Speak directly to the analyst to clarify any post sales queries you may have.

Hydrogen cookers emerge as a strategic decarbonization appliance category where safety, infrastructure readiness, and performance credibility define adoption

Hydrogen cookers are moving from experimental demonstrations into an emerging category shaped by decarbonization mandates, resilience planning, and renewed attention to household and commercial energy security. At their core, these appliances promise high-temperature cooking performance while shifting direct-use emissions away from carbon-based fuels, provided the upstream hydrogen is produced with low-carbon pathways. This “provided that” clause is not a footnote-it is the central commercial reality influencing policy support, infrastructure investment, and end-user acceptance.The market’s momentum is being propelled by multiple stakeholders acting at once. Utilities and grid planners view hydrogen-ready end uses as part of a wider strategy to manage peak demand and integrate variable renewables. Public agencies frame hydrogen cooking within broader clean energy transitions, often tying pilots to safety training and community engagement. Meanwhile, appliance manufacturers and component suppliers see an opening to differentiate through burner design, flame control, materials compatibility, and integrated safety systems that can handle hydrogen’s distinct combustion characteristics.

At the same time, adoption is constrained by practical barriers that are unique compared with electrification pathways. Hydrogen’s storage, distribution, and refueling models vary dramatically by location, and consumer familiarity remains low. As a result, successful commercialization is less about a single breakthrough and more about orchestrating compatible ecosystems: standards, installers, service networks, compatible fuel logistics, and credible claims around lifecycle emissions. This executive summary synthesizes how these forces are reshaping competition and what decision-makers should prioritize as hydrogen cookers transition from novelty to a strategically relevant appliance segment.

The hydrogen cooker landscape is shifting from isolated pilots to ecosystem deployments driven by safety standards, infrastructure models, and cross-industry alliances

The competitive landscape for hydrogen cookers is being transformed by a shift from product-centric innovation to system-centric deployment. Early efforts emphasized whether hydrogen could cook effectively and safely; now, the focal point is whether hydrogen cooking can be integrated into real homes, restaurants, and institutional kitchens with consistent fuel quality, reliable servicing, and clear compliance pathways. This change is pushing vendors to build partnerships beyond traditional appliance channels, including gas network operators, cylinder distributors, hydrogen equipment integrators, and certification bodies.A second transformative shift is the steady convergence of hydrogen cooker development with broader hydrogen economy investments. As industrial hydrogen hubs expand and governments fund demonstration corridors, adjacent opportunities arise for localized distribution models that can serve small commercial users or residential clusters. Consequently, some players are prioritizing modular, scalable designs that can operate with on-site hydrogen generation or storage, while others align with blended gas networks where hydrogen content may increase over time. This diversity of deployment models is fragmenting near-term product requirements and creating multiple “winning designs” rather than a single standardized cooker architecture.

Third, safety and regulatory frameworks are becoming a primary differentiator rather than a compliance checkbox. Hydrogen’s low ignition energy and wide flammability range require robust leak detection, ventilation considerations, and burner stability engineering. Manufacturers are investing in sensor fusion, automatic shutoff logic, and materials that mitigate embrittlement risks in fuel pathways. As standards mature, companies that can demonstrate repeatable safety performance and streamlined certification will shorten time-to-market and reduce installation friction.

Finally, the category is being shaped by shifting consumer narratives. In some markets, hydrogen cooking is positioned as a familiar flame-based alternative for users reluctant to abandon gas. In others, it is framed as a premium, future-ready technology aligned with sustainability goals. This divergence affects branding, pricing architecture, and channel strategy. The net result is a landscape where success depends on aligning technology choices with local infrastructure realities, regulatory trajectories, and the trust-building measures that convert pilots into repeatable deployments.

United States tariff dynamics in 2025 are reshaping hydrogen cooker bills of materials, supplier qualification timelines, and localization strategies across the value chain

The 2025 U.S. tariff environment introduces a layered set of impacts that ripple through hydrogen cooker supply chains, even when tariffs are not aimed specifically at finished appliances. The most immediate effect is cost and lead-time volatility for imported subassemblies such as sensors, valves, regulators, fittings, ignition components, specialized steels, and certain electronic control modules. Because hydrogen cookers often require higher-spec components than conventional gas appliances, procurement teams face fewer qualified substitutes and may experience a disproportionate exposure to tariff-driven pricing adjustments.Beyond direct component costs, tariffs can reshape supplier qualification strategies. Companies that previously relied on single-country sourcing for critical parts are accelerating multi-region qualification to preserve margin and delivery reliability. However, requalification is not trivial in hydrogen applications: even small changes in materials, tolerances, or firmware can trigger additional validation cycles. As a result, tariff pressure can indirectly slow product refresh cadence and extend the time required to scale from pilot batches to broader commercialization.

Tariffs also influence where value is added. To reduce exposure, manufacturers may increase domestic or nearshore assembly, source alternative components, or redesign to use more locally available parts. This can be strategically beneficial, but it may require investment in new tooling, supplier development, and compliance testing. Moreover, any move toward localization must preserve stringent safety performance, which can be jeopardized if supplier capability development is rushed.

Finally, the tariff landscape can change partnership dynamics. Appliance brands may deepen relationships with U.S.-based component makers, while hydrogen ecosystem partners may renegotiate service and warranty structures to account for higher replacement-part costs. In parallel, distributors and installers may demand clearer availability commitments and spare-parts stocking plans. In practical terms, the 2025 tariff context rewards companies that treat trade policy as a design constraint-building resilient bills of materials, maintaining dual sourcing for critical safety parts, and aligning inventory strategy with the realities of certification and after-sales support.

Segmentation patterns show hydrogen cookers succeed only when product form, hydrogen supply model, end-user priorities, and service channels are engineered as one system

Key segmentation insights reveal that adoption pathways and product requirements differ sharply depending on how hydrogen cookers are positioned and deployed, making segmentation discipline essential for strategy. When viewed by product form, built-in cooktops and ranges tend to attract early interest where kitchen remodeling cycles and premium appliance purchases can absorb higher upfront costs, while portable and countertop configurations are better suited to controlled pilots, temporary facilities, and environments where fuel delivery is handled as a service. These differences shape everything from enclosure design and ventilation assumptions to how installers are trained.When examined by fuel storage and supply approach, the market diverges into infrastructure-led and logistics-led models. Pipeline or blended-gas compatibility pushes manufacturers toward designs tolerant of varying hydrogen concentrations and demands robust burner stability across variable calorific values. Cylinder-based or cartridge-based supply emphasizes quick-connect safety, tamper resistance, and predictable user refueling behavior, often favoring standardized interfaces and strong consumer guidance. Where on-site generation is considered, integration requirements expand to include electrolyzer controls, water management, and interlocks that keep the cooking system safe under fluctuating hydrogen purity.

Looking through the lens of end user, residential demand is highly sensitive to perceived safety, ease of service, and total installation complexity, with aesthetics and familiar cooking performance playing an outsized role in purchase intent. Commercial kitchens, by contrast, prioritize uptime, heat responsiveness, and operational cost predictability, and they often have more institutional capacity to manage fuel logistics and compliance documentation. In industrial or institutional settings such as cafeterias and campuses, procurement tends to weigh decarbonization commitments and facility-wide energy strategies, making hydrogen cookers one component of a broader infrastructure program.

Finally, segmentation by distribution and service model is becoming as important as the appliance itself. Direct-to-project deployments through energy programs or municipal pilots can scale learning quickly but may create bespoke configurations that are hard to standardize. Traditional retail channels demand simplicity, clear certification, and dependable after-sales networks, which can be challenging when hydrogen fuel access is uneven. Across these segmentation dimensions, companies that align product architecture with the realities of fuel provisioning, installation responsibilities, and service accountability are better positioned to turn demonstrations into repeatable, lower-friction rollouts.

Regional adoption differs sharply as the Americas, Europe, Middle East & Africa, and Asia-Pacific align hydrogen infrastructure, standards, and consumer trust at different speeds

Regional dynamics highlight that hydrogen cooker progress is less about a uniform global trajectory and more about where infrastructure, policy intent, and consumer readiness intersect. In the Americas, momentum is closely tied to decarbonization programs, industrial hydrogen buildouts, and localized pilots that test safety and acceptance in real kitchens. The region’s diversity in building codes and gas utility structures means commercialization strategies often need to be tailored state by state or province by province, with a premium placed on installer training and clear compliance pathways.In Europe, Middle East & Africa, the picture is shaped by strong policy direction on clean energy, active hydrogen corridor development, and heightened scrutiny of lifecycle emissions. In parts of Europe, hydrogen-ready narratives compete with electrification pathways, making the value proposition hinge on user experience and network strategy rather than environmental claims alone. The Middle East brings a different kind of opportunity: large-scale hydrogen ambition and the potential for high-visibility deployments in new developments, hospitality, and institutional projects where energy systems can be designed holistically from the start. Across Africa, the opportunity is more uneven and tends to depend on localized fuel logistics, affordability, and the ability to maintain equipment reliably; where these constraints are addressed, niche applications can emerge.

In Asia-Pacific, the market is defined by a combination of manufacturing depth, active demonstration activity, and varying national energy strategies. Some economies are pursuing hydrogen as a major pillar of energy transition and are capable of mobilizing standards bodies, utilities, and industry consortia quickly. Dense urban settings and high appliance replacement cycles can support faster diffusion once safety and fueling questions are resolved. However, the region also includes markets where LPG is entrenched and where hydrogen distribution for cooking faces an uphill battle unless bundled with broader infrastructure investments.

Across all regions, a consistent theme is that hydrogen cookers advance fastest where stakeholders can reduce uncertainty for the end user. That means dependable fuel access, transparent certification, visible safety validation, and a service ecosystem that treats hydrogen appliances as maintainable products rather than fragile prototypes. Regional leaders are likely to be those that translate national hydrogen ambition into household- and kitchen-level practicality.

Competitive advantage is concentrating among companies that combine appliance manufacturing discipline with hydrogen-grade components, certifications, and service-ready partnerships

Company activity in hydrogen cookers reflects a blend of incumbents extending gas appliance expertise and specialized players leveraging hydrogen know-how from adjacent sectors. Established appliance manufacturers bring strengths in thermal design, mass production, brand trust, and service networks, enabling them to run credible pilots and iterate toward consumer-ready products. Their challenge is balancing innovation with certification requirements and ensuring that hydrogen-specific safety features do not compromise usability or aesthetics.In parallel, gas technology specialists and combustion-focused engineering firms are influencing burner architectures, flame stability solutions, and control systems that can handle hydrogen’s combustion behavior. These companies often differentiate through proprietary mixing designs, advanced ignition control, and sensor-driven safety shutoffs. Their ability to partner effectively with appliance brands and installers is critical, because technical superiority alone does not guarantee adoption if installation and servicing remain complex.

Hydrogen ecosystem companies-such as those involved in storage, valves, regulators, and detection-are becoming increasingly important to competitive positioning. Their components can determine whether a cooker achieves the reliability and safety required for wider deployment. This is shifting the basis of competition toward integrated solutions, where performance is evaluated at the system level: fuel interface, detection, ventilation assumptions, user guidance, and service procedures.

As the category matures, companies that stand out are those that document safety performance transparently, invest in installer and service training, and design for real-world variability in fuel purity and pressure. Just as importantly, leaders are approaching hydrogen cookers as part of a portfolio strategy, linking them to hydrogen-ready heating, microgeneration, or commercial kitchen solutions to improve the business case for infrastructure partners. The result is an increasingly partnership-driven competitive arena where execution capability-certification, supply resilience, and service readiness-matters as much as product innovation.

Industry leaders can win by prioritizing ecosystem readiness, certification-first design, resilient sourcing, and low-friction installation and service models for users

Industry leaders should prioritize ecosystem readiness over isolated product launches. That starts with designing around realistic hydrogen supply conditions, including pressure variability, purity ranges, and refueling behaviors, and then validating performance under those conditions rather than idealized lab scenarios. In parallel, leaders should invest in a certification-first roadmap, engaging with standards bodies early and building documentation packages that installers and inspectors can use without ambiguity.Supply-chain resilience should be treated as a safety and continuity requirement, not merely a cost exercise. Dual sourcing for critical safety components, pre-qualified alternates, and clear traceability reduce the risk of disruption under tariff changes or geopolitical shifts. Where localization is pursued, supplier capability development must include hydrogen-relevant testing and quality controls to avoid introducing hidden reliability risks.

Go-to-market execution should focus on reducing user friction. That means simplifying installation requirements, packaging clear operating instructions, and offering service models that reassure buyers about maintenance and parts availability. For commercial kitchens, leaders should emphasize uptime guarantees, rapid-response servicing, and training modules that fit into existing compliance routines. For residential pathways, trust-building measures-such as visible safety features, third-party certification clarity, and intuitive user interfaces-are essential.

Finally, leaders should anchor messaging in verifiable outcomes rather than broad promises. Hydrogen cookers will be judged on safety, cooking performance, and practical access to fuel. Positioning should therefore be tied to demonstrable use cases and supported by partnerships that make fueling and servicing tangible. Companies that align engineering, certification, supply chain, and customer experience into a coherent deployment playbook will be best positioned to scale responsibly as hydrogen infrastructure expands.

A triangulated methodology blending stakeholder interviews, standards and policy review, and technical validation builds decision-grade insight for hydrogen cooker strategy

The research methodology for this report combines primary and secondary research to build a defensible view of hydrogen cooker technology pathways, stakeholder priorities, and commercialization constraints. Primary research includes structured interviews with manufacturers, component suppliers, hydrogen ecosystem participants, installers, and informed buyers to capture how requirements are evolving in safety, certification, and servicing. These interviews are used to validate practical assumptions, identify decision criteria, and understand barriers that may not be visible from public information.Secondary research includes analysis of publicly available regulatory documents, standards development activity, policy announcements, corporate communications, patent and product literature, and technical publications relevant to hydrogen combustion and appliance safety. This helps establish the context for how rules are maturing, how companies are positioning products, and which technical approaches are being prioritized.

Findings are triangulated through cross-validation across multiple inputs, with careful attention to inconsistencies between stated strategies and operational realities such as supplier qualification timelines, certification dependencies, and installer readiness. The research emphasizes qualitative rigor and decision-useful insights, focusing on what is changing, why it is changing, and what that implies for product strategy, partnerships, and market entry execution.

Throughout, the methodology is designed to minimize bias by comparing perspectives across the value chain and by separating aspirational claims from evidence-based readiness indicators. The result is a structured synthesis intended to support executives and product leaders who need to make near-term decisions amid evolving infrastructure, standards, and trade conditions.

Hydrogen cookers will scale where safety, fuel access, and serviceability converge, turning pilots into repeatable deployments across diverse infrastructure realities

Hydrogen cookers sit at the intersection of decarbonization ambition and everyday practicality, and that intersection is where the category will be won or lost. The market is no longer defined solely by whether hydrogen can cook; it is defined by whether organizations can deliver safe, serviceable, certifiable systems that fit local fuel realities and user expectations. This places a premium on ecosystem coordination, from component sourcing and installer training to clear standards and credible operating guidance.The evolving landscape is creating multiple viable pathways, including infrastructure-led deployments aligned with gas networks and logistics-led models built around cylinders or on-site generation. Each pathway imposes different design constraints and demands different partnerships. Companies that treat segmentation as a strategic filter-rather than a marketing exercise-will avoid misaligned product launches and build repeatable deployment models.

Trade policy and tariff uncertainty add another layer of complexity, pushing manufacturers toward supply diversification and, in some cases, localization. Those that plan proactively can convert these pressures into a resilience advantage, especially when they embed supply-chain choices into certification and service planning rather than treating them as late-stage procurement decisions.

Ultimately, the near-term opportunity belongs to organizations that can reduce uncertainty for customers and regulators alike. When safety validation is transparent, fueling is dependable, and service is straightforward, hydrogen cookers become more than a pilot-they become a credible appliance category ready for disciplined scaling.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Hydrogen Cookers Market

Companies Mentioned

The key companies profiled in this Hydrogen Cookers market report include:- BDR Thermea Group

- Beko A.Ş.

- Bosch Home Appliances Group

- Cavagna Group S.p.A.

- De'Longhi S.p.A.

- Electrolux AB

- H2B2 Electrolysis Technologies, Inc.

- H2U Technologies

- Heatlie

- Hy4Heat Consortium

- Hysytech S.r.l.

- Noritz Corporation

- Reddi Industries

- Rinnai Corporation

- Valor Fireplaces

- Viessmann Group

- Worcester Bosch

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 192 |

| Published | January 2026 |

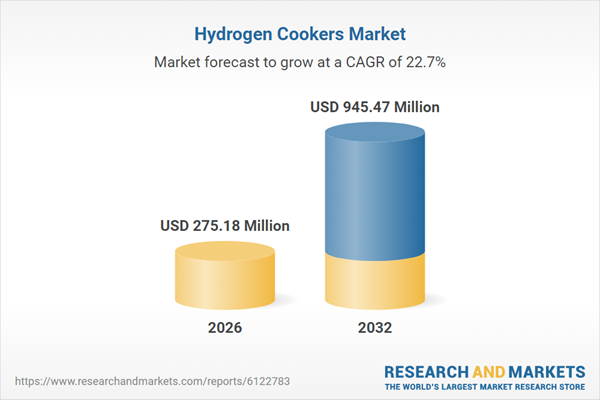

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 275.18 Million |

| Forecasted Market Value ( USD | $ 945.47 Million |

| Compound Annual Growth Rate | 22.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 18 |