Speak directly to the analyst to clarify any post sales queries you may have.

Industrial electrocoat is shifting from a corrosion-control staple to a strategic manufacturing platform shaped by sustainability, complexity, and resilience

Industrial electrocoat, commonly referred to as e-coat, has moved beyond its legacy perception as a dependable corrosion-control workhorse and has become a strategic enabler for modern manufacturing. As product architectures evolve and supply chains regionalize, e-coat lines increasingly sit at the intersection of quality, throughput, sustainability, and total cost of ownership. Manufacturers that treat electrocoat as an integrated system-pretreatment chemistry, bath control, power supply, line design, curing, and compliance-are better positioned to deliver consistent film integrity across complex geometries and mixed-metal substrates.The market’s center of gravity is also shifting toward performance under real-world duty cycles rather than laboratory-only benchmarks. Demands for longer corrosion warranties, improved edge coverage on sharp features, and higher resistance to chipping and underfilm creep are influencing resin design and process windows. At the same time, a heightened focus on environmental and worker-safety compliance is tightening expectations around low-VOC operations, energy efficiency in curing, and responsible management of bath ultrafiltration and waste streams.

Against this backdrop, industrial electrocoat is increasingly framed as a platform technology. It provides a stable base layer that allows downstream topcoats-powder, liquid, or hybrid systems-to perform more reliably, especially in harsh environments. Consequently, decision-makers are revisiting long-standing assumptions around line utilization, bath life, and the make-versus-buy logic for coating operations. These choices are further complicated by trade policy and tariff-related cost volatility, which can quickly change the economics of imported resins, pigments, equipment, and coated components.

This executive summary synthesizes the pivotal shifts reshaping industrial electrocoat and highlights how segmentation dynamics, regional patterns, competitive positioning, and 2025 tariff conditions are changing the strategic playbook. The intent is to provide leaders with a clear, action-oriented understanding of where value is being created and what operational levers matter most in the current landscape.

Transformative landscape shifts are redefining industrial electrocoat through multi-substrate demands, digital process control, and sustainability-led operations

Industrial electrocoat is experiencing transformative shifts that are redefining how manufacturers design, run, and optimize coating operations. One of the most consequential changes is the move toward multi-substrate compatibility. As lightweighting and design-for-efficiency spread across industries, coating lines are increasingly required to handle mixed-metal assemblies that combine steel grades, galvanized substrates, aluminum, and in some cases castings with variable surface conditions. This is driving tighter pretreatment control, more robust contamination management, and resin packages that tolerate broader process variability without sacrificing appearance or corrosion performance.In parallel, regulatory and customer requirements are accelerating the transition to lower-emission operations and improved stewardship of water and waste. While electrocoat is inherently efficient compared with many spray-applied alternatives due to high transfer efficiency and reclaim, plants are still under pressure to reduce energy consumed in curing and to optimize ultrafiltration, bath turnover, and sludge handling. As a result, continuous improvement programs now treat electrocoat as a closed-loop system where chemistry, maintenance, and utilities are optimized together rather than in isolation.

Automation and digitalization are also altering competitive advantage. Modern lines increasingly deploy inline sensing, conductivity and pH monitoring, temperature control, and advanced rectifier management to stabilize deposition. The operational goal has shifted from simply meeting film thickness targets to achieving repeatability across part families and shifts, minimizing rework and preventing defects such as craters, pinholes, and poor edge build. Data-driven control strategies are extending into pretreatment stages, where surface cleanliness and conversion coatings set the baseline for adhesion and corrosion resistance.

Another structural shift is the growing importance of tailored performance attributes beyond corrosion resistance. End users are placing more emphasis on stone-chip resistance, reduced curing times to unlock throughput, improved compatibility with powder topcoats, and better performance on sharp edges and recesses. At the same time, manufacturers are using electrocoat to buffer supply chain variability by standardizing primer performance even when upstream metal suppliers or downstream paint systems change.

Finally, the business environment is pushing companies to rethink network design. Localization, dual sourcing, and regional production footprints are becoming more prominent as geopolitical risks and freight uncertainty persist. This has elevated the value of flexible electrocoat lines capable of running multiple product mixes without extensive downtime, enabling plants to respond quickly to demand swings and new program launches. Collectively, these shifts are transforming electrocoat from a mature process into a dynamic arena where innovation, operational discipline, and supply resilience define winners.

United States tariffs in 2025 are reshaping electrocoat economics by altering input costs, accelerating localization, and raising the bar for supply resilience

The cumulative impact of United States tariffs in 2025 is felt most acutely through cost structure volatility, sourcing recalibration, and negotiation dynamics across the electrocoat value chain. Even when tariffs do not directly target electrocoat coatings as finished goods, they can influence the economics of key inputs such as resins, specialty additives, pigments, steel and aluminum components, and capital equipment used for rectification, conveyors, and curing systems. These indirect effects can raise the landed cost of both materials and spare parts, making maintenance planning and inventory strategy more consequential than in prior years.A second-order consequence is the acceleration of supplier requalification and localization programs. Coaters and OEMs are revisiting approved vendor lists to ensure continuity of supply under changing tariff codes and compliance requirements. In many cases, procurement teams are requiring clearer country-of-origin documentation, more transparent pricing breakdowns, and tariff-adjustment clauses in supply agreements. This creates a strategic advantage for suppliers that can offer regional manufacturing, bonded warehousing options, or stable cross-border logistics.

Tariffs are also reshaping the competitive calculus between importing coated components and coating domestically. For some product categories, higher tariffs on finished or semi-finished components can make domestic electrocoating more attractive, particularly when local coaters can meet quality and throughput expectations. However, this shift also stresses domestic capacity and can expose gaps in technical capability, especially for parts with complex geometries or stringent corrosion specifications. As a result, partnerships between coating applicators and chemistry suppliers are becoming more critical to ramp quality quickly and avoid costly program delays.

From a pricing perspective, the 2025 environment is reinforcing the need for disciplined cost-to-serve models. Electrocoat operations with high energy intensity, older ovens, or inconsistent bath control may see margins compressed if they cannot pass through input cost increases. Conversely, plants that have invested in energy optimization, bath life extension, and defect reduction are better positioned to absorb volatility while maintaining service levels. In addition, finance and operations leaders are increasingly evaluating tariff risk alongside currency exposure and freight rates, treating trade policy as a core operational variable rather than an external shock.

Over time, the cumulative effect is a more regionalized and contract-driven market. Decision-makers are prioritizing resilience-qualifying alternate chemistries, diversifying sources for critical additives, and standardizing process parameters across sites to enable load shifting. Tariffs, therefore, are not merely a cost factor; they are catalyzing structural changes in sourcing, capacity allocation, and the operational maturity required to compete effectively in the U.S. landscape.

Segmentation insights show industrial electrocoat choices hinge on resin chemistry, cathodic versus anodic systems, end-use demands, substrates, and line economics

Key segmentation insights reveal that industrial electrocoat is best understood through how technology choices align with part geometry, substrate mix, compliance constraints, and downstream finishing requirements. By product type, epoxy systems continue to anchor applications where corrosion performance and chemical resistance are paramount, while acrylic offerings are gaining attention where UV stability and exterior durability matter more. Polyurethane and hybrid chemistries are increasingly evaluated when customers demand a balance between flexibility, appearance, and compatibility with diverse topcoat stacks, particularly as OEMs push for simplified coating architectures.By coating type, cathodic electrocoat remains the primary choice for high-corrosion environments because it generally supports superior corrosion resistance and robust underfilm protection, while anodic electrocoat retains relevance in select use cases where specific appearance or functional requirements are prioritized. This split is not merely historical; it reflects how plants balance deposition efficiency, edge coverage expectations, and the sensitivity of each system to bath contamination and pretreatment variability.

By application method and line configuration, decisions are increasingly influenced by throughput and mix complexity. High-volume lines prioritize repeatability, automated bath management, and rectifier performance to maintain uniform deposition, whereas high-mix operations emphasize quick changeover discipline, contamination control, and broader process windows. These operational realities shape which resin systems are preferred and how pretreatment is specified, especially when parts vary widely in mass, surface area, and drainage behavior.

By end-use industry, automotive and transportation continue to set demanding benchmarks for corrosion warranties and process capability, influencing broader adoption of tighter controls and more advanced pretreatments. Heavy equipment and agricultural machinery applications often emphasize thick, durable primer performance and resilience under abrasion and impact, while appliances and general industrial segments focus on cost-efficient consistency and appearance under indoor or mild outdoor exposure. Construction-related metal components and outdoor infrastructure emphasize long-term corrosion control and compatibility with topcoats designed for weathering and color retention.

By substrate, the rise of mixed-metal assemblies is driving renewed attention to pretreatment selection and bath stability. Galvanized steels and aluminum introduce distinct surface chemistries that can complicate adhesion and corrosion performance if pretreatment is not tuned appropriately. As manufacturers seek to reduce line downtime and rework, substrate-driven process capability has become a differentiator, influencing not only chemistry selection but also maintenance routines, filtration strategy, and quality inspection protocols.

By curing and energy strategy, plants are weighing conventional thermal curing against process optimizations that reduce energy demand and cycle time. This includes improved oven zoning, heat recovery, and tighter control of cure schedules to achieve required crosslinking without excessive energy use. The segmentation takeaway is clear: performance outcomes are increasingly determined by integrated system choices rather than any single material attribute, and leaders who align chemistry, equipment, and operating discipline to their specific segment needs gain a durable advantage.

Regional dynamics reveal distinct electrocoat priorities across the Americas, Europe, Middle East & Africa, and Asia-Pacific shaped by regulation and supply chains

Regional insights highlight how industrial electrocoat priorities differ based on manufacturing concentration, regulatory context, and supply chain architecture. In the Americas, decision-making is strongly shaped by nearshoring, tariff-driven sourcing shifts, and the need to modernize capacity for automotive, commercial vehicles, and industrial equipment. Buyers increasingly value suppliers and applicators that can ensure continuity of materials, offer technical service close to plants, and support rapid program launches with disciplined process qualification.In Europe, the market is characterized by stringent environmental expectations, mature automotive standards, and a strong emphasis on process efficiency and lifecycle stewardship. Operations frequently prioritize energy optimization, waste minimization, and compliance-ready chemistry selection. As electrification and lightweighting influence vehicle and component design, the region continues to emphasize electrocoat systems that perform consistently across mixed substrates while meeting demanding corrosion and durability specifications.

In the Middle East and Africa, growth opportunities are often tied to infrastructure investment, industrial expansion, and localization initiatives. Conditions such as heat, dust, and coastal salinity in many operating environments elevate corrosion resistance as a central value driver. At the same time, variability in industrial ecosystems across countries means that technical support, training, and reliable access to consumables can be decisive factors in supplier selection and in the success of new line installations.

In Asia-Pacific, scale, speed, and cost competitiveness shape the competitive environment, with significant manufacturing footprints spanning automotive, appliances, electronics, and general industrial goods. Many producers operate high-throughput coating lines and pursue aggressive efficiency targets, which raises the importance of stable bath control, automation, and defect prevention at scale. The region also exhibits rapid adoption of newer process controls in leading industrial hubs, while other areas focus on pragmatic upgrades that improve reliability and compliance without major line redesign.

Across all regions, a common thread is the rising importance of regional supply resilience and technical proximity. As manufacturers diversify sourcing and reassess network footprints, electrocoat partners that can provide consistent quality, localized troubleshooting, and adaptable chemistry portfolios will be best positioned to capture long-term relationships in each geography.

Company competitiveness in industrial electrocoat is increasingly defined by end-to-end process support, formulation innovation, compliance readiness, and supply reliability

Key company insights indicate that competitive differentiation in industrial electrocoat increasingly comes from the ability to deliver a complete, application-ready solution rather than a standalone coating product. Leading participants compete on the depth of their resin and additive portfolios, their capacity to support both cathodic and anodic systems, and their expertise in aligning pretreatment, bath control, and curing to specific customer production realities. Technical service strength-especially rapid troubleshooting, line audits, and operator training-has become a primary factor in supplier retention.Innovation is focused on improving edge coverage, reducing defect sensitivity, and extending bath stability under variable production conditions. Companies are also investing in chemistries that support lower-energy curing, improved compatibility with downstream topcoats, and robust performance on mixed-metal assemblies. Beyond the coating bath, competitive players differentiate through process control tools, digital monitoring support, and guidance on filtration and ultrafiltration practices that stabilize deposition and reduce operating disruptions.

Another hallmark of strong competitors is their ability to navigate compliance and stewardship requirements. Customers increasingly expect clear documentation for restricted substances, consistent quality management practices, and support for audits. Suppliers that can provide globally consistent formulations, or clearly managed regional equivalents, reduce qualification complexity for multinational manufacturers.

Finally, partnership models are evolving. Rather than transactional supply relationships, many organizations are moving toward multi-year collaboration frameworks that tie technical improvements to measurable operational outcomes such as reduced rework, faster ramp-ups, and more stable line performance. Companies that combine chemistry expertise with process engineering support and supply reliability are better positioned to win in an environment shaped by tariff volatility, tight quality standards, and the ongoing modernization of manufacturing footprints.

Actionable recommendations focus on stabilizing electrocoat operations, building tariff-ready supply resilience, optimizing energy use, and strengthening capability

Industry leaders can strengthen their position in industrial electrocoat by treating the process as a strategic capability with measurable operational and commercial outcomes. Start by standardizing electrocoat governance across sites, including clear ownership of bath health metrics, pretreatment performance indicators, and corrective-action routines. A disciplined control plan that links incoming substrate quality, pretreatment parameters, bath chemistry, and cure validation will reduce defect risk and improve repeatability across product families.Next, prioritize resilience in sourcing and qualification. Given tariff-driven volatility and potential disruptions in specialty inputs, leaders should dual-qualify critical raw materials where feasible and establish contingency recipes or approved alternates that maintain performance. Contract structures should incorporate transparent mechanisms for adjusting to tariff or freight shocks while protecting service continuity. In parallel, inventory strategy should be aligned to lead times for additives, membranes, and critical spares that can otherwise halt production.

Operationally, focus on energy and throughput optimization without compromising corrosion performance. Evaluate oven efficiency, zoning, and cure schedules, and connect these assessments to film performance validation rather than relying on legacy settings. Investments in rectifier upgrades, improved agitation and filtration, and modern inline monitoring often yield outsized benefits by stabilizing deposition and minimizing rework, particularly in high-volume lines where small defect rates translate into large costs.

From a product and customer standpoint, align electrocoat specifications to real service conditions and downstream coating stacks. Collaborate with topcoat providers and end customers to ensure compatibility, especially where powder-over-e-coat systems or multi-layer architectures are used. When mixed substrates are involved, prioritize pretreatment robustness and surface preparation discipline, and incorporate targeted validation for edge coverage and recessed areas to prevent field failures.

Finally, build organizational capability. Electrocoat performance depends heavily on operator expertise and maintenance rigor, so training, documentation, and continuous improvement routines should be treated as core assets. Leaders who combine technical excellence with supply resilience and cross-functional alignment will be best placed to convert electrocoat operations into a durable competitive advantage.

Methodology combines value-chain mapping, expert interviews, and triangulated secondary analysis to translate electrocoat complexity into decision-ready insight

The research methodology integrates structured primary engagement with rigorous secondary analysis to develop a grounded view of industrial electrocoat dynamics. The process begins with mapping the value chain, including resin and additive suppliers, pretreatment and process equipment providers, applicators, and end-use manufacturers. This framework guides the collection of information on operational priorities, qualification requirements, and the practical constraints that shape adoption and switching behavior.Primary inputs are developed through interviews and structured discussions with industry participants such as coating line managers, process engineers, procurement leaders, and technical service specialists. These conversations focus on real-world performance trade-offs, operational pain points, compliance and documentation needs, and the decision criteria used in selecting chemistries, pretreatment systems, and equipment upgrades. Insights are cross-checked across roles to reduce single-perspective bias and to validate how priorities differ between high-volume and high-mix operations.

Secondary research consolidates information from publicly available technical literature, regulatory frameworks, corporate disclosures, patent activity, trade publications, and standards bodies relevant to electrocoat performance and compliance. This material is used to contextualize technology evolution, environmental requirements, and the operational implications of equipment modernization and digital process control.

Throughout the study, triangulation is applied to reconcile differences between sources and to ensure that conclusions reflect consistent patterns rather than isolated claims. The segmentation and regional lenses are used to organize findings, clarify where requirements diverge, and identify practical implications for product strategy and operational planning. The result is an executive-ready narrative that connects technical realities with strategic decisions across procurement, manufacturing, and quality leadership.

Conclusion highlights electrocoat’s rising strategic importance as performance, compliance, and tariff-driven resilience demands reshape manufacturing priorities

Industrial electrocoat remains one of the most efficient and dependable priming technologies in modern manufacturing, but the basis of competition is changing. The process is now expected to perform reliably across mixed substrates, tighter quality standards, and more demanding corrosion and durability requirements, all while meeting elevated expectations for environmental stewardship and energy efficiency. These pressures are pushing companies to modernize both chemistry selection and operational control.At the same time, trade policy and tariff conditions in 2025 are reinforcing the importance of resilience. Organizations are revisiting supplier strategies, requalifying inputs, and reassessing the economics of domestic coating versus imported coated components. In this environment, the strongest performers will be those that connect process discipline with supply continuity and build flexible operations that can adapt quickly to shifting demand and product mixes.

The overarching conclusion is that electrocoat success is increasingly determined by system-level alignment. When pretreatment, bath management, rectification, curing, and quality validation are treated as a single integrated capability-supported by robust partnerships-manufacturers can improve consistency, reduce rework, and protect long-term performance in the field. Leaders who act on these priorities will be best positioned to sustain competitiveness as the industrial landscape continues to evolve.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Industrial Electrocoat Market

Companies Mentioned

The key companies profiled in this Industrial Electrocoat market report include:- Akzo Nobel N.V.

- Allnex Group S.A.

- Asian Paints Limited

- Axalta Coating Systems GmbH

- BASF SE

- Behr Process Corporation

- Chemetall

- Crown Paints Ltd.

- Henkel AG & Co. KGaA

- Jotun A/S

- Kansai Paint Co., Ltd.

- Masco Corporation

- Nippon Paint (USA) Inc.

- Nippon Paint Holdings Co., Ltd.

- PPG Architectural Coatings LLC

- RPM Protective Coatings Group

- Sika AG

- The Sherwin-Williams Company

- Tikkurila Oyj

- Valspar Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 184 |

| Published | January 2026 |

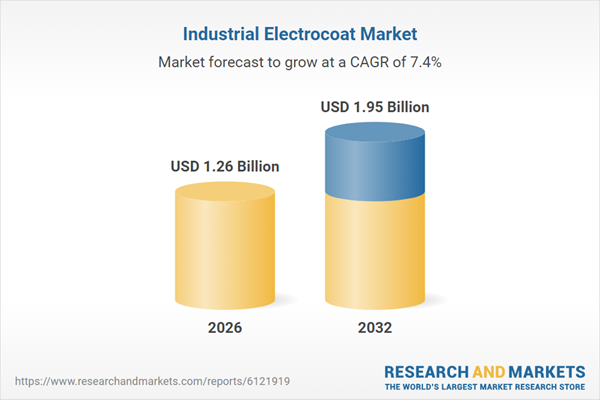

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 1.26 Billion |

| Forecasted Market Value ( USD | $ 1.95 Billion |

| Compound Annual Growth Rate | 7.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |