the country and health system structure. This region also highlights the strategic importance of multi-country manufacturing strategies and the ability to support localization, labeling requirements, and rapid scaling.

Across all regions, one theme persists: hospitals are prioritizing resilience and operational simplicity. Whether the driver is sustainability, public tendering discipline, import exposure, or workforce constraints, regional insights point to the same imperative-build consumable portfolios that are easier to manage, easier to substitute safely, and supported by suppliers that can deliver stable service.

{{GEOGRAPHY_REGION_LIST}}

Company insights highlighting how winners differentiate through service reliability, portfolio coherence, data readiness, and conversion support beyond price

Competitive advantage in low-value consumables increasingly depends on execution quality rather than product novelty. Leading companies differentiate themselves through dependable fill rates, breadth of portfolio, and the ability to support standardization across multi-site health systems. As hospitals compress SKU counts, suppliers that offer coherent product families-supported by consistent specifications, packaging logic, and conversion support-can reduce adoption friction and earn larger share of wallet within standardized formularies.Another differentiator is data and interoperability readiness. Companies that invest in clean product masters, standardized identifiers, and accurate attributes make it easier for hospitals to maintain item catalogs, enable automation, and reduce errors in replenishment and documentation. This capability becomes even more valuable when hospitals pursue enterprise analytics to connect consumption with clinical activity, waste, and operational KPIs.

Service models also matter. Suppliers that provide implementation playbooks, in-servicing, and clinician education can shorten conversion cycles and reduce resistance to change. For private-label and value-tier offerings, trust is built through transparent quality systems, consistent manufacturing controls, and responsive complaint handling. In an environment where substitutions are common, hospitals reward vendors that make equivalency clear, communicate changes proactively, and maintain continuity during disruptions.

Distribution strategy is equally critical. Companies with strong distributor partnerships and optimized case-pack configurations can reduce receiving burden and improve shelf availability at the unit level. Meanwhile, manufacturers with diversified production footprints are better equipped to navigate trade uncertainty and regional disruptions. Over time, these capabilities elevate certain players from commodity providers to operational partners, especially when they can demonstrate measurable reductions in waste, variation, and handling time.

Taken together, the strongest companies pair cost competitiveness with reliability, data discipline, and conversion excellence. Hospitals are less willing to accept friction in exchange for marginal unit savings, and suppliers that internalize this shift will be better positioned as procurement becomes more outcomes-oriented.

Actionable recommendations to reduce SKU complexity, improve utilization visibility, harden supply continuity, and align cost with clinical workflow needs

Industry leaders can strengthen performance in low-value consumables by treating the category as an operating system rather than a set of line items. Start by establishing tighter governance for standardization: define clinically acceptable specifications, build pre-approved alternates, and align stakeholders across nursing, infection prevention, supply chain, and finance. This reduces last-minute substitutions and prevents variation from re-entering through decentralized purchasing.Next, prioritize item master integrity and consumption visibility. Normalize product data, tighten controls on new item introduction, and connect replenishment signals to actual utilization where possible. When hospitals can see where, when, and why items are used, they can reduce waste from over-stocking, prevent expiration, and identify training gaps that drive unnecessary consumption.

Contracting strategy should evolve to address volatility. Leaders can negotiate clearer service-level expectations, define transparent processes for price changes, and incorporate continuity commitments that reflect the operational importance of these products. Where tariff or logistics risk is meaningful, consider structured dual-sourcing and scenario-based contingency planning rather than relying on reactive spot buying.

Operationally, redesign replenishment with labor constraints in mind. Evaluate whether unit-based stock, central distribution, or hybrid models best support each department’s workflow, and adjust par levels to match real demand rather than historical habit. Pair these changes with packaging and case-pack optimization to reduce touches across receiving, stocking, and point-of-use handling.

Finally, embed sustainability and safety into the decision framework without allowing them to become abstract ideals. Set practical targets for packaging reduction, recyclable materials where feasible, and elimination of avoidable waste, while ensuring infection prevention standards remain uncompromised. Suppliers should be expected to contribute with measurable improvements in packaging efficiency, labeling clarity, and quality transparency, turning values into verifiable operating gains.

Research methodology built on stakeholder validation, disciplined scope definition, and triangulated analysis for decision-ready consumables intelligence

The research methodology integrates primary engagement with market participants and rigorous secondary review to build a grounded view of hospitals’ low-value consumables. The work begins with defining the category scope and clarifying inclusion criteria across commonly purchased, high-velocity consumables used in routine care settings. This ensures the analysis focuses on products where unit economics can be deceptive but operational impact is significant.Primary research incorporates structured discussions with stakeholders across the ecosystem, including hospital procurement and supply chain leaders, clinicians involved in standardization decisions, and supplier-side experts spanning manufacturing, distribution, and product management. These conversations are designed to capture how buying decisions are made in practice, what drives substitutions, and where friction arises during conversions and disruptions.

Secondary research synthesizes publicly available regulatory guidance, trade and customs policy documentation, quality and standards references, and industry publications relevant to hospital operations and medical consumables. This step is used to validate terminology, understand compliance expectations, and triangulate themes observed in interviews.

Analytical steps include mapping competitive positioning based on capabilities that matter to hospitals-service reliability, portfolio breadth, data readiness, and conversion support-while also evaluating how policy changes can affect sourcing and contracting. Throughout, the methodology emphasizes consistency checks and cross-validation, ensuring that insights reflect repeatable patterns rather than isolated anecdotes.

Finally, findings are organized to support decision-making: clarifying what is changing, where risks concentrate, and which operational levers can improve resilience. This approach helps leaders translate market insight into category strategies, contracting structures, and implementation roadmaps suited to real hospital constraints.

Conclusion on why low-value consumables have become a compounding advantage through standardization, resilience planning, and workflow-aligned sourcing

Low-value consumables have moved from a background procurement task to a strategic priority because they sit at the intersection of cost, labor, safety, and continuity of care. Hospitals are recognizing that the greatest gains often come not from chasing the lowest unit price, but from reducing variation, preventing waste, and ensuring consistent availability at the point of use.As the landscape evolves, resilience-first sourcing, data-driven standardization, and operationally aligned logistics are becoming the hallmarks of leading programs. Meanwhile, tariff-related pressures and broader policy volatility reinforce the importance of total landed cost thinking and contract structures that can absorb change without creating administrative overload.

The most durable strategies will be those that align clinical acceptance with supply chain discipline. Hospitals that build governance, maintain clean product data, and require suppliers to support conversions and continuity will be better equipped to stabilize operations and protect care delivery. In parallel, suppliers that invest in reliability, transparency, and implementation support will be positioned as partners rather than interchangeable commodity sources.

Ultimately, improving performance in low-value consumables is a compounding advantage. It reduces daily friction for clinicians, strengthens preparedness for disruption, and creates a scalable foundation for broader supply chain transformation.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

16. China Hospitals Low-value Consumables Market

Companies Mentioned

The key companies profiled in this Hospitals Low-value Consumables market report include:- 3M Company

- B. Braun Melsungen AG

- Becton, Dickinson and Company

- Blue Sail Medical Co., Ltd.

- Cardinal Health, Inc.

- Coloplast A/S

- ConvaTec Group PLC

- Gerresheimer AG

- Johnson & Johnson

- Kimberly-Clark Corporation

- Medline Industries, L.P.

- Medtronic plc

- Mölnlycke Health Care AB

- Nipro Corporation

- Owens & Minor, Inc.

- Smith & Nephew plc

- Teleflex Incorporated

- Terumo Corporation

- Top Glove Corporation Bhd

- Zhende Medical Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

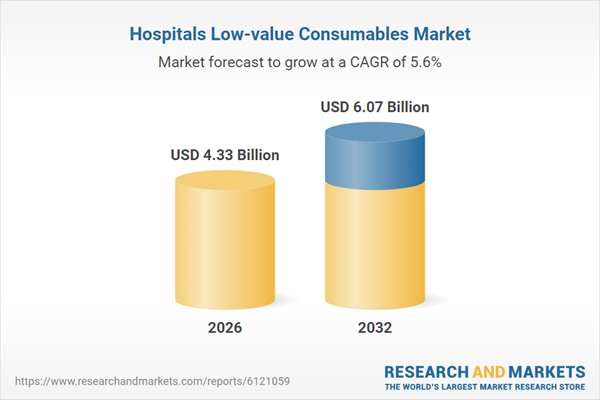

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 4.33 Billion |

| Forecasted Market Value ( USD | $ 6.07 Billion |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |