Speak directly to the analyst to clarify any post sales queries you may have.

Variable inlet guide vanes are becoming a strategic lever for compressor efficiency, operability, and reliability across demanding turbomachinery duty cycles

Variable inlet guide vanes (VIGVs) sit at the intersection of aerodynamics, controls, and mechanical reliability, making them an enabling technology for modern turbomachinery. By modulating the inlet airflow angle and distribution into compressors, VIGVs help operators balance efficiency, surge margin, part-load performance, and emissions outcomes. Their role is especially prominent where demand profiles are volatile, ambient conditions swing widely, or units must ramp quickly without sacrificing stability.In practice, VIGVs influence more than compressor maps and control schedules. They shape plant operability, maintenance intervals, and the ability to comply with tightening environmental requirements. As industrial facilities modernize and utilities prioritize flexibility, VIGVs are increasingly evaluated not only as components but as part of an integrated system that includes actuators, linkages, position feedback, health monitoring, and control logic.

This executive summary frames the market environment around VIGVs through a decision-maker lens, emphasizing how technology shifts, policy changes, and evolving procurement models are redefining competitive advantage. It highlights what matters most for buyers and suppliers: performance under transient conditions, durability in harsh duty cycles, quality assurance across globalized supply chains, and service capabilities that reduce downtime and lifecycle risk.

From component optimization to system operability and digital integration, the VIGV landscape is being reshaped by flexibility, traceability, and lifecycle value

The VIGV landscape is undergoing transformative shifts driven by how end users value flexibility and verification. A notable change is the elevation of operability metrics-ramp rate, turndown, and stable operation under frequent cycling-into core specification requirements. This has pushed design priorities beyond static efficiency toward robust performance across transient regimes, where vane scheduling, hysteresis management, and actuator responsiveness can determine whether a unit meets dispatch and process needs.At the same time, digitalization is changing how VIGVs are designed, validated, and supported. Advanced simulation workflows increasingly couple aerodynamic performance with structural and thermal analysis to reduce the tradeoff between tight clearances and mechanical durability. In parallel, controls integration has become more sophisticated as operators seek tighter coordination between VIGVs, variable speed drives where applicable, anti-surge systems, and combustion controls. This shift favors suppliers that can demonstrate system-level understanding rather than only component-level excellence.

Materials and manufacturing practices are also evolving. Harsh-environment duty, including corrosive atmospheres and particulate exposure, is intensifying interest in coatings, surface treatments, and wear-resistant interfaces that preserve vane motion and positional accuracy over long service intervals. Quality traceability and non-destructive testing expectations are increasing, particularly for high-consequence applications, reflecting a broader industry pivot toward auditable supply chains and repeatable manufacturing.

Sustainability and compliance pressures provide another catalyst for change. Many operators are targeting reduced fuel consumption and lower emissions intensity without compromising reliability, making part-load performance and stable control critical. As a result, VIGVs are increasingly viewed as a mechanism to unlock operational efficiency improvements that compound over time, especially in fleets that experience frequent load variation.

Finally, competitive dynamics are shifting toward lifecycle solutions. Buyers are placing greater value on repairability, spare availability, field service responsiveness, and retrofit kits that can be installed during planned outages. This is redefining the basis of competition: the winning offer is often the one that lowers total operational risk through proven service procedures, documented performance, and predictable lead times, not merely the one that meets baseline technical specs.

United States tariffs in 2025 are amplifying supply-chain scrutiny, redesign-to-availability priorities, and lifecycle planning for VIGV assemblies and spares

The 2025 tariff environment in the United States has intensified attention on the cost and continuity of cross-border supply for turbomachinery components, including VIGV assemblies, actuation hardware, specialty alloys, and precision-machined subcomponents. Even when tariffs do not target VIGVs directly, duties applied to upstream inputs and related mechanical parts can raise landed costs, pressure margin structures, and complicate quoting for long-lead projects.One immediate impact is a renewed emphasis on country-of-origin documentation and customs compliance discipline. Procurement teams are requiring clearer bills of materials, harmonized classification consistency, and contract language that allocates tariff risk. For suppliers, this drives investment in trade compliance capabilities and tighter coordination with subcontractors to avoid misclassification delays that can cascade into outage windows or commissioning milestones.

Tariffs also reshape sourcing strategies. Buyers are increasingly weighing multi-sourcing and regional qualification to reduce exposure to policy-driven cost swings. This does not automatically translate to a wholesale shift to domestic manufacturing, because capability constraints, tooling investment, and qualification timelines can be substantial. Instead, many organizations are adopting hybrid models: localized final assembly and testing paired with globally sourced precision parts, or dual-qualified suppliers for high-risk subcomponents such as actuators, bearings, and linkage elements.

Lead-time volatility is another cumulative effect. When tariffs encourage re-routing of supply chains, competition for capacity at domestic and nearshore machine shops can increase, affecting delivery schedules for both new units and spares. This dynamic elevates the value of suppliers with standardized designs, modular retrofit options, and stocked critical spares. It also makes predictive maintenance and condition-based planning more financially compelling, because avoiding unplanned downtime reduces exposure to expedited freight and emergency procurement under unfavorable trade conditions.

Over the medium term, the tariff landscape is accelerating discussions about design-to-cost and design-to-availability. Engineering teams are revisiting material choices, tolerance stacks, and manufacturability to preserve performance while expanding the eligible supplier base. For VIGVs, this may show up as redesigned vane trunnions, alternative coatings with broader domestic availability, or actuator interfaces that can accept multiple vendor options without extensive control system rework.

Overall, the 2025 tariff effects are best understood as cumulative: they amplify existing market priorities around supply resilience, documentation, and lifecycle planning. Organizations that treat tariffs as a governance and engineering input-rather than a temporary procurement inconvenience-are better positioned to protect outage schedules, maintain performance guarantees, and stabilize long-term operating costs.

Segmentation clarifies how application, vane configuration, actuation choices, materials, and retrofit versus OEM pathways shape VIGV buying criteria and value

Segmentation reveals that demand patterns for VIGVs diverge sharply when viewed through the lens of application context, vane architecture, actuation approach, material strategy, and procurement pathway. In gas turbines, VIGVs are often evaluated as part of a broader operability package because fast starts, ramping, and part-load operation place high demands on vane scheduling and actuator response. In steam-turbine-adjacent or process compressor environments, the emphasis more frequently shifts toward stability across continuous duty, robustness in contaminated atmospheres, and ease of maintenance during tightly planned shutdowns.Across inlet guide vane configurations, the performance conversation is increasingly tied to repeatability and controllability rather than purely geometric optimization. Where variable geometry is used aggressively, buyers tend to prioritize low backlash linkages, durable bushings, and accurate feedback to ensure commanded positions translate into actual aerodynamic outcomes. In contrast, segments that operate with less frequent vane movement often focus on corrosion resistance and long-term sticking avoidance, as infrequent actuation can increase the risk of seizure if materials and coatings are not well matched to the environment.

Actuation segmentation highlights a clear split between buyers who value simplicity and those who prioritize advanced control. Pneumatic and hydraulic approaches can offer high force density and rapid response, but they introduce fluid or air system dependencies that must be maintained for reliability. Electric actuation continues to gain attention where controls integration, diagnostics, and site standardization are valued, especially as plants modernize instrumentation and seek consistent maintenance practices across assets. In all actuation segments, fail-safe behavior and proof of reliability under cycling remain decisive differentiators.

Material and coating segmentation is increasingly defined by the duty cycle and the ingestion profile. Clean-air applications can justify different cost-performance balances than environments with salt, dust, or hydrocarbons, where erosion and corrosion mechanisms dominate. This segmentation also affects how buyers evaluate repairability; in harsher segments, field repair capability and coating restoration processes become as important as the original manufacturing method.

Finally, procurement and lifecycle segmentation separates retrofit-driven opportunities from original equipment integration. Retrofit segments tend to demand outage-friendly kits, clear installation procedures, and compatibility with existing control logic, with minimal commissioning risk. Original equipment segments often emphasize co-design, validation evidence, and contractual performance commitments. Across both, service segmentation is strengthening as operators prefer partners that can supply spares, execute inspections, and provide tuning support that sustains performance beyond initial commissioning.

Regional VIGV priorities diverge by operating conditions and policy pressures, from flexible generation and retrofit needs to harsh-environment durability and localization

Regional dynamics for VIGVs are shaped by differences in installed turbomachinery base, grid flexibility needs, industrial energy intensity, and supply-chain maturity. In the Americas, buyers commonly prioritize rapid service response, predictable spares access, and documentation that supports regulated operating environments. The region’s focus on flexible generation and industrial reliability places VIGVs in the spotlight for part-load performance, cycling durability, and retrofit practicality, particularly where aging fleets are being adapted to new duty profiles.In Europe, the operating context is strongly influenced by decarbonization policy, stringent emissions regimes, and a preference for technology pathways that improve efficiency without compromising reliability. This drives heightened attention to control precision, verification testing, and integration with broader plant optimization programs. European operators often demand robust traceability and quality systems, which can influence supplier selection as much as technical features.

The Middle East presents a distinct profile, where high ambient temperatures, dust exposure, and continuous-duty industrial operations stress mechanical durability and anti-fouling design. Here, VIGV solutions that maintain positional accuracy under harsh conditions and that support rapid turnaround during planned maintenance are especially valued. Local content initiatives and project-based procurement can also shape how suppliers position assembly, service, and partner networks.

Africa reflects a mix of developing industrial bases and critical infrastructure needs, making reliability and maintainability central themes. Where technical resources and spares logistics can be constrained, buyers often favor solutions that reduce complexity and provide clear maintenance procedures, along with training and service support that improves self-sufficiency over time.

Asia-Pacific remains a diverse region with strong industrial growth, significant LNG and petrochemical activity in certain markets, and broad investment in power and manufacturing resilience. In many Asia-Pacific contexts, competitive differentiation hinges on a supplier’s ability to meet delivery schedules, support localization requirements, and provide scalable service coverage. As plants modernize, demand for controls-compatible upgrades and digitized maintenance support is rising, especially where fleets are large and standardized.

Across all regions, a consistent theme is the move toward risk-managed procurement. Buyers increasingly reward suppliers that can demonstrate stable lead times, transparent quality practices, and regional service capability, because VIGVs influence both performance outcomes and the operational continuity that plants depend on.

Competitive advantage is shifting toward integrated VIGV hardware-plus-controls delivery, auditable quality, and aftermarket execution that reduces operational risk

Company strategies in the VIGV space increasingly reflect a convergence of engineering depth and lifecycle execution. Leading participants differentiate through validated aerodynamic design, high-reliability actuation integration, and manufacturing discipline that preserves tight tolerances across scale. However, technical capability alone is no longer sufficient; customers expect documented reliability under cycling, repeatable field performance, and clear evidence that the supplier can support commissioning and tuning in real operating conditions.A major competitive axis is the ability to deliver integrated solutions spanning mechanical hardware, controls interfaces, and diagnostic readiness. Companies that can provide cohesive packages-vane assemblies, linkages, actuators, sensors, and control logic support-reduce integration burden and commissioning risk for buyers. This is particularly important where plants have mixed fleets or where upgrades must interface with legacy control systems.

Another differentiator is aftermarket readiness. Suppliers with established repair procedures, coating restoration capability, exchange programs, and regional service footprints are increasingly favored in procurement decisions. Because VIGVs directly affect operability, operators tend to value partners who can respond quickly to sticking, position drift, or actuator issues and who can provide root-cause analysis that prevents recurrence.

Manufacturing footprint and supply-chain resilience also shape competitive standing. Companies are investing in qualification of alternative sources for critical materials and precision-machined parts, along with enhanced traceability and inspection regimes. This is both a response to policy uncertainty and a recognition that consistent quality underpins performance guarantees.

Finally, collaboration models are maturing. Rather than purely transactional component supply, many companies are pursuing co-engineering relationships, long-term service agreements, and performance-oriented support packages. This approach aligns supplier incentives with uptime and efficiency outcomes, strengthening customer retention and making technical differentiation more defensible over the full lifecycle of the equipment.

Leaders can de-risk performance and supply by standardizing operability specs, qualifying resilient designs, and elevating VIGVs into lifecycle and digital strategies

Industry leaders can strengthen their position by treating VIGVs as an operability and lifecycle platform rather than a discrete mechanical component. The first priority is to standardize specification frameworks that explicitly address cycling durability, response time, backlash limits, and fail-safe behavior. When these parameters are defined upfront, organizations reduce commissioning surprises and can compare supplier offerings on the criteria that actually drive plant availability.Next, organizations should build tariff and supply volatility into engineering and contracting decisions. This includes qualifying alternate materials or coatings where feasible, designing actuator interfaces for multi-vendor compatibility, and negotiating contracts that clarify responsibility for customs delays and duty changes. In parallel, strategic inventory policies for critical spares-guided by failure criticality rather than historical spend-can reduce exposure to expedited procurement during outages.

Digital readiness is another actionable focus. Leaders should require position feedback integrity, diagnostic accessibility, and controls documentation that supports tuning and troubleshooting. Where operations are increasingly dynamic, investing in commissioning support and periodic vane schedule optimization can unlock measurable improvements in stability and efficiency, while also reducing wear associated with poor control alignment.

On the operational side, adopting condition-based inspection practices can improve reliability without over-maintaining. Tracking actuator performance, vane position repeatability, and linkage wear trends enables targeted intervention before performance degrades into trip events or efficiency penalties. This approach is especially valuable for fleets that cycle frequently or operate in erosive and corrosive environments.

Finally, supplier management should evolve toward partnership structures that reward uptime outcomes. Multi-year service arrangements, standardized retrofit kits, and joint root-cause workflows can reduce total downtime and improve learning across sites. The strongest results tend to come when engineering, procurement, and operations align on a shared definition of value: not lowest initial cost, but lowest operational risk and most predictable performance over time.

A lifecycle-oriented methodology combines stakeholder interviews, technical and policy review, and triangulation to validate VIGV requirements across use cases

The research methodology integrates primary engagement with rigorous secondary analysis to provide a balanced view of technology, procurement, and operational realities for VIGVs. The process begins by defining the scope of VIGV use cases across turbomachinery contexts and mapping the value chain from materials and machining through assembly, actuation integration, and field service. This framing ensures that insights reflect the full lifecycle rather than only new-equipment considerations.Primary research incorporates structured discussions with stakeholders such as OEM and component engineers, plant operations leaders, maintenance managers, procurement specialists, and service providers. These conversations focus on decision criteria, common failure modes, qualification practices, and emerging requirements related to controls integration, diagnostics, and compliance documentation. Inputs are cross-checked to separate anecdotal observations from repeatable patterns across different operating environments.

Secondary research reviews technical literature, regulatory and trade policy publications, standards guidance, corporate disclosures, patent activity signals, and publicly available information on manufacturing and service capabilities. The aim is to validate technology directions, understand policy implications such as tariffs and localization, and triangulate the maturity of competing approaches to actuation, coatings, and system integration.

Analytical synthesis follows, where findings are organized by the defined segmentation structure and regional context. Contradictions are resolved through additional validation, and conclusions are stress-tested against known operational constraints such as outage windows, qualification timelines, and supply-chain lead times. The result is an executive-ready narrative that emphasizes actionable implications while remaining grounded in engineering and procurement realities.

VIGVs are evolving into a lifecycle-critical capability where operability, resilient supply, and controls integration determine long-term performance consistency

VIGVs are increasingly central to how turbomachinery operators reconcile flexibility, efficiency, and reliability in an environment defined by tighter constraints and higher variability. The market’s direction is clear: value is moving toward solutions that perform consistently under transient operation, integrate cleanly with modern controls, and remain maintainable under real-world conditions.The 2025 U.S. tariff environment adds another layer that reinforces, rather than replaces, existing priorities. Supply resilience, documentation discipline, and design choices that broaden sourcing options are becoming part of the technical conversation. Organizations that integrate policy risk into engineering and contracting can protect schedules and sustain performance without reactive cost escalations.

Segmentation and regional perspectives show that there is no single winning configuration; optimal choices depend on duty cycle, environment, and procurement pathway. Across these differences, however, the most durable strategies share common elements: tight specification of operability needs, investment in quality and traceability, and a lifecycle mindset that values service execution and retrofit practicality.

Taken together, the competitive edge will belong to those who translate VIGVs from a line item into a managed capability-supported by validated design, resilient supply, and operational intelligence that keeps machines stable, efficient, and available.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

19. China Variable Inlet Guide Vane Market

Companies Mentioned

The key companies profiled in this Variable Inlet Guide Vane market report include:- Accutech Enterprises

- Allied Founders Pvt. Ltd.

- Ansaldo Energia S.p.A.

- Baker Hughes Company

- Flexatherm Expanllow Pvt. Ltd.

- General Electric Company

- Isw Industries

- Kirloskar Pneumatic Company Ltd

- MAN Energy Solutions SE

- Mitsubishi Hitachi Power Systems, Ltd.

- Pratt & Whitney Canada Corp.

- R D Pollution Controls Pvt. Ltd.

- Rolls-Royce plc

- Safran Helicopter Engines

- Siemens Energy AG

- Solar Turbines Incorporated

- Steelcast Ltd.

- The Kolhapur Steel Ltd.

- Valvetek Engineering

- Vdr Engineering Co.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

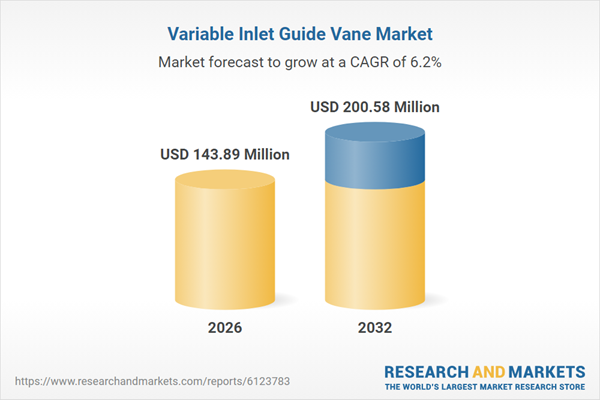

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 143.89 Million |

| Forecasted Market Value ( USD | $ 200.58 Million |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |