Speak directly to the analyst to clarify any post sales queries you may have.

Magnetic reed switches are evolving from simple proximity components into engineered reliability solutions shaped by modern safety, lifecycle, and sourcing demands

Magnetic reed switches remain one of the most elegant electromechanical sensing technologies: a sealed pair of ferromagnetic reeds that close or open in response to a magnetic field. That simplicity is precisely why the component continues to appear across high-volume consumer devices and mission-critical industrial systems alike. When engineers need galvanic isolation, low leakage, stable off-state behavior, and straightforward interfacing without power-hungry electronics at the sensing point, reed switches still earn consideration even in an era dominated by solid-state sensors.What has changed is the context in which reed switches are specified. Product teams increasingly design for harsh operating conditions, compact form factors, and long service life under frequent actuation. At the same time, compliance requirements and customer expectations around safety, sustainability, and supply chain traceability continue to rise. These forces are reshaping what “good enough” looks like for reed switch performance, as well as how suppliers differentiate through materials, hermetic sealing quality, contact plating, and process controls.

Against this backdrop, the magnetic reed switch landscape is best understood as a convergence of mechanical endurance, magnetic design discipline, and industrialized manufacturing excellence. As the following sections show, the market’s evolution is being driven by transformative shifts in application demand, changing cost structures, renewed attention to localization and resilience, and sharper segmentation across end uses, mounting styles, and performance tiers.

Competitive dynamics are shifting from catalog-based price competition to application-engineered reed solutions, tighter qualification, and resilient multi-region supply models

The competitive landscape for magnetic reed switches is undergoing a structural shift from broad catalog competition toward application-specific engineering value. Historically, many reed switch designs competed primarily on availability, basic sensitivity classes, and unit cost. Now, as devices become more compact and operating environments more punishing, buyers are prioritizing repeatable actuation points, contact stability over life, and predictable behavior in the presence of external magnetic noise. This is pushing suppliers to emphasize tighter process control, refined ferromagnetic materials, and improved gas fill and sealing practices that support consistent long-term performance.In parallel, the role of reed switches within system architectures is changing. In some applications, reed switches are being replaced by Hall-effect or magnetoresistive sensors due to their programmability and diagnostic capabilities. However, that substitution is not universal. Where ultra-low power, electrical isolation, or intrinsic simplicity is paramount, reed switches are being retained and often redesigned into integrated sensing assemblies. As a result, demand is shifting from standalone components toward reed-based subassemblies, such as sensor modules embedded in housings, float-switch mechanisms, or security contacts preconfigured for rapid installation.

Another notable shift is the heightened focus on reliability engineering and qualification rigor. Automotive-grade expectations are influencing adjacent sectors, with more customers requesting deeper documentation around endurance cycling, shock and vibration resistance, and behavior under temperature extremes. This is reinforcing investments in advanced testing, statistical process control, and traceability systems. Suppliers that can translate these capabilities into fast qualification support are gaining leverage, particularly when OEMs are trying to reduce redesign cycles and accelerate time-to-market.

Finally, supply chain strategy is becoming a core competitive variable. Companies are diversifying supplier bases, rebalancing inventory policies, and demanding clearer visibility into upstream material sourcing. These shifts reflect lessons learned from multi-year disruptions, and they are pushing reed switch manufacturers to demonstrate resilience through multi-site production, regional stocking strategies, and more transparent change-control processes. Collectively, these transformations are redefining customer expectations and raising the bar for both product and operational excellence.

United States tariff developments for 2025 are reshaping landed-cost models, qualification strategies, and origin governance across reed switch value chains

United States tariff policy developments anticipated for 2025 are set to influence magnetic reed switch procurement strategies, even for organizations that do not manufacture final products in the U.S. Because reed switches often move through multi-country value chains-component fabrication, plating, glass sealing, lead forming, packaging, and distribution-tariff changes can compound across stages. As a result, procurement teams are increasingly modeling total landed cost rather than focusing narrowly on per-unit pricing.A practical near-term impact is renewed attention to origin management and documentation discipline. When tariffs vary by country of origin or by classification details, the precision of part descriptions, harmonized tariff coding, and supplier declarations becomes critical. Many buyers will respond by tightening contractual language around origin changes and by implementing stronger governance for engineering change notifications, since a small process or site change can alter tariff exposure and disrupt previously stable cost assumptions.

Tariff uncertainty also tends to reshape negotiation behavior. Buyers often seek longer pricing validity windows, buffering through safety stock, or dual-sourcing arrangements that preserve continuity if trade measures shift suddenly. For reed switch suppliers, that environment can reward those with regional manufacturing options or distribution footprints that allow customers to rebalance sourcing without requalifying a completely different design. Conversely, suppliers relying on single-country manufacturing may face pressure to justify their risk profile with stronger lead-time guarantees, inventory programs, or localized finishing operations.

Over time, a subtler but important consequence may be the acceleration of design-to-availability thinking. Engineering teams may prioritize reed switch variants that are functionally equivalent across multiple qualified suppliers and geographies, even if that means accepting slightly different sensitivity ranges or packaging styles. This mindset favors standardized footprints, well-documented performance envelopes, and robust interchangeability rules. In effect, tariff dynamics are not only a cost issue; they influence how products are designed, qualified, and managed throughout their lifecycle.

Segmentation reveals how contact logic, packaging choices, sensitivity classes, and end-use requirements combine to determine the most reliable reed switch fit

Segmentation insights for magnetic reed switches become most actionable when the interplay between product configuration, operating requirements, and downstream integration is made explicit. By product type, the distinction between normally open, normally closed, and changeover designs continues to map directly to safety logic and fail-state preferences. Normally open variants often dominate in simple proximity detection and power-saving designs, while normally closed designs are chosen when continuity monitoring or fail-safe behavior is required. Changeover configurations, though less ubiquitous, remain valuable where systems need explicit state switching without additional circuitry.When viewed through the lens of mounting and packaging, through-hole and surface-mount formats increasingly reflect not only assembly preferences but also mechanical robustness expectations. Through-hole reed switches remain common in applications where lead forming, mechanical anchoring, and spacing from magnetic sources are tuned during assembly. Surface-mount versions are advancing where compact electronics and automated placement dominate, yet they demand careful attention to thermal profiles, board stress, and the mechanical coupling between the switch and the magnet. The segmentation by form factor-such as cylindrical glass bodies, flat packages, or encapsulated modules-highlights a broader trend: customers are selecting packaging as a reliability feature, not merely a convenience.

Sensitivity and actuation characteristics create another layer of differentiation. Low pull-in variants can enable compact magnet designs or longer sensing distances, but they can also be more susceptible to stray fields and require careful magnetic circuit design. Higher pull-in switches may provide better immunity in noisy environments but can increase magnet size or alignment constraints. As a result, customers are increasingly segmenting by defined operating points, hysteresis behavior, and stability over temperature, especially in industrial equipment and transportation-related uses.

End-use segmentation reveals why demand profiles vary widely. In automotive and mobility-adjacent systems, reed switches are often evaluated under elevated vibration, temperature cycling, and long-life switching requirements, making plating quality and hermetic integrity central concerns. In industrial automation, the component’s value is frequently tied to robust performance in the presence of electromagnetic interference and harsh ambient conditions, which elevates the importance of encapsulation and connectorized sensor assemblies. In consumer electronics and smart home devices, the focus shifts toward miniaturization, consistent feel in user interactions, and rapid assembly, which favors standardized packages and tight process repeatability. In security and access control, the preference leans toward stable actuation with predictable magnet pairing and tamper-resistance considerations.

Segmentation by application mode-such as proximity sensing, level detection through float mechanisms, position and end-stop sensing, or speed and rotation detection-further clarifies buying criteria. Level detection often prioritizes chemical compatibility and sealing robustness of the overall assembly rather than the bare switch alone. Position sensing in machinery emphasizes switching life, contact resistance stability, and mounting repeatability. Meanwhile, rotation detection can stress bounce characteristics and response consistency at varying speeds. Across these segments, the most successful suppliers are those that translate a broad reed portfolio into clearly defined application playbooks, helping customers select the right combination of sensitivity, packaging, and contact system while reducing redesign iterations.

Finally, segmentation by distribution channel and customer type is becoming more pronounced. High-volume OEMs increasingly seek direct technical engagement, customized lead options, and change-control transparency. Smaller manufacturers and maintenance-focused buyers often rely on distributors for availability and cross-referencing support. This divergence is prompting suppliers to refine their go-to-market models, aligning technical service depth and inventory positioning with each customer segment’s purchasing behavior.

Regional dynamics highlight how compliance intensity, manufacturing concentration, and environmental conditions shape reed switch demand across major global markets

Regional insights for magnetic reed switches reflect the intersection of industrial demand patterns, manufacturing ecosystems, and procurement risk management. In the Americas, customers tend to emphasize supply assurance, documentation rigor, and stable performance across operating extremes, particularly in industrial automation, security infrastructure, and transportation-adjacent applications. Design teams in this region often balance the desire for proven electromechanical simplicity with the increasing need for traceability and qualification evidence, reinforcing opportunities for suppliers that can deliver consistent lifecycle support and clear change-control practices.In Europe, the reed switch landscape is strongly shaped by stringent safety norms, sustainability expectations, and an engineering culture that rewards reliability verification. Buyers frequently expect robust compliance documentation and predictable long-term availability, especially for industrial equipment, building technology, and specialized instrumentation. This environment can favor higher-quality sealed constructions, carefully specified contact plating systems, and well-characterized switching behavior over temperature. As electrification initiatives and automation modernization continue, reed switches remain relevant where passive sensing and electrical isolation support dependable architectures.

The Middle East and Africa present a set of opportunities linked to infrastructure development, security deployment, and industrial projects that often operate under challenging environmental conditions. In these contexts, the reed switch itself is frequently one part of a broader sensor assembly that must withstand heat, dust, and installation variability. As procurement organizations in the region strengthen their vendor qualification approaches, suppliers that can support integrators with ruggedized modules, clear specifications, and dependable distribution coverage are positioned to gain share of project-based demand.

Asia-Pacific remains a central hub for electronics manufacturing and a major source of both component supply and end-product demand. High-volume production environments in this region encourage standardization, process efficiency, and rapid iteration, which in turn drives expectations for consistent sensitivity bins, predictable packaging quality, and reliable lead times. At the same time, the diversity of end markets-from consumer devices to industrial modernization-creates a wide range of performance requirements. This encourages suppliers to maintain broad portfolios while also offering tighter customization for magnet pairing, form factor constraints, and assembly automation needs.

Across regions, an important unifying trend is the growing value of multi-location sourcing and regional stocking strategies. Organizations are increasingly designing procurement playbooks that keep technical specifications stable while allowing geographic flexibility. That shift elevates the importance of globally consistent part documentation, cross-region qualification support, and a supplier’s ability to maintain equivalent performance across different production sites.

Company differentiation is defined by sealing and contact mastery, qualification support, resilient manufacturing footprints, and solution partnerships beyond the bare switch

Key company insights in magnetic reed switches increasingly center on how well suppliers translate core reed expertise into scalable, high-reliability production and application support. Leaders distinguish themselves through hermetic sealing competence, consistent sensitivity control, and robust contact systems that maintain low and stable resistance over repeated cycling. Beyond the switch capsule itself, many notable players are strengthening their positions by offering integrated sensor assemblies, prewired solutions, and application-specific packaging that reduces installation complexity and improves field reliability.Another differentiator is the ability to support customers through qualification and lifecycle management. Companies that provide detailed reliability data, clear process documentation, and responsive engineering engagement tend to be preferred partners for long-lived industrial programs and regulated applications. This includes disciplined control over materials, plating chemistry, and glass-to-metal sealing processes, as well as structured change notification practices that reduce the risk of unexpected performance variation.

Manufacturing footprint and operational resilience also separate strong competitors from the rest. Firms with diversified production and regional logistics capabilities can help customers navigate lead-time volatility, trade policy shifts, and localized demand surges. In addition, suppliers that invest in automation, in-line inspection, and statistical controls are better positioned to deliver consistent performance at scale, which matters for both high-volume consumer programs and industrial clients that cannot tolerate drift in switching points.

Finally, strategic positioning is increasingly defined by ecosystem partnerships. Some companies build advantage by collaborating with magnet suppliers, sensor housing manufacturers, and distributor networks to deliver validated, repeatable sensing solutions rather than standalone parts. This solution-oriented approach helps customers reduce engineering effort, accelerate design verification, and improve interchangeability planning-benefits that are becoming central as procurement and engineering teams align more tightly on risk management.

Action steps to improve reliability, interchangeability, and supply resilience span specification discipline, magnet co-design, rigorous qualification, and change-control governance

Industry leaders can take several concrete actions to strengthen competitiveness and reduce risk in magnetic reed switch programs. First, align engineering specifications with procurement resilience by defining acceptable sensitivity bands, hysteresis ranges, and packaging tolerances that enable second-source qualification without compromising system performance. When interchangeability is treated as a design requirement rather than a procurement afterthought, organizations reduce exposure to sudden lead-time changes and policy-driven cost shifts.Next, institutionalize magnet-and-switch co-design practices. Many field issues attributed to reed switches originate from magnetic circuit decisions, installation variability, or environmental influences rather than from the switch capsule itself. Building a repeatable method for magnet selection, air-gap control, and tolerance stack-up analysis can reduce false triggers, missed actuations, and service returns. This is particularly valuable when transitioning from through-hole legacy designs to more compact surface-mount or encapsulated formats.

Leaders should also upgrade qualification strategies to reflect modern reliability expectations. That means specifying endurance cycling that matches real use profiles, validating behavior under shock and vibration where relevant, and confirming stability across temperature and humidity ranges that reflect worst-case environments. Where reed switches are used in safety-relevant circuits, incorporate failure-mode thinking early by validating contact behavior under abnormal conditions and by ensuring that the chosen normal state supports the intended fail-safe logic.

On the supply side, tariff and trade uncertainty make origin governance and change-control discipline non-negotiable. Strengthen supplier agreements to require proactive notification of site transfers, material substitutions, and plating or sealing process changes. At the same time, develop landed-cost models that incorporate classification clarity and logistics variability, and revisit inventory policies for long-lead assemblies that include reed-based modules.

Finally, use portfolio rationalization to reduce complexity without sacrificing performance. Standardizing on a smaller set of validated packages and sensitivity classes-while maintaining a documented cross-reference strategy-can streamline testing, reduce qualification overhead, and simplify service logistics. This approach creates a foundation for scalable growth and faster product development cycles, especially for organizations managing multiple platforms or regional product variants.

Methodology combines technical baseline mapping, segmentation-led interpretation, and supply-chain policy assessment to produce implementation-ready reed switch insights

The research methodology for this executive summary is designed to produce an implementation-oriented view of the magnetic reed switch landscape without relying on speculative sizing claims. The work begins with structured framing of the technology domain, including reed switch operating principles, key failure modes, packaging approaches, and the engineering variables that most strongly influence performance in real installations. This technical baseline enables consistent comparison across suppliers and application contexts.Next, the study applies a structured segmentation lens to map how customer requirements differ by switch configuration, packaging and mounting format, sensitivity class, application mode, and end-use environment. This segmentation approach is used to interpret demand drivers and qualification expectations, focusing on how specification choices affect reliability, manufacturability, and sourcing flexibility. Throughout, emphasis is placed on identifying decision points that change outcomes, such as tolerance management with magnets, the trade-offs between sensitivity and immunity to stray fields, and the implications of encapsulation for thermal and mechanical stress.

The methodology also incorporates a policy and supply-chain assessment focused on trade dynamics, origin documentation, and operational resilience. Rather than treating tariffs as an external footnote, the analysis evaluates how tariff uncertainty changes sourcing strategies, qualification planning, and inventory behavior. This ensures that recommendations address the real constraints faced by procurement, engineering, and operations teams.

Finally, insights are synthesized into practical guidance for product leaders, design engineers, and sourcing managers. The objective is to connect technical attributes with business outcomes-reducing redesign cycles, improving field reliability, and strengthening continuity of supply. This approach supports decision-making across new product introduction, cost optimization, and lifecycle management activities.

Reed switches remain vital where passive, isolated sensing is prized, but success now depends on engineered selection, validation rigor, and supply resilience

Magnetic reed switches continue to earn their place in modern systems because they deliver passive, isolated, and dependable switching in a compact form. Yet the environment around them is changing: applications are becoming more demanding, qualification expectations are rising, and supply-chain decisions are increasingly shaped by resilience planning and trade policy considerations.The landscape is therefore best understood as a shift from commodity component selection to engineered system decisions. Packaging choice, sensitivity selection, and magnet pairing now carry greater consequences for reliability and manufacturability. At the same time, buyers are asking suppliers to provide not only parts, but also documentation discipline, change-control transparency, and support for faster qualification.

Organizations that treat reed switch selection as a cross-functional decision-linking engineering, quality, and procurement-will be best positioned to protect performance while maintaining sourcing flexibility. With thoughtful specification practices, rigorous validation, and proactive supply governance, reed switches can remain a highly effective solution across industrial automation, security, consumer devices, and specialized sensing applications.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Magnetic Reed Switch Market

Companies Mentioned

The key companies profiled in this Magnetic Reed Switch market report include:- 1LEAP Technologies Private Limited

- Aditi Automation

- Apple Automation and Sensor

- Coto Technology, Inc.

- Electronic Switches Private Limited

- HSI Sensing, Inc.

- J.K. Enterprises

- Littelfuse, Inc.

- Magicpack Automations Private Limited

- Magnasphere Corporation

- Nippon Aleph Corporation

- OKI Sensor Device Corporation

- Ovion Industries

- PIC Proximity Instrumentation Controls Kontaktbauele GmbH

- Reed Relays and Electronics India Limited

- SBM Electric Techno Private Limited

- SICK AG

- Spektrum Fluid Power Private Limited

- Standex Electronics, Inc.

- TE Connectivity Ltd.

Table Information

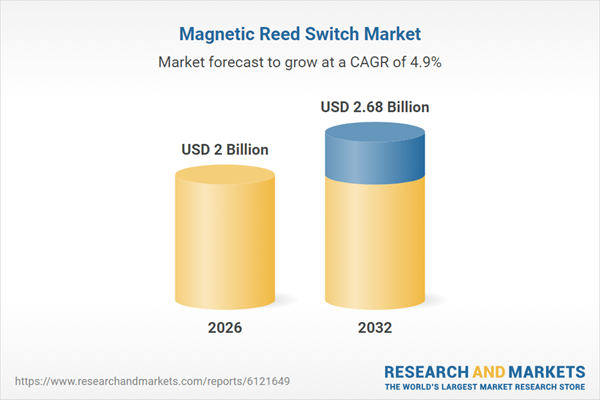

| Report Attribute | Details |

|---|---|

| No. of Pages | 197 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 2 Billion |

| Forecasted Market Value ( USD | $ 2.68 Billion |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |