Speak directly to the analyst to clarify any post sales queries you may have.

Why fully automatic commercial washing machines are becoming strategic infrastructure for uptime, hygiene assurance, and labor-efficient operations

Fully automatic commercial washing machines sit at the center of a behind-the-scenes economy that powers hospitality, healthcare, long-term care, industrial laundries, and multi-housing operations. While the equipment category may appear mature, the competitive battleground has shifted toward automation depth, reliability engineering, and the ability to sustain hygienic outcomes at scale while lowering labor intensity. As a result, buyers are no longer choosing a washer solely on rated capacity or price; they are selecting an operational system that connects equipment, chemistry, workflows, maintenance, and increasingly, data.Over the past few years, the “commercial wash room” has become a measurable production environment. Operators track rewash rates, cycle consistency, peak load balancing, and asset utilization. In parallel, procurement teams have elevated requirements around compliance, sustainability reporting, and supplier accountability. These pressures are driving demand for washers that deliver repeatable performance across variable loads, fabrics, and soil levels, while supporting digital monitoring and predictable servicing.

At the same time, the installed base in many markets is aging, making replacement decisions urgent. However, replacement is rarely a simple like-for-like swap. Site managers must consider electrical and plumbing constraints, noise and vibration limitations in mixed-use buildings, infection prevention protocols, staff turnover, and the ability to standardize training across locations. Therefore, the fully automatic commercial washing machine market is increasingly defined by integrated value-where machine design, control systems, service ecosystems, and operating economics combine to determine outcomes.

This executive summary frames the category through the lenses that matter most to decision-makers: how the landscape is transforming, what tariffs and trade policies imply for cost and sourcing, which segments are reshaping demand, where regional operating realities diverge, and how leading companies are positioning their portfolios. The objective is to provide a clear narrative that supports practical decisions across procurement, operations, and strategic planning.

How software-driven controls, deeper automation, and sustainability mandates are redefining competition beyond capacity and cycle speed

The most transformative shift is the move from mechanical differentiation to software-enabled performance. Control platforms are evolving from simple cycle selectors to programmable systems that support recipe management, operator permissions, and auditability. This shift matters because commercial laundry outcomes are increasingly judged by consistency-especially where hygiene, stain removal, and linen longevity directly affect customer experience or clinical risk. Consequently, buyers are prioritizing machines that can lock validated programs, reduce operator variability, and provide traceability when incidents occur.A second shift is the widening definition of “automation.” Fully automatic no longer refers only to automated fill, heat, and drain sequences; it increasingly includes adaptive logic that adjusts water levels, dosing coordination, extraction profiles, and cycle timing to optimize for the load. In many operations, the washer is now designed to coordinate with chemical dosing systems, water reuse modules, and material handling, enabling higher throughput with fewer touches. As labor remains constrained across service industries, automation that reduces sorting errors, simplifies training, and shortens cycle-dependent bottlenecks has become a primary value driver.

Sustainability requirements are also reshaping product roadmaps. Energy and water efficiency are no longer optional differentiators but baseline expectations tied to corporate ESG commitments, building certifications, and local utility incentives. Manufacturers are responding with improved drum and suspension designs, smarter water management, and more refined extraction control that reduces dryer load. Meanwhile, buyers are applying lifecycle thinking: not only resource consumption, but also service intervals, parts availability, and end-of-life considerations.

Another notable shift is the elevated importance of hygiene and risk management. Healthcare and hospitality operators are strengthening processes around temperature control, chemical concentration, and cross-contamination prevention, which in turn elevates demand for machines that can reliably execute validated cycles. Additionally, the category is seeing increased attention to human factors such as ergonomic loading heights, simplified UI, and clear fault diagnostics-features that reduce training time and avoid “workarounds” that degrade outcomes.

Finally, the competitive landscape is being shaped by service capability and digital support. Remote monitoring, predictive maintenance cues, and faster field service dispatch are becoming differentiators, especially for multi-site operators. In many cases, buyers evaluate the vendor’s service network, spare parts logistics, and software update policies as carefully as they evaluate machine specifications. As a result, the landscape is shifting from product competition to platform and partnership competition, where vendors win by reducing operational volatility for customers.

What United States tariffs in 2025 mean for commercial washer sourcing, lifecycle cost discipline, and service-part availability risk

United States tariff dynamics in 2025 are influencing procurement behavior in ways that extend beyond headline price changes. For fully automatic commercial washing machines, tariffs can affect finished equipment, key subassemblies, and commodity-linked inputs such as stainless steel components, motors, and electronic control parts. Even when a specific model is assembled domestically, upstream exposure can still flow through to lead times and service part pricing, making total cost of ownership more sensitive to trade policy than many buyers anticipate.One immediate impact is a renewed emphasis on supply chain transparency. Buyers with multi-year fleet plans are pressing vendors to clarify country-of-origin assumptions, alternative sourcing strategies, and how tariff adjustments are handled in quotes and service agreements. In response, suppliers are increasingly positioning “tariff-resilient” offerings through regionalized assembly, dual-sourcing, and higher domestic content where feasible. This can improve continuity, but it may also constrain configuration flexibility if certain components remain globally concentrated.

Tariffs are also accelerating a shift in contracting strategies. Rather than single-point purchases, some operators are using phased procurement, framework agreements, or price-protection clauses tied to component indices and delivery schedules. This approach reduces budget shocks but requires more rigorous specification discipline and clearer acceptance criteria. Additionally, organizations are placing greater weight on service coverage and parts availability, recognizing that a modest increase in purchase price can be outweighed by downtime costs if parts become constrained.

From a competitive standpoint, tariff impacts can reorder relative value positions among brands. Vendors with mature North American manufacturing footprints, stable parts warehousing, and service density may gain an advantage as total delivered cost becomes less predictable for import-heavy portfolios. Conversely, suppliers dependent on imported electronics or specialized drive components may face margin pressure, potentially leading to selective SKU rationalization or longer replenishment cycles. Buyers should therefore evaluate not only today’s configuration, but also the vendor’s ability to maintain that configuration over the asset’s life.

Finally, tariff uncertainty is encouraging design and engineering adaptations. Standardized platforms that accept interchangeable components, modular control architectures, and simplified assemblies can reduce exposure to specific parts. Over time, these changes can improve serviceability and shorten repair cycles. In practical terms, 2025 tariff conditions are pushing the market toward more resilient sourcing models, tighter vendor accountability, and procurement decisions that weigh continuity and service stability as heavily as upfront cost.

Segmentation signals show buyers optimizing for workflow certainty, control sophistication, and end-use compliance rather than chasing specs alone

Segmentation patterns reveal that the category is increasingly organized around operating environments and workflow priorities rather than a one-size-fits-all product hierarchy. When viewed by product type, the market’s decision logic often hinges on how fully automatic platforms integrate with surrounding systems such as dosing, water management, and downstream drying or finishing. Buyers in high-throughput settings tend to favor configurations engineered for continuous duty cycles, rapid maintenance access, and consistent results under load variability, whereas smaller facilities prioritize ease of use, footprint efficiency, and reliable performance with limited technical staff.Looking through the lens of capacity bands, purchasing criteria diverge sharply as load size rises. Mid-range capacities often represent the most operationally flexible “standardization” choice for organizations with multiple site formats, allowing shared training and spare-part strategies. Higher capacities, by contrast, are frequently justified by throughput concentration and labor efficiency, particularly where material handling and layout can be optimized to prevent bottlenecks. Meanwhile, lower capacities remain relevant where space constraints, electrical limits, or decentralized laundry models dominate. Across capacity tiers, the strongest preference is for machines that preserve linen quality through controlled mechanical action and extraction profiles, since textile replacement costs can quietly eclipse equipment savings.

Considering technology and control architecture, there is a clear split between operations that need validated, locked-down programs and those that benefit from more open programmability. In regulated or risk-sensitive settings, the ability to enforce cycle parameters, record key events, and support audits is becoming an explicit requirement. In more general commercial use, however, intuitive interfaces and simplified program libraries are often more valuable than deep customization because they reduce operator errors and training burden.

End-use segmentation further clarifies why “fully automatic” is being interpreted differently across buyers. Hospitality emphasizes fast turnaround, fabric care, and noise control; healthcare emphasizes thermal and chemical assurance, cross-contamination controls, and documentation; industrial and contract laundries emphasize throughput, uptime, and integration with handling systems; multi-housing and on-premise laundries emphasize compactness, durability, and ease of service. These end-use differences strongly influence preferred build quality, control features, and service model expectations.

Finally, segmentation by distribution and service models highlights that vendor selection is often determined by who can provide reliable commissioning, operator training, and ongoing maintenance. Direct engagement may appeal to large fleets seeking standardization, while distributor and dealer ecosystems can be decisive for dispersed sites that need rapid local service. Across all segmentation dimensions, the common thread is that buyers are optimizing for operational certainty-repeatable outcomes, minimal downtime, and scalable training-rather than simply purchasing a machine.

Regional realities - from utility costs to compliance pressure - change what ‘best’ looks like for fully automatic commercial washers in practice

Regional dynamics are strongly shaped by utility economics, labor availability, regulatory expectations, and the maturity of service ecosystems. In the Americas, replacement demand and multi-site standardization initiatives are prominent themes, with buyers often prioritizing service responsiveness, parts logistics, and machines that can reduce labor intensity. Sustainability targets also influence specifications, particularly where water and energy costs are structurally high or where corporate reporting drives measurable reductions.Across Europe, the Middle East, and Africa, regulatory heterogeneity and infrastructure diversity create a wide spread of requirements. Many buyers emphasize energy efficiency, noise and vibration control for dense urban environments, and proven hygiene performance for healthcare and hospitality hubs. In several markets, procurement teams place heavy weight on lifecycle service arrangements and documentation readiness, while also evaluating how equipment aligns with broader decarbonization and resource-efficiency mandates.

In the Asia-Pacific region, growth in hospitality capacity, expanding healthcare access, and modernization of commercial laundry operations are important drivers of equipment upgrades. Buyers often balance robust build quality with cost discipline, while increasingly seeking automation features that simplify training for a large and frequently rotating workforce. In addition, the region’s manufacturing depth can create strong availability for certain components and models, yet buyers still prioritize local service capability and rapid parts replacement to keep operations stable.

Across regions, water availability and wastewater management are emerging as consistent strategic considerations. Where water stress is acute, interest rises in systems that optimize fill levels, support reuse, or coordinate effectively with chemical dosing to reduce rewash. Conversely, where labor is the dominant constraint, features that shorten cycle complexity, improve diagnostics, and reduce manual intervention are emphasized. As a result, regional insight is less about broad demand and more about the operating constraints that shape what “best fit” looks like in each geography.

Ultimately, regional variation reinforces a critical procurement lesson: global brands do not automatically deliver uniform outcomes across markets. Site readiness, local compliance expectations, and service density determine whether advanced features translate into real productivity gains. Therefore, regional strategy should focus on matching machine configurations and service models to the realities of utilities, workforce, and regulatory oversight in each operating environment.

Competitive advantage is shifting to outcome control, service infrastructure, and platform reliability as vendors compete beyond hardware features

Company strategies in fully automatic commercial washing machines are converging on three battlegrounds: platform reliability, controllability of wash outcomes, and the strength of after-sales ecosystems. Leading manufacturers are investing in robust drive systems, improved suspension and drum engineering, and service-friendly layouts that reduce time-to-repair. This is not simply a design preference; it reflects the operational truth that downtime costs are often more damaging than incremental differences in purchase price.Portfolio positioning increasingly emphasizes control systems and digital capability. Many established players are enhancing user interfaces, expanding programmable cycle libraries, and improving diagnostic depth to support faster troubleshooting. In parallel, suppliers are refining integration with chemical dosing systems and offering more cohesive “wash process” solutions that combine equipment, chemistry guidance, and training. This approach helps vendors become embedded in customer workflows, raising switching costs while improving customer outcomes.

Another differentiator is the breadth and credibility of service networks. Companies with strong field coverage, well-managed parts distribution, and clear maintenance programs tend to be favored by multi-site operators. Some suppliers strengthen this advantage through authorized service partners, technician certification, and remote support tools that reduce first-visit failure rates. Where digital monitoring is offered, competitive advantage depends less on dashboards and more on whether alerts translate into timely interventions and measurable uptime improvements.

Manufacturers also differentiate through specialization. Some focus on high-throughput commercial laundry environments and engineered integration with material handling, while others prioritize compact, quiet, and aesthetically compatible machines designed for on-premise laundry rooms in hospitality or multi-housing. In healthcare-oriented portfolios, emphasis often falls on validated programs, documentation features, and consistent thermal and chemical control. Across these approaches, the most competitive companies communicate in the language of outcomes-rewash reduction, linen life extension, energy and water discipline, and training simplification-rather than only technical specifications.

As competitive intensity rises, buyers should expect clearer product tiering, more modular option structures, and stronger efforts to bundle equipment with service contracts. For decision-makers, the key is to evaluate whether a vendor’s claimed differentiators are supported by commissioning rigor, operator enablement, and long-term parts availability, because those factors ultimately determine whether performance holds over the full asset lifecycle.

Leaders can win on total lifecycle performance by standardizing outcomes, tightening contracts, and engineering laundry workflows end-to-end

Industry leaders can strengthen procurement outcomes by treating washer selection as a process design decision rather than an equipment purchase. Start by defining measurable operating requirements such as target throughput windows, acceptable rewash tolerance, required hygiene assurances, and constraints related to utilities, space, and noise. When these requirements are explicit, it becomes easier to compare vendors on what matters and to avoid overbuying features that will not be used.Next, prioritize standardization where it improves training and parts management, but avoid forcing uniformity across sites with materially different constraints. A practical approach is to standardize control logic and service processes across locations while allowing capacity and physical configuration to vary. In parallel, insist on commissioning discipline, including program validation, operator training, and documented handover. Many performance problems originate not from the machine, but from inconsistent setup and user behaviors.

To manage tariff and supply uncertainty, strengthen contracts with clarity on lead times, configuration locks, substitution rules, and parts availability commitments. Where possible, structure agreements that encourage continuity-such as defined service response expectations, preventive maintenance schedules, and escalation pathways for chronic issues. Additionally, evaluate whether the vendor can provide stable access to critical wear parts and whether technicians are available locally to minimize downtime.

Operationally, focus on the washers’ role in reducing total labor and textile cost. Choose control systems that reduce operator variability, incorporate safeguards against incorrect cycle selection, and provide diagnostics that shorten troubleshooting. Align extraction performance and cycle design with dryer capacity to reduce downstream congestion. If sustainability is a corporate priority, implement baseline measurement for water, energy, and rewash so that improvements can be verified and maintained.

Finally, build a continuous-improvement loop. Use maintenance logs, fault codes, and rewash drivers to refine programs and training. Review chemical dosing alignment and linen mix periodically, especially when occupancy patterns or patient acuity changes. By treating the wash room as a managed production system, industry leaders can convert equipment investments into durable operational advantage.

A triangulated research approach combining technical documentation, stakeholder interviews, and rigorous validation to reflect real buying criteria

The research methodology applies a structured approach designed to reflect how buyers and suppliers actually make decisions in the fully automatic commercial washing machine category. The process begins with systematic market definition and taxonomy building to ensure consistent interpretation of what qualifies as fully automatic commercial equipment, how product configurations differ, and how end-use environments shape requirements.Next, the study integrates extensive secondary research across publicly available technical documentation, regulatory and standards references, trade publications, corporate filings, and product literature to map technology trends, compliance themes, and competitive positioning. This phase is used to establish baseline understanding of control architectures, efficiency features, and service models, as well as to identify areas where supplier messaging diverges from operational realities.

Primary research is then conducted through structured interviews and validation discussions with stakeholders across the value chain. This includes manufacturer and channel perspectives on product roadmaps, service practices, and procurement patterns, as well as operator viewpoints on pain points such as downtime, training burden, linen damage, and audit readiness. Insights are triangulated to reduce bias, with particular attention to how requirements vary by end-use environment and region.

Finally, findings are synthesized into a coherent analytical narrative supported by segmentation and regional frameworks. Quality checks are applied to ensure internal consistency, remove unsupported claims, and maintain alignment with current industry conditions. The output is designed to be decision-oriented, emphasizing practical implications for sourcing, specification design, and operational improvement rather than abstract descriptions.

The market is rewarding outcome certainty, resilient service models, and context-fit automation that turns laundry rooms into managed systems

Fully automatic commercial washing machines are evolving into digitally enabled, process-critical assets that influence labor productivity, hygiene assurance, and operating stability. The market’s direction is clear: buyers want repeatable outcomes, simpler operation, and dependable service support more than incremental specification gains. As software, diagnostics, and integration capabilities mature, the category is increasingly judged by how well it reduces variability and protects uptime.At the same time, external pressures such as tariff uncertainty, sustainability mandates, and workforce constraints are reshaping procurement priorities. These pressures reward suppliers that can offer resilient supply chains, clear contractual structures, and credible service ecosystems. They also reward operators who define requirements precisely, validate programs at commissioning, and manage laundry as a performance system.

Segmentation and regional differences underscore that “best” equipment is context-dependent. Capacity, control sophistication, and service models must align with end-use realities, from healthcare compliance to hospitality turnaround to contract laundry throughput. Organizations that match technology choices to workflow needs, and that plan for lifecycle service continuity, will be better positioned to secure consistent results and avoid hidden costs.

In this environment, the most effective strategy is disciplined decision-making: clarify outcomes, evaluate vendors on service and lifecycle readiness, and build an operational feedback loop that sustains performance long after installation. Done well, fully automatic commercial washers become not just equipment, but a foundation for reliable, efficient, and compliant operations.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Fully Automatic Commercial Washing Machine Market

Companies Mentioned

The key companies profiled in this Fully Automatic Commercial Washing Machine market report include:- Alliance Laundry Systems LLC

- BSH Hausgeräte GmbH

- Dexter Laundry, Inc.

- Electrolux AB

- Fabcare India Pvt Ltd

- GE Appliances

- Girbau S.A.

- Godrej & Boyce Mfg. Co. Ltd.

- Haier Group Corporation

- IFB Industries Ltd.

- LG Electronics Inc.

- Midea Group

- Mirc Electronics Ltd.

- Panasonic Corporation

- Pellerin Milnor Corporation

- Samsung Electronics Co., Ltd.

- TCL Technology Group Corporation

- Videocon Industries Ltd.

- Voltas Limited

- Welco Garment Machinery Pvt Ltd

- Whirlpool Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 199 |

| Published | January 2026 |

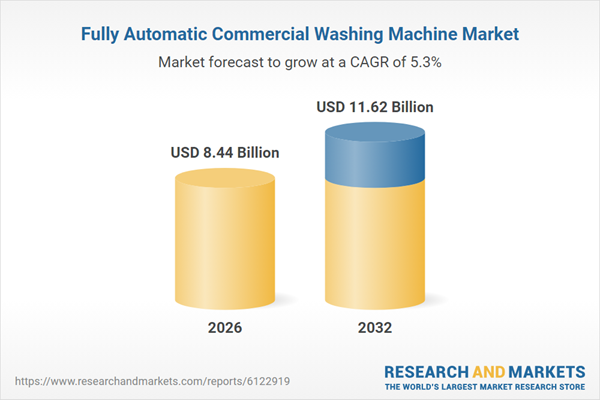

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 8.44 Billion |

| Forecasted Market Value ( USD | $ 11.62 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 22 |